Following adjustments to the federal tax code made in recent years, individuals can expect 6.2 percent of their pay up to a maximum income level of $132,900 to be directed toward Social Security, and 1.45 percent of their paycheck income to be routed to Medicare.

What kind of Medicare do I get in Florida?

The FICA tax withholding from each of your paychecks is your way of paying into the Social Security and Medicare systems that you’ll benefit from in your retirement years. In recent years, the IRS issued some notable revisions for the Form W-4. ... How You Can Affect Your Florida Paycheck. If you want a bigger Florida paycheck you can ask ...

What does Medicare mean on my paycheck?

Apr 02, 2020 · The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income. Your employer also pays a matching Medicare tax based on your paycheck. There are two ways that you may see the Medicare payroll …

What is the payroll tax for Medicare?

Sep 16, 2018 · If you need to apply for Medicare manually, then you may visit your local SSA office or enroll online or over the phone. Visit the Social Security website. Call Social Security at 1-800-772-1213 (TTY users should call 1-800-325-0778), Monday through Friday, 7AM to 7PM. If you worked for a railroad, call the RRB at 1-877-772-5772 (TTY users call ...

Where do Medicare taxes go on your paycheck?

Both the employee and employer contribute 1.45% of the employee’s pay for Medicare. However, there is no wage cap for Medicare tax. All employee wages are subject to the 1.45% tax. When to pay federal payroll taxes. Depending on how much tax you owe, you may have to pay your payroll taxes annually, quarterly, monthly, or semi-weekly.

How much of my paycheck is taxed in Florida?

How much is Medicare tax in FL?

What percentage do they take out of your paycheck?

How much is 70k after taxes in Florida?

How are Medicare wages calculated?

How is Medicare tax calculated?

How much is usually taken out for taxes?

| Tax | Marginal Tax Rate | 2021 Taxes* |

|---|---|---|

| Federal | 22.00% | $9,600 |

| FICA | 7.65% | $5,777 |

| State | 5.97% | $3,795 |

| Local | 3.88% | $2,492 |

How do you calculate payroll?

- 40 hours worked at regular rate of $15 per hour: 40 x 15 = $600.

- Six hours worked at overtime rate of $22.5 per hour: 6 x 22.5 = $135.

- Total Gross Pay for the week: $600 + $135 = $735.

Why do I get taxed so much on my paycheck 2022?

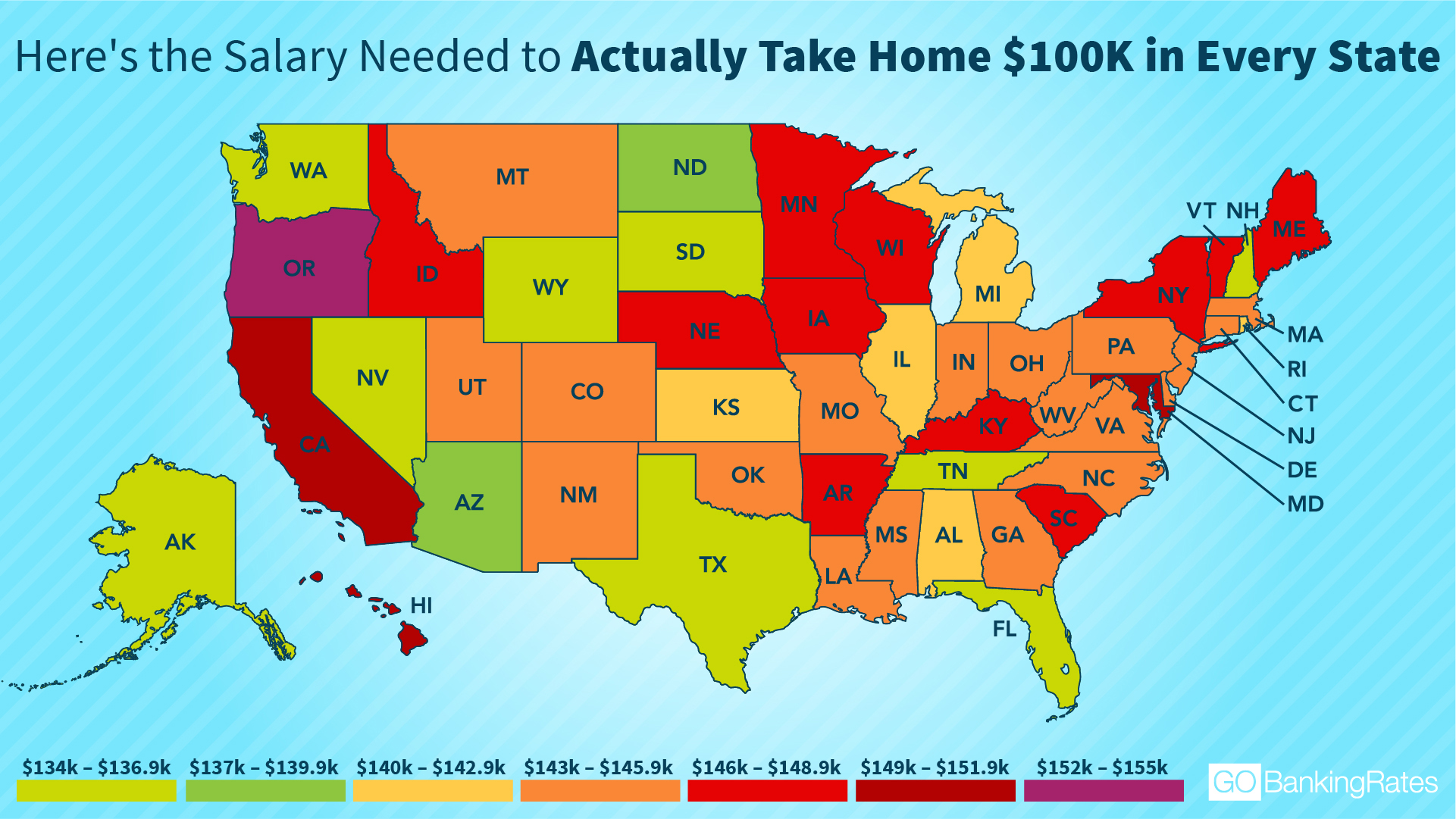

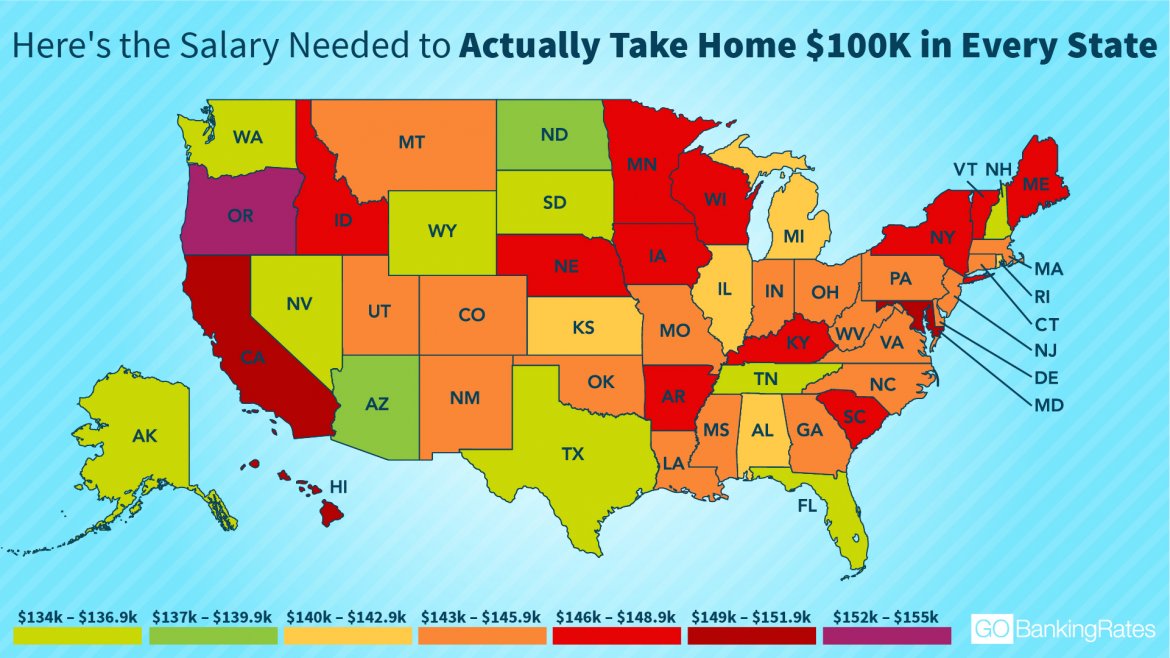

How much is $100000 after taxes in Florida?

What is 80000 a year after taxes in Florida?

How much is 85000 a year after taxes in Florida?

About Medicare in Florida

Medicare beneficiaries in Florida may choose to receive their coverage from Original Medicare, Part A and Part B, or through a Medicare-approved in...

Types of Medicare Coverage in Florida

Original Medicare, Part A and Part B, is federally funded health insurance available to all eligible Medicare beneficiaries. Part A provides inpati...

Local Resources For Medicare in Florida

Medicare Savings Programs in Florida: For residents whose income falls below a certain limit, there are various programs that can assist with payin...

How to Apply For Medicare in Florida

The Medicare enrollment process is the same no matter what state you live in. To qualify for Medicare, you must be either a United States citizen o...

What is the tax rate for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income. Your employer also pays a matching Medicare tax based on your paycheck. There are two ways that you may see the Medicare payroll deduction applied to your paycheck.

What is Medicare tax?

The Medicare tax is an automatic payroll deduction that your employer collects from every paycheck you receive. The tax is applied to regular earnings, tips, and bonuses. The tax is collected from all employees regardless of their age.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

When was Medicare enacted?

When Medicare was enacted as a federal law in 1965, the funds to support the program became a payroll tax on earned income. The payroll taxes required for the Federal Insurance Compensation Act (FICA) are to support both your Social Security and Medicare benefits programs.

Does Florida have Medicare?

Not every Medicare plan may be available everywhere in Florida.

What is Medicare Advantage Plan?

These plans are required to cover everything that Original Medicare does (except for hospice care), but may include additional benefits like vision, dental, hearing, and prescription drug coverage.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also known as Medigap, provides coverage for out-of-pocket costs that are not covered by Original Medicare, which includes deductibles, copayments and, in some cases, medical care when traveling outside of the United States .

Get help paying costs

Learn about programs that may help you save money on medical and drug costs.

Part A costs

Learn about Medicare Part A (hospital insurance) monthly premium and Part A late enrollment penalty.

Part B costs

How much Medicare Part B (medical insurance) costs, including Income Related Monthly Adjustment Amount (IRMAA) and late enrollment penalty.

Costs for Medicare health plans

Learn about what factors contribute to how much you pay out-of-pocket when you have a Medicare Advantage Plan (Part C).

Compare procedure costs

Compare national average prices for procedures done in both ambulatory surgical centers and hospital outpatient departments.

Ways to pay Part A & Part B premiums

Learn more about how you can pay for your Medicare Part A and/or Medicare Part B premiums. Find out what to do if your payment is late.

Costs at a glance

Medicare Part A, Part B, Part C, and Part D costs for monthly premiums, deductibles, penalties, copayments, and coinsurance.

Federal Payroll Taxes

While a 0% state income tax is saving you from some calculations, you are still responsible for implementing federal payroll taxes. Luckily, our Florida payroll calculator is here to assist with calculating your federal withholding and any additional contributions your business is responsible for.

Florida Payroll Taxes

You already know that the State of Florida charges 0% income tax. And even better, no cities within Florida charge a local income tax. All of which means less work for you.

Now Cut Those Checks!

First, pay your employees. Then, it’s time to celebrate. Pop open a bottle of bubbly. Take a bite of that chocolate bar. Sing “Celebration” the whole way home. Splash around the Atlantic. Whatever it is you need to do to celebrate, do it because you’ve just mastered payroll taxes!

Additional Florida Payroll Tax Resources

Though our calculator can do most of the work, here are some helpful links to further your understanding of payroll in Florida.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Does Florida have state income tax?

Just because Florida doesn’t have state income tax doesn’t mean that you don’t have to worry about other types of taxes. As one of the 2.3 million Americans who own a small business in Florida, you are responsible for payroll taxes. While it’s similar to the process for other states, you may find the process in Florida easier and more streamlined.

Why is Florida a good place to retire?

Florida is a popular destination for retirees not only because of the great weather but also because of the absence of state income tax. Just because Florida doesn’t have state income tax doesn’t mean that you don’t have to worry about other types of taxes.

What is the payroll tax rate for 2021?

Payroll taxes include Medicare tax, with a tax rate of 1.45% on all earnings and Social Security tax, with a rate of 6.2% on the first $142,800. as of 2021. You’re also responsible for paying state and federal unemployment taxes. You’re required to pay a reemployment rate of 2.7% if you’re a new employer.

Can you use PTO?

You can take advantage of the Paid Time Off (PTO) laws that require that employees use their time off within the year they accrued it . It’s the use-it-or-lose-it policy, which is beneficial to you as an employer for a variety of reasons.

FAQs

No, as a resident of Florida you are not subject to personal income tax because Florida is one of a few states that does not impose personal income tax.

Florida Resources

The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. These calculators should not be relied upon for accuracy, such as to calculate exact taxes, payroll or other financial data.