Medicare Changes You Need To Know In 2018

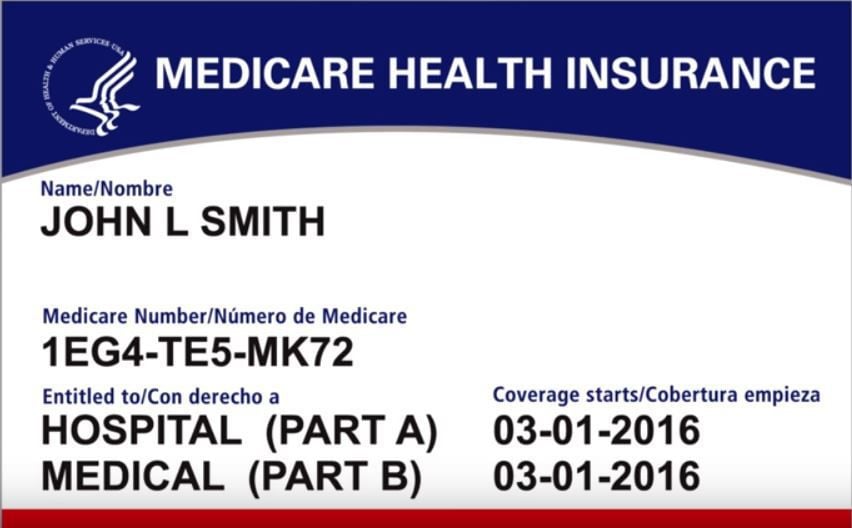

- Your card is being mailed out based on geographic location, but your card could arrive at a different time from your...

- Once you receive your new Medicare card, destroy the old one.

- Only give your new Medicare card number to people you trust to handle your Medicare on your behalf.

- Know that your new Medicare number i...

What changes will you see with Medicare this year?

Nov 14, 2017 · That amount could change for 2018 depending on how the 2 percent Social Security cost-of-living adjustment (COLA) affects your individual monthly payment. Medicare Advantage (MA) premiums dip: The average monthly premium is expected to be about $30 next year, a slight decrease of $1.91 a month. MA plans are a private insurance alternative to …

What are the changes to Medicare Part B deductibles for 2018?

Apr 04, 2018 · Medicare Changes You Need To Know In 2018 1. Your card is being mailed out based on geographic location, but your card could arrive at a different time from your... 2. Once you receive your new Medicare card, destroy the old one. 3. Only give your new Medicare card number to people you trust to ...

When will new Medicare cards with MBIs be available?

Oct 13, 2017 · These guides are sent to those currently enrolled in Medicare. 2018 Medicare changes are listed in the guide. When more 2018 Medicare changes become available, the pdf version will be updated. If you are on a Medicare Advantage plan, you will receive a document entitled “Annual Notice of Changes for 2018” or your plan’s “Evidence of Coverage ” .

How much will Medicare Part D Cost you in 2018?

Jun 07, 2019 · Changes to Medicare mean that most beneficiaries will pay more for their benefits in 2018. Medicare Part A’s deductible and coinsurance amounts will increase slightly. Although Part B premiums will stay the same, individuals in the first modified adjusted gross income (MAGI) tier (see chart below) may see a small increase due to the social security cost-of-living …

What big changes are coming to Medicare?

What are the 2021 proposed changes to Medicare?Increased eligibility. One of President Biden's campaign goals was to lower the age of Medicare eligibility from 65 to 60. ... Expanded income brackets. ... More Special Enrollment Periods (SEPs) ... Additional coverage.Nov 22, 2021

What are the major changes to Medicare for 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.Sep 24, 2021

What changes are coming to Medicare in 2022?

Also in 2022, Medicare will pay for mental health visits outside of the rules governing the pandemic. This means that mental health telehealth visits provided by rural health clinics and federally qualified health centers will be covered. Dena Bunis covers Medicare, health care, health policy and Congress.Jan 3, 2022

Is Medicare changing in 2021?

For 2021, the maximum out-of-pocket limit for Medicare Advantage plans increased to $7,550 (plus out-of-pocket costs for prescription drugs), and it's staying at that level for 2022. As usual, most plans will continue to have out-of-pocket caps below the government's maximum.

What are the changes to Medicare in July 2021?

The MBS indexation factor for 1 July 2021 is 0.9%. Indexation will be applied to most of the general medical services items, all diagnostic imaging services, except nuclear medicine imaging and magnetic resonance imaging (MRI) and two pathology items (74990 and 74991).Jun 30, 2021

Does Medicare have new 2022 cards?

15 through Dec. 7, the more than 63 million Medicare beneficiaries can pick a new Medicare Part D drug plan, a new Medicare Advantage plan, or switch from Original Medicare into a Medicare Advantage plan or vice versa. Any coverage changes made during this period will go into effect Jan. 1, 2022.Oct 15, 2021

Will Social Security get a $200 raise in 2022?

The 2022 COLA increases have been applied to new Social Security payments for January, and the first checks have already started to hit bank accounts. This year, the highest COLA ever will be applied to benefits, with a 5.9% increase to account for rampant and sudden inflation during the pandemic.Jan 22, 2022

Will Social Security get a raise in 2022?

Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 5.9 percent in 2022. Read more about the Social Security Cost-of-Living adjustment for 2022. The maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $147,000.

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.Jan 10, 2022

What are the changes to Medicare Australia for 2021?

This includes $204.6 million to extend the Medicare Benefits Schedule (MBS) telehealth arrangements until 31 December 2021, bringing the total investment in telehealth to $3.6 billion. This is continuing to provide access to health services for all Australians regardless of where they live.Jul 1, 2021

How much is Medicare going up next year?

Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021). And those with fewer than 30 quarters worth of Medicare taxes will likely see a jump from the current rate of $471 in 2021 to $499 in 2022.Jan 4, 2022

What is the Medicare Part B deductible for 2021?

You pay: $1,556 deductible for each benefit period. Days 1-60: $0 coinsurance for each benefit period. Days 61-90: $389 coinsurance per day of each benefit period.

Why does Medicare go up each year?

Medicare premiums typically go up each year in line with the rising cost of healthcare . Yet 2018 is unusual, because some premiums that Medicare participants pay will stay the same.

How much is Medicare Part B?

For 2018, the surcharge ranges from $53.50 to $294.60 per month , which is the same as it has been in the past.

Who is Dan Caplinger?

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Follow @DanCaplinger

Is Medicare affected by the Affordable Care Act?

However, there are a few situations in which Medicare could be affected by what lawmakers are doing.

Does Medicare have a deductible?

Medicare also charges deductibles that participants have to pay before further coverage kicks in. Those amounts typically go up each year, but as with premiums, 2018 will be a bit unusual.

Retirees finally get a raise

After two years of little or no cost-of-living adjustments, retirees will finally get a 2% increase in their Social Security retirement benefits in 2018. It is the biggest COLA in six years. The average retirement benefit will increase by $27 to $1,404 per month and the average retired couple will receive a $46 raise to $2,340 per month.

Higher Medicare premiums offset COLAs

But retirees shouldn’t celebrate their increased benefits too soon. The average Social Security COLA will be consumed by higher Medicare Part B premiums, which pays for doctors’ visits and outpatient services. Most Medicare beneficiaries will pay $134 per month for Part B premiums in 2018, up $25 per month from last year.

Medicare surcharge changes

Some high-income retirees, defined as individuals with modified adjusted gross income (MAGI) exceeding $85,000 and married couples with MAGIs topping $170,000, will pay even more for both Medicare Part B and Medicare Part D prescription drug plan premiums in 2018.

Higher taxes for high-income workers

While income taxes may be going down because of the new tax law, payroll taxes will not. The maximum wages subject to payroll or FICA taxes, which fund Social Security benefits, increase by $1,200 this year. Employers and employees each pay 7.65% of the first $128,400 of wages in 2018.

Early retirees can earn more

Individuals who claim Social Security benefits before their full retirement age and who continue to work are subject to earnings restrictions that can temporarily reduce or eliminate their benefits. In 2018, retirees who are younger than 66 can earn up to $17,040 before losing any benefits, $120 more than last year.

The retirement age is rising

The current full retirement age of 66 is increasing for workers born after 1954 and that means the reduction for claiming benefits early is also on the rise. For individuals born in 1956 who turn 62 this year, their full retirement age is 66 and 4 months.

Qualifying for benefits costs more

The cost of the credits that a worker needs to qualify for Social Security benefits and Medicare coverage is going up. To be eligible for Social Security and Medicare, you must earn at least 40 Social Security credits with a maximum of four credits per year. In 2018, each credit represents $1,320 in earnings, up $20 from last year.