However, if an insurance company sells any Medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

What are Medicare supplement insurance plans?

Medicare Supplement plans pay for the costs, or “gaps,” in coverage that are not paid for by Original Medicare. 1 These can include prescriptions, doctor visits, vision and dental care, and more. The best medicare supplement insurance companies offer competitive pricing and modern, easy-to-use website interfaces.

When can I buy a Medicare supplement policy?

When it comes to Medicare eligibility, you can buy a Medicare Supplement policy beginning on the first day of the month you turn 65, and for the following six months. Depending on the plan and state, however, people who are under 65 may qualify if they are permanently disabled.

How do I choose the best Medicare supplement insurance companies?

The best medicare supplement insurance companies offer competitive pricing and modern, easy-to-use website interfaces. They also make it easy to reach customer service agents and offer discounts to their customers.

How does Medicare supplement insurance (Medigap) work?

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: 1 Copayments 2 Coinsurance 3 Deductibles

What must be included in a Medicare supplement plan?

These costs can include:Your Medicare deductibles.Your coinsurance.Hospital costs after you run out of Medicare-covered days.Skilled nursing facility costs after you run out of Medicare-covered days.

What is the difference between plan G and plan N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

Which of the following is a requirement for Medicare supplement policies?

To be eligible for a Medicare Supplement insurance plan, first enroll in Medicare. Medicare Part A and Part B are generally available to citizens of the USA or permanent legal residents for at least five continuous years who have any one of the following qualifications: Aged 65 and older.

What is a standard Medicare supplement plan?

Medicare Supplement insurance plans are standardized, mean that that each plan of the same letter (designated A through N) must offer the same basic benefits, regardless of which insurance company sells it.

What is the difference between plan F and plan G in Medicare?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

Is plan G better than plan F?

Ultimately, Plan G has the same benefits as the Plan F, except for coverage for the Part B deductible ($233 for 2022). Once you pay the Part B deductible, the coverage is the same for both plans.

How are Medicare supplement plans regulated?

The California Department of Insurance (CDI) regulates Medicare Supplement policies underwritten by licensed insurance companies. The CDI assists consumers in resolving complaints and disputes concerning premium rates, claims handling, and many other problems with agents or companies.

Which renewal provision must all Medicare supplement policies contain quizlet?

A continuation provision must include any reservation by the issuer of the right to change premiums and any automatic renewal premium increases based on the policy holders age.

Which renewal provision must all Medicare supplement policies contain?

A Medicare Supplement Policy must contain a 30-day Free Look Provision on the first page of the policy in bold print.

Which of the following is a requirement for standard Medicare Supplement plans quizlet?

What are those requirements? People must be at least 65 years old, regardless of their health condition, and must apply for a Medicare supplement policy within six months of enrolling in Medicare Part B.

What is supplemental insurance?

Listen to pronunciation. (SUH-pleh-MEN-tul helth in-SHOOR-ents) An additional insurance plan that helps pay for healthcare costs that are not covered by a person's regular health insurance plan. These costs include copayments, coinsurance, and deductibles.

Which of the following is a basic benefit of Medicare supplemental insurance?

Plan A is the most basic of the 10 Medicare Supplement insurance plans, covering the fewest benefits. Medicare Supplement insurance Plan A covers 100% of four things: Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days after Medicare benefits are used up.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance is private insurance that can help cover some of the out-of-pocket costs that Original Medicare (Part A and Part B) does not, such as copayments, coinsurance and deductibles. Comparing Medicare Supplement Insurance plans can help you find the right policy for your health care needs.

What are the additional benefits of Medicare Supplement?

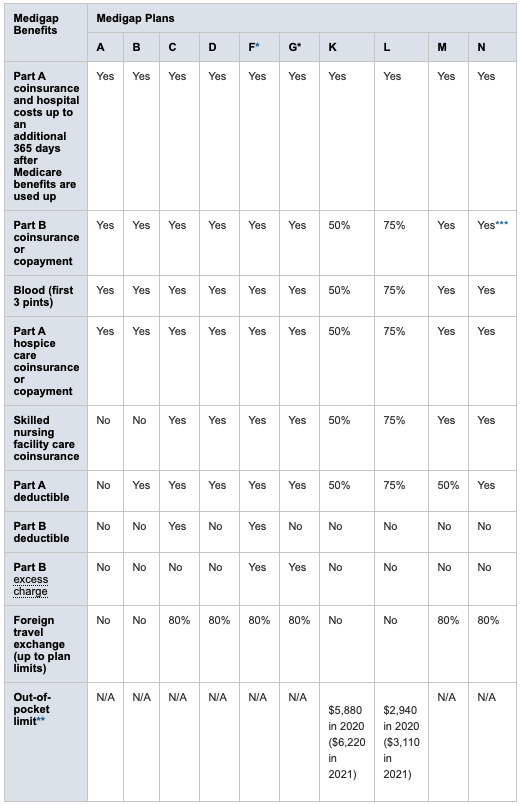

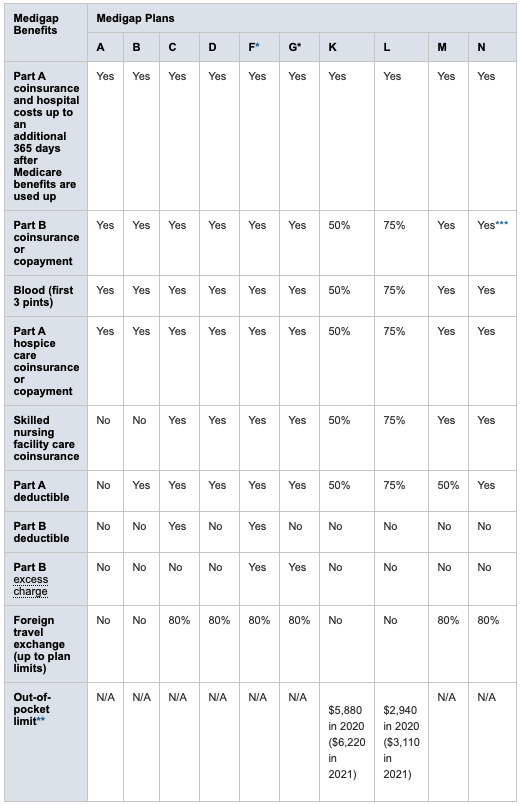

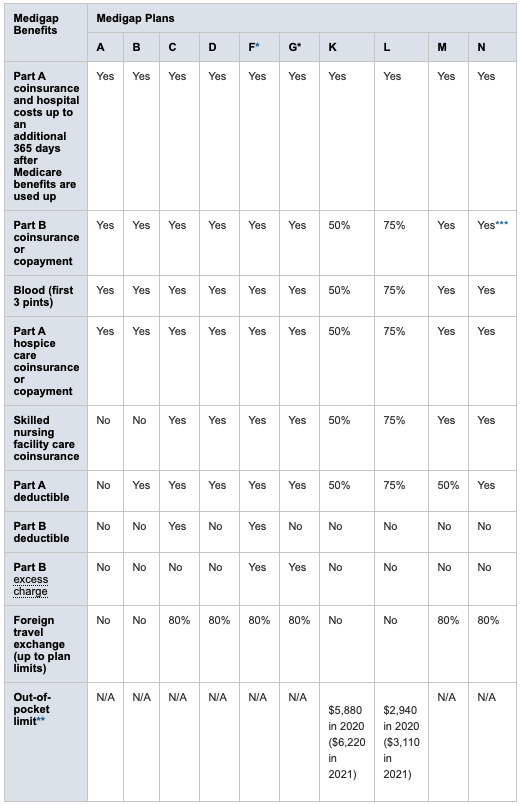

Each type of plan may also cover one or more of these five additional benefits: Skilled nursing facility care coinsurance. Part A deductible. Part B deductible. Part B excess charge. Foreign travel exchange. The chart below illustrates all possible benefits covered by Medicare Supplement Insurance and which plans cover them.

What are the benefits of Medigap?

Each type of Medigap plan covers four standard benefits: 1 Part A coinsurance and hospital costs 2 Part B coinsurance or copayment 3 Your first three pints of blood 4 Part A hospice care coinsurance or copayment

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

Which is the most comprehensive Medicare plan?

Medigap Plan F is the most comprehensive type of plan, which explains why it's also the most popular type of Medicare Supplement Insurance plan. You may be better served with a less comprehensive plan, however, so it's important to compare each type of basic benefit.

Does every insurance company offer a Medigap plan?

Not every insurer offers each type of Medigap plan. However, if an insurance company sells any Medigap policy, they must offer at least Medigap Plan A and either Medigap Plan C or Plan F. Medicare Supplement Insurance plans only cover one person, so if you and your spouse are both eligible, you’ll each need to purchase a separate policy. ...

How To Choose The Top Medicare Supplement Company In Your Area

While every top carrier is competitive, it makes sense to pay more for superior customer service and financial stability.

How Much Do Blue Cross Blue Shield Medicare Supplement Plans Cost

There are some costs associated with Medigap plans, including BCBS plans. These costs may vary by the specific plan and your location. These costs can include:

What Are The Benefits Of Buying A Medicare Supplement Plan

The benefit of a Medicare Supplement plan is that it pays for the costs that are not paid for by Original Medicare. These include coverage for prescription medications, hospital stays, hospice care, bloodwork, and emergency room visits. It can drastically limit the out-of-pocket expenses that you may be hit with.

Mutual Of Omaha Medicare Supplements

Mutual of Omaha was one of the very first companies to offer Medicare supplement plans. When Medicare was signed into law in 1965, Mutual was stepped up to help seniors get more coverage. They have been covering seniors ever since, and have several subsidiary companies, including United World Life Insurance Co.

What Is Covered Under Medicare Supplement Insurance Plan A

Plan A is the most basic of the 10 Medicare Supplement insurance plans, covering the fewest benefits.

Medicare Supplement Plan Reviews

After our evaluation, we selected nine best Medicare supplemental insurance providers: United Medicare Advisors, Cigna, Mutual of Omaha, Medicare.net, Humana, Blue Cross Blue Shield, SelectQuote Senior, Aetna and AARP by United Healthcare. Each of these companies met our criteria and stood out uniquely.

Medicare Supplement Insurance Writers

Information that follows is as of . The same informaton is also available in the following formats.

What is a Medicare Supplement Plan?

A Medicare Supplement Plan, also called a Medigap plan, is a plan sold by private companies, separate from Medicare. Medicare Supplement plans pay for the costs, or “gaps,” in coverage that are not paid for by Original Medicare. These can include prescriptions, doctor visits, vision and dental care, and more.

How long do you have to switch back to Medicare Advantage?

If you’re unhappy with your Advantage plan and switch back to a Medicare Original Plan (which you can do within 12 months of enrolling in the Medicare Advantage plan), you then become eligible for Medicare Supplement insurance.

Is Medicare Advantage the same as Medigap?

Both Medicare Advantage and Medigap plans are supplements to Original Medicare, but they are different. Medicare Advantage is an alternative Medicare plan. Medicare Advantage has a low or $0 monthly charge and covers most prescription medicine, though the choice of doctors and networks may be limited.

Do all Medicare Supplement plans have the same benefits?

No matter which insurance company offers a particular Medicare Supplement plan, all plans with the same letter cover the same basic benefits. For instance, all Plan C policies have the same basic benefits no matter which company sells the plan.

Does Cigna cover Part B?

Warning. As of Jan. 1, 2020, Medicare Supplement plans sold to new Medicare recipients aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on Jan. 1, 2020. Medicare Supplement plans don't cover the costs ...

Does Medicare Supplement cover out of pocket costs?

As the cost of healthcare continues to increase, so do the out-of-pocket costs for services that are not covered by Original Medicare. Because it can be difficult to predict your exact health care needs and costs, Medicare Supplement plans are used to cover many of the services you may need.

Does Mutual of Omaha offer a discount?

Mutual of Omaha also offers a 7% discount if your spouse or domestic partner has applied for, or is applying for, coverage with Mutual of Omaha or an affiliate company. However, the company only offers three plans (F, G, and N).

What is an insured in Medicare?

An insured is covered under a Medicare policy that provides a list of network healthcare providers that the insured must use to receive coverage. In exchange for this limitation, the insured is offered a lower premium.

What is Guarantee of Insurability?

Guarantee of Insurability; Guarantee of insurability option allows the insured to periodically increase benefit levels without providing evidence of insurability. The amount is usually limited to allowing a 5% compounded annual increase. Each Medicare supplement policy must be at least.

What is 20% coinsurance?

The 20% Part B coinsurance amounts for Medicare approved services. B; Medicare Supplement Plan A provides the core, or basic, benefits established by law. All of the above are part of the basic benefits, except for the Medicare Part A deductible, which is a benefit offered through nine other plans.

Can an employee switch to Medicare?

federal laws require keeping the employee on the group health insurance rolls and deferring their eligibility for Medicare until retirement; The employee has the right to reject the company's plan and elect Medicare but the company can offer no incentives for switching to Medicare.

What factors affect Medicare premiums?

In the case of Medicare Supplement plans, many factors affect what you’ll pay each month. Demographic information – such as age , location, and tobacco use – affect Medigap premium prices. Indeed, the carrier offering the plan also influences rates across the board. Each of the top 10 Medicare Supplement carriers on the list above is ...

What is INA insurance?

The Insurance Company of North America (INA) began in 1792 as the first Marine insurer of the United States. INA would eventually become the company we know today as Cigna, one of the most renowned health insurance carriers offering Medicare Supplement policies. Both AM Best and S&P rate Cigna at an A.

What is United American insurance?

United American: A Medigap Carrier with High Ratings. United American Insurance Company was founded in 1947. The company maintains an A+ rating from AM Best and has done so for over 40 years. S&P’s rating for United American is AA-.

Is Medicare competitive in 2021?

While every top carrier is competitive, it makes sense to pay more for superior customer service and financial stability. There are many top-rated medicare supplement companies to choose from in 2021, and when you use our agents, you get your cake and eat it too! When you enroll in a policy through us, you get the benefits ...

Does Cigna have the same coverage as Plan G?

So, Plan G with Mutual of Omaha offers the same coverage as Plan G with Medico. Plan N with Cigna has the same coverage as Plan N with UnitedHealthcare. Additionally, all Medicare Supplement plans allow you to go to any doctor accepting Medicare assignment – which is the majority of doctors, coast-to-coast.