What is the average cost of Plan G?

There is no set premium for Plan G as plans can range from $100 to $200. Your monthly premium will depend on your location and zip code, your gende...

What is the Plan G deductible in 2022?

$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separ...

What is the difference between Plan N and Plan G?

The biggest difference between these two is your out-of-pocket costs. With Plan N you will be responsible for the Part B deductible, $20 copay for...

What Does Medicare Plan G pay for?

Plan G pays for your hospital deductible and all copayments and coinsurance under Medicare. For example, this would include the hospice care coinsu...

Does Medicare Plan G cover dental?

No, since Medicare does not cover routine dental care, a Medigap policy will not either. However, medically necessary dental services can be covere...

Does Plan G cover prescriptions?

Plan G will cover the coinsurance on any Part B medications. These are typically drugs that are administered in a clinical setting, such as chemoth...

Which is better, Medicare Plan F vs G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more th...

What is a small deductible for Medicare?

Medigap Plan G: A Small Deductible = Big Savings. Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $203 in 2021. In fact, if you have a Plan F that has been in place for years, ...

Why is Medicare Supplement G more expensive than Plan N?

Medicare Supplement G usually costs more than Plan N, because it covers more. People seem to like the security and peace of mind that a comprehensive policy like Plan G seems to offer. Want to know which companies offer the best Medicare Plan G policies. Read our Plan G Reviews here or attend one of our free New to Medicare webinars ...

What is the difference between Medigap Plan G and Plan N?

With Plan N you will be responsible for the Part B deductible as well as excess charges. With Medigap Plan G, you will be responsible for the Part B deductible but you will have no excess charges.

Why is Medicare Plan G so popular?

It is because Medigap Plan G is also a long-term rate saver. Medicare Supplemental Plan G has a lower rate increase trend from year to year than Plan F.

How long does a hospital stay last after Medicare runs out?

It also covers the expensive daily copays that you might encounter for a hospital stay that runs longer than 60 days. It provides an additional 365 days in the hospital after Medicare runs out, and it covers your skilled nursing facility co-insurance, too.

How often does Frank see his doctor?

Frank is a diabetic who has Medicare Supplement Plan G. He sees his primary care doctor once per year, but visits his endocrinologist several times a year to renew his prescriptions. In January, he goes to his first doctor visit for the year.

What is Plan G?

After that, Plan G provides full coverage for all of the gaps in Medicare. It pays for your hospital deductible, copays and coinsurance. It also covers the 20% that Part B doesn’t cover.

What is the deductible for Plan G?

Here’s what you need to know about the High Deductible Plan G: You will pay the other 20% until you satisfy the $2,370 deductible. After the out-of-pocket deductible is met, the plan will pay the same benefits as regular Plan G. The plan does not cover the Part B deductible (just like Plan G) The annual Part B deductible ...

What is Medicare Supplement Plan G?

In this case, Medicare Supplement Plan G is the parent plan if you will. To sum it up, Plan G covers your whole portion of medical benefits that are left over after Original Medicare has paid its portion except for the Part B deductible. Similarly, a High Deductible Plan G provides coverage the same way but only after you reach your annual ...

Does Medicare have a high deductible plan?

For beneficiaries who became eligible for Medicare on or after January 1, 2020, a High Deductible Plan G option will be available. This plan will be like the High Deductible Plan F; however, it will not cover your Part B deductible. As with any new plan, there are looming of questions of how a High Deductible Plan G will stack up against ...

Is Medicare Plan F a semi-exit?

As you may know, Medicare Plan F made a semi-exit in 2020, as did Plan C and High-Deductible Plan F. Many people who have considered getting a high deductible Medicare Supplement are left wondering what their options are now that Plan F and its accompanying high deductible Plan F plan are no longer viable options.

Is Plan F going away?

The part you need to know is that for those who are newly eligible for Medicare on or after January 1, 2020, Plans C and F (including the high deductible option) will no longer be available. BUT don’t get this semi-exit confused with the incessant sound bites that say Plan F is going away for good.

What does Medicare cover?

What you pay for Medicare depends on the type of enrollment you have: Parts A, B, C, and/or D. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. It doesn't generally charge a premium. Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium ...

How much does Medicare pay for a hospital stay in 2021?

Part A also charges coinsurance if your hospital stay lasts more than 60 days. In 2021, for days 61 to 90 of your hospital stay, you pay $371 per day; days 91 through the balance of your lifetime reserve days, you pay $742 per day. 3 Lifetime reserve days are 60 days that Medicare gives you to use if you stay in the hospital for more than 90 days.

What is Medicare Part A 2021?

Medicare Part A Costs in 2021. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. 1 For most people, this is the closest thing to free they’ll get from Medicare, as Medicare Part A (generally) doesn't charge a premium. 2 . Tip: If you don't qualify for Part A, you can buy Part A coverage.

What is the Medicare Advantage premium for 2021?

The average plan premium is about $21.00 a month in 2021. 7 . But coinsurance, copayments, premiums, and deductibles may still vary depending on your plan of choice. 3 .

How much will Medicare cost in 2021?

In 2021, it costs $259 or $471 each month, depending on how long you paid Medicare taxes. 2 . That doesn’t mean you aren’t charged a deductible. For each benefit period, you pay the first $1,484 in 2021. A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days.

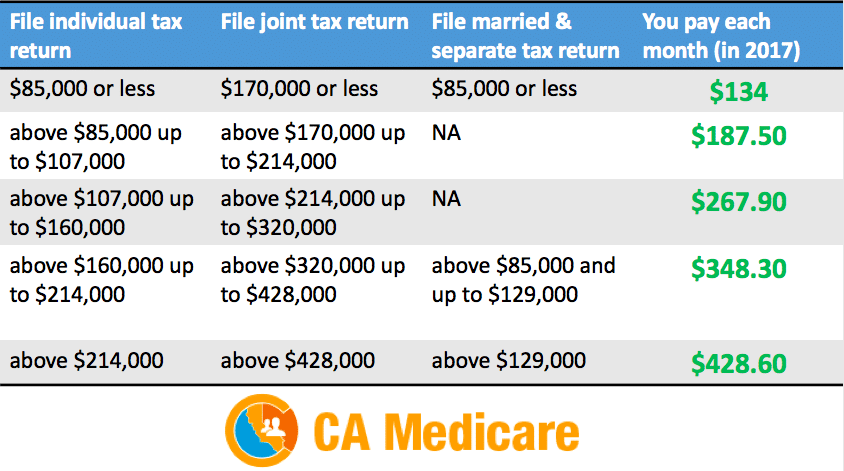

What is the premium for Part B?

Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium of $148.50 in 2021. A small percentage of people will pay more than that amount if reporting income greater than $88,000 as single filers or more than $176,000 as joint filers. 3

How long does a hospital benefit last?

A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days . If you re-enter the hospital the day after your benefit period ends, you’re responsible for the first $1,484 of charges again. 3 .

What is the high deductible plan for Medicare Supplemental?

The high deductible version of Plan F is only available to those who are not new to Medicare before 1/1/2020. High deductible G is available to individuals who are new to Medicare on or after 1/1/2020. People new to Medicare are those who turn 65 on or after January 1, 2020, and those who first become eligible for Medicare benefits due to age, disability or ESRD on or after January 1, 2020.

When is high deductible G available?

High deductible G is available to individuals who are new to Medicare on or after 1/1/2020. People new to Medicare are those who turn 65 on or after January 1, 2020, and those who first become eligible for Medicare benefits due to age, disability or ESRD on or after January 1, 2020.

How to contact Martha Wagley?

Contact: Martha Wagley at 410-786-3778 for actuarial issues or Derrick Claggett at (410) 786-2113 for policy related issues. If you need help regarding enrollment in a Medigap plan please contact your local State Health Insurance Assistance Program (SHIP). Find your local SHIP on Medicare.gov at https://www.medicare.gov/Contacts/#resources/ships. ...

How much is the CPI U increase for 2020?

The increase in the applicable CPI-U from 2019 to 2020 is 1.3%, which results in a deductible of $2,370 after rounding to the nearest $10 in accordance with section 1882 (p) (11) (C) (ii) of the Social Security Act.

How much is the 2021 Plan G deductible?

The deductible is not very high either. In 2021, the Plan G deductible is $203. If you are saving more than $203 in premiums by purchasing Plan G, then it makes sense to pick Plan G over F. You can see why so many people choose this one. Here’s what the Plan G deductible looks like in action.

How much is the Part B deductible for Bob?

Bob goes to the doctor for routine blood work on March 1. In April, he gets a bill from the doctor for $203. That $203 is his Part B deductible. Once he pays that bill, he will not incur any more out-of-pocket costs when he visits the doctor.

What is the financial impact of high deductible plans?

Financial impact of High Deductible Plan Premiums on High Deductible Plans are much lower than their standard deductible counterparts. You may have experienced this with an employer plan prior to joining Medicare. If you chose a high deductible option, your shared cost was much lower.

What is the only high deductible plan for 2021?

In 2021, the only High Deductible plan is the High Deductible Plan F. As we mentioned earlier, Plan F is retiring this year, so Plan G will get a High Deductible Plan to replace it. The best way to explain how the High Deductible G will work is to compare it to the current Plan F option. High Deductible Plan F.

How much is Medicare Part A 2021?

Medicare Part A (hospital) has out of pocket costs. For the year 2021, there is a $1484 deductible and co-payments north of $300 a day for Part A. The out of pocket costs for Part A will go towards the $2,340 deductible for the calendar year.

How much is a 75 year old's premium on a Plan F?

Let’s use a 75-year-old woman under Plan F as an example. For a 75-year-old the average premium is around $3,000 on Plan F. If she bought a High Deductible Plan, her premium drops to around $690. She is saving $2,310 in premium, which is just slightly more than what her deductible would be.

How much is Susan on Plan G?

Susan is on Plan G. Her doctor visits will cost her the Part B deductible of $185. She is charged this amount prior to reaching her $2400 deductible. The $203 will be applied to the deductible. However, if she has already spent the $2,340 deductible on Part A (hospital costs).

What is the difference between a regular plan and a high deductible plan?

The only difference between regular Plan F and High Deductible Plan F is just that – the deductible. With this plan, you must pay Medicare-covered costs such as copayments and coinsurance up to the deductible amount before your plan will pay anything. In 2021, the deductible for High-Deductible Plan F is $2,370.

What is a Medigap Plan G?

Medigap Plan G High Deductible Coverage . The most crucial aspects of the HD Plan G plan are the benefits you will receive and the deductible amount. Your benefits will cover: Part B excess charges. Foreign travel emergency (up to plan limits) Skilled nursing facility care coinsurance.

What is the difference between Plan F and Plan G?

The only difference between Plan F and Plan G is the fact that Plan G does not pay the Part B deductible ($203 in 2021), while Plan F does. Overall, this won’t hurt your pocket. Many seniors find they still find a substantial amount of savings with Plan G, even though they have to pay the Part B deductible. Because Plan F is going away, it’s ...

What is the deductible for a high deductible plan F in 2021?

In 2021, the deductible for High-Deductible Plan F is $2,370. Once you meet the deductible for this plan, you’ll have the exact Plan F coverage as a standard Plan F plan. Because the deductible is so high, you can expect to pay a much lower premium for a High Deductible Plan F plan.

What are the changes to Medicare in 2020?

What are the Medicare Changes in 2020? To provide a quick recap of the events happening in 2020, Medicare Supplement Plan F and Plan C are going away for those who are not eligible for Medicare before January 1, 2020.

What is a skilled nursing facility coinsurance?

Skilled nursing facility care coinsurance. Part A hospice care coinsurance or copayment. The first 3 pints of blood. Part B coinsurance or copayment. Part A coinsurance and hospital costs (up to an additional 365 days after Medicare benefits are used)

How much is HD Plan G 2021?

In 2021, deductible for HD Plan G will be $2,370.

What percentage of Medicare deductible is paid?

After your Part B deductible is met, you typically pay 20 percent of the Medicare-approved amount for most doctor services. This 20 percent is known as your Medicare Part B coinsurance (mentioned in the section above).

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What is a copay in Medicare?

A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays (also called copayments) most often come in the form of a flat-fee and typically kick in after a deductible is met. A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin ...

How much is Medicare coinsurance for days 91?

For hospital and mental health facility stays, the first 60 days require no Medicare coinsurance. Days 91 and beyond come with a $742 per day coinsurance for a total of 60 “lifetime reserve" days.

How much is Medicare Part B deductible for 2021?

The Medicare Part B deductible in 2021 is $203 per year. You must meet this deductible before Medicare pays for any Part B services. Unlike the Part A deductible, Part B only requires you to pay one deductible per year, no matter how often you see the doctor. After your Part B deductible is met, you typically pay 20 percent ...

How much is Medicare Part A 2021?

The Medicare Part A deductible in 2021 is $1,484 per benefit period. You must meet this deductible before Medicare pays for any Part A services in each benefit period. Medicare Part A benefit periods are based on how long you've been discharged from the hospital.

What is Medicare approved amount?

The Medicare-approved amount is the maximum amount that a doctor or other health care provider can be paid by Medicare. Some screenings and other preventive services covered by Part B do not require any Medicare copays or coinsurance.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (. coinsurance.

What do I need to know about Medicare?

What else do I need to know about Original Medicare? 1 You generally pay a set amount for your health care (#N#deductible#N#The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.#N#) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (#N#coinsurance#N#An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).#N#/#N#copayment#N#An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.#N#) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket. 2 You usually pay a monthly premium for Part B. 3 You generally don't need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

What is Medicare Advantage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. .

What is a referral in health care?

referral. A written order from your primary care doctor for you to see a specialist or get certain medical services. In many Health Maintenance Organizations (HMOs), you need to get a referral before you can get medical care from anyone except your primary care doctor.

What is a coinsurance percentage?

Coinsurance is usually a percentage (for example, 20%). An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

Does Medicare cover assignment?

The type of health care you need and how often you need it. Whether you choose to get services or supplies Medicare doesn't cover. If you do, you pay all the costs unless you have other insurance that covers it.

Do you have to choose a primary care doctor for Medicare?

No, in Original Medicare you don't need to choose a. primary care doctor. The doctor you see first for most health problems. He or she makes sure you get the care you need to keep you healthy. He or she also may talk with other doctors and health care providers about your care and refer you to them.