If you have Medicare and COBRA benefits, Medicare is your primary payer. This means that Medicare will pay for services first, and your COBRA plan will help pay for any remaining costs. For example, when you use Medicare Part B, you generally pay a coinsurance of 20 percent of the Medicare-approved cost for the service.

Can I elect Cobra if I am Medicare eligible?

If your Medicare benefits (Part A or Part B) become effective on or before the day you elect COBRA coverage, you can continue COBRA coverage as well as having Medicare. This is true even if your Part A benefits begin before you elect COBRA but you don’t sign up for Part B until later. In this situation, Medicare is always primary to COBRA coverage.

Is Cobra credible for Medicare?

If someone is enrolled in both COBRA and Medicare, Medicare is the primary insurance. In other words, Medicare pays first, and COBRA may pay some of the costs not covered by Medicare. Certain benefits are not included in traditional Medicare. For example, dental, vision and hearing benefits are generally excluded from Medicare coverage, although some Medicare Advantage …

Is Medicaid or COBRA primary?

Jun 03, 2021 · If you have Medicare and COBRA benefits, Medicare is your primary payer. This means that Medicare will pay for services first, and your COBRA plan will help pay for any remaining costs. For...

How does Cobra work with Medicare?

A: Whether you can have COBRA and Medicare depends on which one you had first. If you have COBRA and then become eligible for Medicare, your COBRA may end. If you have Medicare and then become eligible for COBRA, you can sign up for COBRA insurance and it will be secondary to Medicare. If you have COBRA and Medicare, you should consider whether continuing with …

How does COBRA and Medicare work together?

COBRA and Medicare will work together when a person already has Medicare and experiences a qualifying event. Medicare will become the primary insurer, and the COBRA continuation coverage will become the secondary insurer. However, if a person has COBRA first, the coverage will end on the first day of Medicare coverage.Jun 10, 2020

Is COBRA primary or secondary?

Generally, if you are enrolled in both COBRA and Medicare, Medicare will be the primary payer and COBRA coverage will pay second. Certain plans may pay as if secondary to Medicare, even if you are not enrolled in Medicare.

Does COBRA end when Medicare begins?

If you have COBRA before signing up for Medicare, your COBRA will probably end once you sign up. You have 8 months to sign up for Part B without a penalty, whether or not you choose COBRA. If you miss this period, you'll have to wait until January 1 - March 31 to sign up, and your coverage will start July 1.

Is Medicare the primary or secondary?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

Can I have COBRA and Medicare at the same time?

If your Medicare benefits (Part A or Part B) become effective on or before the day you elect COBRA coverage, you can continue COBRA coverage as well as having Medicare. This is true even if your Part A benefits begin before you elect COBRA but you don't sign up for Part B until later.

Do I need Medicare Part B if I have COBRA?

If you become eligible and enroll in Medicare before COBRA, the good news is that you can have both. Taking COBRA is optional, and depending on your situation, you may or may not want to. If you do decide to take COBRA, do not drop your Medicare plan.

Does Medicare coverage start the month you turn 65?

For most people, Medicare coverage starts the first day of the month you turn 65. Some people delay enrollment and remain on an employer plan. Others may take premium-free Part A and delay Part B. If someone is on Social Security Disability for 24 months, they qualify for Medicare.

Is COBRA creditable coverage for Medicare Part B?

Is COBRA creditable coverage for Medicare Part B? COBRA is NOT creditable coverage for Part B. If you delay enrollment, you'll face lifetime penalties.Jan 17, 2022

Is COBRA considered creditable coverage for Medicare Part D?

COBRA is not normally considered to be creditable coverage for Medicare major medical benefits, so people who are enrolled in COBRA and do not enroll in Medicare Part B within 8 months of turning 65 face substantial financial penalties for the rest of their lives, even if they have months or years left on their COBRA ...

Is Medicare always considered primary?

If you don't have any other insurance, Medicare will always be your primary insurance. In most cases, when you have multiple forms of insurance, Medicare will still be your primary insurance.

How do you determine which insurance is primary?

Primary insurance is a health insurance plan that covers a person as an employee, subscriber, or member. Primary insurance is billed first when you receive health care. For example, health insurance you receive through your employer is typically your primary insurance.Oct 8, 2019

When two insurance which one is primary?

Primary insurance: the insurance that pays first is your “primary” insurance, and this plan will pay up to coverage limits. You may owe cost sharing. Secondary insurance: once your primary insurance has paid its share, the remaining bill goes to your “secondary” insurance, if you have more than one health plan.Jan 21, 2022

What happens if you enroll in Cobra?

This means that if your employees enroll in COBRA instead of Medicare, once COBRA coverage ends, they will have to wait until the next annual enrollment period to enroll in Medicare, and they will have to pay late penalties. The late penalties are not minor, either. For Medicare Part B, for example, the monthly premium goes up 10 percent ...

What is the cobra law?

The Consolidated Omnibus Budget Reconciliation Act, or COBRA, is a federal law that requires employers to offer health care continuation to covered employees, their spouses and their dependents after a qualifying event. Enrollees can be required to pay 102 percent of premium costs, which includes the full premium and a 2 percent administrative fee.

How much does Medicare Part B premium go up?

For Medicare Part B, for example, the monthly premium goes up 10 percent for every 12-month period enrollment was delayed. Enrollees have to pay this penalty for the rest of their lives. If your employees are trying to decide between COBRA and Medicare, make sure they understand that they must enroll in Medicare if they want to avoid expensive ...

How to contact CMS about Medicare?

Your employees can contact the CMS Benefits Coordination & Recovery Center at 1-855-798-2627 with questions about Medicare and COBRA. As always, do your best!

Is Medicare Part A free?

Some younger individuals with certain chronic health conditions may qualify as well. Some of your employees may be disappointed to learn that Medicare is not free, although most enrollees qualify for premium-free Medicare Part A.

Is Medicare a qualifying event?

Yes. Employee enrollment in Medicare is considered a qualifying event under COBRA. Imagine this scenario: One of your employees turns 65 and ages into Medicare, but he’s not ready to retire yet. He keeps working. Now he has two health plan options: his group health plan and Medicare.

Is Cobra the same as Medicare?

If someone is enrolled in both COBRA and Medicare, Medicare is the primary insurance. In other words, Medicare pays first, and COBRA may pay some of the costs not covered by Medicare. Certain benefits are not included in traditional Medicare. For example, dental, vision and hearing benefits are generally excluded from Medicare coverage, ...

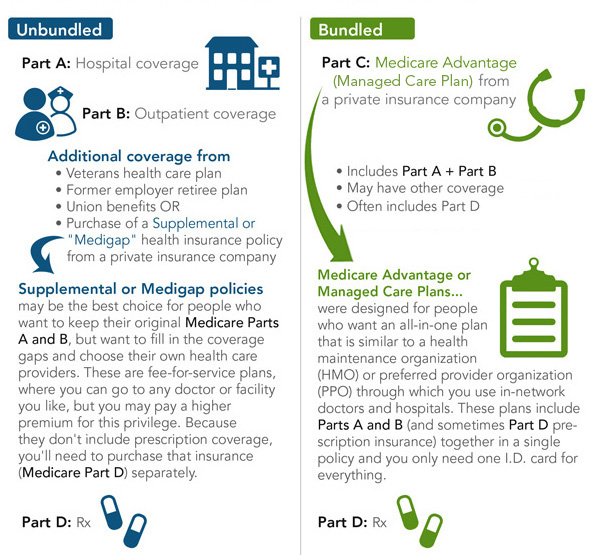

Do you pay Medicare Part A premiums?

Medicare is divided into parts. Medicare Part A is hospital coverage, and most people do not pay a premium for it. As long as you’re eligible for Social Security or Railroad Retirement Board benefits, you won’t pay Part A premiums.

Does Medicare Advantage cover Cobra?

The cost of Medicare Advantage plans varies depending on the plan you choose and your location. Not all plans are available in all states. You can generally find Medicare Advantage plans that cover services original Medicare doesn’t. Your costs compared to a COBRA plan will depend on the details of the COBRA plans and Advantage plans available to you.

Does Cobra save money?

A COBRA plan is likely to cover services that original Medicare doesn’t. Depending on your need for those services, COBRA might save you money. But purchasing a supplemental Medigap plan can also help cover some of those costs and may be less expensive than COBRA. It’s important to read your plan details carefully and compare it with Medicare coverage.

Does Cobra include Medicare?

Your COBRA plan will likely include coverage for medications but you’ll be responsible for paying the entire premium amount. Medicare Part D plans are available at a wide variety of premiums. You can choose a plan that fits your needs and budget.

How many employees can you have with Cobra?

In general, COBRA only applies to employers with 20 or more employees. However, some states require insurers covering employers with fewer than 20 employees to let you keep your coverage for a limited time.

How long does Cobra last?

COBRA coverage generally is offered for 18 months (36 months in some cases). Ask the employer's benefits administrator or group health plan about your COBRA rights if you find out your coverage has ended and you don't get a notice, or if you get divorced.

What is a Part B late enrollment penalty?

In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families. This is called "continuation coverage.".

How long do you have to sign up for Part B?

If you’re eligible for Medicare, you don’t qualify for COBRA coverage without having to pay a premium. You have 8 months to sign up for Part B without a penalty, whether or not you choose COBRA.

What is the number to call for Medicare?

If your group health plan coverage was from a state or local government employer, call the Centers for Medicare & Medicaid Services (CMS) at 1-877-267-2323 extension 61565. If your coverage was with the federal government, visit the Office of Personnel Management.

Do you have to tell Cobra if you are divorced?

You or the covered employee needs to tell the plan administrator if you qualify for COBRA because you got divorced or legally separated (court-issued separation decree) from the covered employee, or you were a dependent child or dependent adult child who's no longer a dependent.

Do you have to tell your employer if you qualify for Cobra?

Once the plan administrator is notified, the plan must let you know you have the right to choose COBRA coverage.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

When is COBRA primary?

Note: If you are eligible for Medicare due to End-Stage Renal Disease (ESRD), your COBRA coverage is primary during the 30-month coordination period. Be sure to learn about ESRD Medicare rules when making coverage decisions.

Is Medicare Part A or Part B?

If you have Medicare Part A or Part B when you become eligible for COBRA, you must be allowed to enroll in COBRA. Medicare is your primary insurance, and COBRA is secondary. You should keep Medicare because it is responsible for paying the majority of your health care costs.

How to learn more about Medicare?

How to Learn More About Your Medicare Options. Primary insurance isn't too hard to understand; it's just knowing which insurance pays the claim first. Medical billing personnel can always help you figure it out if you're having trouble. While it's not hard to understand primary insurance, Medicare is its own beast.

Is Medicare primary insurance in 2021?

Updated on July 13, 2021. Many beneficiaries wonder if Medicare is primary insurance. But, the answer depends on several factors. While there are times when Medicare becomes secondary insurance, for the most part, it’s primary. Let’s go into further detail about what “primary” means, and when it applies.

Is Medicare a primary or secondary insurance?

Mostly, Medicare is primary. The primary insurer is the one that pays the claim first, whereas the secondary insurer pays second. With a Medigap policy, the supplement is secondary. Medicare pays claims first, and then Medigap pays. But, depending on the other policy, you have Medicare could be a secondary payer.

Does Medicare pay your claims?

Since the Advantage company pays the claims, that plan is primary. Please note that Medicare WON’T pay your claims when you have an Advantage plan. Medicare doesn’t become secondary to an Advantage plan. So, you’ll rely on the Advantage plan for claim approvals.

Can you use Medicare at a VA hospital?

Medicare and Veterans benefits don’t work together; both are primary. When you go to a VA hospital, Veteran benefits are primary. Then, if you go to a civilian doctor or hospital, Medicare is primary. But, you CAN’T use Veterans benefits at a civilian doctor. Also, you can’t use Medicare benefits at the VA.

Is Medicare a part of tricare?

Medicare is primary to TRICARE. If you have Part A, you need Part B to remain eligible for TRICARE. But, Part D isn’t a requirement. Also, TRICARE covers your prescriptions. Your TRICARE will be similar to a Medigap plan; it covers deductibles and coinsurances.