The Employee Benefits Division is required to send a Medicare Part D Prescription Drug Program notice annually to all active and retired NYSHIP enrollees and dependents who are 65 or older, or eligible for Medicare due to disability. The notice attests to the creditable coverage status of the NYSHIP prescription drug program.

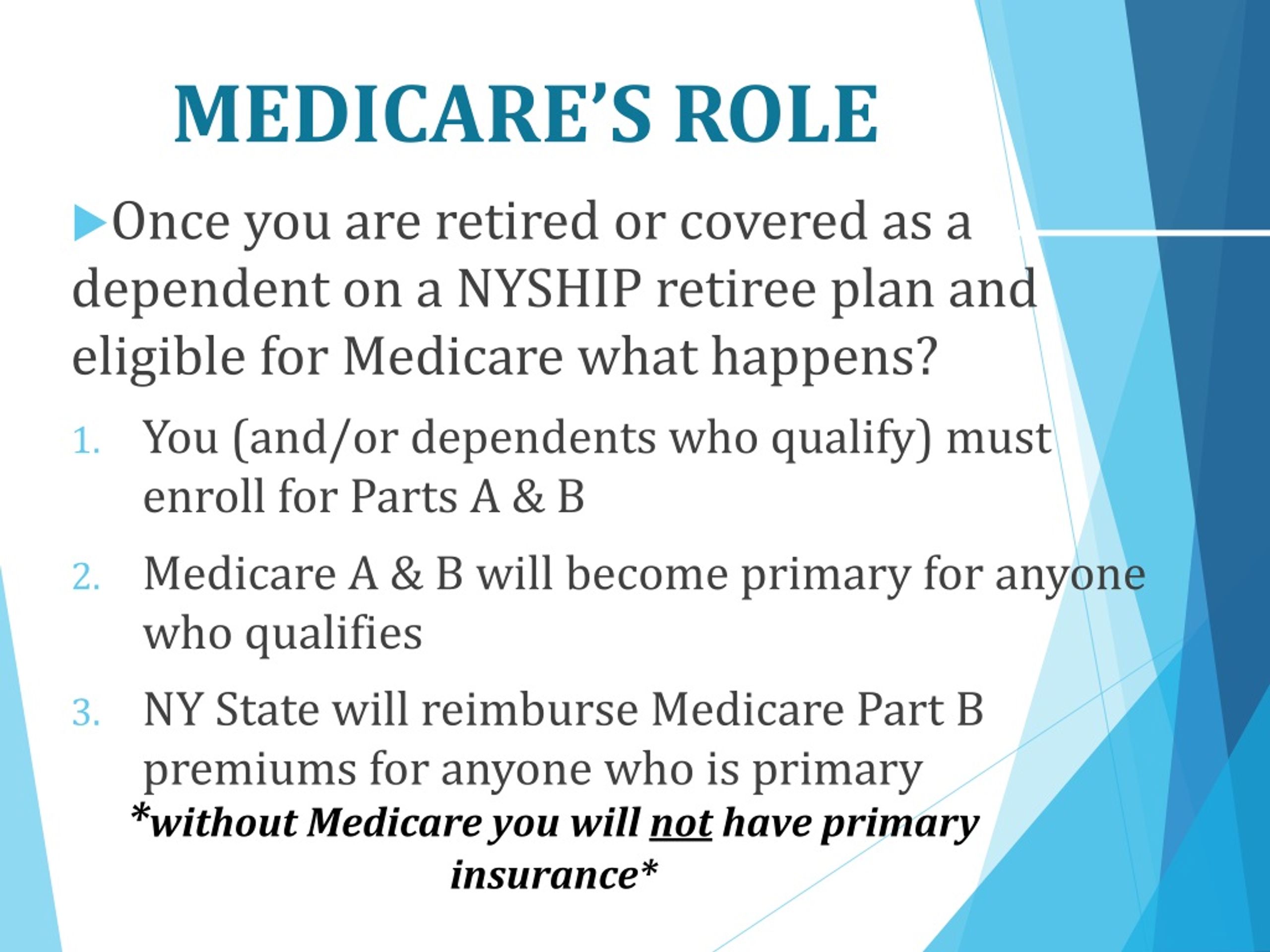

How does nyship work with Medicare?

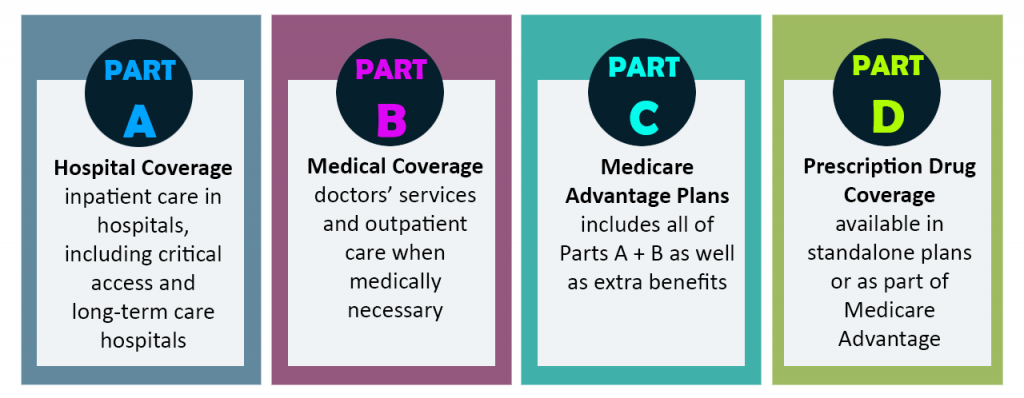

NYSHIP supplements this coverage and requires you and your eligible dependents to be enrolled in both Part A and Part B when Medicare is primary to NYSHIP. Medicare Part A covers inpatient care in a hospital or skilled nursing facility, hospice care and home health care.

How do I get Medicare Part D drug coverage?

You can buy either a standalone Part D drug plan based on your medication needs or you can get Part D coverage through Medicare Advantage (Part C) plans.

How does Medicare Part D work with other insurance?

How Part D works with other insurance. There may be reasons why you should take Medicare Part B instead of, or in addition to, COBRA. If you take COBRA and it includes Creditable prescription drug coverage, you'll have a special enrollment period to join a Medicare Prescription Drug Plan without a penalty when COBRA ends.

What medical expenses does my nyship plan cover?

Your NYSHIP plan covers much of the Medicare Part A and Part B deductible and coinsurance amounts if you use the NYSHIP plan provider network and may cover some other medical expenses Medicare does not cover. For example, hearing aids are not covered under Medicare Part A or Part B, but The Empire Plan offers an allowance for hearing aids.

Is Empire Nyship Medicare?

Effective January 1, 2013, NYSHIP replaced the Empire Plan Prescription Drug Program coverage for Medicare-primary enrollees and dependents with Empire Plan Medicare Rx (PDP), a Medicare Part D prescription drug program with expanded coverage designed especially for NYSHIP.

Does Nyship cover Medicare deductible?

Your NYSHIP plan covers much of the Medicare Part A and Part B deductible and coinsurance amounts if you use the NYSHIP plan provider network and may cover some other medical expenses Medicare does not cover.

Can you refuse Medicare Part D?

To disenroll from a Medicare drug plan during Open Enrollment, you can do one of these: Call us at 1-800 MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Mail or fax a signed written notice to the plan telling them you want to disenroll.

How is Medicare Part D reimbursed?

Medicaid beneficiaries also typically receive covered drugs through pharmacies, which are reimbursed for these drugs by State Medicaid agencies. Most States typically calculate reimbursement based upon the AWP discounted by a specified percentage plus a dispensing fee.

Is Nyship United Healthcare?

Your SEHP medical coverage will be through insurance carriers under contract with NYSHIP: Empire Blue Cross Blue Shield (for hospital benefits), UnitedHealthcare Insurance Company of New York (medical/surgical), GHI/ValueOptions (mental health and substance abuse) and CIGNA/Express Scripts (prescription drugs).

Does Nyship have a deductible?

What is the overall deductible? $1,250($625 for enrollees in positions at or equated to Grade 6 or below or earning less than $38,651 for UUP) per enrollee, per spouse/domestic partner, and per all dependent children combined. The deductible only applies when you seek out-of-network services.

When did Medicare Part D become mandatory?

The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.

Do I have to pay Medicare Part D?

You're required to pay the Part D IRMAA, even if your employer or a third party (like a teacher's union or a retirement system) pays for your Part D plan premiums. If you don't pay the Part D IRMAA and get disenrolled, you may also lose your retirement coverage and you may not be able to get it back.

How do I avoid Part D Penalty?

3 ways to avoid the Part D late enrollment penaltyEnroll in Medicare drug coverage when you're first eligible. ... Enroll in Medicare drug coverage if you lose other creditable coverage. ... Keep records showing when you had other creditable drug coverage, and tell your plan when they ask about it.

Is Medicare Part D optional or mandatory?

Medicare drug coverage helps pay for prescription drugs you need. Even if you don't take prescription drugs now, you should consider getting Medicare drug coverage. Medicare drug coverage is optional and is offered to everyone with Medicare.

What is the maximum out of pocket for Medicare Part D?

Medicare Part D, the outpatient prescription drug benefit for Medicare beneficiaries, provides coverage above a catastrophic threshold for high out-of-pocket drug costs, but there is no cap on total out-of-pocket drug costs that beneficiaries pay each year.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Is Nyship private insurance?

Now, more than 55 years later, NYSHIP is one of the largest public employer health insurance programs in the nation, protecting over 1.2 million State and local government employees, retirees and their families. Over 800 local government employers offer NYSHIP.

Does Empire Plan Nyship cover massage therapy?

We now accept NYSHIP through the empire plan for Massage Therapy! Massage is restorative for your body, but also provides time to relax and unwind in this stressful time. Come take a break at our Medical Massage Facility. Serving the community for 35 years.

What is coinsurance health plan?

The percentage of costs of a covered health care service you pay (20%, for example) after you've paid your deductible. The maximum amount a plan will pay for a covered health care service. May also be called “eligible expense,” “payment allowance,” or “negotiated rate.”

Does Nyship cover speech therapy?

Speech Therapy – You are covered, subject to copayment, for the services of a speech therapist or speech-language pathologist when: such services are prescribed and supervised by your physician; treatment is medically necessary; and. the provider is currently licensed in the state where the service is rendered.

How to disenroll from Medicare?

If an enrollee has received this letter, they may disenroll from the Medicare Prescription Drug program by calling 1-800-MEDICARE (1-800-633-4227). They must also give a copy of this letter to their Medicaid worker in order to continue receiving Medicaid benefits.

What information is needed for Medicare?

This includes: name, DOB, effective dates of Medicare Part A & B and the beneficiary's Medicare ID #. Pharmacies may also be able to help.

What happens if you don't enroll in Medicare?

If enrollees do not participate in a Medicare prescription drug plan, they may lose all their Medicaid benefits. However, some people on Medicare and Medicaid may receive a letter from their employer or union stating that if they enroll in Medicare Part D they will lose the health care benefits provided by the union or employer.

What supplies are covered by Medicare?

Insulin-related supplies defined as syringes and needles, gauze and swabs should be billed to the Part D plan. Other supplies covered by Medicare Part B can be billed to Medicare. Supplies not covered by Medicare can be billed to Medicaid.

How to contact Medicare by phone?

You can obtain assistance in finding a plan to better match your needs by calling 1-800 -MEDICARE (1-800-633-4227) or by going to the CMS website at https://www.medicare.gov/find-a-plan/questions/home.aspx or by contacting HIICAP at 1-800-701-0501.

What to do if you haven't received your Medicare card?

If you haven't received your card, you can use the letter from your plan that states you are enrolled in their plan until you receive your new card. Your pharmacist may also be able to get the necessary information in order to bill your Part D plan from Medicare.

How long does it take for a prescription to change?

The plan must let you know if the drug is covered or there is a change in your quantity of pills/month within 72 hours. If your doctor believes there is a risk waiting for 72 hours , the plan must let you know in 24 hours or sooner if your health requires you have the medication sooner.

Who is required to submit Medicare claims?

Providers (such as hospitals, doctors and laboratories) who accept Medicare are required by federal law to submit claims to Medicare for Medicare-primary patients. After Medicare processes the claim, The Empire Plan considers the balance for secondary (supplemental) coverage.

When does Medicare become primary for spouse?

Since you are no longer actively employed, Medicare becomes primary to NYSHIP for your spouse at age 65. Medicare does not become primary for you until you reach age 65 or otherwise become eligible for Medicare.

What is Empire Plan RX?

Medicare-primary enrollees and dependents enrolled in The Empire Plan have prescription drug coverage under Empire Plan Medicare Rx, a Medicare Part D Prescription Drug Plan with expanded coverage designed especially for NYSHIP. If you or any of your dependents are Medicare primary and enrolled in The Empire Plan, you will be automatically enrolled in Empire Plan Rx.You and each of your Medicare-primary dependents will receive a separate benefit card that you must use to access your Empire Plan Medicare Rx prescription drug benefits. You also will receive additional plan documents that explain your Empire Plan Medicare Rx benefits, as well as your rights and responsibilities.

How to contact Empire Plan?

If you have questions about your NYSHIP coverage, call The Empire Plan toll free at 1-877-7-NYSHIP (1-877-769-7447) and choose the program you need. If you have questions about Empire Plan Medicare Rx,

What is a MAP plan?

Medicare Advantage plans (MAPs) replace your original fee-for-service Medicare Parts A and B coverage. The benefits offered by the plan and all of your medical care (except for emergency or out-of-area urgently needed care) must be provided, arranged or authorized by the MAP.Most NYSHIP HMOs provide Medicare Advantage coverage to Medicare-primary enrollees and dependents. Check the current NYSHIP publication Health Insurance Choices to see if any are offered in your area. If you are enrolled in a NYSHIP HMO that offers a MAP, you receive both your Medicare and NYSHIP benefits from that plan when you become Medicare-primary. However, you must maintain enrollment in Medicare Parts A and B.Most MAPs are not part of NYSHIP. NYSHIP HMO coverage is available only if you live or work in New York State. Be sure you understand how enrolling in a MAP outside of NYSHIP will affect your NYSHIP benefits. If you or your dependent enrolls in a MAP that is not part of NYSHIP, in most cases you will be automatically disenrolled from your NYSHIP plan.

Can you opt out of Medicare if you are not covered?

If you are eligible for Medicare-primary coverage and you receive covered services from a provider who has elected to opt out of Medicare, or whose services are otherwise not covered due to failure to follow applicable Medicare program guidelines, your benefits may be drastically reduced.

Is Empire Plan covered by Medicare?

If you receive services from a provider who does not participate in The Empire Plan, and these services are covered under The Empire Plan but not under Medicare, it is your responsibility to file a claim or have the provider file a claim with the appropriate Empire Plan administrator for Basic Medical or non-network benefits.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

Who is required to submit a claim to Medicare?

Providers (such as hospitals, doctors and laboratories ) who accept Medicare are required by federal law to submit claims to Medicare for Medicare-primary patients. After Medicare processes the claim, NYSHIP considers the balance for secondary (supplemental) coverage.

What is Medicare Part A and B?

Medicare Part A covers inpatient care in a hospital or skilled nursing facility, hospice care and home health care.

How to contact Empire Plan?

If you have questions about your NYSHIP coverage, call The Empire Plan toll free at 1-877-7-NYSHIP (1-877-769-7447) and choose the program you need. If you have questions about Empire Plan Medicare Rx,

Does Medicare send out EOMB?

Medicare will send you an Explanation of Medicare Benefits (EOMB) that will note whether your claim was sent to NYSHIP. This process, known as Medicare Crossover, is automatic for the medical program, hospital program and outpatient mental health and substance use program; however, inpatient mental health and substance use services are not crossed over directly from Medicare to Beacon Health Options. For these services, you will need to submit your EOMB to Beacon Health Options if you receive a bill.

Does Medicare Part A cost?

There is usually no cost for Medicare Part A. If there is a charge for Medicare Part A coverage because the Social Security eligibility requirements were not met, send your HBA a copy of your statement from Social Security confirming your ineligibility for Part A at no cost. NYSHIP will provide primary coverage for Medicare Part A expenses and there will be no need to enroll in Medicare Part A unless eligibility for no-cost Part A coverage is attained. However, enrollment in Medicare Part B is still required. If you receive a statement from Social Security confirming your ineligibility for Medicare Part A at no cost, please send a copy to your HBA. Your former employer will not reimburse for the Medicare Part A cost.

Is NYSHIP primary for Medicare dependents?

After retiring, if you return to work in a benefits-eligible position for your former employer who is providing your health benefits, in most cases NYSHIP is primary for you and your Medicare-eligible dependents. Ask your HBA if you will be in a benefits-eligible position.

Does Medicare pay for Social Security?

Social Security deducts the Medicare Part B premium from your monthly Social Security benefit. If you don’t receive Social Security benefits , you pay the Medicare Part B premium directly to the Centers for Medicare and Medicaid services (CMS).