What is Medicare primary insurance and how does it work?

Sep 13, 2021 · When you’re dual eligible for both Medicare and Medicaid, Medicare is your primary payer. Medicaid will not pay until Medicare pays first. Medicaid will not pay until Medicare pays first. If you’re dual-eligible and need assistance covering the costs of Part B and Part D, you could qualify for a Medicare Savings Program to assist you with these costs.

What happens when Medicare is secondary insurance?

When you have Medicare and another type of insurance, Medicare is either your primary or secondary insurer. Use the table below to learn how Medicare coordinates with other insurances. Go Back. Type of Insurance. Conditions. Primary. Secondary. 65+ with job-based insurance. Fewer than 20 employees.

What if I don’t have Medicare Parts A and B primary?

How Medicare coordinates with other coverage. If you have questions about who pays first, or if your coverage changes, call the Benefits Coordination & Recovery Center at 1-855-798-2627 (TTY: 1-855-797-2627). Tell your doctor and other. health care provider. A person or organization that's licensed to give health care.

Is Medicare Advantage primary or secondary payer?

Medicare works best with your Service Benefit Plan coverage when Medicare Parts A and B (also known as Original Medicare) are your primarycoverage. That means Medicare pays for your service first, and then we pay our portion (secondary coverage). Usually if …

How do you determine which insurance is primary?

Primary insurance is a health insurance plan that covers a person as an employee, subscriber, or member. Primary insurance is billed first when you receive health care. For example, health insurance you receive through your employer is typically your primary insurance.Oct 8, 2019

Which insurance is primary when you have two?

If you have two plans, your primary insurance is your main insurance. Except for company retirees on Medicare, the health insurance you receive through your employer is typically considered your primary health insurance plan.

How do I know if Medicare is primary or secondary?

If the employer has 100 or more employees, then your family member's group health plan pays first, and Medicare pays second. If the employer has less than 100 employees, but is part of a multi-employer or multiple employer group health plan, your family member's group health plan pays first and Medicare pays second.

Is BCBS federal primary to Medicare?

When you're an active federal employee, the Service Benefit Plan is typically your primary coverage, which means we pay for your healthcare services first. When you retire and have Medicare, it typically becomes your primary coverage and they pay first.

Can you have two health insurances at the same time?

Yes, you can have two health insurance plans. Having two health insurance plans is perfectly legal, and many people have multiple health insurance policies under certain circumstances.Jan 21, 2022

What primary insurance means?

Primary insurance is health insurance that pays first on a claim for medical and hospital care. In most cases, Medicare is your primary insurer. See also: Secondary Insurance.

Is Medicare Part B primary or secondary?

Your group insurance plan is the secondary insurer, so you should enroll in Medicare Part B before your group plan will pay its portion of the claim.

Is Medicare always considered primary?

Medicare is primary and your providers must submit claims to Medicare first. Your retiree coverage through your employer will pay secondary. Often your retiree coverage will provide prescription drug benefits, so you may not need to purchase Part D.Mar 1, 2020

Can you have Medicare and Medicare Advantage at the same time?

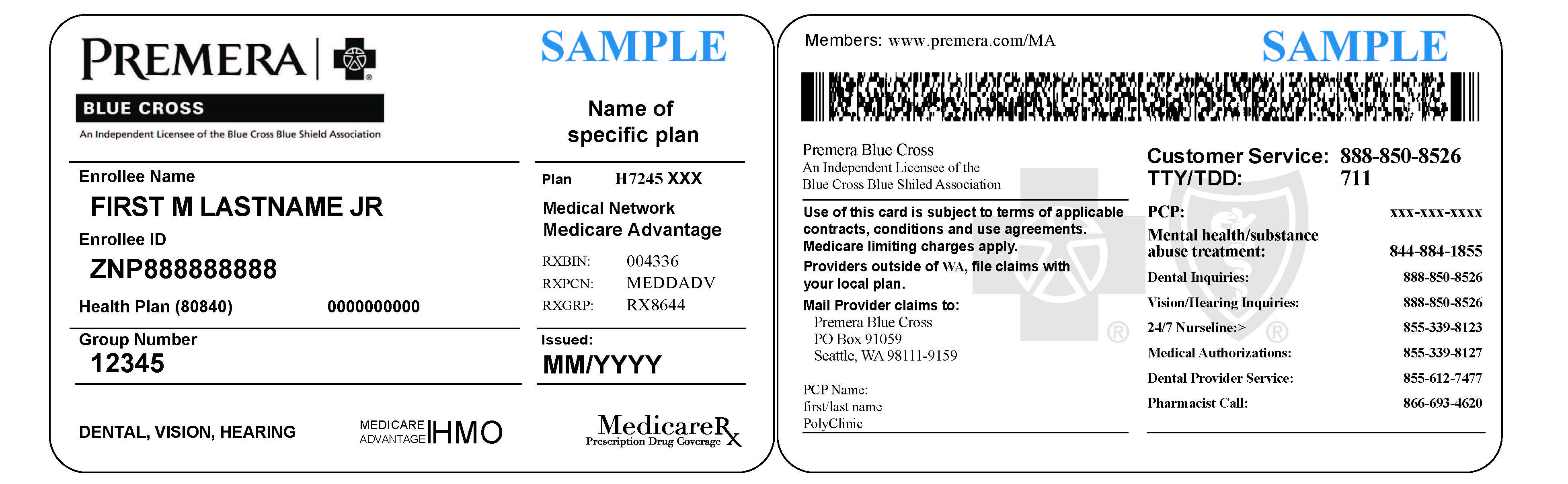

If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare. You must use the card from your Medicare Advantage Plan to get your Medicare- covered services.

Is Medicare primary or secondary to FEHB?

Impact of Medicare and FEHB Generally, if you have Medicare and you (1) are age 65 or older and (2) are not employed in the federal service, Medicare is the primary payer of your health benefits expenses, and your FEHB plan is the secondary payer.

Is Medicare primary or FEHB?

Which Plan is Primary? Since you are retired but covered under your working spouse's policy, your spouse's policy is your primary coverage. Medicare will pay secondary benefits and your FEHB plan will pay third.

Is Blue Cross Blue Shield Medicare?

BCBS companies have been part of the Medicare program since it began in 1966 and now offers multiple Medicare insurance options. Though quality and costs vary by company and by specific plan within those companies, most BCBS plans offer decent value and benefits across a range of health plan options.

What is the difference between Medicare and Medicaid?

Eligible for Medicare. Medicare. Medicaid ( payer of last resort) 1 Liability insurance only pays on liability-related medical claims. 2 VA benefits and Medicare do not work together. Medicare does not pay for any care provided at a VA facility, and VA benefits typically do not work outside VA facilities.

Is Medicare a secondary insurance?

When you have Medicare and another type of insurance, Medicare is either your primary or secondary insurer. Use the table below to learn how Medicare coordinates with other insurances. Go Back. Type of Insurance. Conditions.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What happens if a group health plan doesn't pay?

If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment. Medicare may pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. or a. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.

Why combine Medicare Part A and B?

Another reason to combine your coverage is to get access to benefits not covered by Medicare.

When can I sign up for Medicare if I don't have a Medicare card?

This is January 1 to March 31 every year. You may be able to sign up for coverage outside of this period if a special circumstance (such as the exception noted above for the late enrollment penalty) applies.

What is Medicare for people over 65?

GET TO KNOW MEDICARE. Medicare is a health insurance program provided by the federal government, available to people: • 65 and older • Under 65 with certain disabilities • With permanent kidney failure who need dialysis treatment or a transplant (End-Stage Renal Disease) .

How much can I earn with Blue Health?

Open to Standard and Basic Option members, you can earn up to $170 in 2020 by completing your Blue Health Assessment and up to three Online Health Coach goals. You can use the money for qualified medical expenses, which include prescription drug costs, hearing aids, glasses and more.

What is Blue365 for Blue Cross?

Blue365 is a discount program exclusively for Blue Cross and Blue Shield members. Through the program, you can get discounts on different products and services that can help you live a healthy lifestyle, such as diet and exercise plans, gym shoes and athletic apparel, hearing aids and more.

How long do you have to enroll in Part B?

Once you retire, you’ll have eight months to enroll in Part B before the penalty kicks in. . General Enrollment Period .

Does FEP Blue Focus have a hearing aid discount?

Both Standard and Basic Option have a great hearing aid benefit and provide you access to our Blue365 Discount Program. FEP Blue Focus only provides you access to the Blue365 Discounts. If hearing aids are important to you, keep this in mind.

What is primary insurance?

Primary insurance means that it pays first for any healthcare services you receive. In most cases, the secondary insurance won’t pay unless the primary insurance has first paid its share. There are a number of situations when Medicare is primary.

When does Medicare end for ESRD?

You would then re-enroll when you turn 65. Typically Medicare due to ESRD will end 36 months after you’ve had your kidney transplant unless you also qualify for Medicare due to age or other disability.

What is tricare for life?

You Have Tricare-for-Life. Tricare-for-Life (TFL) is for military retirees and their spouses who are also eligible for Medicare. In this scenario, Medicare is the primary insurance for any care you receive at non-military providers, so you need to enroll in both Part A and B.

Does Tricare cover vision?

People with Tricare sometimes also choose Medicare Advantage plans. Some Advantage plans include routine dental or vision benefits, and this may appeal to members with Tricare. Tricare for life will help to pick up some of the copays associated with Medicare Advantage.

Does medicaid pay first?

Medicaid is assistance with healthcare costs for people with low incomes. Medicaid never pays first. It will only pay after Medicare and or employer group health coverage has first paid. Not all Medicare providers accept Medicaid though. It’s important that you ask providers if they participate in Medicaid before seeking care. Otherwise, you may be responsible for the portions that Medicaid can’t cover.

Is Medicare a part of Medicaid?

Medicare is primary to Medicaid. People who qualify for Medicaid can get help paying for their Medicare Part B and D premiums. If your income is low and you think you might be eligible, contact your state Medicaid office for an application. To learn more about Medicare vs Medicaid, click here.

Is Medicare a secondary insurance?

Medicare is secondary to your group health insurance if the company has 20 or more employees. If the group insurance is affordable, you may choose to delay your enrollment in Part B. ALWAYS speak with a licensed insurance agent who specializes in Medicare before making this decision.

How much does Medicare Part B cover?

If your primary payer was Medicare, Medicare Part B would pay 80 percent of the cost and cover $80. Normally, you’d be responsible for the remaining $20. If you have a secondary payer, they’d pay the $20 instead. In some cases, the secondary payer might not pay all the remaining cost.

What is primary payer?

A primary payer is the insurer that pays a healthcare bill first. A secondary payer covers remaining costs, such as coinsurances or copayments. When you become eligible for Medicare, you can still use other insurance plans to lower your costs and get access to more services. Medicare will normally act as a primary payer and cover most ...

What is FEHB insurance?

Federal Employee Health Benefits (FEHBs) are health plans offered to employees and retirees of the federal government, including members of the armed forces and United States Postal Service employees. Coverage is also available to spouses and dependents. While you’re working, your FEHB plan will be the primary payer and Medicare will pay second.

How long can you keep Cobra insurance?

COBRA allows you to keep employer-sponsored health coverage after you leave a job. You can choose to keep your COBRA coverage for up to 36 months alongside Medicare to help cover expenses. In most instances, Medicare will be the primary payer when you use it alongside COBRA.

Does Medicare cover dental visits?

If you have a health plan from your employer, you might have benefits not offered by Medicare. This can include dental visits, eye exams, fitness programs, and more. Secondary payer plans often come with their own monthly premium. You’ll pay this amount in addition to the standard Part B premium.

Is Medicare Part A the primary payer?

Secondary payers are also useful if you have a long hospital or nursing facility stay. Medicare Part A will be your primary payer in this case.

Is FEHB a primary or secondary payer?

Coverage is also available to spouses and dependents. While you’re working, your FEHB plan will be the primary payer and Medicare will pay second. Once you retire, you can keep your FEHB and use it alongside Medicare. Medicare will become your primary payer, and your FEHB plan will be the secondary payer.

What is COB insurance?

Certain insurances require an annual update from patients, regarding Coordination of Benefits (COB). If this information is not updated by the patient the insurance company will hold payment on the claim.

Is Tricare a secondary insurance?

Because Tricare is a state-funded insurance, it will always be secondary to any other insurance, no matter when his birthday is. The only insurance that will be secondary to Tricare is Medicare or Medicaid . Both Medicare and Medicaid are always secondary to any other insurance, no matter what.

Can you have more than one insurance?

You can see how it's beneficial for a patient to have more than one insurance, especially if one of the insurances is a high deductible insurance plan and the other covers a larger payment amount. This ultimately makes the remaining patient balance less than it would be with one insurance policy.

Does a family member have insurance through one employer?

What this means is that members of a family have insurance through one employer, such as Blue Cross Blue Shield, through the husband's policy. They also have additional insurance through the wife's employer policy, such as United Healthcare.