If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

Can I switch my Medicare plans?

If you decide that you would like to switch Medicare plans, you have a few options available to you. When switching plans, you will need to aware of the different enrollment periods and which ones allow you to change your existing coverage. What Enrollment Periods Occur Throughout the Year?

How does Medicare work with other insurance?

How Medicare works with other insurance. If you have Medicare and other health insurance or coverage, each type of coverage is called a "payer.". When there's more than one payer, " Coordination of benefits " rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to...

Should you switch to Medicare Advantage for supplemental benefits?

If you’re relatively healthy or you don’t frequently use healthcare, switching to Medicare Advantage could end up saving you money. Beyond potential savings, many people switch to Medicare Advantage for supplemental benefits. Supplemental benefits are items and services that Original Medicare doesn’t provide.

What changes can I make to my Medicare coverage?

During this time, you can elect to make changes to your Medicare coverage. You can switch Medicare Advantage plans, switch Part D plans, drop Original Medicare and enroll in a Medicare Advantage plan, or drop your Medicare Advantage plan and revert back to Original Medicare (and enroll in a stand-alone Prescription Drug Plan at this time).

What is the best supplemental insurance for Medicare?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

Can I change my Medicare Supplement company?

You can change your Medicare Supplement company at any time to get a lower premium. Many carriers offer a “rate lock” for the first year of coverage, making this another advantage of switching Medicare Supplement companies. During this rate lock period, you don't need to worry about increases to your premium.

Can I switch from Medicare plan F to plan G?

Switching from Plan F to Plan G If you enrolled in Plan F before 2020, you can continue your plan or switch to another Medigap plan, such as Plan G, if you prefer. You may want to make the change to reduce the price of your health insurance.

What can replace Medicare?

There are alternatives to Medicare. These alternatives include creditable group coverage through your employer until you retire, TRICARE, Veterans benefits, or Indian Health Services. Medicare Advantage is sometimes considered an alternative option.

Can I switch Medicare Supplement plans anytime?

As a Medicare beneficiary, you can change supplements at any time. As a result, there's no guarantee an application will be accepted if switched outside the designated Open Enrollment Period. An application may be “medically underwritten”.

Can you change Medicare Supplement plans every year?

You can either change to a standardized Medicare Supplement insurance plan with the same or fewer basic benefits than your current plan, or buy any Medicare Supplement Plan A, B, C*, F*, K, or L. You've had your current Medicare Supplement insurance plan for less than six months.

Which plan is better F or G?

In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not. This much coverage means that Plan F may come with a higher premium. However, choosing a high-deductible option for Plan F could help keep your premium down.

Is Plan G as good as Plan F?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

Is Plan G cheaper than Plan F?

Even though it has similar coverage, Medigap Plan G's monthly premiums are typically much less expensive than those for Plan F. In some cases, the difference in premiums between the two plans may be so large that you could save money by choosing Plan G, even after the Part B deductible.

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...

Can I switch from a Medicare supplement to an Advantage plan?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

Is there an alternative to Medicare Part D?

You may be able to gain prescription drug coverage through one of the following programs if you qualify: Employer-Sponsored Health Plans. Federal Employee Health Benefits (FEHB) Health Insurance Marketplace Plans.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

What is a Medicare company?

The company that acts on behalf of Medicare to collect and manage information on other types of insurance or coverage that a person with Medicare may have, and determine whether the coverage pays before or after Medicare. This company also acts on behalf of Medicare to obtain repayment when Medicare makes a conditional payment, and the other payer is determined to be primary.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

Which pays first, Medicare or group health insurance?

If you have group health plan coverage through an employer who has 20 or more employees, the group health plan pays first, and Medicare pays second.

How long can you switch to Medicare Advantage?

If you wait to tell your Medicare Advantage plan about your move, then you can switch to Original Medicare for up to two full months after the month that you inform your plan.

How to move from Medicare Advantage to Original Medicare?

The easiest way to move from Medicare Advantage to Original Medicare is during one of two annual periods that allow anyone to leave Medicare Advantage with no questions asked. The second way to leave your Medicare Advantage plan is if you’ve had it for less than one year (that is: you’re entitled to a “trial right”).

How to disenroll from Medicare Advantage?

Visit your local Social Security Office and ask to be disenrolled from Medicare Advantage ; Call 1-800-MEDICARE (1-800-633-4227) and process your disenrollment over the phone; or. Contact your Medicare Advantage insurer directly and request a disenrollment form.

What is Medicare Supplement Plan?

This kind of plan, also known as a Medigap policy, pays for gaps in Medicare’s coverage. For instance, Medicare Part B pays 80% of covered costs after you pay your annual deductible. A Medigap policy would pay the remaining 20% ...

What happens if you drop Medicare Advantage?

You may encounter issues, though, when leaving Medicare Advantage. If you voluntarily drop your Medicare Advantage coverage, you may run into difficulty when signing up for Medicare Part D prescription drug coverage or a Medigap supplemental insurance plan.

When does Medicare open enrollment end?

Medicare Advantage Open Enrollment Period. This special opportunity to leave Medicare Advantage lasts from January 1 through March 31 each year. If you disenroll during January, your changes will be effective on February 1. If you disenroll during February, your changes will be effective on March 1. If you disenroll during March, your changes will ...

When does Medicare leave the Advantage?

This special opportunity to leave Medicare Advantage lasts from January 1 through March 31 each year.

How to switch Medigap insurance?

How to switch Medigap policies. Call the new insurance company and arrange to apply for your new Medigap policy. If your application is accepted, call your current insurance company, and ask for your coverage to end. The insurance company can tell you how to submit a request to end your coverage.

How to end Medigap coverage?

Call the new insurance company and arrange to apply for your new Medigap policy. If your application is accepted, call your current insurance company, and ask for your coverage to end. The insurance company can tell you how to submit a request to end your coverage.

How long do you have to have a Medigap policy?

If you've had your Medicare SELECT policy for more than 6 months, you won't have to answer any medical questions.

How long is the free look period for Medigap?

Medigap free-look period. You have 30 days to decide if you want to keep the new Medigap policy. This is called your "free look period.". The 30- day free look period starts when you get your new Medigap policy. You'll need to pay both premiums for one month.

Can I keep my Medigap policy if I move out of state?

I'm moving out of state. You can keep your current Medigap policy no matter where you live as long as you still have Original Medicare. If you want to switch to a different Medigap policy, you'll have to check with your current or new insurance company to see if they'll offer you a different policy. If you decide to switch, you may have ...

Can you exclude pre-existing conditions from a new insurance policy?

The new insurance company can't exclude your Pre-existing condition. If you've had your Medigap policy less than 6 months: The number of months you've had your current Medigap policy must be subtracted from the time you must wait before your new Medigap policy covers your pre-existing condition.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

Is your healthcare plan still meeting your healthcare needs?

Are changes to your current Medicare plan costing you a little bit more this year? Are you taking any new drugs that may cost less on another plan? Is your doctor still in your plan’s network? Plans can change from year to year. Maybe it’s time to consider your options.

Are you missing out on any new Medicare Advantage benefits?

Most of our Medicare Advantage plans now include coverage for prescription drugs. Many include coverage for routine dental, vision and hearing care, as well—benefits not provided by Original Medicare.

Making the switch is simple

If you currently have Original Medicare and switch to a Medicare Advantage plan, your new health insurance plan will be activated on Jan. 1.

How to check availability of Medicare plan?

You may want to check the availability of plans in your area by calling 1-800-MEDICARE or going to Medicare Plan Finder ( www.medicare.gov/find-a-plan ). You will be able to compare plans by their quality ratings stars and find other data about plans. Once you select a plan that meets your health care coverage needs, it is a good idea to reach out to the plan to verify that the costs and coverage data you researched is current.

What is an ANOC in Medicare?

Each fall, your Medicare Advantage Plan should send you an Annual Notice of Change (ANOC) or Evidence of Coverage (EOC) notice explaining any plan changes for the coming year. Review this notice to understand your plan’s costs, covered services, and rules.

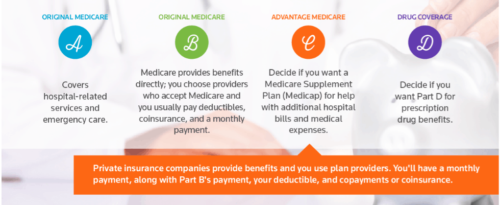

Why switch to Medicare Advantage?

Medicare Advantage provides all the benefits offered by Medicare Part A and Part B, and most Medicare Advantage plans also include prescription drug (Part D) coverage. If you’re relatively healthy or you don’t frequently use healthcare, switching to Medicare Advantage could end up saving you money.

When does the Medicare enrollment period end?

Annual Enrollment Period (AEP) The Annual Enrollment Period starts October 15 and lasts until December 7. During AEP, you can change your coverage in several ways, and that includes switching to Medicare Advantage.

Does Medicare Advantage work nationwide?

Medicare Advantage usually restricts your coverage to a local/regional network. If you travel a lot or you’re a snowbird/sunbird, keep in mind that Medicare Advantage typically limits your coverage to a local network —unless you can find a Medicare Cost Plan, a type of Medicare Advantage plan that works nationwide.

Does Medicare Advantage cover original Medicare?

The right Medicare Advantage plan could end up saving you money. And Medicare Advantage plans often include benefits that Original Medicare doesn’t cover. If you’re on the fence about switching to Medicare Advantage, that’s okay.

Can you switch from Medicare to Medicare Advantage?

And, in some ways, it is: If you switch, you might be limited to a network. You might need authorization for certain treatments. Your company might change your coverage each year.

Does Medicare Advantage have a free perk?

Many plans offer these benefits as a free perk, while other plans require an additional premium for extras such as dental and vision. Here is a list of supplemental benefits available through Medicare Advantage and the percentage of Medicare Advantage enrollees who have that benefit as part of their plan: