Applying for Medicare Part D with Medicare’s plan finder

- Go to the Medicare Plan Finder page: Create an account if you'll want to save your search and come back to it later.

- Enter your information: Select "Drug Plan (Part D). Then enter your zip code and answer any other questions that pop up.

- Enter all your drugs, dosages, and frequencies just as you listed them:...

Full Answer

How do you sign up for Medicare Part D?

- Initial enrollment period: during the 7 months when first becoming eligible.

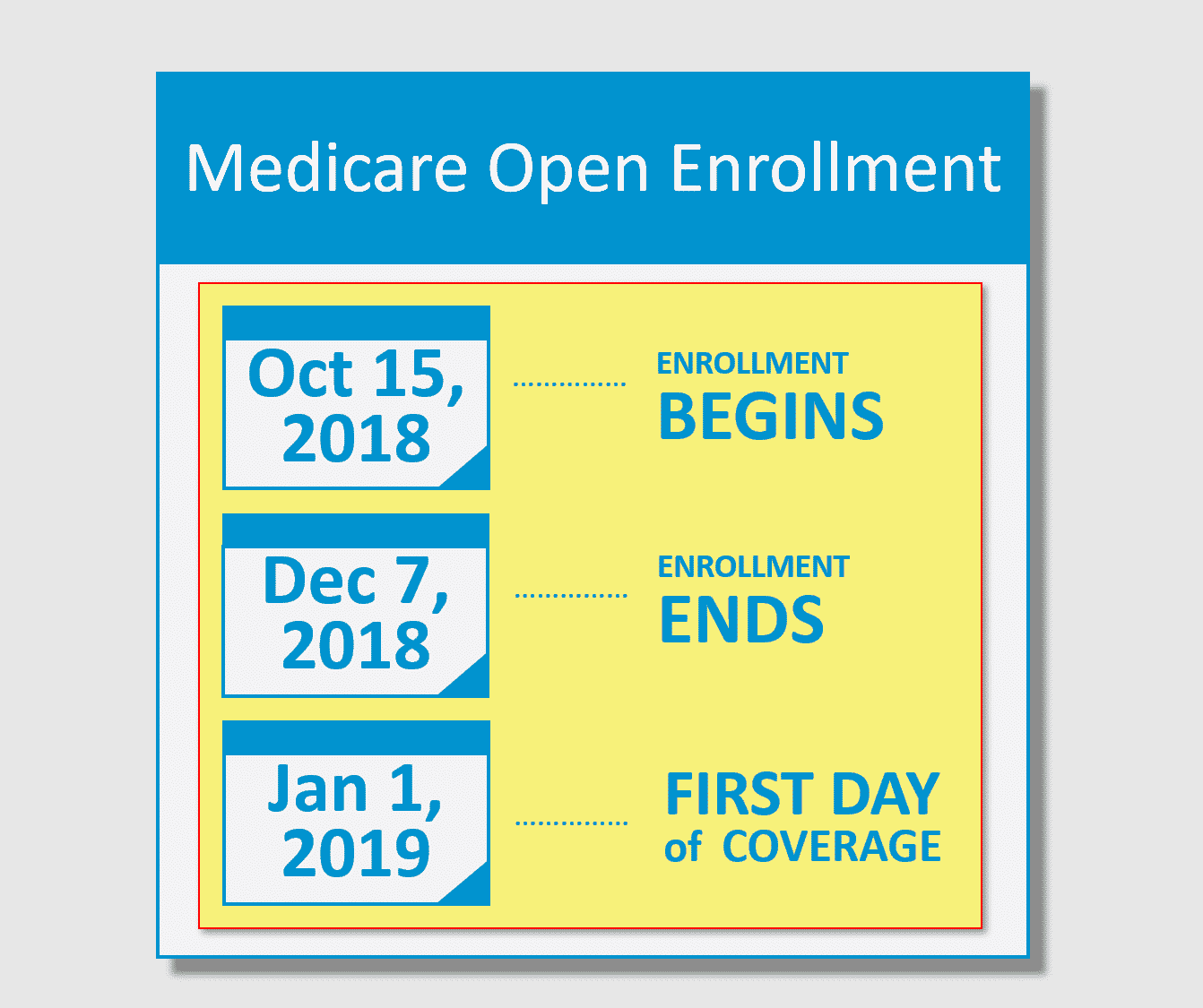

- Annual open enrollment season: every October 15th through December 7th.

- Medicare Advantage Disenrollment period: from January 1st through February 14th, if you have an MAPD plan you can drop it and get a stand-alone Part D policy, also returning you ...

What are the requirements for Medicare Part D?

- Prior to the individual’s initial period of entitlement for Medicare Part D

- Prior to the effective date of the individual’s enrollment in the employer’s prescription drug plan

- Upon any change in the employer’s prescription drug coverage as creditable or non-creditable

- Annually, on or before October 15 of each year

- Upon an individual’s request.

Should you get Medicare Part D?

When you buy Part D, you are not buying it just for the meds you are using now. You are buying insurance coverage for future drug needs. Part D has a catastrophic coverage limit, and it is the best part of the coverage. It protects Medicare beneficiaries from massive drug spending in any given calendar year.

When to enroll in Part D?

You can enroll in Medicare Part D during any of these times:

- Initial Enrollment Period

- Annual Election Period

- Medicare Advantage Open Enrollment Period

- Five Star Special Enrollment Period

- Special Enrollment Period

Can you add Medicare Part D at any time?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

Can I enroll in Medicare Part D online?

Online at www.medicare.gov. If you use the plan finder program to compare Part D or Medicare Advantage plans, you can enroll in the one of your choice by clicking on the “Enroll” button shown alongside the plan's name. You will be required to fill out an application form.

When can I add Part D to my Medicare coverage?

The first opportunity for Medicare Part D enrollment is when you're initially eligible for Medicare – during the seven-month period beginning three months before the month you turn 65. If you enroll prior to the month you turn 65, your prescription drug coverage will begin the first of the month you turn 65.

How do I submit Medicare Part D?

Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

Is it worth getting Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

Can you change Part D plans in the middle of the year?

You may qualify for a special enrollment period to change your Part D plan in certain situations at other times during the year: If you receive financial assistance from the Part D Extra Help program, you can change Part D plans as often as once each calendar quarter during the first three quarters of the year.

How do I choose a Part D plan?

Before you enroll in a Part D prescription drug plan, find out which plans are available in your area and whether they cover your prescriptions. Compare their overall cost and look for a plan that: Features the lowest overall cost.

Do I need Medicare Part D if I don't take any drugs?

No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D.

What are the 4 phases of Medicare Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

How to enroll in Medicare?

Enroll on the Medicare Plan Finder or on the plan's website. Complete a paper enrollment form. Call the plan. Call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. When you join a Medicare drug plan, you'll give your Medicare Number and the date your Part A and/or Part B coverage started.

What are the different types of Medicare plans?

You can only join a separate Medicare drug plan without losing your current health coverage when you’re in a: 1 Private Fee-for-Service Plan 2 Medical Savings Account Plan 3 Cost Plan 4 Certain employer-sponsored Medicare health plans

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What happens if you don't get prescription drug coverage?

If you decide not to get it when you’re first eligible, and you don’t have other creditable prescription drug coverage (like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later.

What is a PACE plan?

Programs of All-inclusive Care for the Elderly (PACE) organizations are special types of Medicare health plans. PACE plans can be offered by public or private companies and provide Part D and other benefits in addition to Part A and Part B benefits. with drug coverage.

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or other. Medicare Health Plan. Generally, a plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits to people with Medicare who enroll in the plan.

Do you have to have Part A and Part B to get Medicare?

You get all of your Part A, Part B, and drug coverage, through these plans. Remember, you must have Part A and Part B to join a Medicare Advantage Plan , and not all of these plans offer drug coverage. Visit Medicare.gov/plan-compare to get specific Medicare drug plan and Medicare Advantage Plan costs, and call the plans you’re interested in ...

What do you need to know before enrolling in a Part D plan?

The most important preparation you can do before finding a Part D plan is recording information about your medications.

How does dosage affect Part D?

Your dosage can affect your final cost or enact certain plan restrictions depending on the Part D plan. The frequency of the medication. The number of pills you take also affects the cost, so double check how often you take your medication and write it down. Once you have these recorded, you’ll be able to compare plans, apples-to-apples.

When is the best time to sign up for Part D?

If you don’t have creditable drug coverage or health insurance from a current employer, the best time to sign up for Part D is during your 7-month initial enrollment period (IEP) to avoid penalties. Under your IEP, you have a 7-month window that opens 3 months before you turn 65 and closes at the end of the 3rd month following your birthday month.

Is Medicare Part D a good program?

Although Medicare is not without its faults, one thing is clear: Medicare Part D has been a successful program. With nearly 70% of all beneficiaries enrolled in Part D, this optional add-on to Original Medicare is a popular way to lower drug costs. 1. But before diving into the deep end of Part D plans, you’ll want to perform due diligence ...

Medicare Part D provides prescription drug coverage, something that was missing from Original Medicare

One of the main frustrations with Original Medicare is that it doesn’t offer any prescription drug coverage. Although Medicare health insurance plans offer a lot of coverage, there is no way to get prescription drug coverage through your main Medicare plans.

What is Medicare Part D: How does it work?

Part D offers Medicare prescription drug coverage. Importantly, these plans are offered by private insurance companies, not the federal government. This means that unlike Part A and Part B, there is a variety to the coverage: not every plan is the same.

Enrolling in Part D: The Initial Enrollment Period

Three months before you turn 65, you will enter the Initial Enrollment Period (IEP). During this seven-month period, you will be able to enroll in Medicare Part A, as well as Medicare Part B and Part D without any late penalties.

Enrolling During the Annual Enrollment Period

The Annual Enrollment Period (AEP) lasts from October 15th to December 7th each year. During this time, you’ll be able to enroll in a Part D plan, but you may have to pay the late penalty if you’re enrolling late. When you sign up during the Annual Enrollment Period, your coverage will begin on January 1st of the following year.

Understanding the Part D Late Enrollment Penalty

If you enroll in a Part D plan after your Initial Enrollment Period, you may have to pay a late fee. This penalty is an additional monthly fee that you pay along with your premium each month. It is not a one-time fee; you'll owe this extra charge the entire time you have Medicare.

How to Avoid the Late Enrollment Penalty

Avoiding the late enrollment penalty is simple - just maintain prescription drug coverage (not a discount program).

Extra Help for Part D

Extra Help is a program for low-income Medicare beneficiaries that helps pay your Part D premiums, deductibles, coinsurance, and other out-of-pocket prescription drug costs.

When can I join a health or drug plan?

Find out when you can sign up for or change your Medicare coverage. This includes your Medicare Advantage Plan (Part C) or Medicare drug coverage (Part D).

Types of Medicare health plans

Medicare Advantage, Medicare Savings Accounts, Cost Plans, demonstration/pilot programs, and Programs of All-inclusive Care for the Elderly (PACE).

How long does it take to enroll in Part D?

This includes three months prior to your 65th birthday, the month of your birthday and then three months after your 65th birthday. Failing to enroll within this time period, also known as the initial enrollment period, means that you may face a late enrollment penalty if you choose to add Part D coverage at a later date.

Why is Medicare important?

Enrolling in Medicare is an important step for many people in protecting their health and their finances as they age. The Medicare program assists millions of seniors and certain individuals with qualifying disabilities, and without Medicare, some Americans would struggle to afford the cost of healthcare and related expenses.

Medicare Advantage (Part C)

You pay for services as you get them. When you get a covered service, Medicare pays part of the cost and you pay your share.

You can add

You join a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage.

Most plans include

Some extra benefits (that Original Medicare doesn’t cover – like vision, hearing, and dental services)

Medicare drug coverage (Part D)

If you chose Original Medicare and want to add drug coverage, you can join a separate Medicare drug plan. Medicare drug coverage is optional. It’s available to everyone with Medicare.

Medicare Supplement Insurance (Medigap)

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare.

Medicare Eligibility, Applications, and Appeals

Find information about Medicare, how to apply, report fraud and complaints.

Voluntary Termination of Medicare Part B

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 ( PDF, Download Adobe Reader) to the Social Security Administration (SSA). Visit or call the SSA ( 1-800-772-1213) to get this form.

Medicare Prescription Drug Coverage (Part D)

Part D of Medicare is an insurance coverage plan for prescription medication. Learn about the costs for Medicare drug coverage.

Replace Your Medicare Card

You can replace your Medicare card in one of the following ways if it was lost, stolen, or destroyed:

Medicare Coverage Outside the United States

Medicare coverage outside the United States is limited. Learn about coverage if you live or are traveling outside the United States.

Do you have a question?

Ask a real person any government-related question for free. They'll get you the answer or let you know where to find it.