How does Medicare work when you have other health insurance?

- Having two insurance plans is a good idea to make sure you are covered for all the care that you need. ...

- If you leave your employer's health insurance plan when you are eligible for Medicare, it is unlikely that you can get back on the plan.

- If you are retired and want health insurance, you can sign up for Medicare. ...

How does Medicare work with my current employer insurance?

- You will always have the choice of keeping your employer health insurance when you are eligible for Medicare if you work for a large company

- Depending on the size of your company, Medicare may be your primary or secondary insurance

- Medicare also works with COBRA, TRICARE, VA benefits, and HRAs

How to deal with Medicare as a secondary insurance?

- Vision: Your medical plan will not cover you for vision care. ...

- Dental: A dental plan can cover you for preventive care such as routine teeth cleanings and some X-rays. ...

- Disability: Short- and long-term disability plans are a type of secondary insurance coverage. ...

How does Medicare work and what it covers?

Medicare also may cover:

- A medical social worker

- Dietary counseling if indicated

- Medical equipment and devices you use during your hospital stay

- Ambulance transportation to and from the facility

Can I have Medicare and private insurance at the same time?

It is possible to have both private insurance and Medicare at the same time. When you have both, a process called “coordination of benefits” determines which insurance provider pays first. This provider is called the primary payer.

What is the best insurance to have along with Medicare?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCMS ratingBlue Cross Blue Shield5.03.8Cigna4.53.8United Healthcare4.03.8Aetna3.53.61 more row•Jun 8, 2022

When Can Medicare be a secondary payer?

Medicare may be the secondary payer when: a person has a GHP through their own or a spouse's employment, and the employer has more than 20 employees. a person is disabled and covered by a GHP through an employer with more than 100 employees.

Will Medicare pay my primary insurance deductible?

“Medicare pays secondary to other insurance (including paying in the deductible) in situations where the other insurance is primary to Medicare.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What will Medicare not pay for?

Generally, Original Medicare does not cover dental work and routine vision or hearing care. Original Medicare won't pay for routine dental care, visits, cleanings, fillings dentures or most tooth extractions. The same holds true for routine vision checks. Eyeglasses and contact lenses aren't generally covered.

Is it better to have Medicare as primary or secondary?

Medicare is always primary if it's your only form of coverage. When you introduce another form of coverage into the picture, there's predetermined coordination of benefits. The coordination of benefits will determine what form of coverage is primary and what form of coverage is secondary.

Does Medicare pay first or second?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

Does Medicare automatically send claims to secondary insurance?

Medicare will send the secondary claims automatically if the secondary insurance information is on the claim. As of now, we have to submit to primary and once the payments are received than we submit the secondary.

Is it beneficial to have dual medical coverage?

Having access to two health plans can be good when making health care claims. Having two health plans can increase how much coverage you get. You can save money on your health care costs through what's known as the "coordination of benefits" provision.

How do deductibles work with two insurances?

If you have multiple health insurance policies, you'll have to pay any applicable premiums and deductibles for both plans. Your secondary insurance won't pay toward your primary's deductible. You may also owe other cost sharing or out-of-pocket costs, such as copayments or coinsurance.

How does secondary insurance work with deductibles?

Usually, secondary insurance pays some or all of the costs left after the primary insurer has paid (e.g., deductibles, copayments, coinsurances). For example, if Original Medicare is your primary insurance, your secondary insurance may pay for some or all of the 20% coinsurance for Part B-covered services.

How does Original Medicare work?

Original Medicare covers most, but not all of the costs for approved health care services and supplies. After you meet your deductible, you pay your share of costs for services and supplies as you get them.

How does Medicare Advantage work?

Medicare Advantage bundles your Part A, Part B, and usually Part D coverage into one plan. Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services.

How does Medicare work?

Here's how Medicare payments work if your employer covers you: 1 If you work for a company with fewer than 20 employees, Medicare is usually considered primary and your employer is secondary. 2 If you work for a larger company, your employer is primary and Medicare is secondary. 3 If Medicare is the secondary payer, it will reimburse based on what the employer paid, what is allowed in Medicare and what the doctor or provider charged. You will then have to pay what's left over.

How does Medicare work if you work for a company?

Here's how Medicare payments work if your employer covers you: If you work for a company with fewer than 20 employees, Medicare is usually considered primary and your employer is secondary. If you work for a larger company, your employer is primary and Medicare is secondary.

What happens if you don't sign up for Part B?

If you don't sign up for Part B, you will lose TRICARE coverage. TRICARE FOR LIFE (TFL) is what TRICARE-eligible individuals have if they carry Medicare Part A and B. TFL benefits include covering Medicare's deductible and coinsurance. The exception is if you need medical attention while overseas, then TFL is primary.

What is Cobra insurance?

COBRA. COBRA lets you keep your employer group health insurance plan for a limited time after your employment ends. This continuation coverage is meant to protect you from losing your health insurance immediately after you lose a job. If you're on Medicare, Medicare pays first and COBRA is secondary.

How to decide if you have dual health insurance?

When deciding whether to have dual health insurance plans, you should run the numbers to see whether paying for two plans would be more than offset by having two insurance plans paying for medical care. If you have further questions about Medicare and COB, call Medicare at 855-798-2627.

Does Medicare cover VA?

Medicare doesn't cover services within the VA. Unlike the other scenarios on this page, there is no primary or secondary payer when it comes to VA vs. Medicare. Having both coverage gives veterans the option to get care from either VA or civilian doctors depending on the situation.

Does Medicare pay a doctor if they are owed money?

The rest is on you if the doctor is still owed money. If Medicare is the secondary payer and the primary insurer doesn't pay swiftly enough, Medicare will make conditional payments to a provider when "there is evidence that the primary plan does not pay promptly.".

Medicare Pays First When It Serves As Your Primary Payer

If you have Medicare as well as another type of insurance, your coverage is provided through a coordination of benefits. In some situations, Medicare will serve as your primary payer, which means Medicare pays first. Your other insurance coverage will then serve as your secondary payer.

Medicare Secondary Claim Development Questionnaire

The Medicare Secondary Claim Development Questionnaire is sent to obtain information about other insurers that may pay before Medicare. When you return the questionnaire in a timely manner, you help ensure correct payment of your Medicare claims.

Does Medicare Work Together With Medicaid

Yes, but Medicaid will always pay as the payer of last resort. This means if you have Medicare and Medicaid, Medicare will pay as primary and Medicaid as secondary. If you have Medicare, another insurance, and Medicaid, Medicaid will only pay after Medicare and the other insurance company have processed the claim.

Employer Or Military Retiree Coverage

If you or your spouse has an Employer Group Health Plan as retiree health coverage from an employer or the military , you may not need additional insurance. Review the EGHPs costs and benefits and contact your employer benefits representative or SHIIP to learn how your coverage works with Medicare.

How Does Medicare Work With My Other Health Insurance Coverage

Medicare works in tandem with your other health insurance coverage. The two tag team. One insurance plan becomes the primary payer or the one that pays costs first. The other insurance becomes the secondary payer and pays the remaining costs.

Is Medicare A Primary Or Secondary Payer

Medicare can be either a primary or secondary payer, depending on what other insurance you have and the situation involved in the claim. For those who have Medicare, here are some of the situations when Medicare might be the secondary payer:

Which Is Better For Those With Dependents

Typically, private insurance is a better option for people with dependents. While Medicare plans offer coverage only to individuals, private insurers usually allow people to extend health coverage to dependents, including children and spouses.

What do I need to know about Medicare?

What else do I need to know about Original Medicare? 1 You generally pay a set amount for your health care (#N#deductible#N#The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.#N#) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (#N#coinsurance#N#An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).#N#/#N#copayment#N#An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.#N#) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket. 2 You usually pay a monthly premium for Part B. 3 You generally don't need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

What is Medicare Advantage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. .

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (. coinsurance.

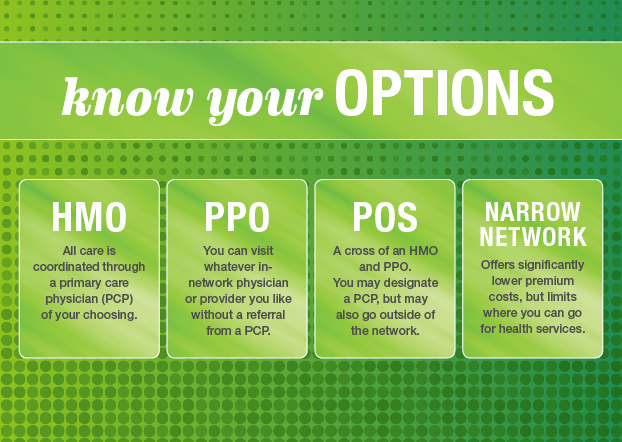

What is a referral in health care?

referral. A written order from your primary care doctor for you to see a specialist or get certain medical services. In many Health Maintenance Organizations (HMOs), you need to get a referral before you can get medical care from anyone except your primary care doctor.

What is a coinsurance percentage?

Coinsurance is usually a percentage (for example, 20%). An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

Does Medicare cover assignment?

The type of health care you need and how often you need it. Whether you choose to get services or supplies Medicare doesn't cover. If you do, you pay all the costs unless you have other insurance that covers it.

Do you have to choose a primary care doctor for Medicare?

No, in Original Medicare you don't need to choose a. primary care doctor. The doctor you see first for most health problems. He or she makes sure you get the care you need to keep you healthy. He or she also may talk with other doctors and health care providers about your care and refer you to them.

Who is eligible for Medicare?

Typically, anyone age 65 or older is eligible for Medicare. Younger people may also be eligible for Medicare if they have disabilities, end-stage renal disease, or amyotrophic lateral sclerosis (ALS, or Lou Gehrig’s disease).

Can you use Medicare while you are working?

You can, but you don’t have to. Your initial Medicare enrollment period begins 3 months before your 65th birthday and lasts for 7 months, but you can enroll after that period ends if you have an employer-sponsored plan. Just be sure to inform Medicare of your other coverage in order to avoid owing a Part B late-enrollment penalty.

How do you know if Medicare is primary or secondary?

Medicare and your other insurance plans coordinate their benefits to avoid duplicate payments. If Medicare is your primary payer, it will pay first and your private plan will kick in to cover some or all of the costs not covered by Medicare. If Medicare is secondary, the opposite will occur.

How to get the most out of your combination of health insurance plans

To make the most of the health insurance plans for which you’re eligible, you’ll need to understand the rules and the costs of the plans. Typically, it makes sense to enroll in Medicare Part A (hospital insurance) when you’re eligible, since many enrollees pay zero in premiums.

Take our quiz

Navigating Medicare can be challenging, especially since different types of coverage won’t necessarily cover all of your expenses. Choosing to purchase additional coverage may help. Find out which supplemental coverage option is best for you, Medicare Advantage or Original Medicare with Medigap.

The bottom line

Sorting out how Medicare works with other types of insurance can feel overwhelming, but to make the most of what’s available to you, understanding how your policies work together is key.

What is Medicare program?

A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs , like premiums, deductibles, and coinsurance. with your prescription drug costs. If you don't join a plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

What is a copayment for Medicare?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. for each drug. If you don't join a drug plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

What type of insurance is considered creditable?

The types of insurance listed below are all considered. creditable prescription drug coverage. Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage .

What is employer or union health coverage?

Employer or union health coverage. This is health coverage from your, your spouse’s, or other family member’s current or former employer or union. If you have drug coverage based on your current or previous employment, your employer or union will notify you each year to let you know if your drug coverage is creditable.

Do you have to have a Medicare drug plan to get tricare?

Most people with TRICARE entitled to Part A must have Part B to keep TRICARE drug benefits. If you have TRICARE, you don’t need to join a Medicare drug plan.

Can you keep a medicaid policy?

Medigap policies can no longer be sold with prescription drug coverage, but if you have drug coverage under a current Medigap policy, you can keep it. If you join a Medicare drug plan, your Medigap insurance company must remove the prescription drug coverage under your Medigap policy and adjust your premiums.

Can you join a Medicare plan without a penalty?

, you'll have a special enrollment period to join a Medicare drug plan without a penalty when COBRA ends.