- Reasons for appeal. A person can appeal an IRMAA for several reasons. ...

- Documents. The appeal requires documentation. To begin an appeal, a person will need to contact the SSA at 800-772-1213.

- Decision. If the SSA approve the appeal, they will adjust the person’s monthly Medicare premiums. If they deny the appeal, they will explain why, generally in a hearing.

How to appeal a denial of Medicaid?

Part 6 of 6: Bringing a Medicare Prescription Drug Appeal

- Talk to your doctor. Appealing the denial from your Medicare prescription drug plan is similar to appealing an “original Medicare” decision.

- Ask for a coverage determination. You or your doctor needs to contact your prescription drug plan. ...

- Receive a determination. ...

- Request Redetermination. ...

- Request Reconsideration by an Independent Review Entity (IRE). ...

How to file for Medicare Appeals?

You can file an appeal if you disagree with a coverage or payment decision made by one of these:

- Medicare

- Your Medicare health plan

- Your Medicare drug plan

How to appeal a higher Medicare Part B monthly premium?

- Getting married, divorced, or losing a spouse

- Loss or sale or income-producing property

- You or your spouse retired and/or income significantly decreased

- Loss of pension income

How can I appeal a denial of Medicare coverage?

- The ALJ level is the best chance to obtain Medicare coverage.

- The QIC should provide a written copy of its decision with information about how to request an ALJ hearing.

- You must request the hearing within 60 days of notice from the QIC that it has denied Medicare coverage for your care.

- Unfortunately, ALJ hearings and decisions are not expedited. ...

Can I contest Irmaa?

As a beneficiary, you have the right to appeal if you believe that an Income Related Monthly Adjustment Amount (IRMAA) is incorrect for one of the qualifying reasons. First, you must request a reconsideration of the initial determination from the Social Security Administration.

When can I file an Irmaa appeal?

Contact SSA to learn how to file this request. If your reconsideration is successful, your premium amounts will be corrected. If your reconsideration is denied, you can appeal to the Office of Medicare Hearings and Appeals (OMHA) level within 60 days of the date on the reconsideration denial.

How do I appeal Medicare surcharge?

Yes. If we determine you must pay more for your Medicare Part B or Medicare prescription drug coverage because of your income, and you disagree, you have the right to request an appeal, also known as a reconsideration. You'll need to request an appeal in writing by completing a Request for Reconsideration (SSA-561-U2).

How do I stop Irmaa surcharges?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).

Are Irmaa adjustments retroactive?

If a change to your IRMAA determination occurs, corrections will be retroactive. If you request an appeal, you must: Ask for an appeal within 60 days. The 60 days start the day after you get your letter.

How often is Irmaa reviewed?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax return is used. This amount is recalculated annually.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

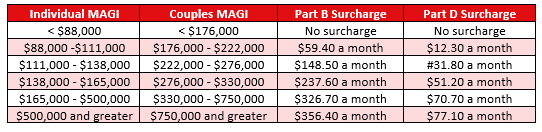

What are the Irmaa brackets for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $276,000 but less than or equal to $330,000$386.10More than $330,000 but less than $750,000$475.20More than $750,000$504.90Married filing separately12 more rows•Dec 6, 2021

Do I have to pay Irmaa Part D if I don't have Part D Medicare?

You're required to pay the Part D IRMAA, even if your employer or a third party (like a teacher's union or a retirement system) pays for your Part D plan premiums. If you don't pay the Part D IRMAA and get disenrolled, you may also lose your retirement coverage and you may not be able to get it back.

Is Irmaa recalculated every year?

Unlike late enrollment penalties, which can last as long as you have Medicare coverage, the IRMAA is calculated every year. You may have to pay the adjustment one year, but not the next if your income falls below the threshold.

Do both spouses have to pay Irmaa?

Yes, if you and your wife file a joint tax return and your modified adjusted gross income exceeds $170,000 then both you and your wife would be required to pay the higher IRMAA premium rates (https://secure.ssa.gov/apps10/poms.nsf/lnx/0601101020).

Does Irmaa brackets change each year?

Not Penalized For Life. If your income two years ago was higher and you don't have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes.

How to appeal Medicare IRMAA?

To get an appeal form, you can go into a nearby Social Security office, call 800-772-1213, or check the Social Security website.

How to appeal an IRMAA?

To get an appeal form, you can go into a nearby Social Security office, call 800-772-1213, or check the Social Security website. Even if you haven’t experienced a life-changing event, you can still appeal an IRMAA. Request an appeal in writing by completing a request for reconsideration form. To get an appeal form, you can go into ...

How long does the IRMAA last?

You get notified by the SSA near the end of the current year if you’ll be required to pay an IRMAA once the calendar flips to January. The IRMAA lasts for one year, and the SSA reevaluates your benefits again for the next year.

What is an IRMAA?

The IRMAA is an amount of money you may be required to pay in addition to your regular Part B premium and/or Part D premium if your income is above a certain level. Every year, the SSA determines your IRMAA, if any, based on information from your income tax return from two years prior, which the SSA obtains from the Internal Revenue Service. ...

How to appeal a Social Security claim?

To get an appeal form, you can go into a nearby Social Security office, call 800-772-1213, or check the Social Security website.

How long does it take to appeal an OMHA denial?

If your appeal is denied, you can choose to appeal to the Medicare Appeals Council within 60 days of the date on the OMHA level denial. If your Council appeal is successful, your premium amount will be corrected.

How is IRMAA calculated?

The IRMAA is based on information from the individual’s income tax return obtained from the Internal Revenue Service (IRS) and calculated according to a mathematical formula established by law. The IRMAA is then added to the standard premium amount to calculate the beneficiary’s total monthly Part B insurance premium.

How to request reconsideration of Social Security?

A request for reconsideration can be done orally by calling the SSA 1-800 number (800.772.1213) as well as by writing to SSA .

What are the circumstances that qualify a beneficiary for a new Part B determination?

Below are the situations which may qualify a beneficiary for a new Part B determination: Events that result in the loss of dividend income or affect a beneficiary's expenses, but do not affect the beneficiary's modified adjusted gross income are not considered qualifying life-changing events.

How To Appeal IRMAA

If you have experienced a significant drop in income, or expect to in the next year – did you know that this can impact how much you pay for Medicare? It can, Medicare looks 2 year back at your income to determine what you should be paying for your premiums.

How much can a Medicare IRMAA appeal save you?

Your potential savings will depend on your income reduction and marital status. The Medicare IRMAA brackets change every year.

Plan to Prevent IRMAA in the Future

Are you impacted by Medicare IRMAA surcharge? While appealing can fix this year’s impact, if you are impacted once it may be likely you are impacted again.

What is an appeal for IRMAA?

Appealing an IRMAA decision is also referred to as requesting a reconsideration. Keep in mind that there are no strict timeframes in which Social Security must respond to a reconsideration request. If you have questions about your appeal status, contact the agency currently reviewing your appeal.

How long does it take to appeal a Medicare reconsideration?

If your reconsideration is denied, you can appeal to the Office of Medicare Hearings and Appeals (OMHA) level within 60 days of the date on the reconsideration denial. Follow the directions on the denial to file an appeal at the OMHA level.

How to request a new initial determination for Medicare?

To request a new initial determination, submit a Medicare IRMAA Life-Changing Event form or schedule an appointment with Social Security. You will need to provide documentation of either your correct income or of the life-changing event that caused your income to decrease.

How does Social Security determine if you owe IRMAA?

The Social Security Administration (SSA) determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior, meaning two years before the year when you pay the IRMAA. For example, Social Security would use tax returns from 2020 to determine your IRMAA in 2022.

How long does it take to appeal a Part B denial?

If the Council denies your appeal, you can choose to appeal to the Federal District Court within 60 days of the date on the Council denial.

What is an initial determination on Social Security?

If Social Security determines that you should pay an IRMAA, they will mail you a notice called an initial determination. This notice should include information on how to request a new initial determination. A new initial determination is a revised decision that Social Security makes regarding your IRMAA.

How to Understand and Appeal Medicare IRMAA

As promised, we’re going to show you how you can appeal an IRMAA if you’re assessed one by Medicare. But first, let’s explain what IRMAA is, and how it’s calculated.

What is an IRMAA?

IRMAA stands for Income Related Monthly Adjusted Amount. Basically, if your income is above a certain level, Medicare may require you to pay an extra amount in addition to your Part B or Part D premium.

How Medicare Premiums Work

Let's start at the beginning. When you get involved in the Medicare system, you’ll realize there are four major parts to Medicare, Medicare A, B, C, and D. Medicare Part A is everything related to inpatient services, Part B is for outpatient and doctor services, Part C is Advantage plans, and Part D is prescription drug plans.

How Is an IRMAA Calculated?

As we mentioned earlier, IRMAA is based on your income. Now, if you’re starting Medicare in 2022, your 2019 income will be assessed to determine if you’re in the IRMAA income bracket.

Conclusion

IRMAA stands for Income Related Monthly Adjusted Amount and is an extra charge added to high-income individual’s Medicare Part B and D premiums. Only about seven percent of the Medicare population has to worry about paying an IRMAA.

Get It Right The First Time

If you want the best Medicare plans for your retirement, give us a call. We provide the education and award-winning guidance you need to make the right decision.

What is an appeal in Medicare?

An appeal is the action you can take if you disagree with a coverage or payment decision by Medicare or your Medicare plan. For example, you can appeal if Medicare or your plan denies: • A request for a health care service, supply, item, or drug you think Medicare should cover. • A request for payment of a health care service, supply, item, ...

What to do if you decide to appeal a health insurance plan?

If you decide to appeal, ask your doctor, health care provider, or supplier for any information that may help your case. See your plan materials, or contact your plan for details about your appeal rights.

What to do if you didn't get your prescription yet?

If you didn't get the prescription yet, you or your prescriber can ask for an expedited (fast) request. Your request will be expedited if your plan determines, or your prescriber tells your plan, that waiting for a standard decision may seriously jeopardize your life, health, or ability to regain maximum function.

How long does Medicare take to respond to a request?

How long your plan has to respond to your request depends on the type of request: Expedited (fast) request—72 hours. Standard service request—30 calendar days. Payment request—60 calendar days. Learn more about appeals in a Medicare health plan.

How to ask for a prescription drug coverage determination?

To ask for a coverage determination or exception, you can do one of these: Send a completed "Model Coverage Determination Request" form. Write your plan a letter.

How long does it take to appeal a Medicare denial?

You, your representative, or your doctor must ask for an appeal from your plan within 60 days from the date of the coverage determination. If you miss the deadline, you must provide ...

How long does it take for a Medicare plan to make a decision?

The plan must give you its decision within 72 hours if it determines, or your doctor tells your plan, that waiting for a standard decision may seriously jeopardize your life, health, or ability to regain maximum function. Learn more about appeals in a Medicare health plan.