The non-facility rate is the payment rate for services performed in the office. This rate is higher because the physician practice does have the overhead expense for performing that service. When you submit a claim submit your usual fee.

What is the difference between facility and non-facility codes?

Some codes may only be performed in one place or the other: for example, an initial hospital visit has only a facility fee, because it is never performed anywhere but a facility. Office visits, on the other hand, may be done in the office (non-facility) or in the outpatient department (facility.)

Does Medicare cover non-skilled in-home care?

Among those Medicare recipients who have a Medicare Advantage plan that offers non-skilled in-home care, there are a few obstacles to taking advantage of the benefit. A doctor’s order or a prescription is not necessary; however, the need for non-skilled in-home care must be recommended by a health care provider.

What is the difference between place of service and non-facility rate?

Some medical practices have a designation of provider based, and use outpatient as the correct place of service. (Place of service 19 or 22) The non-facility rate is the payment rate for services performed in the office. This rate is higher because the physician practice has overhead expenses for performing that service. (Place of service 11)

What is the difference between a non-facility and an office visit?

Some codes may only be performed in one place or the other: for example, an initial hospital visit has only a facility fee, because it is never performed anywhere but a facility. Office visits, on the other hand, may be done in the office (non-facility) or in the outpatient department (facility.) Questions, comments?

What is the difference between Medicare facility and non facility?

In general, Facility services are provided within a hospital, ambulatory surgery center, or skilled nursing facility. Non Facility services are provided everywhere else and include outpatient clinics, urgent care centers, home services, etc.

What does non Facility mean?

The non-facility rate is the payment rate for services performed in the office. This rate is higher because the physician practice has overhead expenses for performing that service. (

What is the difference between facility and non facility fees?

Some codes may only be performed in one place or the other: for example, an initial hospital visit has only a facility fee, because it is never performed anywhere but a facility. Office visits, on the other hand, may be done in the office (non-facility) or in the outpatient department (facility.)

What does Medicare consider a facility setting?

In layman's terms, facilities are hospitals, skilled nursing facilities, nursing homes, or any other place that bills for Medicare Part A.

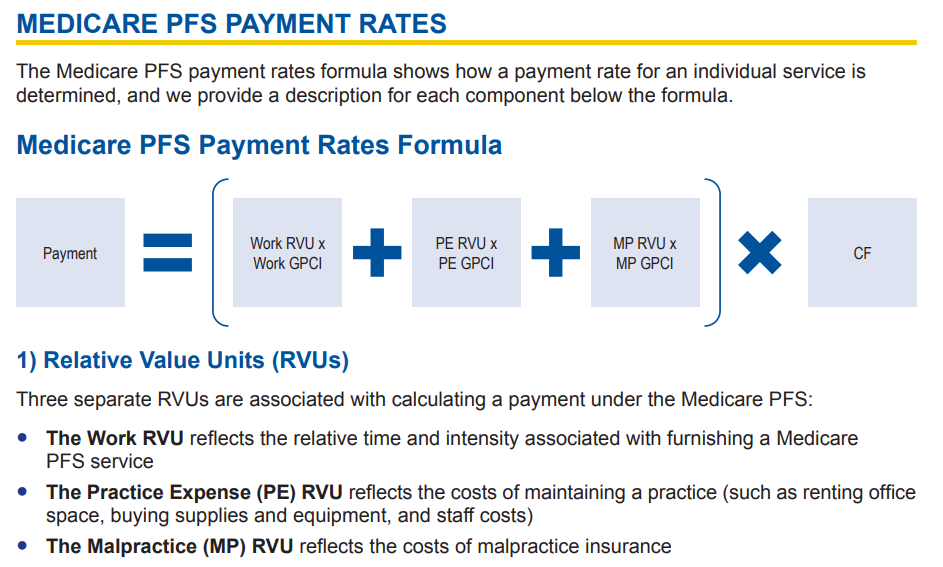

What is non facility when calculating Medicare physician fee schedule?

What does "non-facility" describe when calculating Physician Fee Schedule payments? "Non-facility" location calculations are for private practices or non-hospital owned physician practices.

What is non Facility limiting charge Medicare?

Non-Facility Limiting Charge: Only applies when the provider chooses not to accept assignment. Facility Limiting Charge: Only applies when a facility chooses not to accept assignment.

Is place of service 02 facility or non facility?

Database (updated September 2021)Place of Service Code(s)Place of Service Name02Telehealth Provided Other than in Patient's Home03School04Homeless Shelter05Indian Health Service Free-standing Facility54 more rows

What is the facility fee?

Facility fees are expenses charged by hospitals to cover their overhead- the funding needed to keep the lights on, machines running, and doors open. People who receive outpatient care at hospital-owned buildings are charged a facility fee, in addition to treatment costs and fees charged, individually, by doctors.

Is the 2021 Medicare fee schedule available?

The CY 2021 Medicare Physician Fee Schedule Final Rule was placed on display at the Federal Register on December 2, 2020. This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2021.

Is POS 11 facility or non facility?

By definition, a “facility” place-of-service is thought of as a hospital or skilled nursing facility (SNF) or even an ambulatory surgery center (ASC) (POS codes 21, POS 31 and POS 24, respectively), while “non-facility” is most often associated with the physician's office (POS code 11).

Is POS 22 facility or non facility?

POS 22: On Campus-Outpatient Hospital Claims for covered services rendered in an Off Campus-Outpatient Hospital setting, or in an On CampusOutpatient Hospital setting, if payable by Medicare, shall be paid at the facility rate.

What is the difference between group and facility?

Facility - The entity identified by the associated SUBMITTING-STATE-PROV-ID is a facility. Group - The entity identified by the associated SUBMITTING-STATE-PROV-ID is a group of individual practitioners. Individual - The entity identified by the associated SUBMITTING-STATE-PROV-ID is an individual practitioner.

What is a managed care organization?

Managed Care Organizations (MCOs) include risk-adjusted plans whose funding is based on the health status of their beneficiaries. Government-funded MCOs use CMS information to search for suspected cases of fraud and abuse.

How is the most appropriate care setting for a given surgical procedure determined?

The decision regarding the most appropriate care setting for a given surgical procedure is determined by the physician based on the patient's individual clinical needs and preferences. Of course, there is a difference in reimbursement, and the billing depends on where the procedure took place, such as an office setting, inpatient ...

Does Medicare have a facility fee?

The Medicare Physician Fee Schedule has values for some CPT® codes that include both a facility and a non-facility fee. The facility fee is typically lower.

What happens if a facility does not accept assignment?

If you decide to seek care from a facility that does not fully accept assignment or does not accept assignment at all, you may be forced to pay more out of pocket. In addition to an extra 15 percent or more, you may also be forced to pay for all of your care out-of-pocket initially.

What does Medicare limit charge mean?

What Does Medicare “Limiting Charges Apply” Mean? Medicare is a commonly used healthcare insurance option. Most people over the age of 65 qualify for Medicare benefits, as well as those with certain disabilities or end-stage renal disease.

What is the limiting charge for Medicare?

This limit cap is known as the limiting charge. Providers that do not fully participate only receive 95 percent of the Medicare-approved amount when Medicare reimburses them for the cost of care. In turn, the provider can charge the patient up to 15 percent more than this reimbursement amount.

Can non-participating providers accept assignment?

One possible option for non-participating providers is to choose to accept assignment for some services but to decline assignment for others. For services that they accept assignment for, they are only able to bill the Medicare-approved amount. However, for other services, they are allowed to charge up to 15 percent more than the Medicare-approved amount.

Does Medicare cover out of pocket costs?

Because of this, when you receive care at a facility that accepts assignment, you will be required to pay lower out-of-pocket costs as Medicare will cover the full amount of the service cost.

Can Medicare be assigned to other providers?

Other providers may decide not to accept Medicare assignment at all. These providers do not have to abide by any cost-limiting rules put in place by Medicare. Medicare will still reimburse 95 percent of the Medicare-approved amount, but these providers are able to charge any amount they choose for their services.

What Is Non-Skilled In-Home Care?

Covered non-skilled in-home services typically include assistance with daily living tasks and activities, with services provided in the plan holder’s home by a qualified provider. This includes tending to personal care needs such as bathing, dressing, eating and cleaning. Medication management and making sure that the covered individual takes needed medications and has transportation to medical appointments are also covered services. Non-skilled care is non-clinical help and is sometimes called home care, while skilled care is known as home health and requires a doctor’s order. Patients requiring home health may need physical therapy, monitoring of health status or care for a wound, for example, whereas those patients who need non-skilled care have less urgent needs.

Who is eligible for Medicare Advantage?

Seniors who need help with activities of daily living (ADLs) are the intended recipient of this type of Medicare Advantage benefit. This often includes elderly plan holders who may still be active but need help with transportation, cleaning, cooking or other types of responsibilities.

When should Medicare recipients weigh their options when selecting Medicare Advantage plans?

Medicare recipients should weigh their options when selecting Medicare Advantage plans well before open enrollment each year.

Does Medicare cover in-home care?

Among those Medicare recipients who have a Medicare Advantage plan that offers non-skilled in- home care, there are a few obstacles to taking advantage of the benefit. A doctor’s order or a prescription is not necessary; however, the need for non-skilled in-home care must be recommended by a health care provider.

Does CMS allow non-skilled in-home care?

The change came about as CMS sought to expand the definition of what it considers primarily health-related. The agency will now allow supplemental benefits, including non-skilled in-home care, if they “compensate for physical impairments, diminish the impact of injuries or health conditions and/or reduce avoidable emergency room utilization,” according to the CMS.

Is in home care a supplemental benefit for Medicare?

Page Reviewed / Updated – August 31, 2020. Non-skilled in-home care has been an allowable supplemental benefit for Medicare Advantage (MA) plans since 2019. When the Centers for Medicare and Medicaid (CMS) allowed this type of plan as a benefit under Medicare Advantage, it marked the first time that the agency has allowed any type ...