Medicare Advantage plans generally have lower premiums than Medicare supplements. There are some areas where Medicare Advantage plans have no monthly premiums at all. That is usually offset by higher co-pays and deductibles.

Full Answer

When to choose Original Medicare vs. Medicare Advantage?

The most popular Medicare Supplement plans pay 100% of your out-of-pocket costs with Part A and Part B, except for the Part B deductible. All Medicare …

Is Medicare Advantage better than Medicare?

Medicare Advantage plans generally have lower premiums than Medicare supplements. There are some areas where Medicare Advantage plans have no monthly premiums at all. That is usually offset by higher co-pays and deductibles. This is one reason the MA plans have gotten so popular. But don’t be fooled by the premium.

Is Medigap better than Medicare Advantage?

Aug 01, 2019 · To improve options for Medicare coverage, The Centers for Medicare and Medicaid Services (CMS) contracts with private insurance companies to offer Medicare Advantage plans. Medicare Supplement insurance plans are also available from private insurance companies. However, Medicare Advantage and Medicare Supplement insurance plans are …

Which Medicare Advantage plan is the best?

Dec 27, 2021 · Medicare recipients have two options to help with additional coverage: Medicare Advantage and Medicare Supplement insurance. Medicare Advantage replaces Original Medicare and often includes additional coverage benefits, such as covering prescription drugs, eye care, routine vision and hearing services.

What is better an Advantage plan or a supplemental plan?

A Medicare Advantage plan may be a better choice if it has an out-of-pocket maximum that protects you from huge bills. Regular Medicare plus a Medigap insurance plan generally allows you more choice in where you receive your care.

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

What is the difference between Medicare Advantage and supplement?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

Can I switch from Medicare Advantage to Medicare Supplement?

For example, when you get a Medicare Advantage plan as soon as you're eligible for Medicare, and you're still within the first 12 months of having it, you can switch to Medigap without underwriting. The opportunity to change is the "trial right."Jun 3, 2020

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What is the biggest difference between Medicare and Medicare Advantage?

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you'll pay more for care you get outside your network.Oct 1, 2020

Does getting a Medicare Advantage plan make you lose original Medicare?

If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare. Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is the most comprehensive Medicare plan?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

Should I switch from plan F to plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

What Is Medicare Advantage?

Also called Medicare Part C, Medicare Advantage plans provide coverage through private insurance companies approved by Medicare. These companies pr...

What Is Medicare Supplement?

Also known as Medigap, Medicare Supplement plans are offered by private insurance companies and can take care of certain health care costs not cove...

What If I Choose Medicare Advantage?

If you decide to enroll in a Medicare Advantage plan after being in Original Medicare (Part A and Part B) for some time, you may want to cancel you...

What are the different types of Medicare insurance?

There are two types of private plans that you can purchase that will help fill the gaps of Medicare – Medicare supplements (Medigap) or Medicare Advantage. These two plans are very different and it is imperative that you understand the differences.

How much does Medicare cover in 2021?

If you go with Medicare alone with no additional coverage, you will quickly learn that there are a lot of gaps that Medicare does not cover – a Part A deductible ($1,484 in 2021) that you must pay to the hospital to cover you for up to 60 days of hospital care.

Does Medicare Advantage have Part D?

Nearly 80% of the Medicare Advantage plans available have the Part D coverage included at no additional charge as an option for coverage. By including your Part D coverage with the Medicare Advantage (MAPD), you can keep your monthly premium lower.

What is a Medigap plan?

Under a Medigap plan, Medicare first pays its portion of the bill and then sends the remainder of the bills to your Medicare supplement company to pay their portion. This is done electronically through what is called the crossover system.

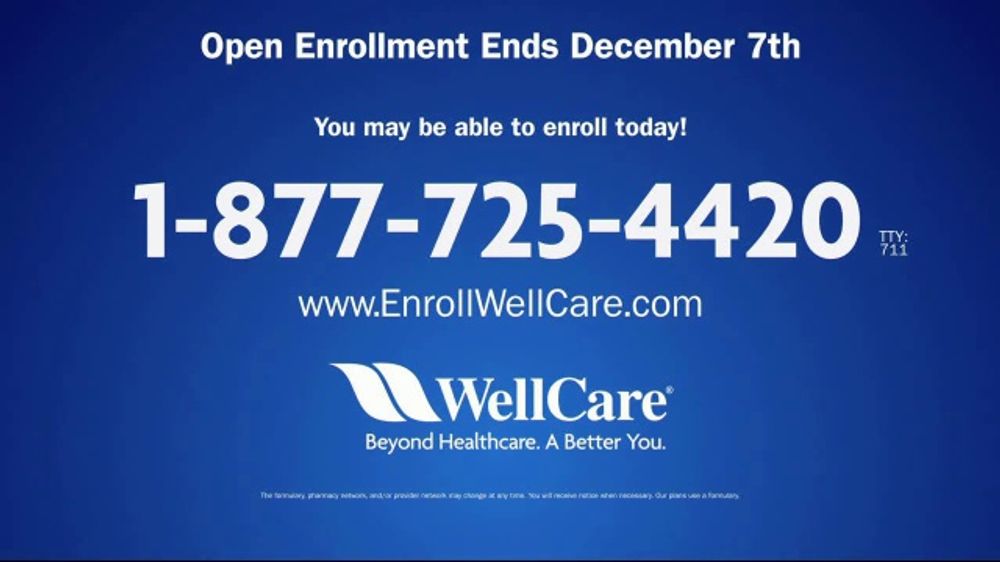

How long does Medicare lock you in?

If you enroll in a Medicare Advantage plan, Medicare locks you into that plan until December 31st. Medicare Advantage plans and Part D prescription drug plans have only one window of opportunity each year for you to enroll. It happens from October 15 through December 7 each year. During that time, you can change plans or go from MAPD to original Medicare with a Medicare Supplement plan (or vice versa). There are Special Enrollment periods such as if you move out of your network coverage area. You have an Initial Enrollment Period three months before and three months after you first enroll in Part B of Medicare. Other than that, you cannot change plans or move back to original Medicare.

Can Medicare Advantage plans change?

Medicare Advantage plans are not guaranteed renewable which means that your deductibles and co-pays are not set in stone. Your plan coverage can change from year to year. Not only can it change, but your plan can leave your region completely or your physicians can be out of network from one year to the next.

What is Medicare Advantage?

Medicare Advantage plans negotiate contracts with networks doctors, hospitals, and other healthcare providers. The agreements they reach can help to keep their costs lower. This means that you must adhere to their networks or face substantially higher out of pocket costs.

What is the difference between Medicare Advantage and Medicare Supplement?

Medicare Advantage vs Medicare Supplement: the basics. Medicare Supplement insurance plans go alongside Original Medicare and help pay for out-of-pocket costs not typically covered by Original Medicare. Since Original Medicare has no out-of-pocket maximum, a Medicare Supplement plan could give you a safety net against high medical costs ...

Does Medicare cover vision?

There may be some services that Original Medicare generally doesn’t cover , such as routine vision care. You may also have to pay coinsurance amounts, like 20% for most covered doctor services.

What is Medicare Advantage?

A Medicare Advantage covers all the hospital and medical services that Original Medicare covers and usually includes prescription drug benefits as well. Medicare Advantage plans also all have out-of-pocket maximums, so you may be spared from high medical bills.

Does Medicare Supplement cover prescription drugs?

Neither Original Medicare nor Medicare Supplement insurance plans typically cover the prescription drugs you take at home. If you want coverage for most prescription drugs, you will generally need to combine Original Medicare and a Medicare Supplement insurance plan with a stand-alone Medicare Part D prescription drug plan.

What is Medicare premium?

Premiums: A premium is an amount you pay monthly to have insurance, whether or not you use covered services. Some Medicare Advantage plans have premiums as low as $0 a month. However, you still must pay your Medicare Part B premium. Most Medicare Supplement insurance plans also have monthly premiums.

Do HMOs have networks?

Generally you must get care from an in-network provider in order for your care to be covered. Networks are designed to keep costs low, which could be an advantage to beneficiaries. On the other hand, you may also feel that a network restricts you from getting care from a provider you like.

Why are networks important?

Networks are designed to keep costs low, which could be an advantage to beneficiaries. On the other hand, you may also feel that a network restricts you from getting care from a provider you like. However, you don’t need to worry about networks in the case of an emergency.