What happened to Medicare Cost plans?

Starting on January 1, 2019, the federal government eliminated Medicare Cost Plans from counties where two or more Medicare Advantage plans were competing the year before. 6 However, that was the case only if those plans met certain enrollment thresholds.

Will Medicare stop paying for hospital insurance in eight years?

It doesn’t mean Medicare will stop paying hospital insurance benefits in eight years. We don’t know what Congress will do—though the answer is probably nothing until the last minute. Lawmakers could raise the payroll tax.

Is Medicare going “broke?

It was hard to miss the headlines coming from yesterday’s Medicare Trustees report: Let’s get right to the point: Medicare is not going “broke” and recipients are in no danger of losing their benefits in 2026. However, that does not mean Medicare is healthy.

How has Medicare changed under the Affordable Care Act?

In the 2010 Affordable Care Act, Congress adopted a package of cost-cutting measures. In 2015, in a law called the Medicare Access and CHIP Reauthorization Act (MACRA), it began to change the way Medicare pays physicians, shifting from a system that pays by volume to one that is intended to pay for quality.

Will Medicare premiums decrease in 2022?

About half of the larger-than-expected 2022 premium increase, set last fall, was attributed to the potential cost of covering the Alzheimer's drug Aduhelm.

Will Medicare be phased out?

In a word—no, Medicare isn't going away any time soon, and Medicare Advantage plans aren't being phased out. The Medicare Advantage (Part C) program is administered through Medicare-approved private insurance companies.

How much will Medicare cost me next year?

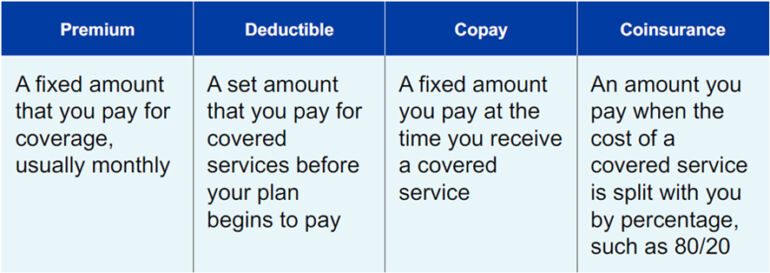

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Is the cost of Medicare going down?

In a report to Becerra, the agency said the premium recommendation for 2022 would have been $160.40 a month had the price cut and the coverage determination both been in place when officials calculated the figure. The premium for 2023 for Medicare's more than 56 million recipients will be announced in the fall.

What will Medicare cost in 2021?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

Is the Medicare donut hole going away in 2021?

En español | The Medicare Part D doughnut hole will gradually narrow until it completely closes in 2020. Persons who receive Extra Help in paying for their Part D plan do not pay additional copays, even for prescriptions filled in the doughnut hole.

What changes are coming to Medicare in 2022?

Changes to Medicare in 2022 include a historic rise in premiums, as well as expanded access to mental health services through telehealth and more affordable options for insulin through prescription drug plans. The average cost of Medicare Advantage plans dropped while access to plans grew.

Will Medicare premiums increase in 2023?

HHS announces Medicare premium increase for Aduhelm will be adjusted in 2023.

Is the cost of Medicare going up in 2022?

Medicare Part A and Part B Premiums Increase in 2022 But for those who have not paid the required amount of Medicare taxes, Part A premiums will increase. Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021).

What will Medicare cost in 2023?

CMS finalizes 8.5% rate hike for Medicare Advantage, Part D plans in 2023. The Biden administration finalized an 8.5% increase in rates to Medicare Part D and Medicare Advantage plans, slightly above the 7.98% proposed earlier this year.

Is Medicare going to reduce Part B premium?

In a statement last week, HHS Secretary Xavier Becerra instructed CMS to reassess Medicare Part B premiums for next year and said it is expected that the 2023 premium will be lower than 2022. The final determination will be made later this fall.

Are they going to reduce the cost of Medicare Part B?

Seniors could see a cut in their monthly Medicare Part B premiums for 2022 after a controversial new drug's price was slashed. In November, Medicare set the monthly Part B premium at $170.10 for this year, a more than 14% increase from 2021.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much did Medicare spend in 2016?

In 2016, people on Original Medicare (Part A and Part B) spent 12% of their income on health care. People with five or more chronic conditions spent as much as 14%, significantly higher than those with none at 8%, showing their increased need for medical care. 9.

How long will a 65 year old live on Medicare?

A Social Security Administration calculator notes a man who turned 65 on April 1, 2019 could expect to live, on average, until 84.0. A women who turned 65 on the same date could expect to live, on average, until 86.5.

What is the source of Medicare trust funds?

The money collected in taxes and in premiums make up the bulk of the Medicare Trust Fund. Other sources of funding include income taxes paid on Social Security benefits and interest earned on trust fund investments.

What is the CMS?

As the number of chronic medical conditions goes up, the Centers for Medicare and Medicaid Services (CMS) reports higher utilization of medical resources, including emergency room visits, home health visits, inpatient hospitalizations, hospital readmissions, and post-acute care services like rehabilitation and physical therapy .

Why is the Department of Justice filing suit against Medicare?

The Department of Justice has filed law suits against some of these insurers for inflating Medicare risk adjustment scores to get more money from the government. Some healthcare companies and providers have also been involved in schemes to defraud money from Medicare.

How much is Medicare payroll tax?

Medicare payroll taxes account for the majority of dollars that finance the Medicare Trust Fund. Employees are taxed 2.9% on their earnings, 1.45% paid by themselves, 1.45% paid by their employers. People who are self-employed pay the full 2.9% tax.

Why is there a doctor shortage?

As it stands, there is already an impending doctor shortage because of limited Medicare funding to support physician training. Decrease Medicare fraud, waste, and abuse. Private insurance companies run Medicare Advantage and Part D plans.

Why Are Medicare Cost Plans not Renewing?

The short story is that Cost Plan contracts will not be renewed in areas that have at least two competing Medicare Advantage plans that meet certain enrollment requirements. If your organization has decided to convert your plan to Medicare Advantage, it can continue as a Cost Plan until the end of 2018.

What Are the Options for Employer- or Union-Sponsored Cost Plans?

If you purchase your Cost Plan from your workplace or union, your plan may simply change to a similar Medicare Advantage plan. Also, you can disenroll from your Cost Plan at any time to return to Original Medicare.

Are Insurance Companies Offering Alternatives to Medicare Cost Plans?

Many of the country’s leading insurance companies are expanding their options in areas that currently have Medicare Cost Plans. During this year’s annual enrollment period, you’ll likely see additional Medicare plans from existing companies and offerings for plans from companies that are new to your area.

Switching to a Medicare Supplement Plan

If you’re an individual who chose a Medicare Cost Plan so that your coverage is easily portable when traveling to other states, your best choice may be to switch to one of the Medicare Supplement plans, also known as Medigap plans, that can also fully protect you when you’re out of your coverage area.

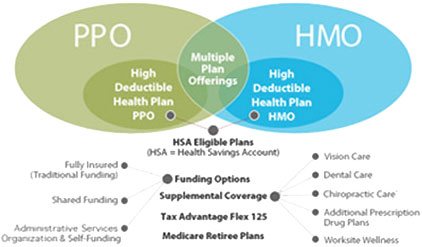

Switching to a Medicare Advantage Plan

Cost-conscious individuals with a Cost Plan may benefit by considering a Medicare Advantage Plan, also known as Medicare Part C. It includes all the benefits of Original Medicare and can also include extra features such as emergency care, wellness programs, Medicare Part D, as well as other benefits.

HealthMarkets Can Make Your Medicare Cost Plan Switch Easy

HealthMarkets offers Medicare Advantage, Medicare Part D, and Medigap plans, and we know how to help you choose the best option. We have licensed agents ready to talk to you at (800) 488-7621. You can also find a local agent online. If you’re ready to find the right Medicare Advantage or Medicare Supplement plan that fits your needs, call today!

When did Medicare cost plans end?

Starting on January 1, 2019, the federal government eliminated Medicare Cost Plans from counties where two or more Medicare Advantage plans were competing the year before. 6 However, that was the case only if those plans met certain enrollment thresholds.

What is a cost plan for Medicare?

A Medicare Cost Plan is a hybrid between Medicare Advantage and Original Medicare. It offers a narrow network of providers like a Medicare Advantage plan and likewise may be able to offer you more benefits. It also gives you the freedom to use Original Medicare whenever you require care outside of your plan's network.

What is Medicare Advantage?

Medicare Advantage plans are network-based by county. To make sure each plan provides adequate access to people in rural areas, the Centers for Medicare and Medicaid Services (CMS) requires that "organizations must ensure that at least 90% of the beneficiaries residing in a given county have access to at least one provider/facility of each specialty type within the published time and distance standards." 4 In order for a plan to be viable, it also had to reach a certain enrollment threshold.

When was Medicare Advantage first offered?

4 In order for a plan to be viable, it also had to reach a certain enrollment threshold. When Medicare Advantage was first offered in 1997, there was little reach into rural communities. Medicare Cost Plans came into existence to fill that gap.

When did Medicare start phasing out?

5 Now that there are more Medicare Advantage options available, the federal government is slowly phasing out Medicare Cost Plans. Starting on January 1, 2019, the federal government eliminated Medicare ...

Does Medicare Advantage cover all services?

Original Medicare vs. Medicare Advantage. Original Medicare has the advantage of offering a nationwide network of providers, but it may not cover all the services you need. If you want prescription drug coverage, you will need to also sign up for a Medicare Part D plan.

Does Medigap cover Part D?

These plans can also include Part D coverage.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

When does Medicare Part B start?

Please note that if you sign up for Part A during General Enrollment, you must also enroll in Part B. Coverage begins July 1, 2019.

Do you have to undergo medical underwriting for Medigap?

This is a special Medigap enrollment period specifically for people losing their Cost Plan. If you enroll in a Medigap plan during this time, you do not have to undergo health screening or medical underwriting.

Is it good to change Medicare?

Over the course of our lives, our healthcare needs change. The plan that suited you when you first chose it may no longer be your best option.