How will health care reform affect Medicare Advantage?

Health care reform will affect Medicare Advantage ….. and not in a good way for the millions of Medicare beneficiaries who have come to enjoy the plan benefits. The Centers for Medicare and Medicaid Services (CMS) predicted that enrollment in Medicare Advantage Plans will be cut in half as a result of the new Health Care Reform Bill.

How has Medicare enrollment changed over time?

The total number of Medicare beneficiaries has been steadily growing as well, but the growth in Medicare Advantage enrollment has far outpaced overall Medicare enrollment growth. In 2004, just 13% of Medicare beneficiaries had Medicare Advantage plans. That had grown to more than 43% by 2021.

Will the Affordable Care Act change Medicare?

In the end, the Affordable Care Act prevailed, and the federal government quickly prepared to unroll a raft of changes and improvements to Medicare.

Is it too soon to switch from marketplace to Medicare?

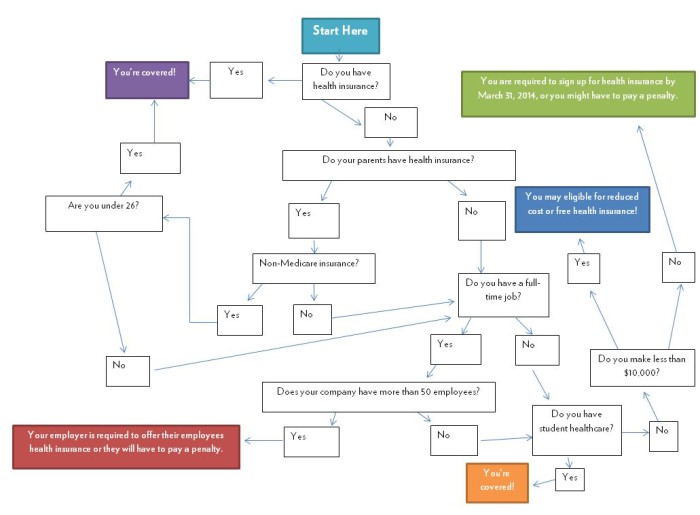

If you have a health plan through the Health Insurance Marketplace® and will soon have Medicare eligibility, it’s not too soon to start planning for your coverage to switch. If you have a Marketplace plan now, you can keep it until your Medicare coverage starts.

What are the major Medicare changes for 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.

How does the Affordable Care Act affect Medicare recipients?

Medicare Premiums and Prescription Drug Costs The ACA closed the Medicare Part D coverage gap, or “doughnut hole,” helping to reduce prescription drug spending. It also increased Part B and D premiums for higher-income beneficiaries. The Bipartisan Budget Act (BBA) of 2018 modified both of these policies.

How does the build back better plan affect Medicare?

The Build Back Better Act would add a hard cap limit on how much beneficiaries can spend on drugs in a year starting at $2,000. It will also lower beneficiaries' share of total drug costs below the spending cap from 25% to 23%.

What are the 2022 changes to Medicare?

Part A premiums, deductible, and coinsurance are also higher for 2022. The income brackets for high-income premium adjustments for Medicare Part B and D start at $91,000 for a single person, and the high-income surcharges for Part D and Part B increased for 2022.

How will repealing Obamacare affect Medicare?

Dismantling the ACA could thus eliminate those savings and increase Medicare spending by approximately $350 billion over the ten years of 2016- 2025. This would accelerate the insolvency of the Medicare Trust Fund.

How does the Affordable Care Act affect the elderly?

"The ACA expanded access to affordable coverage for adults under 65, increasing coverage for all age groups, races and ethnicities, education levels, and incomes."Under the ACA, older adults' uninsured rate has dropped by a third, indicators of their health and wellness have improved, and they're now protected from ...

What Medicare changes are in the build back better bill?

The House-passed Build Back Better Act includes additional provisions that expand health care access and support better health. The bill would make Medicaid coverage permanently available 12 months postpartum, extend enhanced ACA marketplace subsidies, and add hearing services to Medicare Part B.

Was the Build Back Better Act passed?

The bill was passed 220–213 by the House of Representatives on November 19, 2021. To provide for reconciliation pursuant to title II of S. Con.

Is Medicare in the build back better bill?

Among other adjustments, the BBBA would significantly improve Medicaid coverage and provide Medicare hearing care coverage for the first time. It also would reduce drug prices and cost sharing.

How much will Medicare premiums increase in 2022?

$170.10 a monthMedicare premiums are rising sharply next year, cutting into the large Social Security cost-of-living increase. The basic monthly premium will jump 15.5 percent, or $21.60, from $148.50 to $170.10 a month.

Will Medicare premium go down in 2022?

Medicare's Part B $170.10 basic monthly premium will not be reduced this year, but instead any savings from lower spending will be passed on to beneficiaries in 2023.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Q: What are the changes to Medicare benefits for 2022?

A: There are several changes for Medicare enrollees in 2022. Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that...

How much will the Part B deductible increase for 2022?

The Part B deductible for 2022 is $233. That’s an increase from $203 in 2021, and a much more significant increase than normal.

Are Part A premiums increasing in 2022?

Roughly 1% of Medicare Part A enrollees pay premiums; the rest get it for free based on their work history or a spouse’s work history. Part A premi...

Is the Medicare Part A deductible increasing for 2022?

Part A has a deductible that applies to each benefit period (rather than a calendar year deductible like Part B or private insurance plans). The de...

How much is the Medicare Part A coinsurance for 2022?

The Part A deductible covers the enrollee’s first 60 inpatient days during a benefit period. If the person needs additional inpatient coverage duri...

Can I still buy Medigap Plans C and F?

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap plans C and F (including the high-deductible Plan F) are n...

Are there inflation adjustments for Medicare beneficiaries in high-income brackets?

Medicare beneficiaries with high incomes pay more for Part B and Part D. But what exactly does “high income” mean? The high-income brackets were in...

How are Medicare Advantage premiums changing for 2021?

According to CMS, the average Medicare Advantage (Medicare Part C) premiums for 2022 is about $19/month (in addition to the cost of Part B), which...

Is the Medicare Advantage out-of-pocket maximum changing for 2022?

Medicare Advantage plans are required to cap enrollees’ out-of-pocket costs for Part A and Part B services (unlike Original Medicare, which does no...

How is Medicare Part D prescription drug coverage changing for 2022?

For stand-alone Part D prescription drug plans, the maximum allowable deductible for standard Part D plans is $480 in 2022, up from $445 in 2021. A...

Will Medicare follow suit?

But, the problem is unlikely to end with that. When Medicare arrives at a decision, private payers often follow suit, as the National Bureau of Economic Research has documented. If history repeats itself, it might not be long before more insurance companies follow the CMS’s lead on payments.

Can a physician cut back on time on their payroll?

The American Medical Association and the American Academy of Family Physicians are among the many professional organizations that have expressed concern that the new reimbursement rules will cause healthcare employers to cut back on the amount of time doctors on their payroll can spend with patients. After all, if a five-minute visit pays the same as a 50-minute visit, and the overall result is less income generated per hour, one way to compensate is to add more patients to the schedule.

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

How many people will have Medicare Advantage in 2020?

People who enroll in Medicare Advantage pay their Part B premium and whatever the premium is for their Medicare Advantage plan, and the private insurer wraps all of the coverage into one plan.) About 24 million people had Medicare Advantage plans in 2020, and CMS projects that it will grow to 26 million in 2021.

What is the maximum out of pocket limit for Medicare Advantage?

The maximum out-of-pocket limit for Medicare Advantage plans is increasing to $7,550 for 2021. Part D donut hole no longer exists, but a standard plan’s maximum deductible is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending decreases significantly) is increasing to $6,550.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

How much is the Medicare coinsurance for 2021?

For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020). The coinsurance for lifetime reserve days is $742 per day in 2021, up from $704 per day in 2020.

What is the income bracket for Medicare Part B and D?

The income brackets for high-income premium adjustments for Medicare Part B and D will start at $88,000 for a single person, and the high-income surcharges for Part D and Part B will increase in 2021. Medicare Advantage enrollment is expected to continue to increase to a projected 26 million. Medicare Advantage plans are available ...

How long is a skilled nursing deductible?

See more Medicare Survey results. For care received in skilled nursing facilities, the first 20 days are covered with the Part A deductible that was paid for the inpatient hospital stay that preceded the stay in the skilled nursing facility.

Why did Medicare enrollment drop?

When the ACA was enacted, there were expectations that Medicare Advantage enrollment would drop because the payment cuts would trigger benefit reductions and premium increases that would drive enrollees away from Medicare Advantage plans.

How did the ACA reduce Medicare costs?

Cost savings through Medicare Advantage. The ACA gradually reduced costs by restructuring payments to Medicare Advantage, based on the fact that the government was spending more money per enrollee for Medicare Advantage than for Original Medicare. But implementing the cuts has been a bit of an uphill battle.

How much does Medicare Part B cost in 2020?

Medicare D premiums are also higher for enrollees with higher incomes .

What is Medicare D subsidy?

When Medicare D was created, it included a provision to provide a subsidy to employers who continued to offer prescription drug coverage to their retirees, as long as the drug covered was at least as good as Medicare D. The subsidy amounts to 28 percent of what the employer spends on retiree drug costs.

What percentage of Medicare donut holes are paid?

The issue was addressed immediately by the ACA, which began phasing in coverage adjustments to ensure that enrollees will pay only 25 percent of “donut hole” expenses by 2020, compared to 100 percent in 2010 and before.

How many Medicare Advantage enrollees are there in 2019?

However, those concerns have turned out to be unfounded. In 2019, there were 22 million Medicare Advantage enrollees, and enrollment in Advantage plans had been steadily growing since 2004.; Medicare Advantage now accounts for well over a third of all Medicare beneficiaries.

How many Medicare Advantage plans will be available in 2021?

For 2021, there are 21 Medicare Advantage and/or Part D plans with five stars. CMS noted that more than three-quarters of all Medicare beneficiaries enrolled in Medicare Advantage plans with integrated Part D prescription coverage would be in plans with at least four stars as of 2021.

How many baby boomers are delaying Medicare?

In addition, currently around 40 percent of baby boomers are delaying their enrollment into Medicare until after the end of their initial enrollment period. These consumers look and act differently than enrollees who enter Medicare on time.

What happens if you don't do good during the AEP?

So, if you did good during the AEP, be careful, and if you didn’t do good during the AEP, there is still an opportunity,” he says. A more competitive market. The Medicare Advantage market is also heating up.

When did the Open Enrollment Period return?

Even then some had buyer’s remorse. The Open Enrollment Period (OEP) returned for the first time in six years and consumers took advantage of it. Five percent switched to another Medicare Advantage plan or to Original Medicare during the 2019 OEP.

Will baby boomers be on Medicare?

Baby boomers and Medicare. While leading-edge baby boomers have already aged into the Medicare program, the tailwind of baby boomers will continue to come into the Medicare space for the next eight or so years, notes Brousseau. Health plans need to prepare for these trailing edge baby boomers to enter Medicare and make sure they are targeting them ...

Is there a guarantee that Medicare beneficiaries will stay in their plan?

MA plan switching. There is no longer a guarantee that a Medicare beneficiary will stay in your plan even after enrollment during the Annual Election Period (AEP). Brousseau notes that after a three-year decline, the MA switch rates spiked during the 2019 Medicare AEP. Even then some had buyer’s remorse.

What happens if you enroll in Medicare after the initial enrollment period?

Also, if you enroll in Medicare after your Initial Enrollment Period, you may have to pay a late enrollment penalty. It’s important to coordinate the date your Marketplace coverage ends with the effective date of your Medicare enrollment, to make sure you don’t have a break in coverage.

Why is it important to sign up for Medicare?

It’s important to sign up for Medicare when you’re first eligible because once your Medicare Part A coverage starts, you’ll have to pay full price for a Marketplace plan. This means you’ll no longer be eligible to use any premium tax credit or help with costs you might have been getting with your Marketplace plan.

Is it too soon to switch to Medicare if you turn 65?

If you have a health plan through the Health Insurance Marketplace® and will soon have Medicare eligibility, it’s not too soon to start planning for your coverage to switch.

Can I cancel my Medicare Marketplace coverage for myself?

If you and your spouse (or other household members) are enrolled on the same Marketplace plan, but you’re the only one eligible for Medicare, you’ll cancel Marketplace coverage for just yourself. This way any others on the Marketplace application can keep Marketplace coverage. Find out how here.

When does Medicare sequestration expire?

We see no major regulatory changes, no significant Medicare policy or reimbursement changes, and nothing to extend the suspended 2% Medicare sequestration payment reduction, which is set to expire on April 1. This is likely because the reconciliation process does not allow for policy changes.

When was the American Rescue Plan Act approved?

On March 10, the House of Representatives approved nearly $1.9 trillion in new federal spending to address the nation’s ongoing public health and economic crisis. The American Rescue Plan Act of 2021, which now heads to the White House for President Biden’s signature, generally follows proposals the president outlined prior to his inauguration, ...