The individual mandate provision of the federal health law requires you, your family, children or anyone else that you claim as a dependent on your taxes to have health insurance. This coverage can be supplied through your employer, public programs like Medicare or Medicaid or an individual policy that you purchase.

What is the individual mandate for Medicare Part A?

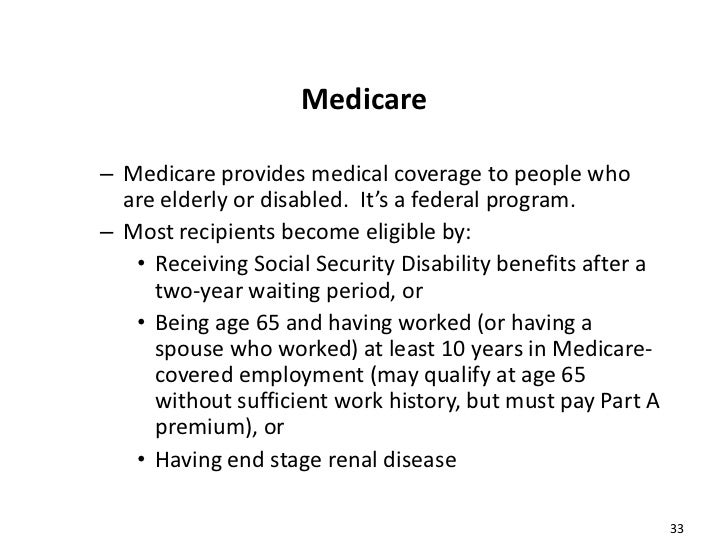

Feb 18, 2022 · Those who qualify for Medicare satisfy the following requirements: United States citizen or qualified legal resident Either 65 years of age or older, younger than 65 with a qualifying disability or...

What is the individual health insurance mandate for 2019?

For plan years through 2018, if you can afford health insurance but choose not to buy it, you may pay a fee called the individual Shared Responsibility Payment when you file your federal taxes. (The fee is sometimes called the "penalty," "fine," or "individual mandate.") Starting with the 2019 plan year (for which you’ll file taxes by July 15, 2020), the Shared Responsibility Payment no …

What is the individual mandate and why is it important?

Apr 06, 2022 · To be eligible for coverage, you’ll need to have been a member for 36 consecutive months. Medi-Share doesn’t cover primary care, unlike insurance. Well-child visits for up to six years old and one annual physical for each member are exempt. You’ll also need to pay out of pocket for most preventive services, such as flu shots, if you have them.

How will the CMS mandate be enforced?

The individual mandate, also called the “individual shared responsibility payment,” is no longer applicable in most states as of 2019. 1 However, your state of residence may require you and each member of your family to do at least one of the following or face a tax penalty: Have qualifying health coverage,

Who is exempt from the individual mandate provision of the Affordable Care Act?

Income Below Tax Threshold: In 2014 anyone with a household income under the tax filing threshold of $10,150 for an individual will be exempt from the individual mandate and the ensuing penalties.Dec 14, 2020

What does the individual mandate require?

The individual mandate is a provision within the Affordable Care Act that required individuals to purchase minimum essential coverage – or face a tax penalty – unless they were eligible for an exemption. The Supreme Court just upheld the ACA.

What is the primary reason for the individual mandate?

The rationale behind the mandate The rationale behind the individual mandate is that if everyone is required to have insurance—especially healthy people—the risk pools will be broad enough to lower premiums for everyone, even those with expensive medical conditions.Oct 16, 2021

What is the individual mandate component of the Patient Protection and Affordable Care Act?

The individual mandate required people with incomes above 150 percent of poverty to enroll in insurance or pay a penalty based on half the cost of the cheapest plan available in the individual market.Jul 11, 2018

Will there be a penalty for no health insurance in 2021?

Unlike in past tax years, if you didn't have coverage during 2021, the fee no longer applies. This means you don't need an exemption in order to avoid the penalty.

What is the penalty for not having health insurance in 2021?

Technical Information Release TIR 21-1: Individual Mandate Penalties for Tax Year 2021Individual Income Category*150.1-200% FPL200.1-250% FPLPenalty$23/month $276/year$44/month $528/year

Why do insurance companies favor the ACA's individual mandate?

The individual mandate keeps a higher share of younger and healthier people enrolled in the risk pool and therefore helps to cushion against a situation in which a disproportionate number of older, less healthy individuals buy coverage.

When did the individual mandate end?

The ACA's individual mandate penalty, which used to be collected by the IRS on federal tax returns, was reduced to $0 after the end of 2018. In most states, people who have been uninsured since 2019 are no longer assessed a penalty.Dec 8, 2021

Why is the individual mandate unconstitutional?

Two individuals and several states, including Texas, then challenged the individual mandate as unconstitutional, arguing that because it no longer carried a penalty, it no longer qualified as a tax. They also argued that because the individual mandate is essential to the ACA, the entire statute must be struck down.Jun 17, 2021

What is an individual mandate in health care?

(ACA) is the “individual mandate,” which. requires most individuals to purchase health insurance coverage or pay a penalty. What is the individual mandate? Beginning in 2014, the ACA requires most individuals to obtain acceptable health insurance coverage for themselves and their family members or pay a penalty.

Is the individual mandate still in effect?

As of 2019, the Obamacare individual mandate – which requires you to have health insurance or pay a tax penalty –no longer applies at the federal level.Jan 21, 2022

What is the individual mandate?

The individual mandate—officially called the individual shared responsibility provision—requires virtually all citizens and legal residents of the United States to have health insurance. It is part of the Affordable Care Act, and from 2014 through 2018, there was a financial penalty —assessed by the IRS—for people who didn't comply with ...

What did the Supreme Court decide about the individual mandate?

The Supreme Court decided the penalty imposed by the individual mandate was actually a tax on people who go without health insurance. Since the government has the right to tax its citizens, the Supreme Court decided the individual mandate was constitutional. It's actually this argument that has propelled Texas v.

Why did the plaintiffs call for the ACA to be overturned?

And because they argue that the mandate is not severable from the rest of the ACA, the plaintiffs called for the entire ACA to be overturned. A federal district court judge in Texas sided with the plaintiffs in December 2018, ruling that the ACA should indeed be overturned once the individual mandate penalty was reduced to zero.

How many states have not expanded Medicaid?

But the Supreme Court ruled that Medicaid expansion was optional, and 14 states still hadn't expanded Medicaid as of early 2021 (Oklahoma and Missouri both plan to expand Medicaid as of mid-2021, leaving just 12 states without expanded Medicaid eligibility). 10.

What did opponents of the individual mandate argue?

While the law was being debated in Congress, and in the years after it was enacted, opponents argued that the government shouldn’t be allowed to penalize people for not buying something. Challenges to the constitutionality of the individual mandate went all the way to the Supreme Court. The Supreme Court decided the penalty imposed by ...

Why does Vermont use the individual mandate?

Instead of a penalty, Vermont uses the data collected under the individual mandate's protocols in order to reach out to uninsured residents and connect them with available health coverage options. 2 )

Why did the Affordable Care Act require the creation of health insurance exchanges?

In order to help people comply with the individual mandate, the Affordable Care Act (ACA) required the creation of health insurance exchanges, or marketplaces, where people can buy health insurance.

Do you have to pay for health insurance if you qualify?

In some cases, you may qualify for a health coverage exemption from the requirement to have insurance. If you qualify, you won't have to pay the fee. Learn about health coverage exemptions.

Do you need an exemption for catastrophic health insurance?

You don’t need an exemption in order to avoid the penalty. If you’re 30 or older and want a “Catastrophic” health plan, you may want to apply for an exemption. See details about exemptions and catastrophic coverage.

How Will CMS Enforce this Mandate?

The CMS Mandate does not establish any additional reporting requirements, even for facilities subject to quality reporting measures.

Who is Exempt?

Each provider or supplier must offer “a process by which staff may request an exemption from the staff COVID-19 vaccination requirements based on the applicable Federal law.”

How Does the CMS Mandate Work with the OSHA and other Federal Vaccine Requirements

Facilities subject to the CMS Mandate must comply with the CMS rule first. If a health care provider or supplier is not subject to the CMS Mandate, then the Executive Order on Ensuring Adequate COVID Safety Protocols for Federal Contractors or the OSHA COVID-19 Healthcare Emergency Temporary Standard applies.

Make sure you have health care coverage

To avoid a penalty, you need minimum essential coverage (MEC) for each month of the year for:

Get coverage

If you do not have coverage, open enrollment continues through January 31, 2022. Visit Apply | Covered California™ 13 or call (800) 300-1506 to sign up for health care coverage.

Special enrollment period

Due to the economic impact from COVID-19, individuals may enroll in health care coverage during Covered California’s special enrollment period, generally from November through January. Eligibility requirements are similar to those in place during the annual open-enrollment period.

Exemptions

You may qualify for an exemption to avoid the penalty. Most exemptions may be claimed on your state income tax return.

Financial help

Help meeting the requirements for health care coverage is available for qualifying individuals and families through Covered California and is based on:

Penalty

You will have to pay a penalty, the Individual Shared Responsibility Penalty, when you file your state tax return if:

What is the individual mandate?

Known as the “individual mandate,” it played an important role in the funding and ongoing sustainability of Obamacare. Fortunately, if you had Medicare Part A, then you met the individual mandate requirement up until this year, and you didn’t need to do anything else to prove your compliance.

What are the benefits of Medicare under the ACA?

One of the benefits included under minimum essential coverage is the ability to see your doctor for yearly screenings and wellness checkups.

How does Obamacare help people?

In many ways, the Affordable Care Act improves the standard of care that those with insurance receive. And, it helps to prevent the spread of diseases and other medical conditions to people without insurance. Medicare beneficiaries, in particular, gain valuable advantages, like being able to afford brand name prescription drugs or getting yearly colonoscopies to detect early forms of cancer. Obamacare seeks to help people stay healthier for longer by making better coverage an affordable option; this goal extends to Medicare beneficiaries. And despite the emphasis on better medical treatments and prevention, the new standard of healthcare doesn’t affect how you sign up for or receive your Medicare benefits.

What is a Medicare Part D coverage gap?

If you have Medicare Part D prescription coverage, then you may be familiar with the concept of the coverage gap or “donut hole.” The coverage gap happens when a person reaches the limit for covered prescriptions, but has to wait until he gets to the other side of the “donut” or coverage period to get covered prescriptions again.

Is Demetrius a Medicare beneficiary?

As a Medicare beneficiary for the last five years, Demetrius is already familiar with what Medicare covers and how his medical claims get filed. Demetrius is fairly healthy, but he does need to visit the doctor more frequently than some men his age, because he has a family history of diabetes and stroke.

Does Obamacare affect Medicare?

One of the biggest concerns among Medicare beneficiaries is that Obamacare will alter their existing coverage, so that they won’t enjoy the same benefits as before. In reality, the Affordable Care Act seeks to strengthen health insurance across the board, including Medicare.

When did the Affordable Care Act change?

The Affordable Care Act (ACA), also known as Obamacare, made significant changes to the healthcare industry in the United States starting in 2010. Several of these changes centered on the social insurance policy of Medicare, including the way that Medicare is administered and distributed. Sorting through Medicare policies can be challenging enough, ...

What happens if you don't enroll in tricare?

However, you losing your creditable coverage should trigger a special enrollment period for Part B (generally people would have Part B and TRICARE, but if TRICARE was considered creditable coverage for you, then it shouldn’t be the case).

How does Obamacare work?

Here is How ObamaCare Works if You are Over 65, But Don't Qualify For Medicare . You’re over 65 but not eligible for Medicare. You are eligible to get coverage on HealthCare.gov (the ObamaCare marketplace). If you meet the qualifications based on income and family size, you are eligible for cost-saving subsidies, too.

Is Medicare.Gov a good place to start?

If you are Medicare age a great place to start your journey is Medicare .Gov, if not then Healthcare.gov is best. It isn’t that these are your only options, it is that this is a good place to start when you are confused. Enrolling in Medicare is a little complex and must be done during open enrollment periods.

Does a woman with no work credit qualify for Medicare?

She does not have enough work credits to qualify for social security which means she will not qualify for Medicare either. She does not want to purchase medicare because she does not have any income other than a small monthly SSI check and the monthly premiums for Medicare are too high.

Can I get marketplace insurance if I qualify for Medicare?

If you qualify for Medicare then you can’t get marketplace insurance. One can however apply for assistance via Medicare. https://www.medicare.gov/your-medicare-costs/get-help-paying-costs. Reply. Anne McDannels on June 9, 2021. I am a senior and didn’t take part b medicare as I was still covered by Tricare Prime.

Definition

Federal Mandate Penalty Is $0 as of 2019

- Under the terms of the Tax Cuts and Jobs Act that Congress enacted in late 2017, the individual mandate penalty was eliminated starting in 2019.1 People who were uninsured in 2018 were subject to the penaltywhen they filed their tax returns in early 2019, unless they were exempt. But people who were uninsured in 2019 or a future year do not owe a penalty on their tax returns unl…

Background of The Individual Mandate

- The individual mandate has always been a controversial part of the Affordable Care Act. While the law was being debated in Congress, and in the years after it was enacted, opponents argued that the government shouldn’t be allowed to penalize people for notbuying something. Challenges to the constitutionality of the individual mandate went all the way to the Supreme Court. The Supre…

How The Individual Mandate Works

- Some people are exempt from the individual mandate, but the majority of Americans fall under its mandate and were subject to a penalty for non-compliance if they were uninsured between 2014 and 2018. People who were uninsured—and who didn't qualify for an exemption—during that time frame had to pay the shared responsibility paymentwhen they filed their federal income taxes. I…

How Many People Owed A Penalty?

- In early 2016, the Internal Revenue Service reported that for the 2014 coverage year, a total of 7.9 million tax filers reported a total of $1.6 billion in shared responsibility provision penalties that averaged about $210 per tax filer.11 On the other hand, there were 12.4 million tax filers who were also uninsured in 2014, but who claimed one of the exemptions and were therefore not subject t…

How Much Was The Penalty?

- If you were uninsured and not eligible for an exemption, the penalty in 2018 was the GREATER OF: 1. 2.5 percent of your taxable household income, OR 2. $695 per uninsured adult, plus $347.50 per uninsured child, up to a maximum of $2,085 per family (this was to be adjusted annually for inflation beginning in 2017, but the IRS announced that the inflation adjustment would be $0 for …