What is the reimbursement rate for Medicare and Medicaid?

According to the Centers for Medicare & Medicaid Services (CMS), Medicare’s reimbursement rate on average is roughly 80 percent of the total bill. 1 Not all types of health care providers are reimbursed at the same rate.

What percentage of Medicare reimbursement goes to specialty care?

For example, clinical nurse specialists are reimbursed at 85% for most services, while clinical social workers receive 75%. 1 Medicare uses a coded number system to identify health care services and items for reimbursement.

What percentage of Medicare reimbursement do nurses receive?

For example, clinical nurse specialists are reimbursed at 85% for most services, while clinical social workers receive 75%. 1 Medicare uses a coded number system to identify health care services and items for reimbursement. The codes are part of what’s called the Healthcare Common Procedure Coding System (HCPCS).

Are all types of health care providers reimbursed at the same rate?

Not all types of health care providers are reimbursed at the same rate. For example, clinical nurse specialists are reimbursed at 85% for most services, while clinical social workers receive 75%. 1 Medicare uses a coded number system to identify health care services and items for reimbursement.

What percentage is Medicare reimbursement?

roughly 80 percentAccording to the Centers for Medicare & Medicaid Services (CMS), Medicare's reimbursement rate on average is roughly 80 percent of the total bill. Not all types of health care providers are reimbursed at the same rate.

What does the Medicaid Medicare reimbursement ratio refer to?

The Medicare-to-Medicaid fee index is a computed ratio of the Medicaid fee for each service in each state to the Medicare fee for the same services. Comparable Medicare fees are calculated using relative value units, geographic adjusters, and conversion factor.

How are Medicare reimbursements calculated?

The Centers for Medicare and Medicaid Services (CMS) determines the final relative value unit (RVU) for each code, which is then multiplied by the annual conversion factor (a dollar amount) to yield the national average fee. Rates are adjusted according to geographic indices based on provider locality.

What does Medicare reimbursement depend on?

Medicare reimbursement rates depend on the number of individual services provided to the patient in one day. Similar to its hospital inpatient counterpart, the OPPS also provides some hospitals with add-on payments.

How is reimbursement determined?

Payers assess quality based on patient outcomes as well as a provider's ability to contain costs. Providers earn more healthcare reimbursement when they're able to provide high-quality, low-cost care as compared with peers and their own benchmark data.

What is Medicare reimbursement fee schedule?

A fee schedule is a complete listing of fees used by Medicare to pay doctors or other providers/suppliers. This comprehensive listing of fee maximums is used to reimburse a physician and/or other providers on a fee-for-service basis.

What is reimbursement percentage?

Reimbursement Percentage This is the percentage of covered costs you'll get back after you meet your deductible.

What is the conversion factor for Medicare?

In implementing S. 610, the Centers for Medicare & Medicaid Services (CMS) released an updated 2022 Medicare physician fee schedule conversion factor (i.e., the amount Medicare pays per relative value unit) of $34.6062.

What is reimbursement rate?

Reimbursement rates means the formulae to calculate the dollar allowed amounts under a value-based or other alternative payment arrangement, dollar amounts, or fee schedules payable for a service or set of services.

Do doctors lose money on Medicare patients?

Summarizing, we do find corroborative evidence (admittedly based on physician self-reports) that both Medicare and Medicaid pay significantly less (e.g., 30-50 percent) than the physician's usual fee for office and inpatient visits as well as for surgical and diagnostic procedures.

Why is Medicare not paying on claims?

If the claim is denied because the medical service/procedure was “not medically necessary,” there were “too many or too frequent” services or treatments, or due to a local coverage determination, the beneficiary/caregiver may want to file an appeal of the denial decision. Appeal the denial of payment.

How does Medicare Part B reimbursement work?

The Medicare Part B Reimbursement program reimburses the cost of eligible retirees' Medicare Part B premiums using funds from the retiree's Sick Leave Bank. The Medicare Part B reimbursement payments are not taxable to the retiree.

What percentage of Medicare is reimbursed?

According to the Centers for Medicare & Medicaid Services (CMS), Medicare’s reimbursement rate on average is roughly 80 percent of the total bill. 1. Not all types of health care providers are reimbursed at the same rate.

What Are Medicare Reimbursement Rates?

Medicare reimburses health care providers for services and devices they provide to beneficiaries. Learn more about Medicare reimbursement rates and how they may affect you.

What is Medicare coded number?

Medicare uses a coded number system to identify health care services and items for reimbursement. The codes are part of what’s called the Healthcare Common Procedure Coding System (HCPCS).

Is it a good idea to use HCPCS codes?

Using HCPCS codes. It’s a good idea for Medicare beneficiaries to review the HCPCS codes on their bill after receiving a service or item. Medicare fraud does happen, and reviewing Medicare reimbursement rates and codes is one way to help ensure you were billed for the correct Medicare services.

What is the federal Medicaid share?

The Federal share of all Medicaid expenditures is estimated to have been 63 percent in 2018. State Medicaid expenditures are estimated to have decreased 0.1 percent to $229.6 billion. From 2018 to 2027, expenditures are projected to increase at an average annual rate of 5.3 percent and to reach $1,007.9 billion by 2027.

What percentage of births were covered by Medicaid in 2018?

Other key facts. Medicaid Covered Births: Medicaid was the source of payment for 42.3% of all 2018 births.[12] Long term support services: Medicaid is the primary payer for long-term services and supports.

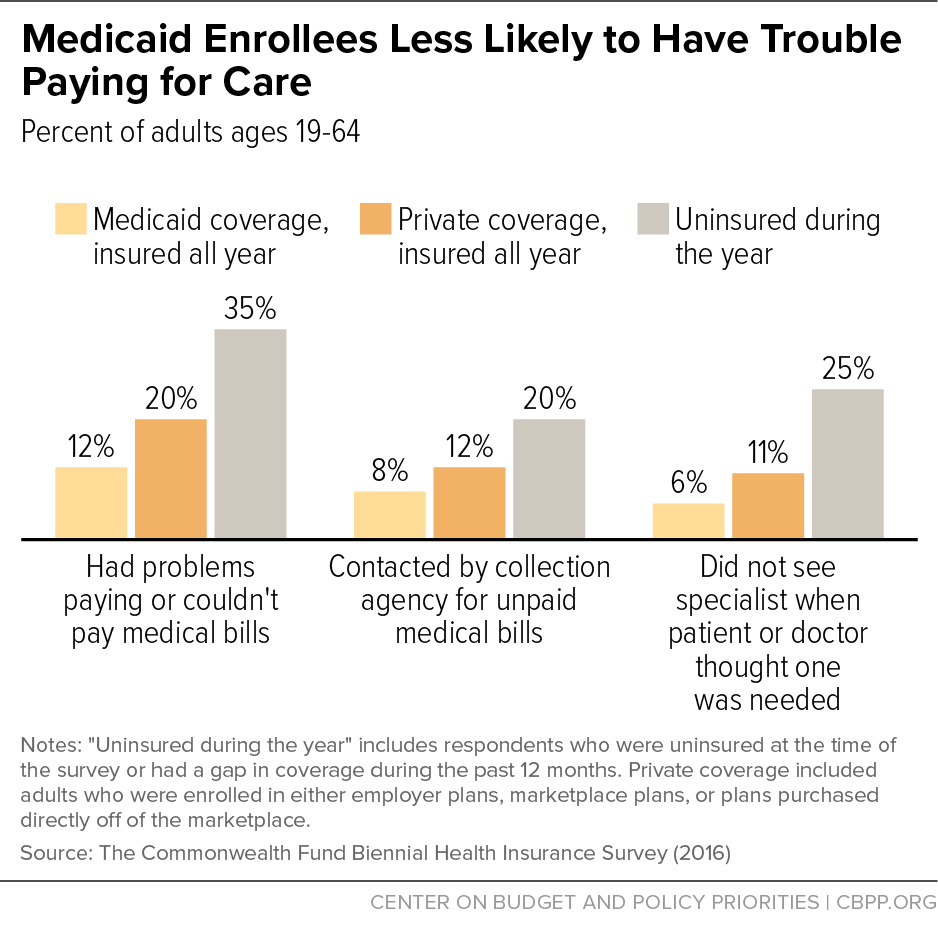

What percentage of Medicaid beneficiaries are obese?

38% of Medicaid and CHIP beneficiaries were obese (BMI 30 or higher), compared with 48% on Medicare, 29% on private insurance and 32% who were uninsured. 28% of Medicaid and CHIP beneficiaries were current smokers compared with 30% on Medicare, 11% on private insurance and 25% who were uninsured.

What is the Perm rate?

PERM results:[8] Through the Payment Error Rate Measurement (PERM) program, HHS estimates Medicaid and CHIP improper payments on an annual basis, utilizing federal contractors to measure three components: FFS, managed care, and eligibility. The PERM program uses a 17-state rotational approach to measure the 50 states and the District of Columbia over a three-year period. Under this approach, each state is measured once every three years and national improper payment rates include findings from the most recent three-year cycle measurements. Each time a cycle of states is measured, the new findings are utilized and the respective cycle’s previous findings are removed. The FY 2019 national Medicaid improper payment rate estimate is 14.9 percent. The FY 2019 national improper payment rate estimate for CHIP is 15.83 percent. The FY 2019 improper payment rate for each Medicaid component is:

What is CMS and Medicaid?

CMS works alongside the Department of Labor (DOL) and the U.S. Treasury to enact insurance reform. The Social Security Administration (SSA) determines eligibility and coverage levels. Medicaid, on the other hand, is administered at the state level.

How much did Medicare spend in 2019?

If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE. 3 . The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028.

How Does Medicaid Expansion Affect State Budgets?

That’s because the federal government pays the vast majority of the cost of expansion coverage , while expansion generates offsetting savings and , in many states, raises more revenue from the taxes that some states impose on health plans and providers. 19

What is Medicare contribution tax?

It is known as the unearned income Medicare contribution tax. Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans .

What is Medicare 2021?

Updated Jun 29, 2021. Medicare, and its means-tested sibling Medicaid, are the only forms of health coverage available to millions of Americans today. They represent some of the most successful social insurance programs ever, serving tens of millions of people including the elderly, younger beneficiaries with disabilities, ...

How much will healthcare cost in 2028?

The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028. This means healthcare will cost an estimated $6.2 trillion by 2028. Projections indicate that health spending will grow 1.1% faster than GDP each year from 2019 to 2028.

How much did the Affordable Care Act increase in 2019?

1 2 . According to the most recent data available from the CMS, national healthcare expenditure (NHE) grew 4.6% to $3.8 trillion in 2019.

How many types of reimbursement rates are there for LTSS?

The different reimbursement rates available to your LTSS program can be highly complex. The information in the sections below highlights eight different types of rates that may be available to your program, as well as guidance on comparing those rates.

How does Medicaid work?

Many states deliver Medicaid through managed care organizations, which manage the delivery and financing of healthcare in a way that controls the cost and quality of services. More states are joining this trend because they think it may help manage and improve healthcare costs and quality.

What is FQHC in Medicare?

The FQHC rate is a benefit under Medicare that covers Medicaid and Medicare patients as an all-inclusive, per-visit payment, based on encounters. Tribal organizations must apply before they can bill as FQHCs. Allowable expenses vary by state. Each tribe and state must negotiate the exact reimbursement rate.

What is capitated rate?

A capitated rate is a contracted rate based on the total number of eligible people in a service area. Funding is supplied in advance, creating a pool of funds from which to provide services. This rate can be more beneficial for providers with a larger client base because unused funds can be kept for future use.

What is fee for service?

The fee-for-service rate reimburses providers for specific services, like office visits or tests. For example, if you visit your family doctor because you have a fever, and your doctor notices other symptoms and tests you for strep throat, the office visit and the test may count as two separate services. Insurers usually decide what types of things qualify as different services.

How many beds does a CAH have?

A qualified CAH: participates in Medicare, has no more than 25 inpatient beds, has an average length of patient stay that is 96 hours or less, offers emergency care around the clock, and is located in a rural setting. Learn more about critical access hospitals.

Does LTSS qualify for reimbursement?

LTSS delivered through a CA H facility may qualify for different reimbursement rates. Reimbursement is on a per-cost basis instead of the standard Medicare reimbursement rates. Learn more about critical access hospitals.

What is Medicare reimbursement?

The Centers for Medicare and Medicaid (CMS) sets reimbursement rates for all medical services and equipment covered under Medicare. When a provider accepts assignment, they agree to accept Medicare-established fees. Providers cannot bill you for the difference between their normal rate and Medicare set fees.

How much does Medicare pay?

Medicare pays for 80 percent of your covered expenses. If you have original Medicare you are responsible for the remaining 20 percent by paying deductibles, copayments, and coinsurance. Some people buy supplementary insurance or Medigap through private insurance to help pay for some of the 20 percent.

What happens after Medicare pays its share?

After Medicare pays its share, the balance is sent to the Medigap plan. The plan will then pay part or all depending on your plan benefits. You will also receive an explanation of benefits (EOB) detailing what was paid and when.

What is Medicare Part D?

Medicare Part D or prescription drug coverage is provided through private insurance plans. Each plan has its own set of rules on what drugs are covered. These rules or lists are called a formulary and what you pay is based on a tier system (generic, brand, specialty medications, etc.).

How often is Medicare summary notice mailed?

through the Medicare summary notice mailed to you every 3 months

What does ABN mean in Medicare?

By signing the ABN, you agree to the expected fees and accept responsibility to pay for the service if Medicare denies reimbursement. Be sure to ask questions about the service and ask your provider to file a claim with Medicare first. If you don’t specify this, you will be billed directly.

How to report Medicare fraud?

If you have tried to get the provider to file a claim and they refuse, you can report the issue by calling 800-MEDICARE or the Inspector General’s fraud hotline at 800-HHS-TIPS.

What is Medicare reimbursement rate?

The reimbursement rates are the monetary amounts that Medicare pays to health care providers, hospitals, laboratories, and medical equipment companies for performing certain services and providing medical supplies for individuals enrolled in Medicare insurance. To receive reimbursement payments at the current rates established by Medicare, health care professionals and service companies need to be participants in the Medicare program. While non-participating professionals and companies are able to submit claims and receive reimbursements for their services, their reimbursements will be slightly lower than the rates paid to participants.

How much does Medicare pay for medical services?

The Medicare reimbursement rates for traditional medical procedures and services are mostly established at 80 percent of the cost for services provided. Some medical providers are reimbursed at different rates. Clinical nurse specialists are paid 85 percent for most of their billed services and clinical social workers are paid 75 percent ...

What is the Medicare coinsurance?

Today, Medicare enrollees who use the services of participating health care professionals will be responsible for the portion of a billing claim not paid by Medicare. The majority of enrollee responsibility will be 20 percent, often referred to as coinsurance. With clinical nurse specialists that responsibility would be 15 percent and 25 percent for clinical social workers.

How many specialists are on the Medicare committee?

Medicare establishes the reimbursement rates based on recommendations from a select committee of 52 specialists. The committee is composed of 29 medical professionals and 23 others nominated by professional societies.

Why use established rates for health care reimbursements?

Using established rates for health care reimbursements enables the Medicare insurance program to plan and project for their annual budget. The intent is to inform health care providers what payments they will receive for their Medicare patients.

What percentage of Medicare bill is not paid?

The majority of enrollee responsibility will be 20 percent , often referred to as coinsurance.

What is Medicare establishment rate schedule?

The establishment rate schedules are complex, multifunctional, and revised annually. The schedules for Medicare reimbursement rates are pre-determined base rates developed using a variety of factors that include the following.

What is the Medicaid base rate?

In Medicaid, payment rates, sometimes called the “base rate,” are set by state Medicaid agencies for specific services used by patients. In addition, Medicaid also may make supplemental payments to hospitals (Figure 1). 6. Figure 1: Medicaid payment to hospitals consists of base payments as well as supplemental payments.

Why is it so hard to understand how much Medicaid pays hospitals?

Understanding how much Medicaid pays hospitals is difficult because there is no publicly available data source that provides reliable information to measure this nationally across all hospitals.

What payment policy changes could affect Medicaid hospital payments?

However, a number of upcoming policy changes, including reductions in DSH payments and limits on other supplemental payments , will restrict the use of supplemental payments. Federal officials believe that reform of Medicaid supplemental payments is needed to make payment more transparent, targeted, and consistent with delivery system reforms that reduce health care costs, and increase quality and access to care. However, these policy changes are causing concern among hospitals that have long been dependent on Medicaid revenue for their financial viability. 22,23,24 In addition, payment changes are occurring against the backdrop of coverage expansions under the ACA, which are affecting payer mix for some hospitals.

Why is Medicaid important?

Medicaid payments to hospitals and other providers play an important role in these providers’ finances, which can affect beneficiaries’ access to care. States have a great deal of discretion to set payment Medicaid rates for hospitals and other providers. Like other public payers, Medicaid payments have historically been (on average) below costs, ...

How does the ACA affect hospitals?

The ACA included a number of restrictions on Medicare payments for hospitals and expanded coverage has also resulted in markets shifts and new competition. Hospitals also may see shifts in patient acuity, Medicaid payment rate changes or other changes in Medicaid payment policy. In addition, hospitals are constantly implementing strategies to increase revenue (e.g. diversify payer mix) and reduce the costs of providing services. Many safety net hospitals are trying to diversify their payer mix by changing their “safety net image” in the community, competing more aggressively for privately insured patients, retaining the privately insured patients they already have, and expanding services beyond inner city service areas where they are typically located. 21 Thus, Medicaid expansion is just one of many factors that will influence hospitals’ financial viability in the future.

What is the ACA in healthcare?

First, the Affordable Care Act (ACA) is leading to changes in hospital payer mix, especially in states adopting the Medicaid expansion where studies have shown a decline in self-pay discharges ...

How much will the DSH be reduced?

27 These reductions will amount to $43 billion between 2018 and 2025; reductions start at $2 billion in FY 2018 and increase to $8 billion by FY 2025.