How is Medicare Part A funded?

Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury. These funds can only be used for Medicare. Hospital Insurance (HI) Trust Fund How is it funded? Payroll taxes paid by most employees, employers, and people who are self-employed Other sources, like these: Income taxes paid on Social Security benefits

How does Medicare Part a pay for hospital care?

Aug 06, 2021 · How is Medicare Part A Funded? Your hospital coverage through Part A has funding through the Hospital Insurance trust fund. This trust fund covers inpatient care like hospice, home health care, and skilled nursing facilities. Typically, people pay 2.9% on Medicare taxes from their payroll earnings.

How does the Medicare hospital insurance trust fund get money?

2 ways to find out if Medicare covers what you need. Talk to your doctor or other health care provider about why you need certain services or supplies. Ask if Medicare will cover them. You may need something that's usually covered but your provider thinks that Medicare won't cover it in your situation. If so, you'll have to read and sign a notice.

What is part a of Medicare Part A?

Original Medicare includes Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance). You pay for services as you get them. When you get services, you’ll pay a . deductible [glossary] at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance. If you want drug ...

How is Part A of Medicare funded?

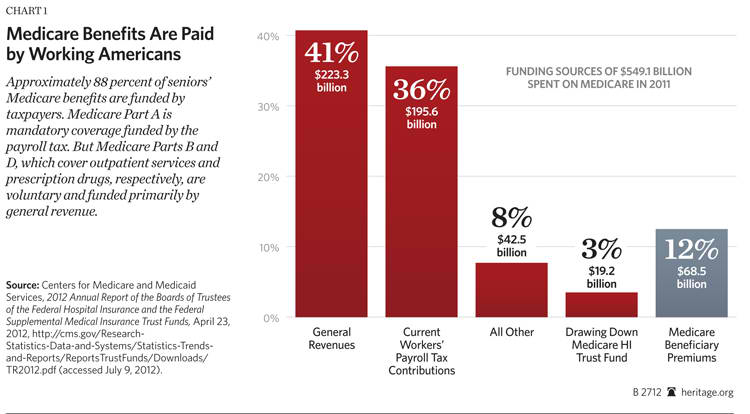

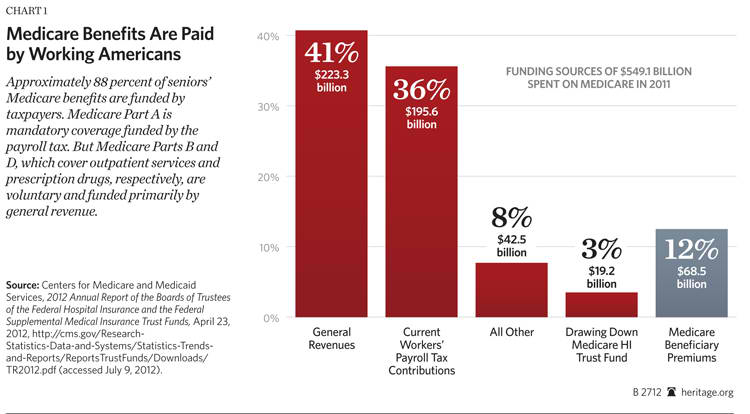

Q: How is Medicare funded? A: Medicare is funded with a combination of payroll taxes, general revenues allocated by Congress, and premiums that people pay while they're enrolled in Medicare. Medicare Part A is funded primarily by payroll taxes (FICA), which end up in the Hospital Insurance Trust Fund.

What is Medicare hospital fund?

The hospital insurance (HI) trust fund, also known as Part A of Medicare, finances health care services related to stays in hospitals, skilled nursing facilities, and hospices for eligible beneficiaries—mainly people over age 65 with a sufficient history of Medicare contributions.

How is Medicare Part A funded quizlet?

Part A Medicare financing financed primarily through payroll taxes. Employees & employers (1.45%), self-employed individuals (2.9%), & beneficiary cost sharing (25%).

What is Part A insurance?

Medicare Part A is hospital insurance. Part A generally covers inpatient hospital stays, skilled nursing care, hospice care, and limited home health-care services. You typically pay a deductible and coinsurance and/or copayments.

Is Medicare federally funded?

Medicare is a federal program. It is basically the same everywhere in the United States and is run by the Centers for Medicare & Medicaid Services, an agency of the federal government.

Is Medicare tax funded?

Medicare is primarily financed through taxation, which includes the imposition of a Medicare levy on taxable income.Jul 12, 2016

What are the 4 parts of Medicare and what do they cover quizlet?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Which service is covered by Medicare Part B quizlet?

Part B helps cover medically-necessary services like doctors' services, outpatient care, durable medical equipment, home health services, and other medical services.

How is Medicaid funded quizlet?

Medicaid is funded thru personal income, corporate and excise taxes. Federal and state support is shared based on the states per capita income. All state Medicaid operations must be approved by the Centers for Medicare and Medicaid services. The Medicaid program reimburses providers directly.

What is meant by the prospective payment system and what part of Medicare does it affect?

A Prospective Payment System (PPS) is a method of reimbursement in which Medicare payment is made based on a predetermined, fixed amount. The payment amount for a particular service is derived based on the classification system of that service (for example, diagnosis-related groups for inpatient hospital services).Dec 1, 2021

What is the difference between Medicare Part A and Part B?

Medicare Part A covers hospital expenses, skilled nursing facilities, hospice and home health care services. Medicare Part B covers outpatient medical care such as doctor visits, x-rays, bloodwork, and routine preventative care. Together, the two parts form Original Medicare.May 7, 2020

What is Medicare Part C called?

Medicare Advantage PlansMedicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

What is benchmark amount for Medicare?

Benchmark amounts vary depending on the region. Benchmark amounts can range from 95% to 115% of Medicare costs. If bids come in higher than benchmark amounts, the enrollees must pay the cost difference in a monthly premium. If bids are lower than benchmark amounts, Medicare and the health plan provide a rebate to enrollees after splitting ...

What are the sources of revenue for Advantage Plans?

Three sources of revenue for Advantage plans include general revenues, Medicare premiums, and payroll taxes. The government sets a pre-determined amount every year to private insurers for each Advantage member. These funds come from both the H.I. and the SMI trust funds.

What is supplementary medical insurance?

The supplementary medical insurance trust fund is what’s responsible for funding Part B, as well as operating the Medicare program itself. Part B helps to cover beneficiaries’ doctors’ visits, routine labs, and preventative care.

What are the sources of Social Security?

Another source of funding for the program comes from: 1 Income taxes on Social Security benefits 2 Premiums associated with Part A 3 Interest accrued on trust fund investments

Does Medicare Supplement pay for premiums?

Many times, seniors who are retired may have their premiums paid by their former employers. The federal government doesn’t contribute financially to Medigap premiums.

Will Medicare stop paying hospital bills?

Of course, this isn’t saying Medicare will halt payments on hospital benefits; more likely, Congress will raise the national debt. Medicare already borrows most of the money it needs to pay for the program. The Medicare program’s spending came to over $600 billion, 15% of the federal budget.

Who is Lindsay Malzone?

https://www.medicarefaq.com/. Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

Is Medicare Advantage the same as Original Medicare?

What's covered? Note. If you're in a Medicare Advantage Plan or other Medicare plan, your plan may have different rules. But, your plan must give you at least the same coverage as Original Medicare. Some services may only be covered in certain settings or for patients with certain conditions.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

How long does Medicare deductible last?

A deductible applies for each benefit period. Your benefit period with Medicare does not end until 60 days after discharge from the hospital or the skilled nursing facility. Therefore, if you are readmitted within those 60 days, you are considered to be in the same benefit period.

What is a skilled nursing facility?

A skilled nursing facility provides medically necessary nursing and/or rehabilitation services. To receive Medicare coverage for care in a skilled nursing facility: A physician must certify that you require daily skilled care that can only be provided as an inpatient in a skilled nursing facility. You must have been an inpatient in a hospital ...

How long does Medicare cover nursing?

Original Medicare measures your coverage for hospital or skilled nursing care in terms of a benefit period. Beginning the day you are admitted into a hospital or skilled nursing facility, the benefit period will end when you go 60 consecutive days without care in a hospital or skilled nursing facility. A deductible applies for each benefit period.

What is Medicare Part A?

Medicare Part A – Hospital Insurance. Medicare Part A, often referred to as hospital insurance, is Medicare coverage for hospital care , skilled nursing facility care, hospice care, and home health services. It is usually available premium-free if you or your spouse paid Medicare taxes for a certain amount of time while you worked, ...

How many days can a skilled nursing facility be covered by Medicare?

The facility must be Medicare-approved to provide skilled nursing care. Coverage is limited to a maximum of 100 days per benefit period, with coinsurance requirements of $164.50 per day in 2017 for Days 21 through 100. Coverage includes: A semiprivate room.

How much does Medicare pay for Grandpa's stay?

Grandpa is admitted to the hospital September 1, 2017. After he pays the deductible of $1,316, Medicare will pay for the cost of his stay for 60 days. If he stays in the hospital beyond 60 days, he will be responsible for paying $329 per day, with Medicare paying the balance.

How much is my grandpa's deductible?

If Grandpa has supplemental insurance, he can submit a claim for the $1,316 deductible and the $329 per day he paid. If he stays longer than 90 days, he may choose to use some of his lifetime reserve days to continue his Medicare coverage.

How is Medicare funded?

Medicare is funded through the Hospital Insurance Trust Fund and the Supplementary Medical Insurance Trust Fund.

Get involved with Medicare

Get involved with Medicare to help us define, design, and deliver care. Join a Technical Expert Panel, comment on proposed rules, and follow Medicare news.

Contact Medicare

How to contact the Centers for Medicare & Medicaid Services (CMS) by phone, TTY, or mail.

Plain writing

Information about CMS's efforts to write content so you can understand.

Information in other languages

Languages include: American Sign Language, Spanish, Chinese, Vietnamese, Korean, Russian, Tagalog, French, Haitian Creole, Italian, Polish, Hindi, Cambodian, Hmong, Laotian, Samoan, Tongan.

Accessibility & Nondiscrimination Notice

Learn about the Centers for Medicare & Medicaid Services' (CMS) accessibility and nondiscrimination policies. Learn how to file a complaint if you believe you've been subjected to discrimination in a CMS program or activity.

How fast will Medicare spending grow?

On a per capita basis, Medicare spending is also projected to grow at a faster rate between 2018 and 2028 (5.1 percent) than between 2010 and 2018 (1.7 percent), and slightly faster than the average annual growth in per capita private health insurance spending over the next 10 years (4.6 percent).

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

Why is Medicare spending so high?

Over the longer term (that is, beyond the next 10 years), both CBO and OACT expect Medicare spending to rise more rapidly than GDP due to a number of factors, including the aging of the population and faster growth in health care costs than growth in the economy on a per capita basis.

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

How is Medicare's solvency measured?

The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years when annual income to the trust fund exceeds benefits spending, the asset level increases, and when annual spending exceeds income, the asset level decreases.

How much will Medicare per capita increase in 2028?

Medicare per capita spending is projected to grow at an average annual rate of 5.1 percent over the next 10 years (2018 to 2028), due to growing Medicare enrollment, increased use of services and intensity of care, and rising health care prices.

What percentage of Medicare is spending?

Key Facts. Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.

What is Medicare Advantage?

Medicare Advantage (Medicare Part C) is an alternative way to get your benefits under Original Medicare (Part A and Part B). By law, Medicare Advantage plans must cover everything that is covered under Original Medicare, except for hospice care, which is still covered by Original Medicare Part A.

What does the trust fund pay for?

The money in this trust fund pays for Part A expenses such as inpatient hospital care, skilled nursing facility care, and hospice.

Can I enroll in a zero premium Medicare Advantage plan?

You may be able to enroll in a zero-premium Medicare Advantage plan (although, remember, you still have to pay your regular Part B premium) and you may have other costs, such as copayments and coinsurance.

Does Medicare Advantage charge a monthly premium?

In addition to the Part B premium, which you must continue to pay when you enroll in Medicare Advantage, some Medicare Advantage plans also charge a separate monthly premium.

Does Medicare Advantage have a lower cost?

In return, however, Medicare Advantage plans tend to have lower out-of-pocket costs than Original Medicare, and unlike Original Medicare, Medicare Advantage plans also have annual limits on what you have to pay out-of-pocket before the plan covers all your costs.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).