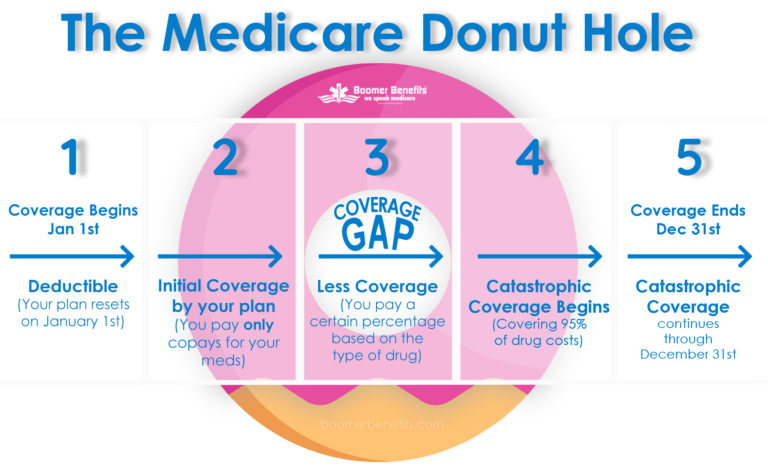

If the combined amount you and your drug plan pay for prescription drugs reaches a certain level during the year—that limit is $4,130 in 2021—you enter the Part D coverage gap or “donut hole.” Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs.

What does the donut hole mean with Medicare?

· By 2020, the coverage gap will be closed, meaning there will be no more “donut hole,” and you will only pay 25% of the costs of your drugs until you reach the yearly out-of-pocket spending limit. Throughout this time, you will get continuous Medicare Part D coverage for your prescription drugs as long as you are on a prescription drug plan.

Can you avoid falling into the Medicare Donut Hole?

· Understanding How the Medicare Part D Donut Hole Works Once you fall into the Medicare donut hole, you’ll usually have to pay a certain percentage of your prescription drug cost. For 2019, this cost was 25% for every brand name prescription and 37% for every generic prescription. The costs couldn’t exceed these percentages. While you’re in the donut hole, you’ll …

Is there still a donut hole in Medicare?

· After you reach a total of $4,430, you enter the Coverage Gap stage, also known as the Donut Hole. 3 The Donut Hole (Coverage Gap Stage) While in this stage, you are responsible for: 25%* of the cost of generic (non-brand name) Part D medications. Tufts Health Plan pays the remaining 75% of the cost. 25% of the cost of Part D brand name medications.

How do you explain the donut hole?

· Out-of-pocket threshold (also known as the coverage gap or donut hole: Not everyone will reach this phase; it begins if you and your plan spend a combined $4,020 in 2020 as described above. While in the coverage gap, you’ll typically pay up to 25% of the plan’s cost for both covered brand-name drugs and generic drugs in 2020.

How is the donut hole calculated?

In the donut hole, a person pays for 25% of their medication costs out-of-pocket and receives discounts from drug manufacturers to cover the remaining costs. The insurance company will add up what a person has paid out-of-pocket for medications in the donut hole.

How does the donut hole work in 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

Does the Medicare donut hole reset each year?

Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your 2021 Donut Hole or Coverage Gap ends on December 31, 2021 (at midnight) along with your 2021 Medicare Part D plan coverage.

How does Medicare explain the donut hole?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs.

Can I avoid the donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

What is the Medicare donut hole for 2022?

$4,430In 2022, you'll enter the donut hole when your spending + your plan's spending reaches $4,430. And you leave the donut hole — and enter the catastrophic coverage level — when your spending + manufacturer discounts reach $7,050. Both of these amounts are higher than they were in 2021, and generally increase each year.

Does donut hole go away in 2020?

The donut hole closed for all drugs in 2020, meaning that when you enter the coverage gap you will be responsible for 25% of the cost of your drugs. In the past, you were responsible for a higher percentage of the cost of your drugs.

Is the donut hole going away in 2022?

In 2022, the coverage gap ends once you have spent $7,050 in total out-of-pocket drug costs. Once you've reached that amount, you'll pay the greater of $3.95 or 5% coinsurance for generic drugs, and the greater of $9.85 or 5% coinsurance for all other drugs. There is no upper limit in this stage.

How long do you stay in the donut hole?

When does the Medicare Donut Hole End? The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year.

Do Medicare Advantage plans cover the donut hole?

Some people ask: Do Medicare Advantage plans cover the donut hole? If you choose to include Medicare prescription drug coverage in your Medicare Advantage plan, it will still have a donut hole just like a regular Part D plan. Medicare Advantage does not cover any additional Part D costs during the coverage gap.

Why does Medicare Part D have a donut hole?

Why is there a donut hole in Medicare Part D? The donut hole was created to incentivize people to use generic drugs. Thus, keeping beneficiary costs low and reducing Medicare expenses on the program level.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What Is The Coverage Gap (“Donut Hole”), and When Does It Start?

For those who are new to the coverage gap, or “donut hole,” learning about the different Medicare Part D coverage phases is a good place to start....

What Costs Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Once you’ve entered the coverage gap (“donut hole”), it’s important to understand which out-of-pocket costs count towards helping you reach the cat...

What Costs Don’T Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Not all out-of-pocket costs count towards reaching catastrophic coverage. The following costs don’t count towards getting you out of the coverage g...

How Do I Avoid The Medicare Part D Coverage Gap (“Donut Hole”)?

Now that you know about the coverage gap (“donut hole”), here is some good news: 1. Many Medicare beneficiaries won’t have to pay the increased pri...

What If I Have Questions About The Coverage Gap (“Donut Hole”)?

If you have questions about how the coverage gap works and how to avoid it, I can help. A licensed insurance agent such as myself can help you comp...

What is the donut hole in Medicare?

The donut hole is a stage in Part D’s coverage plan that can temporarily limit what medications the plan will and won’t cover.

How much is the donut hole?

If you and your plan exceed a certain cap in a calendar year, you’ll enter the donut hole. This amount is $4,020 for 2020, and there are a few things that count toward it.

How much does Medicare pay for prescription drugs?

Once you fall into the Medicare donut hole, you’ll usually have to pay a certain percentage of your prescription drug cost. For 2019, this cost was 25% for every brand name prescription and 37% for every generic prescription.

Is there a donut hole every year?

Every year, you’ll enter this donut hole at a different dollar amount. The Affordable Care Act implemented yearly changes in the dollar threshold for the cost-sharing amount and the Medicare donut hole.

Can you get out of the Medicare donut hole?

It is possible to get out of the Medicare donut hole. Once you spend a set amount of money out of your pocket, you’ll reach a benefit stage called catastrophic coverage.

Does Medicare cover donut holes?

No. Not every Medicare beneficiary enters the donut hole stage in their Part D coverage. This donut hole starts after your Medicare Prescription Drug Plan and you have spent a specific amount for your prescription drugs in a calendar year.

What is a donut hole?

What is the Donut Hole? The Medicare Part D Donut Hole, or Coverage Gap, is one of four stages you may encounter during the year while a member of a Part D prescription drug plan. Specifically, the Donut Hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached ...

How much does it cost to get into catastrophic coverage?

While in Catastrophic Coverage you will pay the greater of: 5% of the total cost of the drug or $3.70 for generic drugs and $9.20 for brand- name drugs. You will remain in the Catastrophic Coverage Stage until January 1.

How to contact Medicare for copays?

If you qualify, you may receive help paying for your monthly premium and prescription drug copays. For more information, contact Medicare at 1-800-633-4227 (TTY 1-877-486-2048), the Social Security Office at 1-800-772-1213 (TTY 1-800-325-0778), or the Office of Medicaid Commonwealth of Massachusetts at 1-617-573-1770.

What tiers are deductibles?

The deductible counts toward any combination of drugs on Tiers 3, 4, and 5. You will not pay a separate deductible for each tier. After you pay the deductible, you will pay only your copay for Tier 3, 4, and 5 drugs.

What percentage of Tufts pays for Part D?

25%* of the cost of generic (non-brand name) Part D medications. Tufts Health Plan pays the remaining 75% of the cost.

Does Tufts Medicare have a Part D deductible?

All other plans do not have a Part D deductible. If you are a member of Tufts Medicare Preferred HMO Value Rx, Basic Rx, or Saver Rx plan: There is no deductible for drugs on Tier 1 and Tier 2. The is a deductible for drugs on Tier 3, Tier 4, and/or Tier 5.

What is the Medicare donut hole?

Back to the visual donut image. Picture a donut with a hole in the middle. Maybe it’s an old fashioned style, chocolate glazed, vanilla frosted with sprinkles, apple cider or any other flavor of your choice. Now that we’ve got your attention, let’s continue.

What is the Medicare donut hole for 2021?

The Medicare donut hole for 2021 starts once you hit $4,130 in out-of-pocket prescription drug costs, and it extends to $6,550. If your prescription drug spending reaches $6,550 in 2021, you’ll have catastrophic coverage for the rest of the year.

Did the Medicare donut hole go away in 2020?

No. The Medicare donut hole still exists. However, starting in 2020, instead of being responsible for 37% of the cost of generic prescription drugs and 25% of the cost of brand name prescription drugs while in the donut hole (as was the case in 2019), Medicare beneficiaries only pay 25% for both brand name and generic drugs.

Can I avoid the Medicare donut hole?

The only way to avoid the Medicare donut hole is to prevent your out-of-pocket expenses for prescription drugs from reaching $4,130 in 2021. Once you hit that amount, you enter the Medicare coverage gap.

Do Medicare Advantage plans cover the Medicare donut hole?

Some Medicare Advantage plans may offer extended gap coverage for enrollees in the Medicare donut hole, though you should check with your specific plan for more details.

Initial coverage limit

You enter the donut hole after you surpass the initial coverage limit of your Part D plan. The initial coverage limit includes the total (retail) cost of drugs — what both you and your plan pay for your prescriptions.

OOP threshold

This is the amount of OOP money that you have to spend before you exit the donut hole.

Extra Help considerations

Some people enrolled in Medicare qualify for the Medicare Extra Help program based on their income. This program helps people pay for their prescription drug costs.

Generic drugs

For generic drugs, only the amount you actually pay counts toward your OOP threshold. For example:

Brand-name drugs

For brand-name drugs, 95 percent of the total medication price will count towards reaching the OOP threshold. This includes the 25 percent that you pay OOP plus a manufacturer discount.

What happens after I exit the donut hole?

After you exit the donut hole, you’ll receive what’s called catastrophic coverage. This means that you’ll have to pay whatever is greater for the rest of the year: Five percent of a drug’s cost or a small copay.

1. Consider switching to generic drugs

These are often less expensive than brand-name drugs. If you’re taking a brand-name drug, ask your doctor about generic drugs.

What is the deductible for Medicare 2021?

The 2021 standard deductible is $445. Choose the your coverage start month - usually January: *. January February March April May June July August September October November December. Most plans start in January. If you are just turning 65 or a Medicaid recipient, your plan may start in a month other than January.

Can you enter your monthly premium into the total?

You can enter your monthly premium, to have it calculated into the total.

Is 100% of prescriptions deductible?

You are responsible for 100% of your prescription (Rx) costs. This occurs during the Initial Deductible Phase of coverage. (Many plans do not have an initial deductible.) It also occurred in the Coverage Gap (Donut Hole) unless your plan has Donut Hole coverage. $$.

What is the gap in Medicare?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , coinsurance, and copayments. The discount you get on brand-name drugs in the coverage gap. What you pay in the coverage gap.

What to do if you don't get a discount on a prescription?

If you think you've reached the coverage gap and you don't get a discount when you pay for your brand-name prescription, review your next " Explanation of Benefits" (EOB). If the discount doesn't appear on the EOB, contact your drug plan to make sure that your prescription records are correct and up-to-date.

What is the coverage gap for Medicare?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,130 on ...

How much does Medicare pay for generic drugs?

Generic drugs. Medicare will pay 75% of the price for generic drugs during the coverage gap. You'll pay the remaining 25% of the price. The coverage for generic drugs works differently from the discount for brand-name drugs. For generic drugs, only the amount you pay will count toward getting you out of the coverage gap.

How much will Medicare cover in 2021?

Once you and your plan have spent $4,130 on covered drugs in 2021, you're in the coverage gap. This amount may change each year. Also, people with Medicare who get Extra Help paying Part D costs won’t enter the coverage gap.

What to do if your drug plan doesn't agree with your discount?

If your drug plan doesn't agree that you're owed a discount, you can file an appeal.