How do I calculate my income for Medicare?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

At what income level do you pay more for Medicare?

You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. You'll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

What percentage do you pay for Medicare?

You'll usually pay 20% of the cost for each Medicare-covered service or item after you've paid your deductible. If you have limited income and resources, you may be able to get help from your state to pay your premiums and other costs, like deductibles, coinsurance, and copays. Learn more about help with costs.

How much money can you make before it affects your Medicare?

To qualify, your monthly income cannot be higher than $1,010 for an individual or $1,355 for a married couple. Your resource limits are $7,280 for one person and $10,930 for a married couple. A Qualifying Individual (QI) policy helps pay your Medicare Part B premium.

What will Medicare cost in 2021?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

How much does Social Security take out for Medicare each month?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Why is my Medicare premium so high?

If You Have a Higher Income If you have higher income, you'll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. We call the additional amount the “income-related monthly adjustment amount.” Here's how it works: Part B helps pay for your doctors' services and outpatient care.

Why is my first Medicare bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

Does everyone pay the same for Medicare Part B?

Does everyone pay the same for Medicare Part B? No, each beneficiary will pay a Medicare Part B premium that is based on their income.

Does Medicare look at your bank account?

Medicare will usually check your bank accounts, as well as your other assets when you apply for financial assistance with Medicare costs. However, eligibility requirements and verification methods vary depending on what state you live in. Some states don't have asset limits for Medicare savings programs.

What is the Medicare levy threshold 2021?

2021-22 Medicare Levy Income Thresholds Medicare levy low-income thresholds for singles, families and seniors and pensioners are increased (by CPI) for the 2021-22 year. Single seniors and pensioners threshold: increases from $36,705 to $36,925. Singles threshold increases from $23,226 to $23,365.

What income is subject to the 3.8 Medicare tax?

The tax applies only to people with relatively high incomes. If you're single, you must pay the tax only if your adjusted gross income (AGI) is over $200,000. Married taxpayers filing jointly must have an AGI over $250,000 to be subject to the tax.

How is modified adjusted gross income for Medicare premiums calculated?

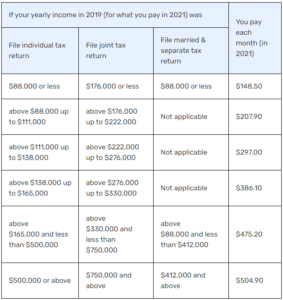

Your MAGI is calculated by adding back any tax-exempt interest income to your Adjusted Gross Income (AGI). If that total for 2019 exceeds $88,000 (single filers) or $176,000 (married filing jointly), expect to pay more for your Medicare coverage.

What are the Irmaa brackets for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $276,000 but less than or equal to $330,000$386.10More than $330,000 but less than $750,000$475.20More than $750,000$504.90Married filing separately12 more rows•Dec 6, 2021

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

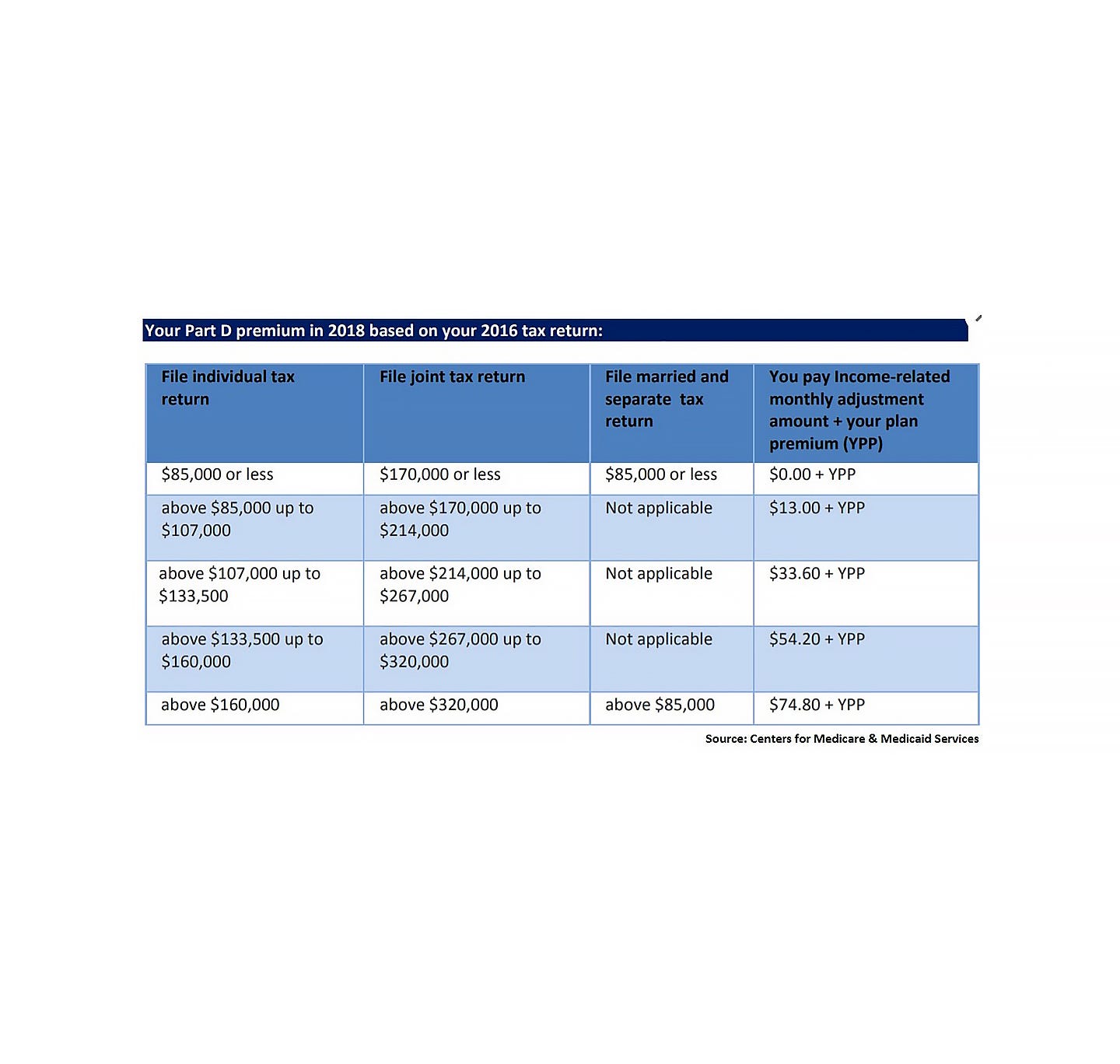

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is the maximum amount you can pay for Medicare in 2021?

In 2021, people with tax-reported incomes over $88,000 (single) and $176,000 (joint) must pay an income-related monthly adjustment amount for Medicare Part B and Part D premiums. Below are the set income limits and extra monthly costs you could pay for Medicare Part B and Part D based on your tax-reported income.

How much is Part B insurance in 2021?

The IRMAA is based on your reported adjusted gross income from two years ago. For 2021, your Part B premium may be as low as $148.50 or as high as $504.90.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Do you have to factor in Medicare tax?

When you become eligible for Medicare and look at how much to budget for your annual health care costs, you’ll need to also factor in your tax-reported income.

How much does Medicare Advantage cost?

If you choose a Medicare Advantage plan, expect a range between $0 – $100 per month and these plans often include prescription coverage (Part D). Most plans are less than $50 per month and are often $0 premium. Before you choose a plan it is important to compare rates.

How much do you have to pay for Part B?

If you earned over $88,000 as an individual or $176,000 as a couple you are required to pay $207.90 per month for your Part B premium. This is $59.40 more than the standard amount of $148.50 per month, that most folks pay.

How much is Medicare Part A in 2021?

Medicare Part A, which provides coverage at the hospital is typically “free” for most people if you have worked for at least 10 years in your life and paid Medicare taxes during that time. Part A also has some deductibles and out-of-pocket costs. In 2021 the Part A hospital deductible is $1,484 up $76 from $1,404 in 2020.

How much is Medicare Supplement for days 61 – 90?

For days 61 – 90, there is a $371 copay per day, increased from $352 in 2020. Note: most Medicare Supplement and Medicare Advantage plans will cover the Part A deductible and the inpatient copays.

How much does Medigap cost?

If you choose a Medigap plan you will pay anywhere between $85-$150 per month, depending on where you live. This will provide you with nearly 100% coverage, protecting you against the high medical costs that come with just having Original Medicare and no plan.

How much is the Part B premium for 2021?

Your Monthly Part B Premium in 2021 is: Check Again. The standard Part B premium increased from $144.60 per month to $148.50, an increase of $3.9 per month. If your income was over a certain threshold you will pay extra for your Part B and D premiums.

How much is Part D insurance in 2021?

In 2021 the average Part D (RX) plan premium is between $15-$25 per month. Similar to your Part B premium, this plan can also be subject to your income. The chart below shows the premium increases due to your income for Part D plans. These amounts would be in addition to your Part D plan premium. If your yearly income in 2019 was.

How much is Medicare Part B?

More than $129,000. $389.80. Your Medicare Part B premium payment is typically deducted from your monthly Social Security benefit. If you have to pay an income-related monthly adjustment amount, you’ll get a notice from Social Security.

How much does Medicare pay for generic drugs?

If you qualify, you’ll generally pay a maximum of $2.95 per generic drug prescription and $7.40 per brand-name drug prescription.

What is Medicare Part D?

Medicare Part D is optional prescription drug coverage, available as a stand-alone Medicare Prescription Drug Plan that you enroll into to augment your Original Medicare coverage or through a Medicare Advantage Prescription Drug plan.

What is the number to call for Medicare Part B?

TTY users call 1-312-751-4701. In some situations, your Part B premium may be higher than the above amounts. The government looks at your income as reported on your tax return from two years ago to set your Medicare Part B premium. This table refers to your 2014 income and your 2016 Medicare Part B monthly premium.

What happens if your income is below certain limits?

If your income is below certain limits, you might qualify for programs that reduce your Medicare costs. On the other hand, if your income is higher than a certain level, you might have to pay a higher Medicare Part B premium and a higher Medicare Part D premium (if you have a Part D Prescription Drug Plan or Medicare Advantage Prescription Drug ...

How does income affect Medicare?

How Your Income May Affect Your Medicare Costs. The federal Medicare program has costs that come with it. There may be premiums, copayments, coinsurance, and deductibles associated with Medicare Part A, Part B, and the optional Part D (prescription drug coverage). If your income is below certain limits, you might qualify for programs ...

What is the difference between Medicare Part A and Medicare Part B?

Medicare Part A (hospital insurance) and Medicare Part B (medic al insurance) make up Original Medicare. If you’re automatically enrolled in Medicare, as many Americans are when they turn 65 , Original Medicare is the type of insurance you get.

Get help paying costs

Learn about programs that may help you save money on medical and drug costs.

Part A costs

Learn about Medicare Part A (hospital insurance) monthly premium and Part A late enrollment penalty.

Part B costs

How much Medicare Part B (medical insurance) costs, including Income Related Monthly Adjustment Amount (IRMAA) and late enrollment penalty.

Costs for Medicare health plans

Learn about what factors contribute to how much you pay out-of-pocket when you have a Medicare Advantage Plan (Part C).

Compare procedure costs

Compare national average prices for procedures done in both ambulatory surgical centers and hospital outpatient departments.

Ways to pay Part A & Part B premiums

Learn more about how you can pay for your Medicare Part A and/or Medicare Part B premiums. Find out what to do if your payment is late.

Costs at a glance

Medicare Part A, Part B, Part C, and Part D costs for monthly premiums, deductibles, penalties, copayments, and coinsurance.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

What is the Medicare Part B rate for 2021?

If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

What is Medicare premium based on?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS. To set your Medicare cost for 2021, Social Security likely relied on the tax return you filed in 2020 that details your 2019 ...

What is a hold harmless on Medicare?

If you pay a higher premium, you are not covered by “hold harmless,” the rule that prevents most Social Security recipients from seeing their benefit payment go down if Medicare rates go up. “Hold harmless” only applies to people who pay the standard Part B premium and have it deducted from their Social Security benefit.

Can you ask Social Security to adjust your premium?

You can ask Social Security to adjust your premium if a “life-changing event” caused significant income reduction or financial disruption in the intervening tax year — for example, if your marital status changed , or you lost a job , pension or income-producing property. You’ll find detailed information on the Social Security web page “Medicare ...

Do you pay Medicare Part B if you are a high income beneficiary?

If you are what Social Security considers a “higher-income beneficiary,” you pay more for Medicare Part B, the health-insurance portion of Medicare. (Most enrollees don’t pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income ...