How much does Medicare plan N cost?

But, most doctors accept Medicare assignment, so excess charges are rare. Plan N also includes foreign travel emergency benefits. If you travel outside the United States, Plan N will cover emergency services up to plan limits. The average cost of Plan N is around $120-$180 per month.

What is Medicare plan N – part N?

Medicare Plan N – Part N. Medicare Plan N is a supplemental policy that typically has lower premiums while you pay your Part B deductible, excess charges and some copays for doctor and emergency visits. It has been popular since it was first introduced in 2010.

Where can I buy Medicare supplement plan N?

Where can you buy Medicare Supplement Plan N? The government doesn’t sell Medigap policies. You’ll have to buy the policy from a health insurance company. Once you’ve identified an insurer you may like to purchase the plan from, contact the company directly to apply for a policy.

What is the difference between Medicare Plan G and plan N?

On Plan G, your cost-sharing is limited to the Part B deductible only. You are eligible to enroll in Plan N as long as you have Medicare Parts A and B. You must also live in the plan’s service area. The best time to enroll in Medicare Plan N is during your Medigap Open Enrollment Period.

What is Medicare Select N?

Medicare Plan N is coverage that helps pay for the out-of-pocket expenses not covered by Medicare Parts A and B. It has near-comprehensive benefits similar to Medigap Plans C and F (which are not available to new enrollees), but Medicare Plan N has lower premiums. This makes it an attractive option to many people.

What is deductible for plan N?

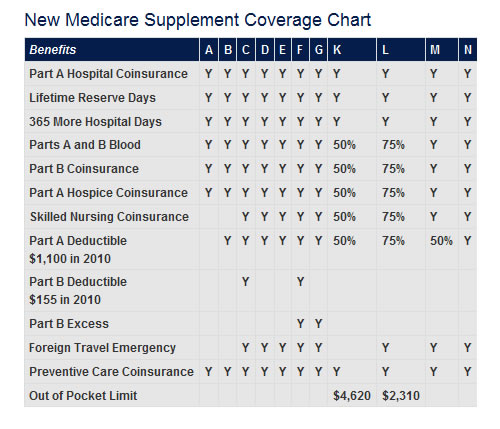

What does Plan N cover? Plan N covers the Medicare Part A deductible of $1,556, coinsurance for Parts A and B, three pints of blood and covers 80% of medical costs incurred during foreign travel.

What are plan N excess charges?

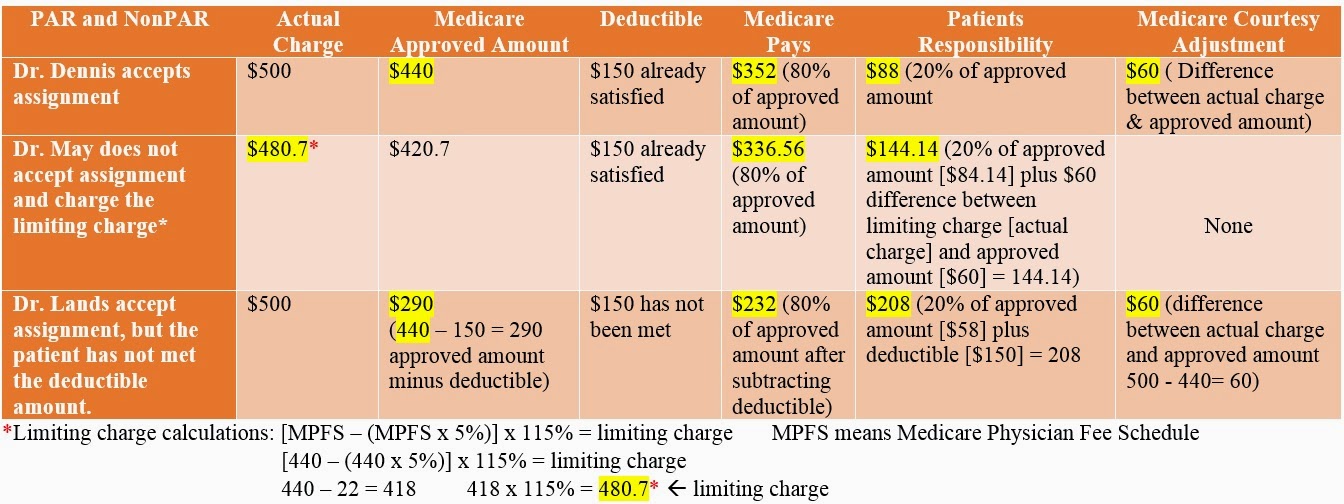

Finally, people with Medigap N also pay excess charges to some medical providers. Providers can charge 15% more than what Medicare allows. This is called an excess charge. Plan N does not cover this for you like Plan F or G would.

What is AARP plan N?

Plan N covers the Medicare Part B coinsurance but you pay copayments for covered doctor office and emergency room visits in exchange for a mid-range monthly premium.

Is plan n Better Than G?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

Does plan N have copays?

With Plan N, you are responsible for copayments up to $20 when you visit the doctor's office (or up to $50 for emergency room visits). You are also responsible for any excess charges, the additional amount a doctor may charge for services above what Medicare covers.

What is difference between plan G and N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

Is plan N guaranteed issue?

While Plan N does have a potential of fees that the patient is responsible for, its rate increase history has and will remain low as it is not a guaranteed issue plan. This secures your client in a stable plan for a longer amount of time.

Does Medicare Plan N Cover Part B deductible?

With Plan N, you'll pay $20 for some doctor's visits and $50 if you go to the emergency room. Plan N also doesn't cover Part B excess charges, which is the fee you pay if your healthcare provider charges more than Medicare will pay for services.

Does Medicare Plan N cover prescriptions?

Like all Medigap plans, Medicare Supplement Plan N coverage does not include prescription drugs. If you want prescription coverage you can purchase Medicare Part D. Medicare Plan N also does not cover dental, vision, or hearing. If you want coverage for these services, consider a Medicare Advantage plan.

What is the difference between Medigap Plan D and Plan N?

The benefits of Medigap Plan N are similar to Plan D's policy, the sole exception being how it covers Medicare Part B coinsurance costs. Under Medigap Plan N, 100% of the Part B coinsurance costs are covered, except up to a $20 copayment for office visits and up to $50 for emergency room visits.

What is the most comprehensive Medicare Supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

How much does Plan N cost monthly?

Plan N does not have a set premium but ranges from $85 to $200. The premium will depend on several factors such as zip code, gender, age, tobacco u...

What is the deductible for Plan N?

In 2022, the deductible is $233 which is the Part B annual deductible that you are responsible for with Plan N. The Part B deductible is one gap th...

What is the difference between Plan G and Plan N?

Plan N has more out-of-pocket than Plan G, but the premium for Plan N is typically lower. You must pay up to $20 copays for office visits and up to...

Can I switch from Plan N to Plan G?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to ans...

Do people prefer Plan N over Plan G?

Plan N is very appealing as it tends to have lower premiums than Plan G. For those who don’t visit the doctor often, this plan may be a great fit!...

Is Medicare Plan N a good plan?

Medigap Plan N combines fairly extensive coverage with relatively modest premiums, making Plan N a good policy. It is important to remember that Pl...

How popular is Medicare Plan N?

Amount 10% of all Medigap enrollees have Plan N, making it the third most popular plan overall and the second most popular plan for new enrollees.

Does Plan N have a deductible?

Most Plan N policies do not have a deductible. However, beneficiaries enrolled in Plan N are required to meet the Medicare Part B deductible, which...

Does Plan N have a maximum out-of-pocket limit?

Plan N does not have an out-of-pocket limit. Only two Supplement plans have an out-of-pocket limit: Plans K and L.

Can I have Medigap Plan N while enrolled in a Medicare Advantage plan?

No. Medigap policies are only available to people enrolled in the Original Medicare program. They cannot be used by beneficiaries who have Medicare...

What is Medicare Plan N?

Medicare Plan N is a supplemental policy that typically has lower premiums while you pay your Part B deductible, excess charges and some copays for doctor and emergency visits. It has been popular since it was first introduced in 2010. Also called Medigap Plan N, this option was created for consumers who like the idea ...

What is Medicare Supplement Plan N?

Also called Medigap Plan N, this option was created for consumers who like the idea of paying a lower premium in exchange for taking on a small annual deductible and some copays. All Medicare Supplement Plan N policies are the same, no matter which insurance company you choose.

How much is the Part B deductible for 2021?

First, you agree to pay the small annual Part B deductible ($203 in 2021). You will also pay co-payments up to $20 for doctor appointments. Emergency room visits have a $50 copay. Finally, people with Medigap N also pay excess charges to some medical providers. Providers can charge 15% more than what Medicare allows.

What is the difference between Medicare Plan N and Plan G?

People who enroll in Plan N also often look at Plan G as an alternative because Plan G is only slightly more expensive. The primary difference is that Plan G covers the little copays and excess charges so there are less bills showing up in your mailbox.

How much does Medicare pay for a medical bill?

Medicare pays 80% and then sends the bill to your Medigap plan. If your doctor does not accept Medicare assignment, you will pay a 15% excess charge. Read more about how this would work in our Medigap Plan N Example below.

When is the best time to enroll in Medicare Plan N?

You must also live in the plan’s service area. The best time to enroll in Medicare Plan N is during your Medigap Open Enrollment Period. This six-month window starts with your Part B effective date. It’s your one chance to enroll in any Medigap plan without health underwriting.

Does Plan N cover hospital deductible?

For inpatient care, Medicare Supplement Plan N fully covers her hospital deductible.

What is Medicare Supplement Plan N?

Medicare Supplement Plan N coverage is one of 10 federally standardized options to help fill “gaps” in original Medicare coverage. It’s an option for people who want broad coverage but, to lower their premiums, are willing to pay for some copays and a small annual deductible.

How many Medigap plans are there?

There are 10 different Medigap Plans (A, B, C, D, F, G, K, L, M, N) which all feature different coverage and have different premiums. This selection allows you to choose coverage based on your needs and budget.

How to get a Medigap policy?

Getting a Medigap policy. Once you have original Medicare, you can purchase a Medigap policy from an insurance company. To pick a specific plan and insurance company, many people consult with a trusted family member, friend with a current Medigap policy, or insurance agent.

Is Medigap standardized?

Standardization. Medigap plans are standardized the same way in 47 of the 50 states. If you live in Massachusetts, Minnesota, or Wisconsin, Medigap policies (including Medicare Supplement Plan N coverage) are standardized differently.

Does Medicare Supplement Plan N cover dental?

Like all Medigap plans, Medicare Supplement Plan N coverage does not include prescription drugs. If you want prescription coverage you can purchase Medicare Part D. Medicare Plan N also does not cover dental, vision, or hearing. If you want coverage for these services, consider a Medicare Advantage plan.

What is Medicare Supplement Plan N?

Medicare Supplement Plan N. Medicare Supplement Plan N is one of the more popular plans among beneficiaries in 2021. It’s the plan for those who prefer lower monthly premiums without forfeiting benefits. Yet, when you enroll in this plan, you’re responsible for deductibles and a few copays.

What is the difference between Plan G and Plan N?

Plan G covers Part B excess charges , which are not a concern in most cases but especially not if they aren’t allowed in your state to begin with. Plan N also involves cost-sharing via copayments and coinsurance, which Plan G covers. However, premiums for Plan G are usually higher than those for Plan N.

Why is Plan N so popular?

This popularity is not surprising, because the policy offers a decent amount of coverage at a reasonable price. Plan N offers extra coverage to supplement your Medicare benefits without breaking the bank. The small copays this plan involves keeping the monthly premium lower.

How much does Medigap cost in 2021?

How Much Does Medigap Plan N Cost in 2021. The average cost of Plan N is around $120-$180 per month. However, in some states, it can be as much as $200 and in others, it can be as low as $80. Your premium rates depend on your personal information as well as the plan letter you choose. Factors such as your state of residence, gender, age, ...

What are the factors that affect your monthly premium rates?

Among the factors that affect your monthly premium rates is the pricing method that your carrier uses. In the last five years, premium rates for Plan N have increased between 2% and 4%. These increases are lower when compared to Plan F and comparable when compared to Plan G.

Does Medigap cover out of pocket costs?

It covers 100% of your out-of-pocket costs. Outside of the monthly premium, you never need to pay out-of-pocket . Plan N is two steps down from Plan F in terms of coverage. Yet, the premiums for Plan F are higher because the more benefits a plan offers, the higher the premiums will be. Also, Medigap Plan F is not available to all beneficiaries, ...

Does Plan N cover travel?

Plan N also includes foreign travel emergency benefits. If you travel outside the United States, Plan N will cover emergency services up to plan limits.

What is Medicare Supplement Plan N?

Medicare Supplement Plan N: Understanding the Costs. Plan N is a Medicare supplement (Medigap) plan that helps cover the costs of medical care. Federal law ensures that no matter where you purchase your Medigap Plan N, it will include the same coverage. The cost for Medigap Plan N may vary based on where you live, when you enroll, and your health.

How long does Medicare plan N last?

Plan N coverage includes: Part A coinsurance and hospital costs for up to an additional 365 days after you use your Medicare benefits.

How long does it take to get Medicare Part B?

This is a 6-month period that begins the month you are both age 65 or older and enrolled in Medicare Part B. A company can not use medical underwriting during this initial enrollment period to sell you a policy. This means they cannot consider your overall health and medical conditions when they sell you a policy.

When to enroll in Medigap Plan N?

The cost for Medigap Plan N may vary based on where you live, when you enroll, and your health. Enrolling in Medigap when you’re first eligible, around your 65th birthday, is the easiest way to get the lowest cost. Medicare Supplement Plan N, also called Medigap Plan N, is a type of supplemental insurance to help cover some ...

Can you still buy a medicaid policy after open enrollment?

This means they cannot consider your overall health and medical conditions when they sell you a policy. The insurance company must sell you the policy for the same price they sell it to people who are in general good health. You can still purchase a Medigap policy after your Medicare open enrollment period.

Is Medigap Plan N a supplement plan?

The takeaway. Medigap Plan N is one example of a standardized Medicare supplement plan. The plan may help you avoid out-of-pocket costs associated with Medicare. You can compare plans through sites such as Medicare.gov and by contacting private insurance companies.

How much is Medicare Supplement Plan N?

On average – and this can change depending on a variety of factors – a Plan N is between $30-$50 cheaper than a Plan F. That means that every month, you pay $30-$50 less ...

How much does a plan N cost?

While the price of a Plan N varies depending on where you live, how old you are, your health, and more, it generally costs between $85-$120 per month.

What is a plan N?

What is Plan N? Plan N is one of the Medicare Supplement plan options, which are plans that help pay for gaps Medicare leaves behind. Like the other Medigap plans (such as Plan F or G), Plan N is sold by private insurance companies, such as Accendo Insurance Company or Lumico. Plan N has very similar benefits to Plan F and Plan G, ...

How much is a Medigap Plan N copay?

One of its main differences when compared to Plan F or G is the copay. When you have a Medigap Plan N, you pay a small copay when you go to the doctor’s office. However, it’s usually only about $10.

What happens if a doctor doesn't accept Medicare?

If they don’t, you would receive a bill in the form of an excess charge. However, most doctors accept Medicare (they accept Medicare assignment).

Does Plan N have copays?

Yes, it has copays and excess charges , but ultimately, it's worth the premium savings for a lot of individuals. For a free, no obligation Plan N quote, call us today at 833-801-7999 or send us an email at [email protected].

Can you opt for a Plan G supplement?

Sure, there are a few trade offs, but you’ll likely end up saving money on your supplement. If you’re worried about those excess charges, you can always opt for a Plan G, which is one of our favorite plans. The Plan G is also becoming the most popular plan on the market.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.