If you set benefits to begin at full retirement age (FRA) — 66 and 4 months for people born in 1956 and gradually rising to 67 over the next few years — your first payment generally will arrive in the month after you attain that age.

When does Medicare start at age 65?

If you sign up during one of the months before your 65th birthday, your coverage will begin on the first day of the month you turn 65 (or one month before your birthday if you were born on the first day of the month). Is Medicare Free at Age 65?

What does it mean to retire at 67 with Medicare?

Coverage. Retiring at 67? Understanding Your Medicare Benefits. For anyone born after 1960 or after, the full retirement age is 67. This is the age that you will be able to receive your full retirement benefits.

When should I begin receiving my retirement benefits?

That there are other things to consider when making the decision about when to begin receiving your retirement benefits. If you decide to delay your benefits until after age 65, you should still apply for Medicare benefits within three months of your 65th birthday.

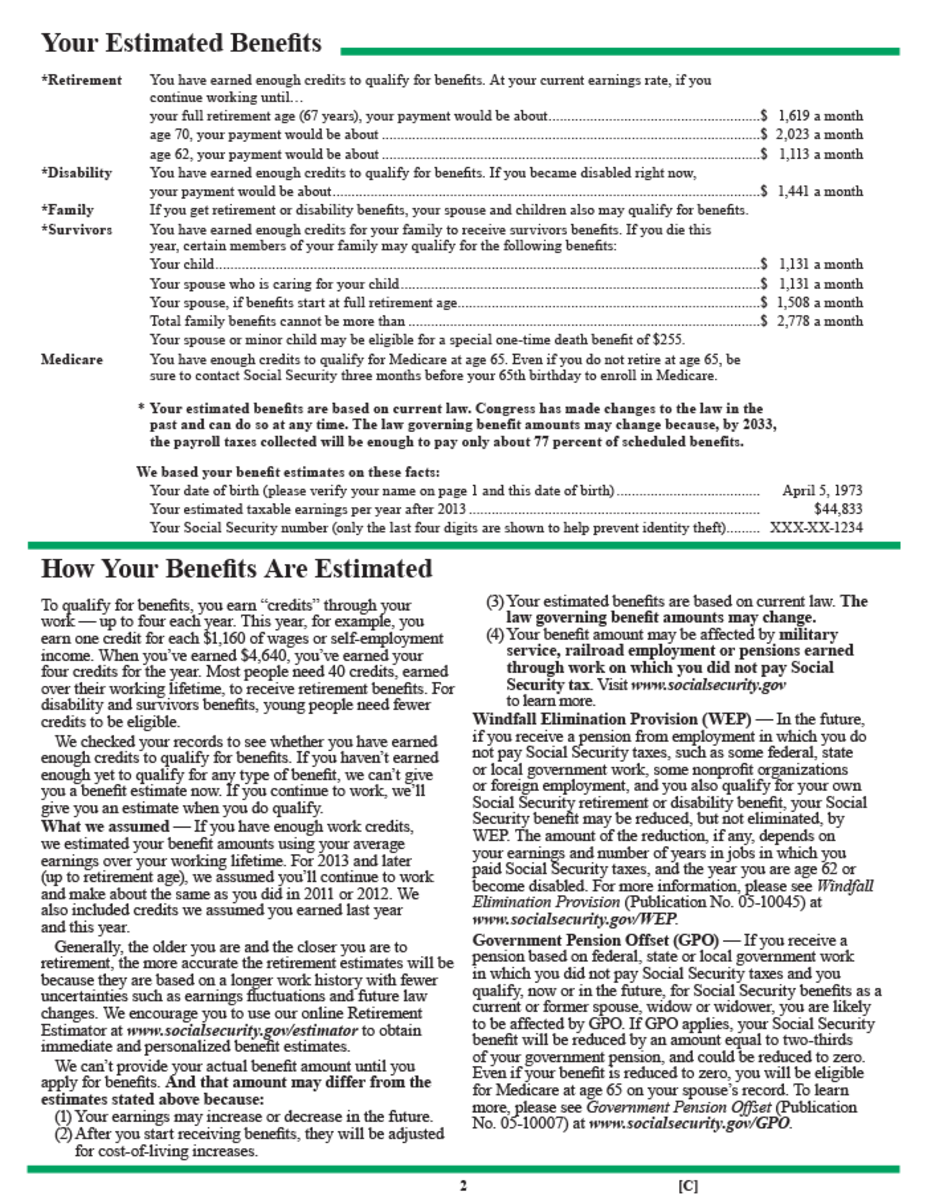

What is the full retirement and age 62 benefit by year?

Full Retirement and Age 62 Benefit By Year Of Birth Year of Birth 1. Full (normal) Retirement Age Months between age 62 and full retiremen ... At Age 62 3. At Age 62 3. 1958 66 and 8 months 56 $716 $333 1959 66 and 10 months 58 $708 $329 1960 and later 67 60 $700 $325 6 more rows ...

Does Medicare start automatically at age 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

How soon before I retire should I apply for Medicare?

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application.

Does Medicare start when you start Social Security?

If you are already getting benefits from Social Security or the RRB, you will automatically get Part A and Part B starting on the first day of the month when you turn 65. If your birthday is on the first day of the month, Part A and Part B will start the first day of the prior month.

How many months before a person turns 65 can he or she enroll for Medicare benefits?

3 monthsYour first chance to sign up (Initial Enrollment Period) It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month.

When should I apply for Social Security when I turn 66 and 2 months?

You can apply up to four months before you want your retirement benefits to start. For example, if you turn 62 on December 2, you can start your benefits as early as December. If you want your benefits to start in December, you can apply in August.

When can I get Medicare if I was born in 1966?

The standard age for Medicare eligibility has been 65 for the entirety of the health insurance program, which debuted in 1965.

How much does Social Security take out for Medicare each month?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

What month is Medicare deducted from Social Security?

The Medicare premium that will be withheld from your Social Security check that's paid in August (for July) covers your Part B premium for August. So, if you already have Part B coverage you'll need to pay your Medicare premiums out of pocket through July.

Can you have Medicare and employer insurance at the same time?

Yes, you can have both Medicare and employer-provided health insurance. In most cases, you will become eligible for Medicare coverage when you turn 65, even if you are still working and enrolled in your employer's health plan.

What should I be doing 3 months before 65?

You can first apply for Medicare during the three months before your 65th birthday. By applying early, you ensure your coverage will start the day you turn 65. You can also apply the month you turn 65 or within the following three months without penalty, though your coverage will then start after your birthday.

What documents do I need to apply for Medicare?

What documents do I need to enroll in Medicare?your Social Security number.your date and place of birth.your citizenship status.the name and Social Security number of your current spouse and any former spouses.the date and place of any marriages or divorces you've had.More items...

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Do I Automatically Get Medicare When I Turn 65?

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift...

What if I’m Not Automatically Enrolled at 65?

If your Medicare enrollment at 65 is not automatic, but you want to enroll, here are some more magic numbers.

Is Medicare Free at Age 65?

While Medicare Part B has a standard monthly premium, 99 out of 100 people don’t have to pay a premium for Medicare Part A. Still, no part of Medic...

How Much Does Medicare Cost at Age 65?

The standard premium for Part B modestly increases year over year. Part A costs also can increase, including the annual deductible and other coinsu...

Can You Get on Medicare at Age 62?

No, but while the standard age of eligibility remains 65, some call for lowering it. In a recent GoHealth survey, among respondents age 55 and olde...

Can a 55-Year-Old Get Medicare?

While 65 has always been Medicare’s magic number, there are a few situations where the Medicare age limit doesn’t apply, and you may be able to get...

When does Part A coverage start?

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65. (If your birthday is on the first of the month, coverage starts the month before you turn 65.)

When does insurance start?

Generally, coverage starts the month after you sign up.

How long do you have to sign up for a health insurance plan?

You also have 8 months to sign up after you or your spouse (or your family member if you’re disabled) stop working or you lose group health plan coverage (whichever happens first).

What is a health plan?

In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How to change Medicare premiums?

On Medicare.gov, go to “Your Medicare costs,” and click “Medicare costs at a glance” to stay informed of the current rates for premiums, deductibles and coinsurance for parts A and B. Those enrolled in parts C and D should receive premium change notifications directly from the insurance companies providing coverage, typically mailed near the last quarter of each year, so beneficiaries are able to make changes during the open enrollment period.

When will Medicare start in 2020?

Medicare costs in 2020. In most cases, eligibility for Medicare benefits begins at age 65. If the Medicare application for Part A and/or Part B is submitted to Social Security during the first three months of the initial enrollment period, the effective date will be either the first of the month in which your birthday falls or the first ...

What is the Medicare premium for 2020?

Therefore, expect to pay more at age 66, 67 and so on. For 2020, the standard Part B monthly premium is $144.60. Based on income, it may be more. The deductible is $198, and the coinsurance is 20% of the Medicare-approved amount. Part C, Medicare Advantage, varies with the plan.

What are the costs of Medicare?

Cost categories for Medicare benefits#N#Medicare costs may include the following: 1 Premium: Periodic payment for medical or prescription drug coverage. 2 Deductible: Payment required for healthcare or drugs before insurance-covered payments kick in. 3 Coinsurance: Amount that reflects your share of the cost of services after applicable deductibles. 4 Copayments: Determined amount you pay at point of service.

What is the penalty for not enrolling in Medicare?

If you are not eligible for premium-free Part A, the late penalty is a monthly premium increase of 10%. This higher premium will be required for double the number of years you were eligible for Part A but did not enroll. Based on the illustration provided by Medicare, if you could have been enrolled in Part A for the past two years but did not sign up, your liability is a 10% higher premium for four years. Similarly, the penalty for failing to apply for Part B is 10%; however, you may have to pay the penalty for the duration of your enrollment in Part B.

What is premium insurance?

Premium: Periodic payment for medical or prescription drug coverage. Deductible: Payment required for healthcare or drugs before insurance-covered payments kick in. Coinsurance: Amount that reflects your share of the cost of services after applicable deductibles. Copayments: Determined amount you pay at point of service.

Do you have to pay late enrollment penalty for Medicare?

Medicare recipients who are permitted to sign up during a special enrollment period usually are not required to pay a late enrollment penalty. This is typically the case for people who are still employed and covered under the company’s group health plan.

When do you get Medicare?

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

How long do you have to be on Social Security to get Medicare?

Individuals under 65 and already receiving Social Security or Railroad Retirement Board benefits for 24 months are eligible for Medicare. Still, most beneficiaries enroll at 65 when they become eligible for Medicare.

Why do people not get Medicare at 65?

These days, fewer people are automatically enrolled in Medicare at age 65 because they draw Social Security benefits after 65. If you do not receive Social Security benefits, you will not auto-enroll in Medicare.

What is the age limit for Medicare?

Most older adults are familiar with Medicare and its eligibility age of 65. Medicare Part A and Medicare Part B are available based on age or, in some cases, health conditions, including:

When did Medicare become law?

In the summer of ‘65, President Lyndon Johnson signed Medicare into law, establishing the age of eligibility at 65. The eligibility age for Medicare remains the same to this day.

How old do you have to be to get medicare?

While some specific circumstances can impact at what age you are eligible for Medicare, most people must wait until 65 as things currently stand.

Does Medicare Part B have a premium?

While Medicare Part B has a standard monthly premium, 99 out of 100 people don’t have to pay a premium for Medicare Part A. Still, no part of Medicare can genuinely be called “free” because of associated costs you have to pay, like deductibles, coinsurance and copays.

What is the retirement age for Medicare?

Understanding Your Medicare Benefits. For anyone born after 1960 or after, the full retirement age is 67. This is the age that you will be able to receive your full retirement benefits. However, if you are planning to retire at the age of 67, you should be aware that you may need to make some decisions about your health insurance prior ...

What age does Medicare cover?

Medicare provides coverage for all adults over the age of 65 or with long-term disabilities, but to take advantage of this care, you must enroll at the appropriate time to receive the best coverage at the best price.

What is Medicare Part D?

Medicare Part D is designed to cover prescription medications and requires a premium payment and usually a copayment with each medication.

When do you have to apply for medicare?

In order to receive Medicare coverage, you will need to apply during the initial enrollment period. This period begins three months prior to your birthday and ends three months after you turn 65. In order to receive Medicare benefits, it is critical that you enroll in coverage during this initial period so that you can ensure you gain coverage ...

How old do you have to be to qualify for special enrollment?

In order to qualify for Special Enrollment, you must be over the age of 65 and still be receiving healthcare coverage through a plan sponsored by either your or your spouse’s employment. This period begins as soon as you turn 65 and ends eight months after you retire or the healthcare plan you are using is terminated.

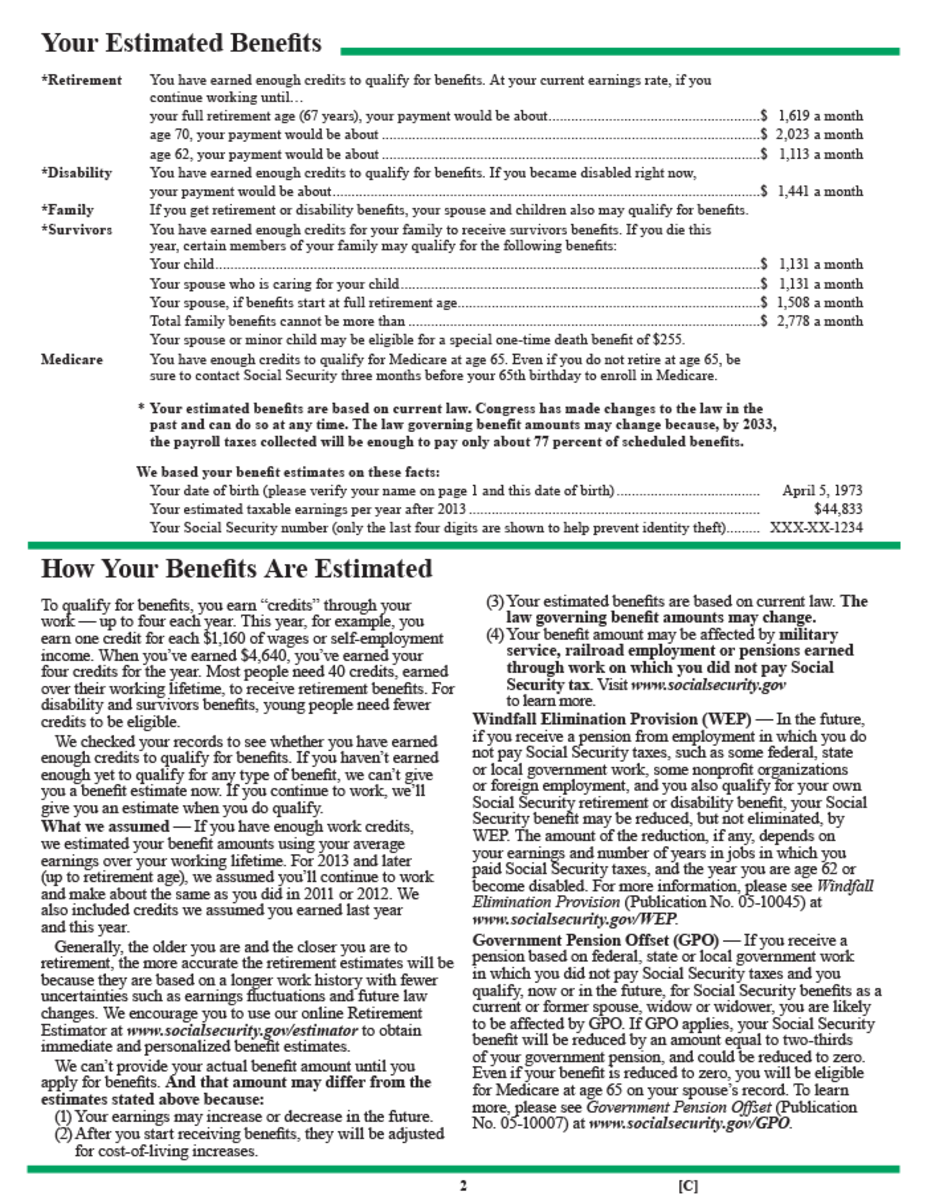

What happens if you delay taking your full retirement?

If you delay taking your benefits from your full retirement age up to age 70, your benefit amount will increase. If you start receiving benefits early, your benefits are reduced a small percent for each month before your full retirement age.

What is the maximum amount of retirement benefits for spouse?

The maximum benefit for the spouse is 50 percent of the benefit the worker would receive at full retirement age. The percent reduction for the spouse should be applied after the automatic 50 percent reduction. Percentages are approximate due to rounding.

Is it better to collect your retirement benefits before retirement?

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

If you don't, it could end up costing you some of your monthly Social Security benefit

If you are turning 66 this year, there's something very important you should know about Social Security.

This change to Social Security will affect benefits for retirees turning 66

To understand the rule change that will affect you if you're turning 66 next year, you need to know a few basic facts about how Social Security benefits work.

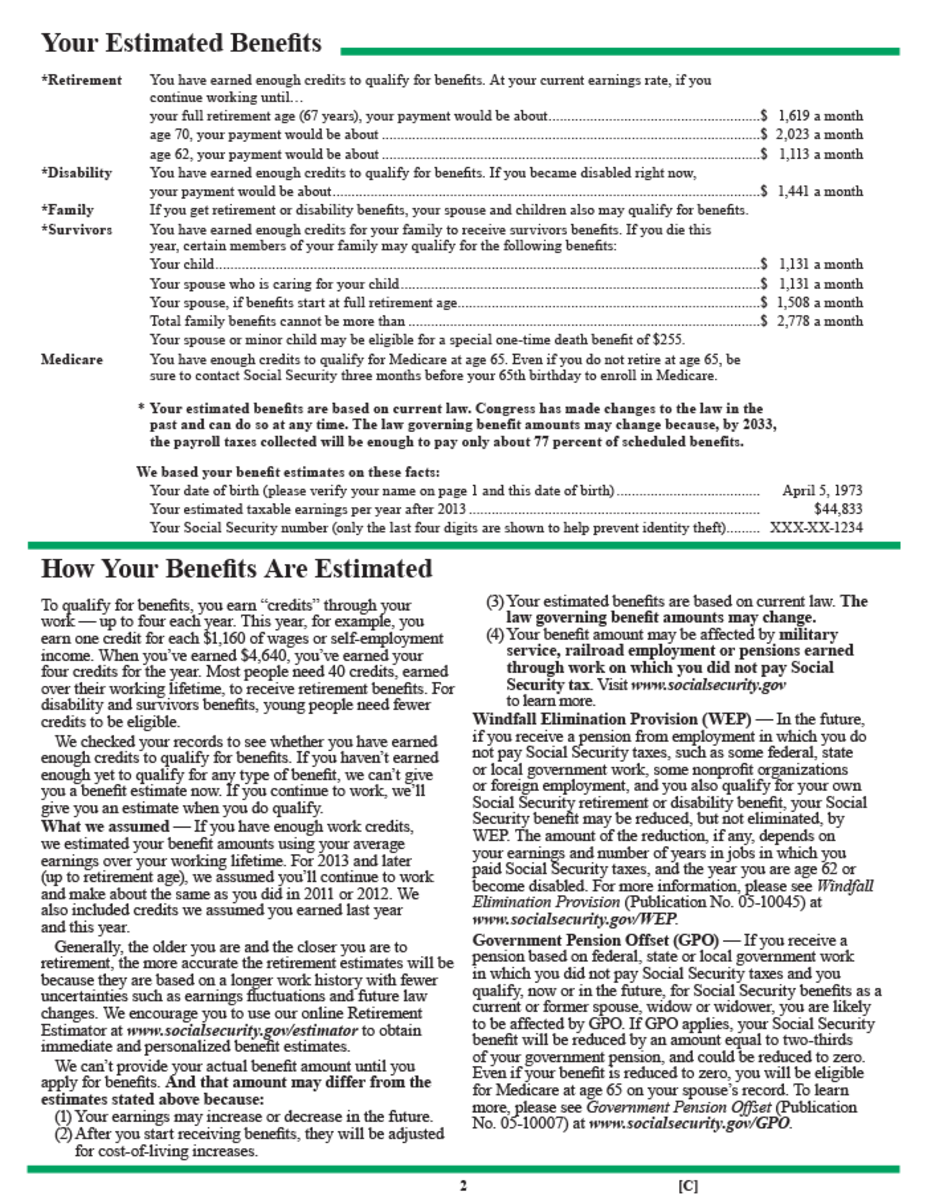

How FRA is changing if you're turning 66 in 2022

Amendments to Social Security in 1983 slowly phased in a change to FRA. As the chart below shows, here is when full retirement age is, based on the year you were born.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

When will Social Security pay my first payment?

If you set benefits to begin at full retirement age (FRA), which now is 66 and 2 months and gradually will rise to 67 over the next several years, your first payment generally will arrive in the month after you attain that age. That’s because Social Security pays benefits a month behind, so your benefit for, say, June 2021 will arrive in July.

When will Social Security pay in 2021?

That’s because Social Security pays benefits a month behind, so your benefit for, say, June 2021 will arrive in July. Your birthday generally determines your monthly payment schedule: If the birthday is between the first and the 10th day of the month, the benefit payment arrives on the second Wednesday of each month.

How long does it take to get a disability?

Benefit applications can take up to three months to process, so apply three months before your planned start date.

When is the best time to retire from Social Security?

A. Personal health and economic issues may suggest the most advantageous time to begin Social Security, but on an actuarial basis, there is no “best” time to begin benefits. Early retirees receive smaller benefits for more years. Late retirees receive higher benefits for fewer years. Considering the time value of money and average life expectancy, a retiree receives roughly the same dollar total whether retirement begins at age 62, age 70 or any month in between.

What is the difference between late retirement and early retirement?

A major difference in early and late retirement is the benefit paid to a surviving spouse.

When are spouse and wage earner benefits reduced?

Wage earner benefits and spouse benefits are each reduced if benefits begin before full retirement age. If a spousal benefit is payable, benefits to a couple are maximized if the major wage earner applies for benefits at or after full retirement age whether or not the low earner spouse begins benefits early. There is no advantage ...

What is the minimum Social Security benefit for a widow?

A special provision of Social Security law protects the widow/er of an age-62 retiree by guaranteeing the survivor the greater of his or her own benefit or a minimum of 82.5 percent of the deceased wage earner’s benefit if the survivor is at least 62 when benefits begin.