How do I sign up for Medicare Easy Pay?

Just the Essentials...

- There are two ways to sign up for Medicare Easy Pay: use your online account with Medicare’s secure site, or print and mail a short form to send by mail.

- A few programs make up Medicare. ...

- You can delay signing up for Medicare due to health coverage through a current or former employer. ...

How to sign up for Medicare Easy Pay?

- An 8-month enrollment period to sign up for Medicare Part B

- No late penalty fee applies during this 8-month enrollment window

- You can also sign up for Medicare Advantage, or a Part D policy for prescription drugs

How to pay my first Medicare payment?

- Medicare’s Easy Pay system lets you pay your Part A or Part B premium electronically. ...

- You can pay with a debit card or credit card by writing your card number directly on your bill and mailing it in.

- You can pay with a check or money order.

How do I pay for my Medicare?

On your Medicare account is your Medicare information such as:

- What Medicare Part D prescription drug plan or Medicare Advantage plan you are enrolled in.

- What your Medicare Part A and B enrollment dates are.

- What you can view on your “Medicare.gov” account is paying your Medicare premium, Medicare claims, print your Medicare card and much more.

How do I set up automatic Medicare payments?

Sign up for Medicare Easy Pay, which is a free, electronic payment option that automatically deducts premium payments from your savings or checking account each month it is due. To sign up, go to Medicare.gov or call 1-800-MEDICARE (1-800-633-4227; TTY users, call 1-877-486-2048).

How do I deduct Medicare from my bank account?

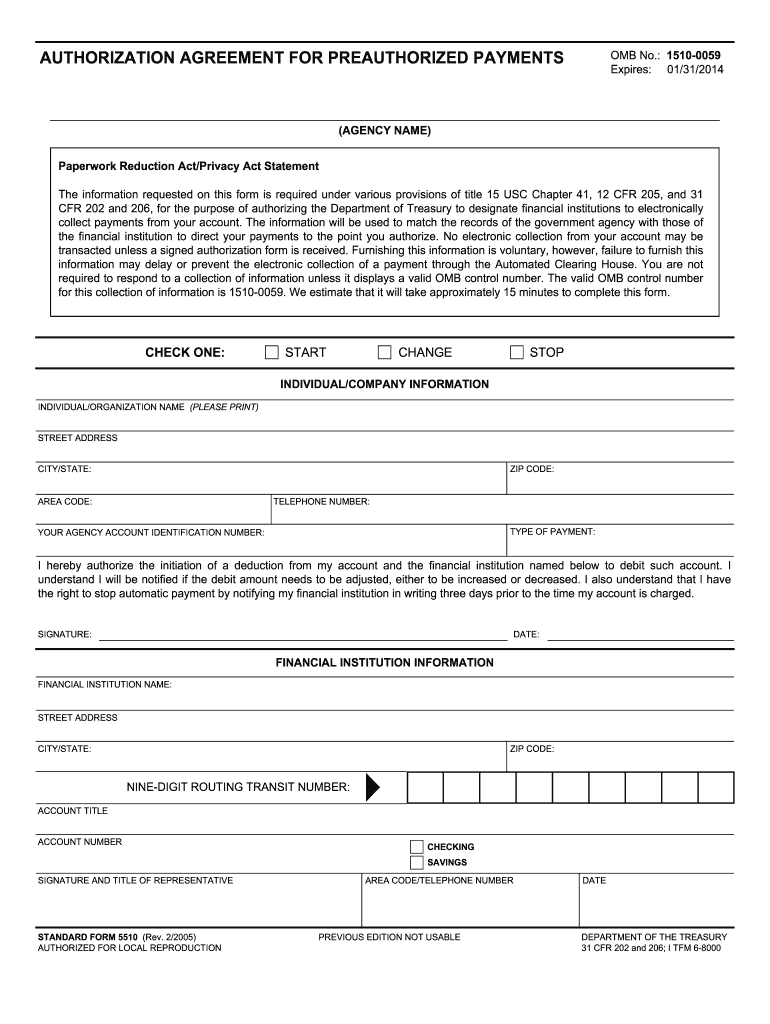

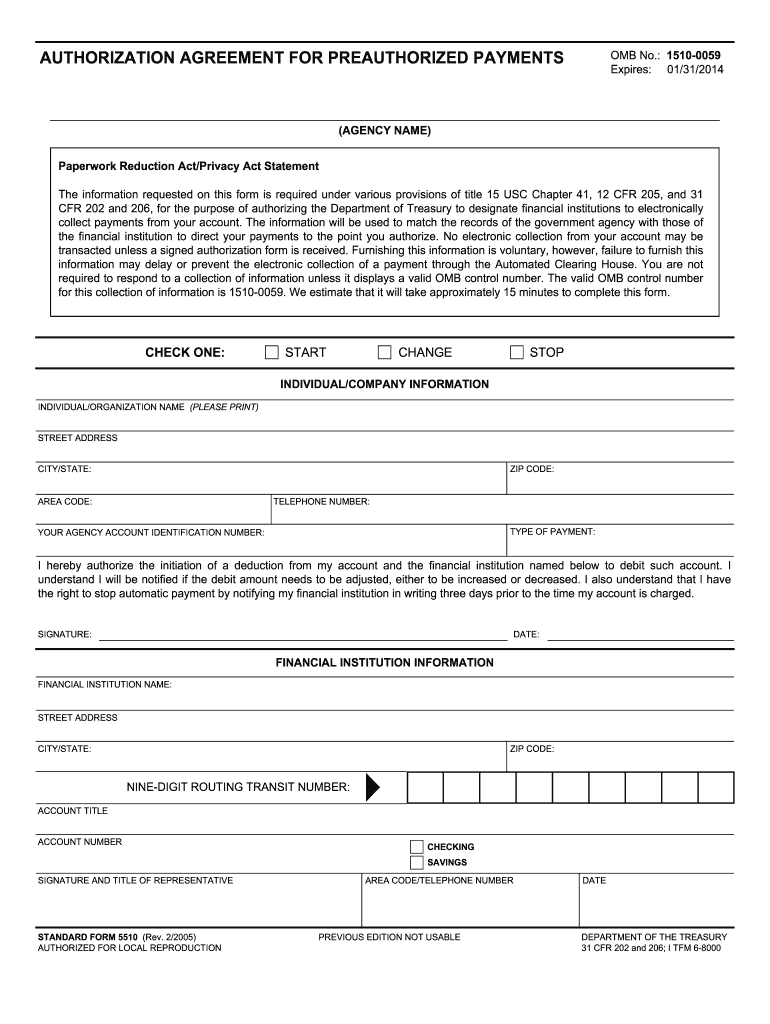

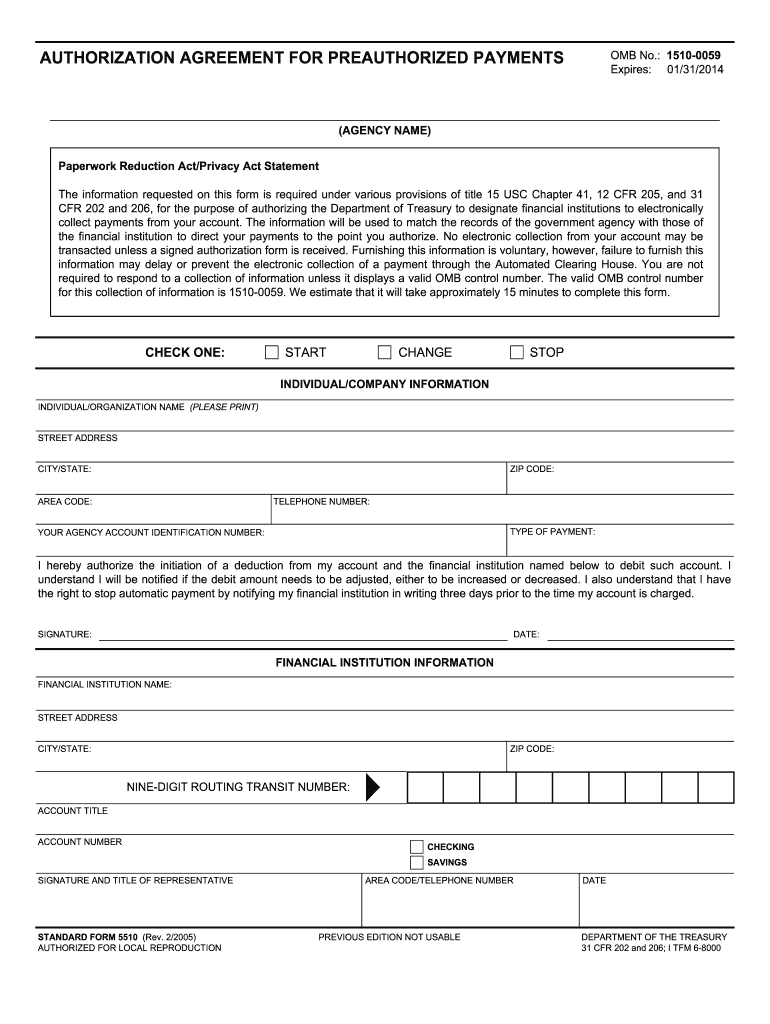

By completing and returning the Authorization Agreement for Preauthorized Payments form (SF-5510), you're authorizing the Centers for Medicare & Medicaid Services (CMS), the Federal agency that runs the Medicare program, to deduct your monthly Medicare premium from your bank account.

How do I make a Medicare direct payment?

Log into (or create) your secure Medicare account — Select “Pay my premium” to make a payment by credit card, debit, card, or from your checking or savings account. Our service is free. Contact your bank to set up an online bill payment from your checking or savings account.

Does Medicare Easy Pay stop automatically?

Until then, you may get a bill to pay your premium or your payment may still be automatically deducted from your old bank account. If you stop Medicare Easy Pay: It can take up to 4 weeks for your automatic deductions to stop.

Can you pay Medicare with a credit card?

Medicare premiums can be paid by check, credit card, bank transfer or automatic deduction from your Social Security benefit.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

How do I pay for Medicare if not on Social Security?

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a “Notice of Medicare Premium Payment Due” (CMS-500). You will need to make arrangements to pay this bill every month.

What income is used to determine Medicare premiums?

modified adjusted gross incomeMedicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How do I connect my bank account to Medicare?

account number.Step 1: sign in. Sign in to myGov and select Medicare. If you're using a computer, sign in to myGov and select Medicare. ... Step 2: change your bank details. Select Edit in Bank details. Update your bank details and enter your: ... Step 3: sign out. From the homepage you can complete other transactions.

How do I pay Easy Pay?

Make an Online Payment Make a payment online any time using your Checking/Savings account, ATM/Debit Card, or Visa, MasterCard, or Discover card. Our payment processing agent charges a convenience fee for this service.

Is Medicare Easy Pay Safe?

Is Medicare Easy Pay safe? Yes. Medicare uses encryption and other technologies to keep customers' information secure. However, it's always a good idea to check your bank account statement regularly to make sure the correct amount is debited each month.

Are Medicare premiums tax deductible?

You can deduct your Medicare premiums and other medical expenses from your taxes. You can deduct premiums you pay for any part of Medicare, including Medigap. You can only deduct amounts that are more than 7.5 percent of your AGI.

How to add electronic signature to Medicare form 5510?

In order to add an electronic signature to a printable medicare form sf 5510, follow the step-by-step instructions below: Log in to your signNow account. If you haven’t made one yet, you can, through Google or Facebook. Add the PDF you want to work with using your camera or cloud storage by clicking on the + symbol.

What browser is used to sign Medicare Form 5510?

form 5510 Chrome’ s browser has gained its worldwide popularity due to its number of useful features, extensions and integrations. For instance, browser extensions make it possible to keep all the tools you need a click away. With the collaboration between signNow and Chrome, easily find its extension in the Web Store and use it to eSign printable medicare form sf 5510 right in your browser.

How to speed up business workflow?

Speed up your business’s document workflow by creating the professional online forms and legally-binding electronic signatures.

What is a 1099-MISC?

Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

How to change ink cartridge on HP printer?

so you need to replace a cartridge in your HP printer let's walk through the steps together the first thing to do is turn the printer on so press the power button next raise the cartridge access door the carriage moves into the access area allow the carriage to stop moving then find the cartridge you want to replace and press the tab on the front of the cartridge to release it lift the cartridge out to remove it from the slot now take the new cartridge out of its package you pull the orange plastic tab from the new cartridge to remove the plastic wrap it is very important that you use the orange pull tab to remove the plastic this will properly expose the vent slot in the top of the cartridge twist the orange cap on the bottom of the cartridge counterclockwise to remove it significant force might be required to remove the cap when handling the cartridges be aware of the electrical contacts and ink port be careful not to touch the contacts or port because touching these can cause clogs

Do you have to fill out a W-2?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

What is Medicare Easy Pay?

Medicare Easy Pay is an electronic payment option if you are directly billed for your Part A or Part B premiumsby Medicare. This payment option allows you to have your Medicare premiums automatically deducted fromeither your savings or checking account free of charge on the 20th of each month. You can sign up for theMedicare Easy Pay at any time.

What does it mean when you get a notice of Medicare payment due?

You’ll get a Notice of Medicare Premium Payment Due stating, “This is not a bill” to let you know that the premium will be deducted from your bank account.

What is Medicare Easy Pay?

Medicare Easy Pay, a free and secure automatic payment method, helps avoid missed payments for Medicare Part A and B premiums and gives you peace of mind for seamless health care coverage.

When does Medicare Easy Pay automatically take out?

Once enrolled in Medicare Easy Pay, there will be an automatic deduction from your checking or savings account usually on the 20 th of each month. You’ll see these payments listed on your bank account statement as a ‘CMS Medicare Premium’ Automated Clearing House (ACH) transaction.

How long does it take to pay Medicare bill?

Also, starting, stopping, or changing Medicare Easy Pay can take up to eight weeks. In addition, you cannot use Medicare Easy Pay to pay monthly premiums for Medicare products offered by private insurance ...

How long does it take for Medicare to process a form?

Medicare will process your form within six to eight weeks. Once processed, you’ll receive something that looks like a bill (Note: It’s called a CMS-500 form or ‘Medicare Premium Bill’); however, it will clearly state the following in the upper right corner: ‘THIS IS NOT A BILL.’.

What is the Medicare account number?

Your ‘agency account number’ is your 11-character Medicare number from your red, white, and blue Medicare insurance card. The ‘type of payment’ is ‘Medicare premiums.’

How long does it take to fill out a Medicare form?

It should take you about 15 minutes to complete the form in its entirety. Here are some tips to help you fill out the form correctly: First, know that the ‘agency name’ is ‘Centers for Medicare & Medicaid Services.’. Next, print your name exactly as it appears on your Medicare insurance card.

Why do people use Medicare Easy Pay?

There are several reasons some beneficiaries may consider using Medicare Easy Pay, such as the following: Time savings . Once you set it up initially, you’re done. You don’t need to spend time each month paying the bill manually online or going to the post office to physically mail payments. No missed payments.

When do you have to enroll in Medicare?

Assuming you don’t qualify for automatic enrollment, the first opportunity you have to enroll in Original Medicare is typically during your seven-month Initial Enrollment Period, which generally begins three months before you turn 65, includes your birthday month, and ends three months after the month you turn 65. If you don’t enroll at this time, you may face a late-enrollment penalty.

How to report Medicare fraud?

If you suspect Medicare fraud, waste, or abuse, you should immediately report fraud online. Alternatively, you can call the HHS Office of Inspector General at 1-800-447-8477 (TTY users 1-800-377-4950) or CMS at 1-800-633-4227 (TTY users 1-877-486-2048).

What is Medicare Advantage?

If you’d like, you may be able enroll in Medicare Advantage (Medicare Part C) as an alternative way to get your Original Medicare, Part A and Part B, benefits. Medicare Advantage plans are offered by private health insurance companies that contract with Medicare to deliver your Medicare Part A and Part B benefits – with the exception of hospice care, which is still covered under Part A. Many Medicare Advantage plans include benefits beyond Part A and Part B coverage as well; for example, some plans offer prescription drug coverage, routine vision care, and/or wellness programs. (Medicare Part A and Part B may cover prescription drugs in specific situations, but for the most part this coverage doesn’t extend to medications you take at home.)

What is Medicare prescription drug plan?

Medicare Prescription Drug Plans are available from private, Medicare-approved insurance companies. To qualify, you need to be enrolled in Medicare Part A and/or Part B and live in the plan’s service area. Plan availability, costs, and benefit details may vary. Read about enrollment periods for Medicare Prescription Drug Plans.

How to compare Medicare Advantage plans?

You can compare Medicare Advantage plans available where you live; just click Find Plans or Compare Plans on this page. Note that you need to continue paying your Medicare Part B premium, along with any premium the plan may charge.

When do you get Medicare if you are already on Social Security?

If you’re already receiving Social Security Administration (SSA) or Railroad Retirement Board (RRB) retirement benefits, you’ll typically get enrolled in Medicare when you turn 65.

How old do you have to be to get Medicare?

How to Complete Medicare Enrollment Forms. As you approach the age of 65, you’ll want to make sure you enroll in the Medicare insurance plan that may suit your needs. To do so, you need to know how to sign up for Medicare and which Medicare application forms to complete.

What is the account number on a Medicare check?

Your “Nine-Digit Routing Number” is the number from the bottom left corner of your check. The “Account Title” is the name of the checking or savings account holder. The “Account Number” is the checking or savings account number (don’t use spaces or symbols).

How long can you deduct Medicare premiums?

We’ll deduct your premiums from your bank account, usually on the 20th of each month. It will appear on your bank statement as a “CMS Medicare Premium” Automated Clearing House (ACH) transaction. Your initial ACH deduction can be up to 3 months’ premiums. After the initial deduction, 1 month’s premiums plus $10 is the maximum deduction each month.

What is SF-5510?

By completing and returning the Authorization Agreement for Preauthorized Payments form (SF-5510), you’re authorizing the Centers for Medicare & Medicaid Services (CMS), the Federal agency that runs the Medicare program, to deduct your monthly Medicare premium from your bank account. This notice tells you what happens once you complete ...

What is the agency name on Medicare?

The “Agency Name” should be “Centers for Medicare & Medicaid Services”. The “Individual/Organization Name” is your name the way it looks on your Medicare card. Your “Agency Account Identification Number” is your 11-character Medicare Number from your Medicare card. The “Type of Payment” should be “Medicare Premiums”.

How long does it take to complete an OMB form?

The valid OMB control number for this collection of information is 1530-0015. We estimate that it will take approximately 15 minutes to complete this form. CHECK ONE: START CHANGE STOP.

How long does it take to change your bank account on Medicare?

Mail the completed form to the address above. It can take 6 to 8 weeks to change your bank account. You can get a new form at Medicare.gov or by calling 1-800-MEDICARE (1-800-633-4227).

Is there a bill for Medicare?

Once your form is successfully processed, your Medicare Premium Bills (form CMS-500) will state “THIS IS NOT A BILL” in the upper right corner, indicating that your automatic deductions should begin. Until then, you must pay your Medicare premiums another way.

When does Medicare Easy Pay deduct premiums?

Anyone who received a bill from Medicare for their premiums is eligible for Medicare Easy Pay. They usually deduct the premium from the bank on the 20th of the month.

How to pay Medicare by credit card?

How to Pay Medicare By Debit or Credit Card. Pay by debit or credit card by completing the bottom portion of the payment coupon on your Medicare bill, and sign it. You’ll need to provide the account information as it appears on your debit or credit card and the expiration date.

What is Medicare Premium Bill?

If you pay Part A, B, or D premiums; then, you have a “ Medicare Premium Bill .” The bill covers next month’s coverage and additional months if you elect quarterly payments.

When do you have to send in Medicare payment?

( Medicare premiums are due by the 25th of the month) If the billing date on the first bill is February 27th, send in payment by March 25th. If the box says, “Second Bill,” Medicare didn’t get dues by the date shown on the first bill.

Can you deduct Medicare premiums from civil service?

If you’re entitled to Civil Service benefits but not Social Security benefits, you can choose to have your premium deducted from your Civil Service Annuity. You can also sign up for Medicare Easy Pay, which we’ll explain below.

Do you have to pay a premium for Part A?

Most people do not have to pay a premium for Part A. If you’re not collecting Social Security, then you’ll have to pay your Part B premium yourself. For those who get Social Security, automatic deduction occurs. If you receive Railroad Retirement Benefits or Civil Service benefits, your premium is an automatic deduction.

Does Medicare have an automatic payment?

Now that you're signed up for Medicare, with easy pay set up, consider looking into supplemental plans that can help lower your costs. Most supplemental Medicare plans have an automatic payment option and even offer a discount when selecting this payment option.

How to file a Medicare claim?

First, it’s unlikely that you’ll have to submit your Medicare claim. Most doctors have a medical billing and coding office that will file claims for you. But, in the rare case you do need to fill out a claim form, you’ll fill out the Patient Request for Medical Payment form (CMS-1490S)

How to file a complaint with Medicare?

Also, you can contact the State Health Insurance Assistance Program. Submit a Medicare complaint form to file a complaint about your Medicare plan. Contact Medicare if you have an issue with a Durable Medical Equipment supplier or your reporting Medicare fraud. But, if you have private insurance, contacting your plan to discuss complaints is always an option.

How to terminate Medicare Part A and Part B?

Medicare Part A and Part B Termination Form. If you want to terminate Part A or Part B, you’ll need to fill out the CMS 1763 form. Medicare isn’t Mandatory, but, if you don’t have creditable coverage, you may risk penalties in the future. To Terminate Part B you’ll need to file the CMS-L457 form to acknowledge your request for termination.

What is Medicare questionnaire?

The questionnaire informs Medicare about any other insurance you may have. Different types of coverage could be employer benefits or veterans’ benefits. Initial enrollment questionnaires are online through MyMedicare.gov. But you can answer questions over the phone.

How to disclose health information to spouse?

If this describes you, fill out the Authorization to Disclose Personal Health Information form. This form is available online, or you can contact Medicare for the information.

What is scope of appointment in Medicare Advantage?

The Medicare Advantage Scope of Appointment form is a paper you fill out before an agent comes to your house to discuss Part C options in your area. There is an electronic Scope of Appointment process that can help maximize proficiency. Although, if you enroll over the phone, the recorded phone call serves as the Scope of Appointment.

What is CMS 36?

Form CMS-36 gives consent for federal and state health survey personal to visit your home. During the visit, they would evaluate the quality of home health care.