Medicaid Claim Adjustment Reason Code:119 Medicaid Remittance Advice Remark Code:Nil MMIS EOB Code:237 Services denied. The unit limit has been reached for this capped rental item.

Is co-237 an e-Rx program penalty?

Feb 11, 2015 · Jan 27, 2015. #1. Our practice has recently see an ajustment code CO-237 on our Medicare EOBs for claims in 2015. When I researched this code the only information I can find is a E-Rx program penalty. The adjustment amount is 1% of the allowable but per our practice manager we are actively participatinig in E-prescribing.

What does B22 and B23 mean on a Medicare claim?

Mar 29, 2016 · It is important to check your Medicare remittance for the following RARCs for each provider in your group so that you understand the payment reductions set forth for non-participation in the government programs. ... CO-237 – Legislated/Regulatory Penalty. At least one Remark Code must be provided (may be comprised of either the NCPDP Reject ...

Is there a co-237 penalty for not having demonstrated meaningful use?

updates the dates mentioned under section Claim Adjustment Reason Code to June and October replacing January and July respectively. All other information remains the same. SUBJECT: Claim Adjustment Reason Code (CARC), Remittance Advice Remark Code (RARC), and Medicare Remit Easy Print (MREP) and PC Print Update . Effective Date: October 1, 2011

How much does Medicare take from co 237?

Dec 01, 2021 · The current review reason codes and statements can be found below: List of Review Reason Codes and Statements. Please email [email protected] for suggesting a topic to be considered as our next set of standardized review result codes and statements. Page Last Modified: 12/01/2021 07:02 PM. Help with File Formats and Plug-Ins.

What does patient has not met the required eligibility requirements mean?

What is a Claim Adjustment Reason code?

What is the Medicare incentive adjustment?

What is a remittance advice remark code?

What is remark code M51?

What are reason codes?

What is adjustment payment?

What is a Medicare sequestration adjustment?

What is a good MIPS score?

What is 835 remittance advice definition?

How often are claim adjustment reason codes and remark codes updated?

What does denial code M51 mean?

Definition: Missing/incomplete/invalid procedure code(s) Verify the procedure code is valid for the date of service on the claim.Mar 30, 2016

What is the CMS remittance code list?

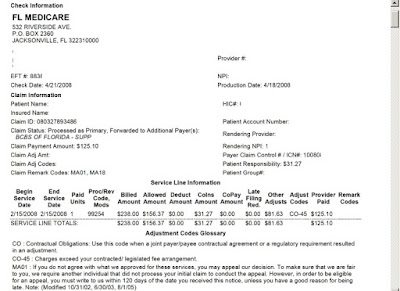

CMS is the national maintainer of the remittance advice remark code list. This code list is used by reference in the ASC X12 N transaction 835 (Health Care Claim Payment/Advice) version 004010A1 and 005010A1 Implementation Guide (IG)/Technical Report (TR) 3. Under HIPAA, all payers, including Medicare, have to use reason and remark codes approved by X12 recognized code set maintainers instead of proprietary codes to explain any adjustment in the claim payment. CMS as the X12 recognized maintainer of RARCs receives requests from Medicare and non- Medicare entities for new codes and modification/deactivation of existing codes. Additions, deletions, and modifications to the code list resulting from non-Medicare requests may or may not impact Medicare. Remark and reason code changes that impact Medicare are usually requested by CMS staff in conjunction with a policy change. Contractors are notified about these changes in the corresponding instructions from the specific CMS component which implements the policy change, in addition to the regular code update notification. If a modification has been initiated by an entity other than CMS for a code currently used by Medicare, contractors must use the modified code even though the modification was not initiated by Medicare. Shared System Maintainers have the responsibility to implement code (both CARC and RARC) deactivation making sure that any deactivated code is not used in original business messages, but the deactivated code in derivative messages is allowed. Contractors must stop using codes that have been deactivated on or before the effective date specified in the comment section (as posted on the WPC Web site) if they are currently being used. Medicare contractors are not to use any deactivated reason and/or remark code past the deactivation date whether the deactivation is requested by Medicare or any other entity. The complete list of remark codes is available at:

Does the revision date apply to red italicized material?

Disclaimer for manual changes only: The revision date and transmittal number apply only to red italicized material. Any other material was previously published and remains unchanged. However, if this revision contains a table of contents, you will receive the new/revised information only, and not the entire table of contents.