A “block grant” is a fixed amount of money that the federal government gives to a state for a specific purpose. If Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

What is ‘block granting’ of Medicaid?

It’s called “block granting.” Right now, Medicaid, which was expanded under the 2010 health law to insure more people, covers almost 75 million adults and children. Because it is an entitlement, everyone who qualifies is guaranteed coverage and states and the federal government combine funds to cover the costs.

How are block grants calculated for States?

Under those, states also get a fixed amount of money each year, but that sum is calculated based on how many people are in the program. Since block grants aren’t based on individual enrollment each year, the state wouldn’t necessarily get more money to compensate if, say, more people qualified for Medicaid because of an economic downturn.

How would the federal Medicaid grant work?

But the basic idea is that states would get fixed federal grants that would be based on the state and federal Medicaid spending in that state. The grant would grow slightly each year to account for inflation.

What do fixed and block grants mean for health care reform?

The fixed grants could mean states cut benefits or force beneficiaries to take on more cost-sharing, for instance. Some federal requirements are necessary, said Tom Miller, a resident fellow at the conservative American Enterprise Institute. Block granting could “be great or a disaster,” he said, depending on how it’s implemented.

Is Medicare a block grant?

These programs create a government obligation to finance a benefit or service for a prescribed set of people, with no aggregate limit on funding. Examples of such programs are Social Security, Medicare, food stamps, unemployment insurance, and, by extension, tax benefits like the deduction for mortgage interest.

How does the government use block grants?

Block grants provide state and local governments funding to assist them in addressing broad purposes, such as community development, social services, public health, or law enforcement, and generally provide them more control over the use of the funds than categorical grants.

How are block grants distributed?

Block grants are fixed-sum federal grants to state and local governments that give them broad flexibility to design and implement designated programs. Federal oversight and requirements are light, and funds are allocated among recipient governments by formula.

What would be the major challenges in introducing block grants for Medicaid?

The major problems with replacing entitlement programs with block grants include:No automatic response. When people or communities are most vulnerable economically, block grants don't respond to increased need.Capped and falling funding. ... “Increased flexibility” and lack of minimum standards.

What is a block grant example?

Block Grant Examples This can be in the form of childcare expenses, work assistance, and job-finding services. The Low Income Home Energy Assistance block grant is another example of this type of grant. This program, established in 1981, gives financial assistance to families who need help with energy costs.

How do block grants give power to the states?

Block grants are federal grants-in-aid that allow states considerable discretion (within broad limits) about how the funds will be spent. These give greater flexibility to state political actors to tailor programs to the state's particular needs than do categorical grants.

Are block grants taxable?

A: Yes, all block grant payments to applicants are taxable income and are subject to 1099 reporting with the IRS.

What is block grant funding?

1.4 The block grants are the element of the devolved administrations' funding which comes directly from the UK Government. Once the block grant has been determined, the devolved administrations have freedom to make their own spending decisions in areas of devolved responsibilities within the overall totals.

What is the difference between a grant program and a block grant?

Block grants are distinct from discretionary grants because they generally allow for more autonomy and flexibility to the states to decide how to implement the program. States may use the block grant funding to establish a program or to make sub-awards to local organizations to provide the services within their region.

What are the advantages and disadvantages of a block grant?

Welfare is used to help support low income families and the Low-Income Home Energy Assistance Block Grant is assistance to low-income families to help pay energy bills. The advantage of block grants is that it is less restrictive, but a disadvantage could be the use of the money ineffectively.

Are block grants automatic?

Block grants do not adapt and respond automatically to increased need.

What is the biggest problem with federal block grants?

What is one of the biggest problems with federal block grants? There is a need for greater accountability in how the funds are actually spent by the states.

Overview of the Medicaid program

Medicaid is funded by both the federal government and states, guaranteeing coverage to all eligible adults and children regardless of total cost. Under this structure, the federal government pays a set percentage of all costs incurred by states in providing services to all eligible Medicaid enrollees.

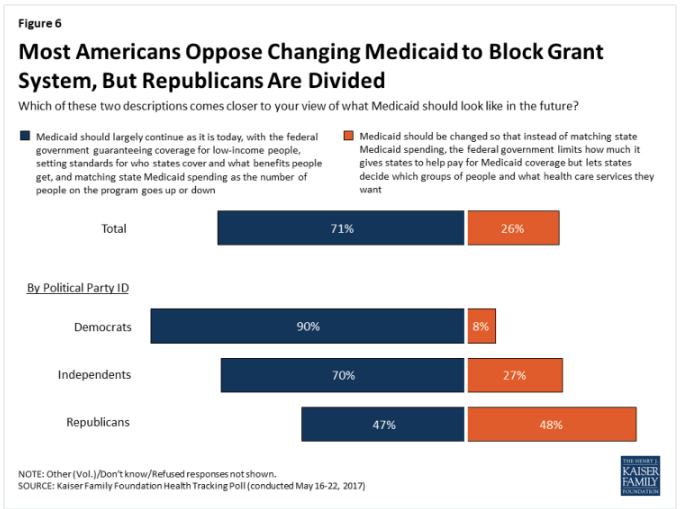

Attempts to undermine Medicaid through block grants and caps

Congressional Republicans have consistently tried to alter the current Medicaid payment structure; two of their long-standing proposals have been to adopt a block grant and a per-capita cap structure.

Conclusion

These efforts to implement Medicaid block grants and per-capita caps using Section 1115 waivers would not only critically undermine the federal government’s mandate to provide affordable health care for low-income, vulnerable populations, but they would also reduce overall funding for the program and shift Medicaid responsibility to the states.

Endnotes

Jon Greenberg, “Long odds against repeal with Democrats running the House,” Politifact, January 7, 2019, available at https://www.politifact.com/truth-o-meter/promises/trumpometer/promise/1388/repeal-obamacare/.