Particularly, it’s unclear how that cut would affect levies for Social Security or Medicare or both. Currently, employees and employers are each subject to a 6.2% tax for Social Security and 1.45% for Medicare. Self-employed individuals, meanwhile, make the full contributions on their own, 12.4% for Social Security and 2.9% for Medicare.

Full Answer

How would a payroll tax cut affect social security and Medicare?

Full details on how the Trump administration could implement a payroll tax cut are still not known. Particularly, it’s unclear how that cut would affect levies for Social Security or Medicare or both. Currently, employees and employers are each subject to a 6.2% tax for Social Security and 1.45% for Medicare.

Do I have to pay taxes on Social Security benefits?

The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits. Social Security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income payments, which aren't taxable.

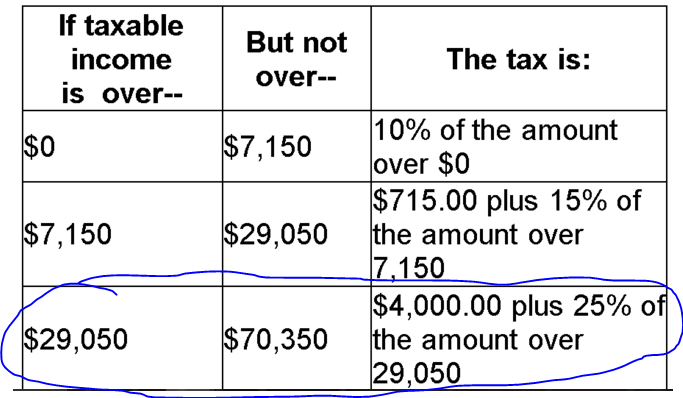

Are Social Security benefits subject to federal tax brackets?

Yes, a portion of your Social Security (SS) benefits may be subject to federal taxation using tax brackets. Your tax bracket is determined by your net taxable income, as shown on Form 1040. This value is your gross income minus all allowable deductions.

Do married couples pay taxes on Social Security benefits?

Married couples who live together but file separately have a threshold of $0 and must pay taxes on Social Security benefits regardless of other income earned. 4 What Is Ordinary Income?

What is the relationship between Social Security and Medicare taxes?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Does income tax affect SSI?

The good news is that tax refunds and tax credits don't immediately affect your SSI eligibility. This is because the SSA understands that this is money owed to you, and most likely was earned during a time when you were working full time and not receiving benefits.

How does income affect Social Security and Medicare?

If You Have a Higher Income If you have higher income, you'll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. We call the additional amount the “income-related monthly adjustment amount.” Here's how it works: Part B helps pay for your doctors' services and outpatient care.

Why are we running out of money for Social Security and Medicare?

Over the next ten plus years, the Social Security administration will draw down its reserves as a decreasing number of workers will be paying for an increasing number of beneficiaries. This is due to a decline in the birth rate after the baby boom period that took place right after World War II, from 1946 to 1964.

How much money can you have in bank on SSI?

WHAT IS THE RESOURCE LIMIT? The limit for countable resources is $2,000 for an individual and $3,000 for a couple.

Will tax refund affect benefits?

For every £1 you earn, your Universal Credit allowance decreases by 63p. So if your tax refund takes you over a certain threshold, this will impact on your Universal Credit payment for the assessment period.

What will Medicare cost in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

At what age do you stop paying taxes on Social Security benefits?

However once you are at full retirement age (between 65 and 67 years old, depending on your year of birth) your Social Security payments can no longer be withheld if, when combined with your other forms of income, they exceed the maximum threshold.

How much is taken out of your Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

Will Social Security be cut?

According to the 2022 annual report of the Social Security Board of Trustees, the surplus in the trust funds that disburse retirement, disability and other Social Security benefits will be depleted by 2035. That's one year later than the trustees projected in their 2021 report.

Will Social Security benefits be reduced in the future?

Introduction. As a result of changes to Social Security enacted in 1983, benefits are now expected to be payable in full on a timely basis until 2037, when the trust fund reserves are projected to become exhausted.

What president took money from the Social Security fund?

3. The financing should be soundly funded through the Social Security system....President Lyndon B. Johnson.1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19646.REMARKS WITH PRESIDENT TRUMAN AT THE SIGNING IN INDEPENDENCE OF THE MEDICARE BILL--JULY 30, 196515 more rows

How much is Social Security taxed?

Currently, employees and employers are each subject to a 6.2% tax for Social Security and 1.45% for Medicare. Self-employed individuals, meanwhile, make the full contributions on their own, 12.4% for Social Security and 2.9% for Medicare.

When will Medicare run out of money?

The Medicare Part A trust fund is projected to run out of money in 2026. Meanwhile, the latest estimate projects Social Security’s trust funds will be insolvent in 2035.

Why is payroll tax cut important?

A payroll tax cut is one idea President Donald Trump is considering in response to the negative effects of coronavirus on the U.S. economy. Experts say such a move would not necessarily be a magic bullet. One reason why: It could impair funding to Medicare and Social Security, which rely on payroll taxes for funding and are already facing looming ...

When was the last time there was a payroll tax cut?

That could be accomplished as it was the last time there was a payroll tax cut, in 2011, when money was moved from the general fund to the trust funds. However, halting payroll taxes for up to a year, which has been mentioned as a potential strategy, would be very expensive.

Is payroll tax regressive?

The other problem is that payroll taxes are regressive, so it’s a bigger chunk for people with low or moderate incomes than high income workers. And big earners are unlikely to spend that extra cash. “We know when high -income people get a tax cut, they don’t spend as much as low-income people do,” Gleckman said.

Will people who lose their jobs get a payroll tax cut?

Those who lose their jobs because of the negative impacts of the coronavirus will not benefit from a payroll tax cut. “They’re the ones who are going to have the biggest drops in income, and yet they’re not going to get anything from a payroll tax holiday,” Greszler said.

Can payroll tax cuts stimulate consumer spending?

While payroll tax cuts can stimulate consumer spending, there are reasons to believe that won’t necessarily work in this situation.