Other insurance, or third party liability (TPL), refers to health, long term care or dental insurance coverage an MHCP member may have through private or public funds. MHCP considers Medicare and TPL primary to MHCP coverage. Verify eligibility through MN–ITS to ensure MHCP and Medicare or other insurance coverage.

Full Answer

When is Medicare the primary payer?

Medicare remains the primary payer for beneficiaries who are not covered by other types of health insurance or coverage. Medicare is also the primary payer in certain instances, provided several conditions are met.

Is Medicare Advantage primary or secondary payer?

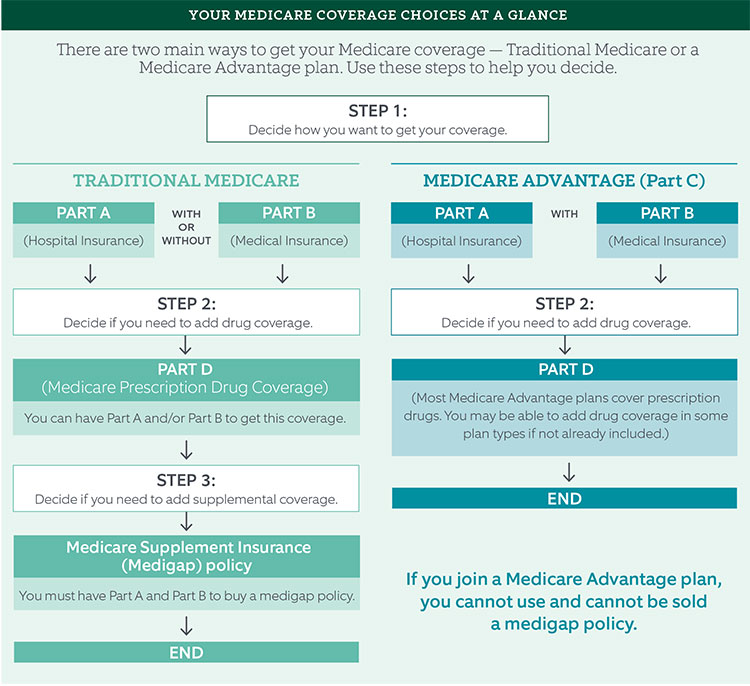

Medicare pays claims first, and then Medigap pays. But, depending on the other policy, you have Medicare could be a secondary payer. Is Medicare Advantage Primary or Secondary When you enroll in an Advantage plan, the company you select will pay all your claims.

What is Medicare Part MSP and how does it protect Medicare?

The MSP provisions have protected Medicare Trust Funds by ensuring that Medicare does not pay for items and services that certain health insurance or coverage is primarily responsible for paying. The MSP provisions apply to situations when Medicare is not the beneficiary’s primary health insurance coverage.

Is Medicare secondary or primary?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

Is Medicare a third party insurance?

Federal statutes also assign responsibility when an individual is covered by more than one public program. Generally, Medicare and other state and federal programs can be liable third parties unless specifically excluded by federal statute.

Is Medicare a primary provider?

Even if you have a group health plan, Medicare is the primary insurer as long as you've been eligible for Medicare for 30 months or more.

What is Medicare TPL?

If another insurer or program has the responsibility to pay for medical costs incurred by a Medicaid-eligible individual, that entity is generally required to pay all or part of the cost of the claim prior to Medicaid making any payment. This is known as “third party liability” or TPL.

How do you determine which insurance is primary?

Primary insurance is a health insurance plan that covers a person as an employee, subscriber, or member. Primary insurance is billed first when you receive health care. For example, health insurance you receive through your employer is typically your primary insurance.

What is TPL insurance?

If one of your employees injures someone or causes damage to their property while driving a company vehicle, your company can be held liable. TPL is compulsory vehicle insurance, which every vehicle owner is required by law to take out.

Does Medicare automatically forward claims to secondary insurance?

If a Medicare member has secondary insurance coverage through one of our plans (such as the Federal Employee Program, Medex, a group policy, or coverage through a vendor), Medicare generally forwards claims to us for processing.

Can you have Medicare and employer insurance at the same time?

Can I have Medicare and employer coverage at the same time? Yes, you can have both Medicare and employer-provided health insurance. In most cases, you will become eligible for Medicare coverage when you turn 65, even if you are still working and enrolled in your employer's health plan.

Is Medicare Part D always primary?

Usually Medicare Part D coverage pays first. For example: Are you retired and have prescription drug coverage through your or your spouse's former employer's or union's retiree Group Health Plan and Medicare Part D coverage? If so, your Medicare Part D coverage is primary and the Group Health Plan is secondary.

When a patient is covered by the same primary and secondary commercial health insurance plan?

When a patient is covered by the same primary and secondary commercial health insurance plan, submit just one CMS-1500 to the payer. commas. NPI.

When the same commercial payer issues the primary and secondary?

Commercial Ins/ BCBSQuestionAnswerwhen same payer issues the primary, secondary, or supplemental policiesyou would submit one claim for all policiesmandatory second surgical system is necessary whenpatient is considering elective, non-emergency surgical care33 more rows

What is the difference between personal and third party health insurance?

A first-party insurance claim is a claim you make directly against your own insurance. A third-party insurance claim occurs when you submit a claim to someone else's insurance provider. The third-party definition is going outside of your insurance provider when seeking compensation.

What is the difference between Medicare and Medicaid?

Eligible for Medicare. Medicare. Medicaid ( payer of last resort) 1 Liability insurance only pays on liability-related medical claims. 2 VA benefits and Medicare do not work together. Medicare does not pay for any care provided at a VA facility, and VA benefits typically do not work outside VA facilities.

Is Medicare a secondary insurance?

When you have Medicare and another type of insurance, Medicare is either your primary or secondary insurer. Use the table below to learn how Medicare coordinates with other insurances. Go Back. Type of Insurance. Conditions.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

What happens when there is more than one payer?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) to pay. In some rare cases, there may also be a third payer.

What is TPL in Medicaid?

It is possible for Medicaid beneficiaries to have one or more additional sources of coverage for health care services. Third Party Liability (TPL) refers to the legal obligation of third parties (for example, certain individuals, entities, insurers, or programs) to pay part or all of the expenditures for medical assistance furnished ...

Can a third party request Medicaid?

Third parties should treat a request from the contractor as a request from the state Medicaid agency. Third parties may request verification from the State Medicaid agency that the contractor is working on behalf of the agency and the scope of the delegated work.

Can Medicaid be contracted with MCO?

State Medicaid programs may contract with MCOs to provide health care to Medicaid beneficiaries, and may delegate responsibility and authority to the MCOs to perform third party discovery and recovery activities. The Medicaid program may authorize the MCO to use a contractor to complete these activities.

What happens if a third party is not liable for Medicaid?

If there is no established liable third party, the SMA may pay claims to the maximum Medicaid payment amount established for the service in the state plan. If the SMA later establishes that a third party was liable for the claim, it must seek to recover the payment. This may occur when the Medicaid beneficiary requires medical services in casualty/tort, medical malpractice, Worker’s Compensation, or other cases where the third party’s liability is not determined before medical care is provided. It may also occur when the SMA learns of the existence of health insurance coverage after medical care is provided.

Who is liable for Medicaid?

Medicaid and Other Coverage: A Medicaid beneficiary may have a third party resource (health insurance, or another person or entity) that is liable to pay for the beneficiary’s health care.

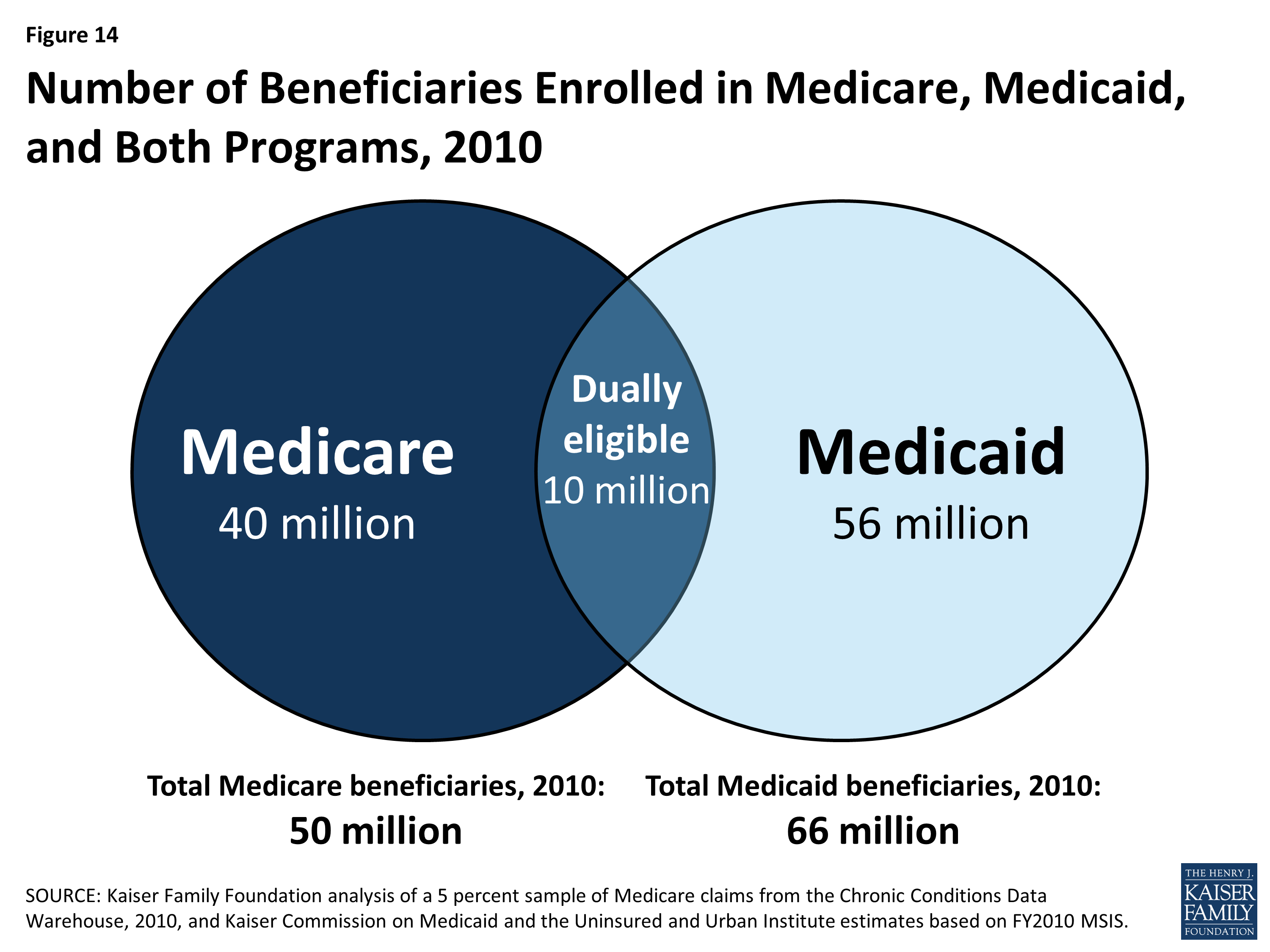

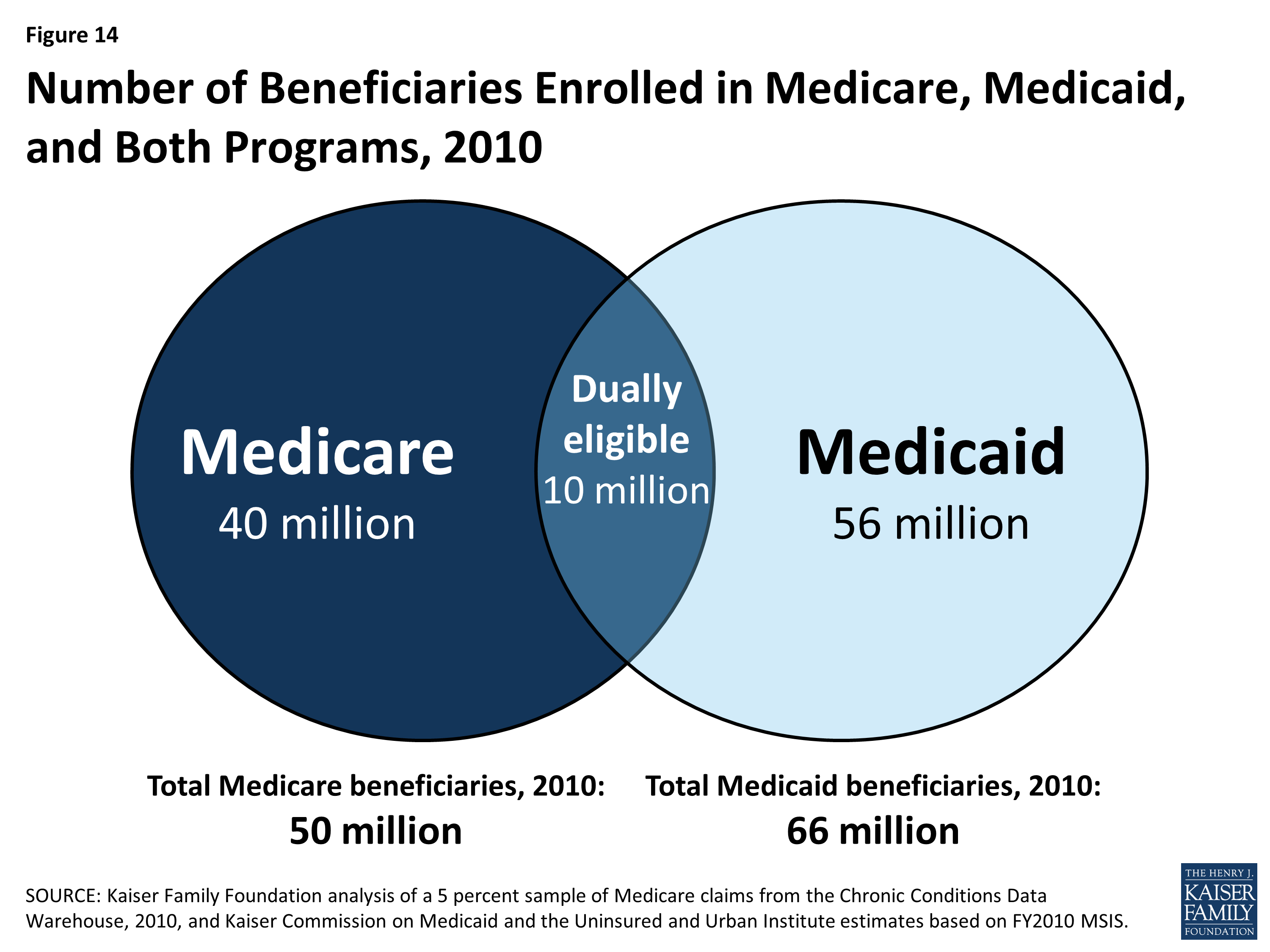

What is a dually eligible beneficiary?

These beneficiaries are enrolled in Medicare Part A and/or Part B and qualify for help from Medicaid to pay some Medicare costs. Some dually eligible beneficiaries may also qualify for additional Medicaid benefits, depending on income and resources.

What is a TAG in Medicaid?

The COB/TPL TAG is a forum for state Medicaid senior COB/TPL managers to discuss technical and operational issues and share best practices with CMS, relating to Medicaid policy issues. The purpose of the TAG is to inform and advise CMS as it prepares guidance, identifies and resolves issues, reviews operational policies, and carries out its responsibilities with respect to Medicaid COB/TPL requirements. The TAG also enables CMS to apprise members of current and planned initiatives in areas of interest. State members of the TAG include a Chairperson and 10 State Representatives, one for each of the 10 CMS regions. Each State Representative is responsible to solicit subjects for discussion from the states in his region and share TAG meeting summaries and other communications with the states. The COB/TPL team and Regional Office staff attend monthly conference calls, and other program and state staff attend the TAG meetings, as appropriate.

Is Medicaid a payer of last resort?

There are a few exceptions to the general rule that Medicaid is the payer of last resort and these exceptions generally relate to federal-administered health programs. For a federal-administered program to be an exception to the Medicaid payer of last resort rule, the statute creating the program must expressly state that the other program pays only for claims not covered by Medicaid; or, is allowed, but not required, to pay for health care items or services.

Is Medicaid a third party payer?

Medicaid is generally the “payer of last resort,” meaning that Medicaid only pays claims for covered items and services if there are no other liable third party payers for the same items and services. This concept is implied in statute and regulation, and has been cited by the U.S. Congress and the U.S. Supreme Court.

Is Medicaid a federal or state partnership?

Medicaid’s COB/TPL activities—like the rest of the Medicaid program—are administered through a federal–state partnership. Both the federal and state governments have the responsibility to ensure that Medicaid is appropriately identifying potentially liable third parties and coordinating benefits to reduce Medicaid program costs.

Coordination of Benefits

The Benefits Coordination & Recovery Center (BCRC) consolidates the activities that support the collection, management, and reporting of other insurance coverage for Medicare beneficiaries.

Medicare Secondary Payer (MSP) Recovery

MSP is the term used by Medicare when Medicare is not responsible for paying first. The MSP statute and regulations require Medicare to recover primary payments it mistakenly made for which a GHP is the proper primary payer.

Mandatory Insurer Reporting

Section 111 of the Medicare, Medicaid, and SCHIP Extension Act of 2007 (MMSEA) (P.L.110-173) sets forth new mandatory reporting requirements for GHP arrangements and for liability insurance (including self-insurance), no-fault insurance, and workers' compensation (also referred to as Non-Group Health Plans or NGHPs). See 42 U.S.C.

What is Medicare Secondary Payer?

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility - that is, when another entity has the responsibility for paying before Medicare. When Medicare began in 1966, it was the primary payer for all claims except for those covered by Workers' Compensation, ...

What age is Medicare?

Retiree Health Plans. Individual is age 65 or older and has an employer retirement plan: Medicare pays Primary, Retiree coverage pays secondary. 6. No-fault Insurance and Liability Insurance. Individual is entitled to Medicare and was in an accident or other situation where no-fault or liability insurance is involved.

Why is Medicare conditional?

Medicare makes this conditional payment so that the beneficiary won’t have to use his own money to pay the bill. The payment is “conditional” because it must be repaid to Medicare when a settlement, judgment, award or other payment is made. Federal law takes precedence over state laws and private contracts.

How long does ESRD last on Medicare?

Individual has ESRD, is covered by a GHP and is in the first 30 months of eligibility or entitlement to Medicare. GHP pays Primary, Medicare pays secondary during 30-month coordination period for ESRD.

What are the responsibilities of an employer under MSP?

As an employer, you must: Ensure that your plans identify those individuals to whom the MSP requirement applies; Ensure that your plans provide for proper primary payments whereby law Medicare is the secondary payer; and.

What is the purpose of MSP?

The MSP provisions have protected Medicare Trust Funds by ensuring that Medicare does not pay for items and services that certain health insurance or coverage is primarily responsible for paying. The MSP provisions apply to situations when Medicare is not the beneficiary’s primary health insurance coverage.

What age does GHP pay?

Individual is age 65 or older, is covered by a GHP through current employment or spouse’s current employment AND the employer has 20 or more employees (or at least one employer is a multi-employer group that employs 20 or more individuals): GHP pays Primary, Medicare pays secondary. Individual is age 65 or older, ...