Does my income level affect Medicare Part A costs?

Medicare Part A costs are not affected by your income level Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

Do Medicare Part B and Part D premiums depend on your income?

Medicare Part B and Part D premiums can both be affected by your income level. Learn more about what you may pay for Medicare, depending on your income. Medicare Part B and Part D require higher income earners to pay higher premiums for their plan.

Will My Medicare premiums be based on my previous year’s income?

If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

Are you eligible for Medicare Part A?

Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance). You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

Is Medicare discriminatory?

CMS doesn't exclude, deny benefits to, or otherwise discriminate against any person on the basis of race, color, national origin, disability, sex (or gender identity), or age.

How does Medicare define reasonable and necessary?

"Reasonable and Necessary" Furnished in a setting appropriate to the patient's medical needs and condition; Ordered and furnished by qualified personnel; Meets, but does not exceed, the patient's medical need; and.

What is the threshold for Medicare?

Qualified Medicare Beneficiary (QMB) program You can qualify for the QMB program if you have a monthly income of less than $1,094 and total resources of less than $7,970. For married couples, the limit is less than $1,472 monthly and less than $11,960 in total.

What determines the cost of Medicare?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What are the four components of Medicare medical necessity?

What are the 4 parts of Medicare?Medicare Part A – hospital coverage.Medicare Part B – medical coverage.Medicare Part C – Medicare Advantage.Medicare Part D – prescription drug coverage.

Who determines medical necessity for Medicare?

The services need to diagnose and treat the health condition or injury. Medicare makes its determinations on state and federal laws. Local coverage makes determinations through individual state companies that process claims.

Does your income affect how much you pay for Medicare?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, you'll pay higher premiums.

Is everyone entitled to Medicare?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance).

What are the income limits for Medicare 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

What will Medicare not pay for?

In general, Original Medicare does not cover: Long-term care (such as extended nursing home stays or custodial care) Hearing aids. Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures.

Why is my Medicare premium so high?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

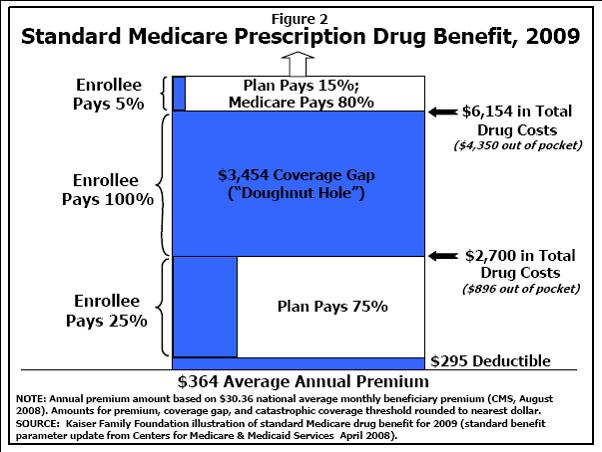

When did Medicare start providing prescription drugs?

Since January 1, 2006, everyone with Medicare, regardless of income, health status, or prescription drug usage has had access to prescription drug coverage. For more information, you may wish to visit the Prescription Drug Coverage site.

How long do you have to be on disability to receive Social Security?

You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months. ( Note: If you have Lou Gehrig's disease, your Medicare benefits begin the first month you get disability benefits.)

How to learn more about Medicare?

How to Learn More About Your Medicare Options. Primary insurance isn't too hard to understand; it's just knowing which insurance pays the claim first. Medical billing personnel can always help you figure it out if you're having trouble. While it's not hard to understand primary insurance, Medicare is its own beast.

When is Medicare Primary?

For the most part, when you have more than one form of coverage, Medicare is primary. Some examples include having group coverage through a smaller employer, COBRA, being on inactive duty with TRICARE, or Medicaid. Usually, secondary insurance will only pay if the primary insurance paid its portion first.

What is secondary insurance?

Secondary insurance helps cover out-of-pocket costs left over after your primary coverage pays their portion. There are a few common scenarios when Medicare is secondary. An example includes having group coverage through a larger employer with more than 20 employees.

Is Medicare a part of tricare?

Medicare is primary to TRICARE. If you have Part A, you need Part B to remain eligible for TRICARE. But, Part D isn’t a requirement. Also, TRICARE covers your prescriptions. Your TRICARE will be similar to a Medigap plan; it covers deductibles and coinsurances.

Can you have Medicare and Cobra at the same time?

There are scenarios when you’ll have Medicare and COBRA at the same time. The majority of the time, Medicare will be primary and COBRA will be secondary. The exception to this is if your group coverage has special rules that determine the primary payer.

Is Cobra better than Medicare?

It’s not common for COBRA to be the better option for an individual who’s eligible for Medicare. This is because COBRA is more expensive than Medicare. Once you enroll in Medicare, you can drop your COBRA coverage.

Does Medicare cost less?

Also, consider how much you’re paying for employer coverage. Most of the time, Medicare costs a lot less in monthly premiums. Compare both options side by side to see if making Medicare your primary coverage will save you money.

What is an orange notice from Medicare?

An orange notice from Medicare that says your copayment amount will change next year. If you have. Supplemental Security Income (Ssi) A monthly benefit paid by Social Security to people with limited income and resources who are disabled, blind, or age 65 or older.

What are some examples of documents you can send to Medicare?

Examples of documents you can send your plan include: A purple notice from Medicare that says you automatically qualify for Extra Help. A yellow or green automatic enrollment notice from Medicare. An Extra Help "Notice of Award" from Social Security. An orange notice from Medicare that says your copayment amount will change next year.

How long does Medicaid pay for stay?

Or, a copy of a state document showing Medicaid paid for your stay for at least a month. A print-out from your state’s Medicaid system showing you lived in the institution for at least a month. A document from your state that shows you have Medicaid and are getting home- and community-based services.

How much does a prescription cost for 2021?

Make sure you pay no more than the LIS drug coverage cost limit. In 2021, prescription costs are no more than $3.70 for each generic/$9.20 for each brand-name covered drug for those enrolled in the program. Contact Medicare so we can get confirmation that you qualify, if it's available.

When will Medicare Part B and Part D be based on income?

If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

How much is the 2021 Medicare Part B deductible?

The 2021 Part B deductible is $203 per year. After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

Does Medicare have a 0 premium?

Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations. Find out if a $0 premium plan is available where you live by calling to speak with a licensed insurance agent.

Does Medicare Advantage cover Part A?

Did you know that a Medicare Advantage plan covers the same benefits that are covered by Medicare Part A and Part B (Original Medicare)? Did you know that some Medicare Advantage plans also offer benefits not covered by Original Medicare?

Who sells Medicare Part C?

Medicare Part C plans (also called Medicare Advantage) and Medicare Supplement Insurance plans (also called Medigap) are sold by private insurance companies. The cost of plans can vary from one provider to the next.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

When do you need to sign up for Medicare?

If the employer has less than 20 employees: You might need to sign up for Medicare when you turn 65 so you don’t have gaps in your job-based health insurance. Check with the employer.

What is a Medicare leave period?

A period of time when you can join or leave a Medicare-approved plan.

Do I need to get Medicare drug coverage (Part D)?

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

What happens if you don't sign up for Part A and Part B?

If you don’t sign up for Part A and Part B, your job-based insurance might not cover the costs for services you get.

Do you have to tell Medicare if you have non-Medicare coverage?

Each year, your plan must tell you if your non-Medicare drug coverage is creditable coverage. Keep this information — you may need it when you’re ready to join a Medicare drug plan.

Does Medicare work if you are still working?

If you (or your spouse) are still working, Medicare works a little differently. Here are some things to know if you’re still working when you turn 65.

Do I need to sign up for Medicare when I turn 65?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work.

What is Medicare premium based on?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS. To set your Medicare cost for 2021, Social Security likely relied on the tax return you filed in 2020 that details your 2019 ...

What is a hold harmless on Medicare?

If you pay a higher premium, you are not covered by “hold harmless,” the rule that prevents most Social Security recipients from seeing their benefit payment go down if Medicare rates go up. “Hold harmless” only applies to people who pay the standard Part B premium and have it deducted from their Social Security benefit.

What is the Medicare Part B rate for 2021?

If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

Does Medicare Part D increase with income?

Premiums for Medicare Part D (prescription-drug coverage), if you have it , also rise with higher incomes .

Can you ask Social Security to adjust your premium?

You can ask Social Security to adjust your premium if a “life-changing event” caused significant income reduction or financial disruption in the intervening tax year — for example, if your marital status changed , or you lost a job , pension or income-producing property. You’ll find detailed information on the Social Security web page “Medicare ...

Do you pay Medicare Part B if you are a high income beneficiary?

If you are what Social Security considers a “higher-income beneficiary,” you pay more for Medicare Part B, the health-insurance portion of Medicare. (Most enrollees don’t pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income ...

What is reasonable diligence in Medicare?

Through reasonable diligence, you or a staff member identify receipt of an overpayment and quantify the amount. According to SSA Section 1128J(d), you must report and return a self-identified overpayment to Medicare within:

What happens if Medicare overpayment exceeds regulation?

Medicare overpayment exceeds regulation and statute properly payable amounts. When Medicare identifies an overpayment, the amount becomes a debt you owe the federal government. Federal law requires we recover all identified overpayments.

What is SSA 1893(f)(2)(A)?

SSA Section 1893(f)(2)(A) outlines Medicare overpayment recoupment limitations. When CMS and MACs get a valid first- or second-level overpayment appeal , subject to certain limitations , we can’t recoup the overpayment until there’s an appeal decision. This affects recoupment timeframes. Get more information about which overpayments we subject to recoupment limitation at

How long does it take to get an ITR letter?

If you fail to pay in full, you get an ITR letter 60–90 days after the initial demand letter. The ITR letter advises you to refund the overpayment or establish an ERS. If you don’t comply, your MAC refers the debt for collection.

Can Medicare overpayments be recouped?

outlines Medicare overpayment recoupment limitations. When CMS and MACs get a valid first- or second-level overpayment appeal, subject to certain limitations, we can’t recoup the overpayment until there’s an appeal decision. This affects recoupment timeframes. Get more information about which overpayments we subject to recoupment limitation at