Should the Affordable Care Act (ACA) be repealed?

Fully repealing the ACA would accelerate the projected insolvency of the Medicare Hospital Insurance (HI) trust fund, out of which Part A benefits are paid.

How many people would lose their health insurance if Obamacare is repealed?

Across the country, 29.8 million people would lose their health insurance if the Affordable Care Act were repealed—more than doubling the number of people without health insurance. And 1.2 million jobs would be lost —not just in health care but across the board. How many people would lose their health insurance if the ACA were repealed?

How has the Affordable Care Act changed Medicaid's role?

ISSUE: The Affordable Care Act enhanced Medicaid's role as a health care purchaser by expanding eligibility and broadening the range of tools and strategies available to states. All states have embraced delivery and payment reform as basic elements of their programs.

What are the Medicare provisions of the Affordable Care Act?

The Medicare provisions of the ACA have played an important role in strengthening Medicare’s financial status for the future, while offsetting some of the cost of the coverage expansions of the ACA and also providing some additional benefits to people with Medicare.

How has the Affordable Care Act affect Medicare?

Medicare Premiums and Prescription Drug Costs The ACA closed the Medicare Part D coverage gap, or “doughnut hole,” helping to reduce prescription drug spending. It also increased Part B and D premiums for higher-income beneficiaries. The Bipartisan Budget Act (BBA) of 2018 modified both of these policies.

What will happen if the ACA is overturned?

The health insurance industry would be upended by the elimination of A.C.A. requirements. Insurers in many markets could again deny coverage or charge higher premiums to people with pre-existing medical conditions, and they could charge women higher rates.

Is Medicare Advantage Part of the Affordable Care Act?

The ACA does not eliminate Medicare Advantage plans or reduce the extra benefits they provide. It is up to each private insurer to decide what extra benefits to offer (they are required to offer all benefits covered by traditional Medicare).

How did the ACA impact Medicaid?

The ACA also made a number of other significant Medicaid changes, such as preventing states from reducing children's Medicaid eligibility until FY 2019; setting a uniform standard for children's eligibility at 138 percent FPL; streamlining eligibility, enrollment, and renewal processes; and updating payments to safety- ...

What would happen if Medicare ended?

Payroll taxes would fall 10 percent, wages would go up 11 percent and output per capita would jump 14.5 percent. Capital per capita would soar nearly 38 percent as consumers accumulated more assets, an almost ninefold increase compared to eliminating Medicare alone.

What effect will the repeal of the Patient Protection and Affordable Care Act have on health insurance markets?

Across the country, 29.8 million people would lose their health insurance if the Affordable Care Act were repealed—more than doubling the number of people without health insurance. And 1.2 million jobs would be lost—not just in health care but across the board.

How does the Affordable Care Act affect the elderly?

"The ACA expanded access to affordable coverage for adults under 65, increasing coverage for all age groups, races and ethnicities, education levels, and incomes."Under the ACA, older adults' uninsured rate has dropped by a third, indicators of their health and wellness have improved, and they're now protected from ...

What are the benefits of repealing the Affordable Care Act?

Many hospitals, family doctors, and other medical providers are already struggling financially because of COVID-19. Without the ACA, the financial pressures would increase, and many more rural and safety net hospitals that serve low- and middle-income families could be forced to close.

Can I have both Medicare and Obamacare?

No. The Marketplace doesn't affect your Medicare choices or benefits, so if you have Medicare coverage, you don't need to do anything. This means no matter how you get Medicare, whether through Original Medicare or a Medicare Advantage Plan (like an HMO or PPO), you don't have to make any changes.

Who benefits from the Affordable Care Act?

While the Medicaid program has historically covered low-income parents, children, elderly people, and disabled people, the ACA called for states to expand Medicaid to adults up to 138 percent of the federal poverty level and provided federal funding for at least 90 percent of the cost.

What is the difference between Medicaid and the Affordable Care Act?

The most important difference between Medicaid and Obamacare is that Obamacare health plans are offered by private health insurance companies while Medicaid is a government program (albeit often administered by private insurance companies that offer Medicaid managed care services).

Why are there variations of Medicaid after the Affordable Care Act was enacted?

Medicaid enrollment has grown regardless of expansion status in most states following implementation of the ACA. This is likely due to the so-called welcome-mat effect in which enrollment increases among individuals who were previously eligible for coverage but not enrolled.

What would happen if Medicare spending increased?

The increase in Medicare spending would likely lead to higher Medicare premiums, deductibles, and cost sharing for beneficiaries, and accelerate the insolvency of the Medicare Part A trust fund. Policymakers will confront decisions about the Medicare provisions in the ACA in their efforts to repeal and replace the law.

What are the benefits of the ACA?

Medicare Benefit Improvements. The ACA included provisions to improve Medicare benefits by providing free coverage for some preventive benefits , such as screenings for breast and colorectal cancer, cardiovascular disease, and diabetes, and closing the coverage gap (or “doughnut hole”) in the Part D drug benefit by 2020.

How much will Medicare increase over 10 years?

Increase Part A and Part B spending. CBO has estimated that roughly $350 billion 3 of the total $802 billion in higher Medicare spending over 10 years could result from repealing ACA provisions that changed provider payment rates in traditional Medicare.

How much will Medicare save in 2026?

Increase Medicare spending over time, in the absence of the Board’s cost-reducing actions. CBO projects Medicare savings of $8 billion as a result of the IPAB process between 2019 and 2026. 12

What is the ACA payment?

Payments to Health Care Providers. The ACA reduced updates in Medicare payment levels to hospitals, skilled nursing facilities, hospice and home health providers, and other health care providers. The ACA also reduced Medicare Disproportionate Share Hospital (DSH) payments that help to compensate hospitals for providing care to low-income ...

Why is the ACA important?

The Medicare provisions of the ACA have played an important role in strengthening Medicare’s financial status for the future, while offsetting some of the cost of the coverage expansions of the ACA and also providing some additional benefits to people with Medicare.

How many members are on the Medicare Advisory Board?

The ACA authorized a new Independent Payment Advisory Board (IPAB), a 15-member board that is required to recommend Medicare spending reductions to Congress if projected spending growth exceeds specified target levels, with the recommendations taking effect according to a process outlined in the ACA.

How would losing health insurance affect the economy?

By helping pick up the tab for individual insurance and expanding coverage on Medicaid, the ACA has helped millions of Americans afford their care. If this support were withdrawn, people would have less money to spend on other basic necessities like food and rent. Fewer dollars spent at grocery stores and other businesses means 1.2 million jobs would be lost.

How many people would lose their health insurance if the Affordable Care Act was repealed?

A cross the country, 29.8 million people would lose their health insurance if the Affordable Care Act were repealed—more than doubling the number of people without health insurance. And 1.2 million jobs would be lost —not just in health care but across the board.

How much of Medicare Part C is spent on other health care?

Under the ACA, Medicare Advantage (Medicare Part C) plans are required to spend at least 85% of the revenue generated by plan premiums on other plan health care costs, and not toward company profits or overhead.

Does Medicare pay for a wellness exam?

Because of provisions within the ACA, Medicare beneficiaries pay no deductibles or coinsurance for certain preventive screenings for conditions such as cancer, heart disease and diabetes. Annual Medicare wellness exams are free of charge, as are flu shots and certain other vaccines.

How many people are on medicaid in 2016?

According to government statistics, as of October 2016, Medicaid enrollment surpassed 74 million. More than 17 million people—an increase of 30 percent—gained eligibility since October 2013, just before full implementation of the ACA. Although 19 states have not yet chosen to adopt the ACA’s adult Medicaid eligibility expansion, ...

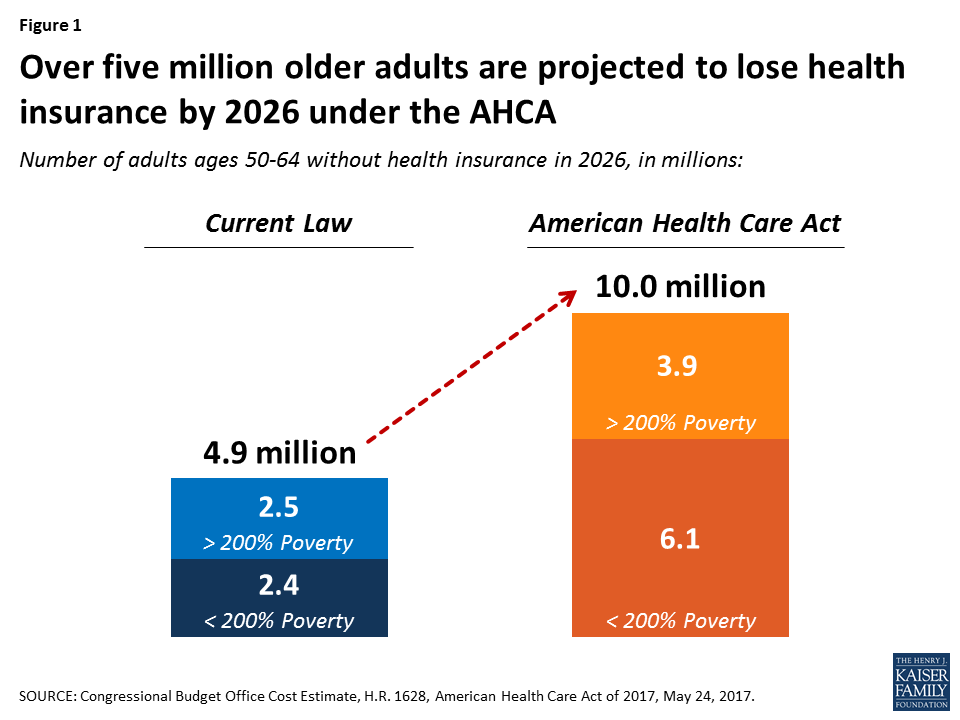

What is the American Health Care Act?

The American Health Care Act, reported by the House Energy and Commerce and Ways and Means committees in March 2017, would eliminate the ACA’s enhanced funding to support the expansion population, among other changes. The bill also would cap the amount paid by the federal government to states to support their overall Medicaid program, setting the cap at an amount below actual annual program growth costs, even though per person Medicaid spending is lower than that of either Medicare or private health insurance. The Congressional Budget Office has concluded that the loss of Medicaid funds at the enhanced rate for the expansion population (100% in 2014–2016, declining to 90% in 2020) to states’ normal federal Medicaid matching rates (ranging from 50% to 75%) would lead a number of states to eliminate coverage for the expansion population. 20 By 2026, less than one-third of all people eligible for coverage through the ACA expansion would live in a state that offers such coverage. The House measure also reduces Medicaid spending for community-based long-term services and supports and introduces new barriers to eligibility and enrollment. 21

How does fixed limit Medicaid funding help?

At least in theory, fixed limits on per person Medicaid funding could help foster innovation by encouraging strategies that substitute less costly but equally appropriate care, reduce excessive use of services of questionable value, or lower the price paid for care.

How much of the population does Medicaid cover?

Nationwide, Medicaid now covers 20 percent of the population; in expansion states with exceptionally large poor populations, such as West Virginia or California, Medicaid insures 25 percent or more of the total population (Exhibit 1). 14 At this rate, Medicaid can be expected to have considerable impact on health care.

What is the goal of delivery and payment reform?

Goal: To examine the effects of reducing the size and scope of Medicaid under legislation to repeal the ACA. Findings and Conclusions: Were the ACA’s Medicaid expansion to be eliminated and were federal Medicaid funding to experience major reductions ...

How does repeal and replace affect insurance?

For a half-century, the federal and state governments have partnered to improve the accessibility and quality of care for tens of millions of low-income and medically vulnerable children and adults and have shared in the cost of this undertaking. If repeal-and-replace efforts curtail this partnership, consequences could include the loss of coverage for millions, but also a dismantling of transformation endeavors or removing incentives from future progress. Medicaid already is a comparatively efficient means of insuring the population; the CBO has estimated that Medicaid coverage costs one-third less than comparable coverage bought on the individual market using tax subsidies. 25 Efforts to reduce federal funding will serve only to impede further payment and delivery reforms.

How would Medicaid be transformed?

House of Representatives that would transform Medicaid, not only by eliminating enhanced federal funding for eligibility expansion but also by reducing the amount of funding states receive to run their traditional programs.

How long after the repeal of the Medicaid expansion did the subsidies take effect?

The bill’s effects on insurance coverage and premiums would be greater once the repeal of the Medicaid expansion and the subsidies for insurance purchased through the marketplaces took effect, roughly two years after enactment. Effects on Insurance Coverage.

What would happen if we eliminated the penalty for not having health insurance?

But eliminating the penalty for not having health insurance would reduce enrollment and raise premiums in the nongroup market. Eliminating subsidies for insurance purchased through the marketplaces would have the same effects because it would result in a large price increase for many people.

How much will premiums increase in the nongroup market?

Premiums in the nongroup market (for individual policies purchased through the marketplaces or directly from insurers) would increase by 20 percent to 25 percent —relative to projections under current law—in the first new plan year following enactment.

What is H.R. 3762?

Importantly, H.R. 3762 would leave in place a number of market reforms— rules established by the ACA that govern certain health insurance markets. Insurers who sell plans either through the marketplaces or directly to consumers are required to: Provide specific benefits and amounts of coverage; Not deny coverage or vary premiums because ...

Why are baselines different from CBO and JCT?

Those baselines differ in part because CBO and JCT have reduced their projections of the number of people with health insurance coverage through the marketplaces and increased their projections of the number of people with coverage through Medicaid under current law. Future Legislation.

How many people will be in the non-group market by 2026?

By 2026, fewer than 2 million people would be enrolled in the nongroup market, CBO and JCT estimate. According to the agencies’ analysis, eliminating the mandate penalties and the subsidies while retaining the market reforms would destabilize the nongroup market, and the effect would worsen over time.

How many people will not have medicaid in 2026?

The estimated increase of 32 million people without coverage in 2026 is the net result of roughly 23 million fewer with coverage in the nongroup market and 19 million fewer with coverage under Medicaid, partially offset by an increase of about 11 million people covered by employment-based insurance.

When did Medicare ACA become law?

Those restrictions dramatically lowered costs for plan participants since the ACA became law in 2010 and enticed more Medicare enrollees to choose Advantage plans. Over the past decade, the average Medicare Advantage premium plummeted 43% while enrollment soared 117%, according to the NCPSSM.

How long will the ACA last?

A study cited in the amicus brief filed by the Center for Medicare Advocacy found that the ACA extended the solvency of the program’s trust fund by eight years to 2026, mostly by finding new sources of revenue and slowing the growth of payments to all providers.

What is the Medicare doughnut hole?

The Medicare Doughnut Hole Returns. Since 2011 the ACA has been steadily closing the prescription drug coverage gap , known as the doughnut hole, in Medicare Part D by requiring drug manufacturers and insurers to pick up more of the cost.

Does Medicare Advantage charge more for chemo?

The ACA requires Medicare Advantage plans to spend 85% of premium dollars on health care, not profits or overhead. The plans also can’t charge more than traditional Medicare for chemotherapy , renal dialysis, skilled nursing care and other specialized services.

Which case challenged the Affordable Care Act?

The case, California v. Texas, which was filed by 20 Republican-leaning states, challenges whether the Affordable Care Act can exist without the individual mandate to buy health insurance. A Republican-controlled Congress removed the financial penalty for those without insurance in 2017.

Will Medicare premiums rise faster?

Medicare Premiums and Medicare Deductibles Will Rise Faster. Curbing provider payments also lowered costs for seniors, helping to keep Medicare Part A deductibles and copayments in check. Similarly, Part B premiums and deductibles are much lower than projected before the ACA became law.