Medicare is always primary if it’s your only form of coverage. When you introduce another form of coverage into the picture, there’s predetermined coordination of benefits. The coordination of benefits will determine what form of coverage is primary and what form of coverage is secondary.

Is Medicare always your primary insurance?

Medicare is always primary if it’s your only form of coverage. When you introduce another form of coverage into the picture, there’s predetermined coordination of benefits. The coordination of benefits will determine what form of coverage is primary and what form of coverage is secondary.

When does Medicare become primary?

There are a number of situations when Medicare is primary. Learning about them ahead of time will help you avoid costly enrollment deadlines. You are 65 or Older and Your Employer is a Small Business. Medicare is primary when your employer has less than 20 employees. Medicare will pay first and then your group insurance will pay second.

When Medicare is primary and secondary?

Medicare is often the primary payer when working with other insurance plans. A primary payer is the insurer that pays a healthcare bill first. A secondary payer covers remaining costs, such as coinsurances or copayments.

Is Medicaid primary over Medicare?

Medicaid is a state-run federal assistance program assisting low-income Americans. When you become eligible for Medicare and are also eligible for Medicaid, you’re dual-eligible. When you’re dual eligible for both Medicare and Medicaid, Medicare is your primary payer. Medicaid will not pay until Medicare pays first.

How do I know if my Medicare is primary or secondary?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

How do you determine which insurance is primary?

Primary insurance is a health insurance plan that covers a person as an employee, subscriber, or member. Primary insurance is billed first when you receive health care. For example, health insurance you receive through your employer is typically your primary insurance.

Is Medicare primary or secondary insurance?

Medicare is always primary if it's your only form of coverage. When you introduce another form of coverage into the picture, there's predetermined coordination of benefits. The coordination of benefits will determine what form of coverage is primary and what form of coverage is secondary.

Is Medicare a primary provider?

Even if you have a group health plan, Medicare is the primary insurer as long as you've been eligible for Medicare for 30 months or more.

When two insurance which one is primary?

If you have two plans, your primary insurance is your main insurance. Except for company retirees on Medicare, the health insurance you receive through your employer is typically considered your primary health insurance plan.

Does Medicare automatically forward claims to secondary insurance?

If a Medicare member has secondary insurance coverage through one of our plans (such as the Federal Employee Program, Medex, a group policy, or coverage through a vendor), Medicare generally forwards claims to us for processing.

Can you have Medicare and employer insurance at the same time?

Yes, you can have both Medicare and employer-provided health insurance. In most cases, you will become eligible for Medicare coverage when you turn 65, even if you are still working and enrolled in your employer's health plan.

Does Medicare Secondary cover primary copays?

Medicare is often the primary payer when working with other insurance plans. A primary payer is the insurer that pays a healthcare bill first. A secondary payer covers remaining costs, such as coinsurances or copayments.

When Can Medicare be a secondary payer?

If the employer has 100 or more employees, then your family member's group health plan pays first, and Medicare pays second. If the employer has less than 100 employees, but is part of a multi-employer or multiple employer group health plan, your family member's group health plan pays first and Medicare pays second.

When a patient is covered through Medicare and Medicaid which coverage is primary?

Medicaid can provide secondary insurance: For services covered by Medicare and Medicaid (such as doctors' visits, hospital care, home care, and skilled nursing facility care), Medicare is the primary payer. Medicaid is the payer of last resort, meaning it always pays last.

Can I keep my private insurance and Medicare?

It is possible to have both private insurance and Medicare at the same time. When you have both, a process called “coordination of benefits” determines which insurance provider pays first. This provider is called the primary payer.

Is Medicare Part D always primary?

Usually Medicare Part D coverage pays first. For example: Are you retired and have prescription drug coverage through your or your spouse's former employer's or union's retiree Group Health Plan and Medicare Part D coverage? If so, your Medicare Part D coverage is primary and the Group Health Plan is secondary.

How to learn more about Medicare?

How to Learn More About Your Medicare Options. Primary insurance isn't too hard to understand; it's just knowing which insurance pays the claim first. Medical billing personnel can always help you figure it out if you're having trouble. While it's not hard to understand primary insurance, Medicare is its own beast.

Is Medicare primary insurance in 2021?

Updated on July 13, 2021. Many beneficiaries wonder if Medicare is primary insurance. But, the answer depends on several factors. While there are times when Medicare becomes secondary insurance, for the most part, it’s primary. Let’s go into further detail about what “primary” means, and when it applies.

Is Medicare a primary or secondary insurance?

Mostly, Medicare is primary. The primary insurer is the one that pays the claim first, whereas the secondary insurer pays second. With a Medigap policy, the supplement is secondary. Medicare pays claims first, and then Medigap pays. But, depending on the other policy, you have Medicare could be a secondary payer.

Does Medicare pay your claims?

Since the Advantage company pays the claims, that plan is primary. Please note that Medicare WON’T pay your claims when you have an Advantage plan. Medicare doesn’t become secondary to an Advantage plan. So, you’ll rely on the Advantage plan for claim approvals.

Can you use Medicare at a VA hospital?

Medicare and Veterans benefits don’t work together; both are primary. When you go to a VA hospital, Veteran benefits are primary. Then, if you go to a civilian doctor or hospital, Medicare is primary. But, you CAN’T use Veterans benefits at a civilian doctor. Also, you can’t use Medicare benefits at the VA.

Is Medicare a part of tricare?

Medicare is primary to TRICARE. If you have Part A, you need Part B to remain eligible for TRICARE. But, Part D isn’t a requirement. Also, TRICARE covers your prescriptions. Your TRICARE will be similar to a Medigap plan; it covers deductibles and coinsurances.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

How does Medicare work with service benefit plan?

Combine your coverage to get more. Together, the Service Benefit Plan and Medicare can protect you from the high cost of medical care . Medicare works best with our coverage when Medicare Part A and Part B are your primary coverage. That means Medicare pays for your service first, and then we pay our portion.

How much does Medicare reimburse for a B plan?

Each member of a Basic Option plan who has Medicare Part A and Part B can get reimbursed up to $800 per year for paying their Medicare Part B premiums.

What is Medicare for seniors?

What's Medicare? Medicare is a federal health insurance program for people age 65 or older, people under 65 who have certain disabilities and people of any age who have End-Stage Renal Disease. It has four parts that cover different healthcare services.

When will Medicare send you a card?

Medicare will send you a mailing with the medic care cards about 3 months before you are 65. With the mailing you will have the option of declining part B. You usually don't have to pay for part A but have to pay for part B. In my case I have both A and B.

Is Medicare Part A free?

Medicare Part A (which covers 80 percent of most hospital costs) is free if you sign up for it. Plan B (which covers 80 percent of most doctor charges and some tests) is voluntary and costs a monthly premium (presently $97.40 a month for most of those on Medicare) deducted from your Social. Security benefit.

Does Medicare pay for FEHB?

They complement each other by paying for benefits the other does not (regular Medicare doesn 't pay for meds/FEHB can; Medicare pays fully for approved durable medical equipment/FEHB provides only partial coverage; Medicare covers some NH days/many FEHB plans provide no coverage, etc.

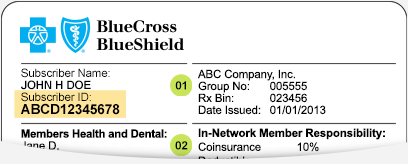

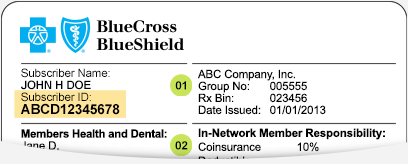

Is BCBS a good company?

Best Answer. BCBS is a great company and can give you all the answers you need. Now is a good time to either visit their office or at least call them on the phone. Be sure to do this before you reach 65 or you may end up paying more money for several months until it is corrected and you have just Medicare and BC BS.

How many states does Blue Cross Blue Shield offer Medicare?

Blue Cross Blue Shield offers Medicare Advantage plans in 44 states, plus Washington, D.C., and Puerto Rico, and Medicare prescription drug plans in 46 states. Nationally, BCBS offers plans in 1,181 counties, or 37% of counties in the U.S. [2].

How many states does BCBS offer Medicare Advantage?

Wide network: With BCBS companies providing Medicare Advantage plans in 44 states, there’s a good chance you have access to a plan from a BCBS insurer. Low-cost plans available: BCBS companies offer plans with $0 premiums in 40 states.

What are the factors that determine the satisfaction of Medicare Advantage plans?

Power measured member satisfaction with Medicare Advantage plans based on six factors: coverage and benefits, provider choice, cost, customer service, information and communication, and billing and payment.

Does Blue Cross Blue Shield of Michigan have a highmark?

Power’s latest Medicare Advantage study. Depending on your location, you may not have access to a higher-rated Blue.

Does Blue Cross Blue Shield offer Medicare Advantage?

Blue Cross Blue Shield offers Medicare Advantage Prescription Drug plans, or MAPDs, as well as stand-alone Prescription Drug Plans and Medicare Advantage Plans without drug coverage. A health maintenance organization, or HMO, generally requires that you use a specific network of doctors and hospitals.

Does Blue Cross Blue Shield cover vision?

These plans generally include benefits that aren’t covered by Original Medicare, such as wellness programs, hearing aids and vision coverage.

Is BCBS a Medicare Advantage?

Not quite 6 in 10 BCBS customers are in a Medicare Advantage contract rated 4 or higher (out of 5) on the Medicare Star Rating scale.

What is the difference between Medicare and Medicaid?

Eligible for Medicare. Medicare. Medicaid ( payer of last resort) 1 Liability insurance only pays on liability-related medical claims. 2 VA benefits and Medicare do not work together. Medicare does not pay for any care provided at a VA facility, and VA benefits typically do not work outside VA facilities.

Is Medicare a secondary insurance?

When you have Medicare and another type of insurance, Medicare is either your primary or secondary insurer. Use the table below to learn how Medicare coordinates with other insurances. Go Back. Type of Insurance. Conditions.

What is Blue365 for Blue Cross?

Blue365 is a discount program exclusively for Blue Cross and Blue Shield members. Through the program, you can get discounts on different products and services that can help you live a healthy lifestyle, such as diet and exercise plans, gym shoes and athletic apparel, hearing aids and more.

Why combine Medicare Part A and B?

Another reason to combine your coverage is to get access to benefits not covered by Medicare.

What is Medicare for people over 65?

GET TO KNOW MEDICARE. Medicare is a health insurance program provided by the federal government, available to people: • 65 and older • Under 65 with certain disabilities • With permanent kidney failure who need dialysis treatment or a transplant (End-Stage Renal Disease) .

What is Blue365 discount?

Through the program, you can get discounts on different products and services that can help you live a healthy lifestyle, such as diet and exercise plans, gym shoes and athletic apparel, hearing aids and more. View all the current available deals at

How to contact Medicare for service benefits?

or call 1-800-MEDICARE (TTY: 1-877-486-2048) . << Previous Next >>. 3. Combining your Service Benefit Plan coverage with Medicare is a choice. Here are some things to know that can help you decide: Keep your future healthcare needs in mind before making a decision.

How long do you have to enroll in Part B?

Once you retire, you’ll have eight months to enroll in Part B before the penalty kicks in. . General Enrollment Period .

How much can I earn with Blue Health?

Open to Standard and Basic Option members, you can earn up to $170 in 2020 by completing your Blue Health Assessment and up to three Online Health Coach goals. You can use the money for qualified medical expenses, which include prescription drug costs, hearing aids, glasses and more.