What the extra premiums look like

| Income Level for Individual Taxpayers* | Income Level for Joint Filers | Added Monthly Charge for Part B Premium | Added Monthly Charge for Part D Premium |

| $85,000 to $107,000 | $170,000 to $214,000 | $54.10 | $12.40 |

| $107,000 to $133,500 | $214,000 to $267,000 | $135.40 | $31.90 |

| $133,500 to $160,000 | $267,000 to $320,000 | $216.70 | $51.40 |

| $160,000 to $500,000 | $320,000 to $750,000 | $297.90 | $70.90 |

Does my income level affect my Medicare Part A premiums?

Nov 16, 2021 · Just like with your Part B coverage, you’ll pay an increased cost if you make more than the preset income level. In 2022, if your income is more than $91,000 per year, you’ll pay an IRMAA of $12.40...

Do you have to pay more for Medicare if you earn more?

Feb 15, 2022 · Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes. Medicare Part A premium costs in 2022 are as follows:

What is the income limit to receive Medicare?

If you earn less than $88,000, you’ll only have to pay the plan premium. If you earn more than $88,000 but less than $412,000, you’ll pay $70.70 on top of your plan premium. If you earn $412,000 or more, you’ll pay $77.10 in addition to your plan premium. Medicare will bill you for the additional Part D fee every month.

Are Medicare Part B premiums based on income level?

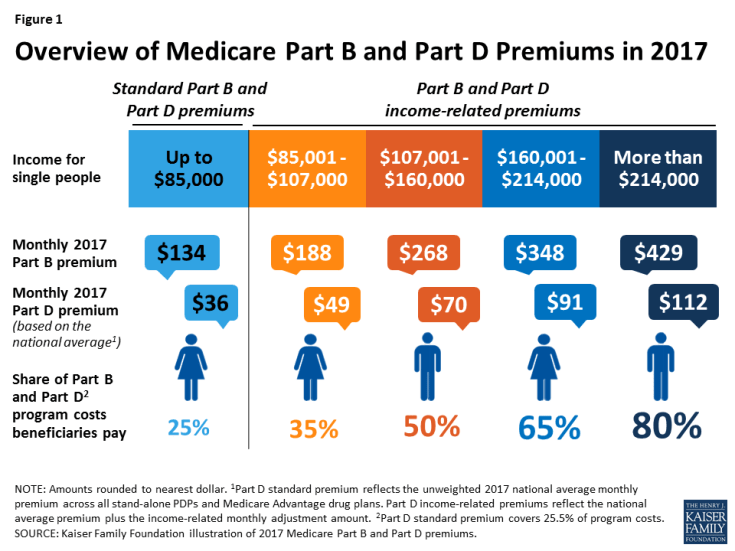

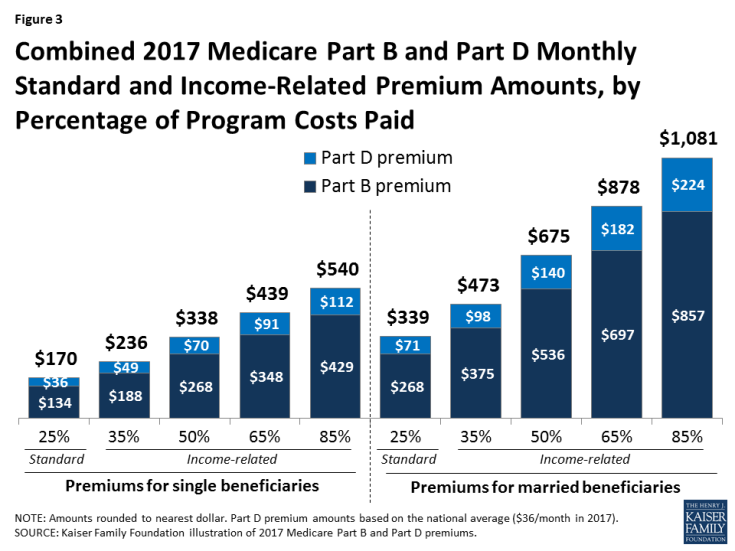

Nov 17, 2021 · In contrast, individuals with higher incomes pay from 35–85% of the premium. The majority of people fall into the income range associated with the …

What are the Medicare income brackets for 2020?

| Beneficiaries who file individual tax returns with income: | Beneficiaries who file joint tax returns with income: | Total monthly premium amount |

|---|---|---|

| Greater than $87,000 and less than or equal to $109,000 | Greater than $174,000 and less than or equal to $218,000 | 202.40 |

What triggers higher Medicare premiums?

What are the Irmaa brackets for 2021?

| IRMAA Table | 2021 |

|---|---|

| More than $222,000 but less than or equal to $276,000 | $297.00 |

| More than $276,000 but less than or equal to $330,000 | $386.10 |

| More than $330,000 but less than $750,000 | $475.20 |

| More than $750,000 | $504.90 |

How does income affect Medicare premiums?

What income is used to determine Medicare premiums 2021?

Does Social Security income count towards Irmaa?

Wages, Social Security benefits, Pension/Rental income, Interest, Dividends, distributions from any tax-deferred investment like a Traditional 401(k) or IRA and, again, Capital Gains.

Is Irmaa based on adjusted gross income?

How do you calculate Magi for Irmaa?

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

What percentage of Medicare Part B is paid?

After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

Does Medicare Advantage have a monthly premium?

Some of these additional benefits – such as prescription drug coverage or dental benefits – can help you save some costs on your health care, no matter what your income level may be. Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Will Medicare Part B be paid in 2021?

The majority of consumers will pay the usual Medicare Part B premium in 2021. The premium for the Part D plan you select is your responsibility. Depending on your income, you may be required to pay an additional amount to Medicare. There are different tax brackets for married couples who file their taxes separately.

Can low income people get Medicare?

Medicare beneficiaries with a low income may be eligible for financial assistance. Low-income individuals may be eligible for help with the costs of original Medicare and Part D. Medicare savings programs cover premiums, deductibles, coinsurance, and other expenses.

What is SLMB in Medicare?

SLMB, or Specified Low-Income Medicare Beneficiary. If you earn less than $1,296 per month and have less than $7,860 in assets, you may be eligible for SLMB. Married couples must make less than $1,744 per month and have less than $11,800 in debt to qualify. This plan covers your Part B premiums.

What is the income limit for QDWI?

You must meet the following income criteria if you want to enroll in your state’s QDWI program: Individuals must have a monthly income of $4,339 or less and a $4,000 resource limit. A married couple’s monthly income must be less than $5,833. A married couple’s resource limit must be less than $6,000.

How much will prescriptions cost in 2021?

Through the Extra Help program, prescriptions can be obtained at a significantly reduced cost. In 2021, generic drugs will cost no more than $3.70, while brand-name prescriptions will cost no more than $9.20.

Income adjusted premiums

A person’s income cannot be so high that it disqualifies them from Medicare.

Non-income adjusted premiums

The law does not require Medicare to adjust premiums based on income for the below programs:

The basis for higher premiums

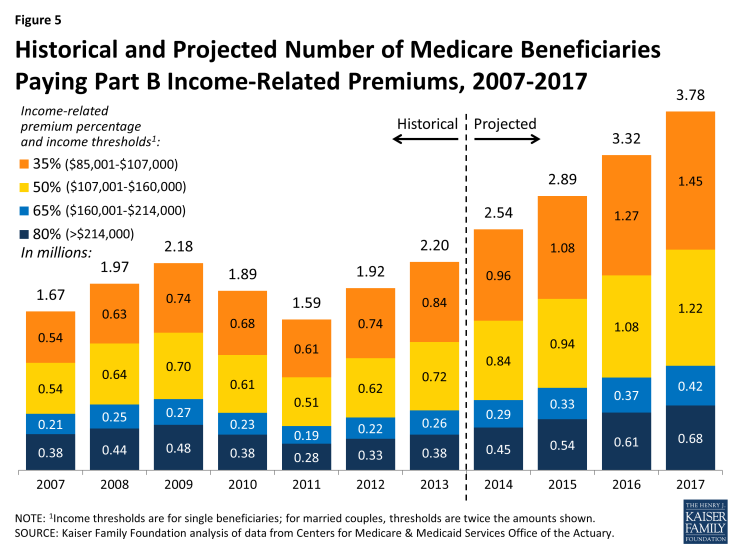

According to the Kaiser Family Foundation, several congressional acts in recent decades have required Medicare to adjust monthly premiums based on income.

Premium adjustments for Part B

Social Security reports that the government pays approximately 75% of the Part B premium for most beneficiaries, which means a person would pay the remaining 25%.

Premium adjustments for Part D

For most individuals, the government pays a large portion of the total expense of Part D, and the beneficiaries pay the rest.

How to appeal

If an individual does not agree with Medicare’s decision about their income-related premium adjustment, they can file an appeal.

Summary

A person’s income cannot be so high that it disqualifies them for Medicare. Even those who receive very high incomes may enroll.

What is the Medicare Part B rate for 2021?

If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

What is Medicare premium based on?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS. To set your Medicare cost for 2021, Social Security likely relied on the tax return you filed in 2020 that details your 2019 ...

What is a hold harmless?

If you pay a higher premium, you are not covered by “hold harmless,” the rule that prevents most Social Security recipients from seeing their benefit payment go down if Medicare rates go up. “Hold harmless” only applies to people who pay the standard Part B premium and have it deducted from their Social Security benefit.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much is Part B insurance in 2021?

The IRMAA is based on your reported adjusted gross income from two years ago. For 2021, your Part B premium may be as low as $148.50 or as high as $504.90.

How much does Medicare pay for prescriptions?

For 2019, the base amount that most people pay is $135.50 per month. Medicare Part D prescription drug coverage isn't mandatory, but if you participate, then you'll pay a monthly premium to your plan provider. The amount can vary widely and depends on the drugs covered and the amount of coverage you get.

How does Medicare Part B work?

For most Medicare participants, paying for coverage works as follows: 1 As long as you or a spouse had a long enough work history, then there's no monthly premium for hospital insurance coverage under Medicare Part A. Instead, there are deductibles and copayment amounts if you end up needing to use that coverage. 2 Medicare Part B typically comes with monthly premiums. For 2019, the base amount that most people pay is $135.50 per month. 3 Medicare Part D prescription drug coverage isn't mandatory, but if you participate, then you'll pay a monthly premium to your plan provider. The amount can vary widely and depends on the drugs covered and the amount of coverage you get.

Does Medicare Part A cover hospital insurance?

As long as you or a spouse had a long enough work history, then there's no monthly premium for hospital insurance coverage under Medicare Part A. Instead, there are deductibles and copayment amounts if you end up needing to use that coverage. Medicare Part B typically comes with monthly premiums.

Is Medicare Part D mandatory?

Medicare Part D prescription drug coverage isn't mandatory, but if you participate, then you'll pay a monthly premium to your plan provider. The amount can vary widely and depends on the drugs covered and the amount of coverage you get.

Who is Dan Caplinger?

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com.