You're exempt from paying the Medicare Levy if: You are a foreign resident for tax purposes You are not entitled to Medicare benefits You earn under the lower threshold of $22,801

Full Answer

Who is exempt from the Medicare levy?

Medicare levy exemption You may qualify for an exemption from paying the Medicare levy if you were in any of the following three exemption categories at any time in the financial year: meet certain medical requirements are a foreign resident

What is a HIC number for Medicare?

September 23, 2014. A HIC number (HICN) is a Medicare beneficiary’s identification number. Also, remember when billing, ALWAYS use the name as it appears on the patient's Medicare card.

What is the Medicare levy for 2016-17?

The Medicare Levy of 2% is applied to your taxable income if you earn above the threshold. For instance, the 2016-17 threshold is $27,068 per year, which means if you earned $75,000, your Medicare Levy would be $1,500. If your income is below the threshold, you may not have to pay it at all.

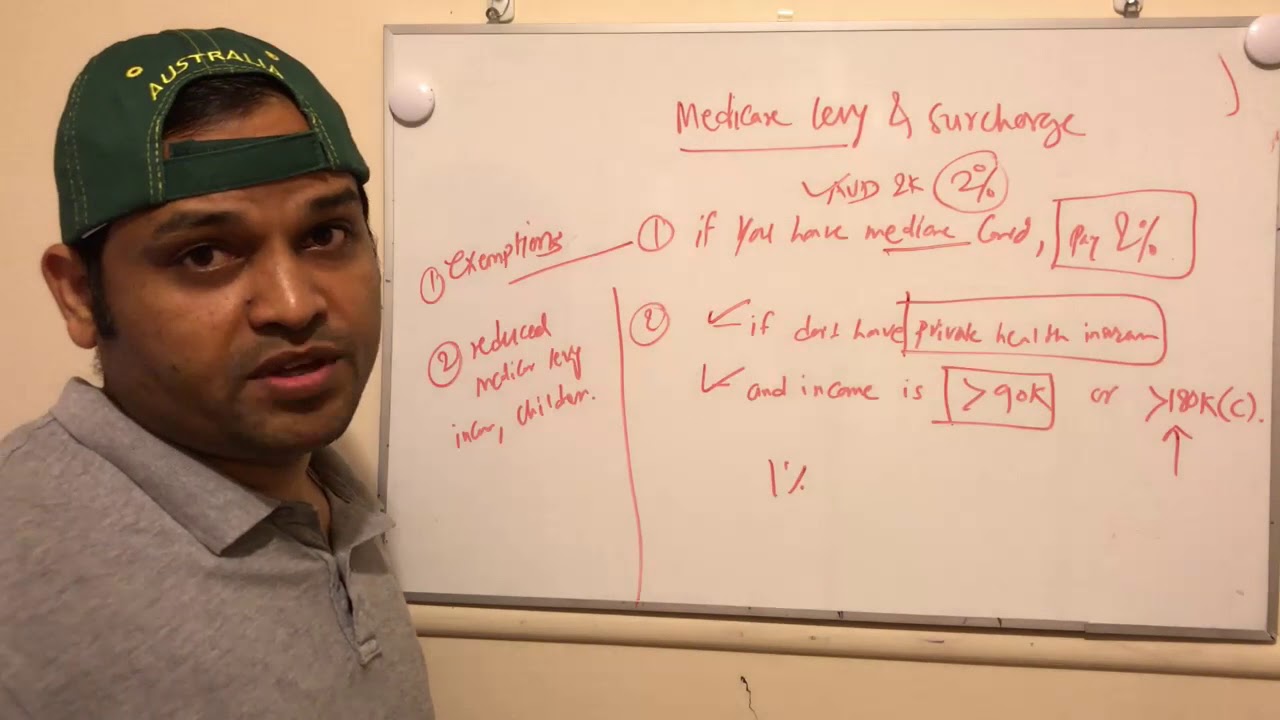

What is the Medicare levy?

The Medicare Levy is a 2% tax that goes towards funding the public health system. You pay a Medicare Levy in addition to the tax you pay on your taxable income. Most of us have to pay it unless we earn less than $22,801 a year.

.jpg)

What is full and half Levy exemption?

As an ADF member, you are entitled to either a full or half exemption from paying the Medicare levy. A full exemption from the levy may be claimed where: You are entitled to full free medical treatment for the whole of the relevant financial year. You meet any of these conditions.

What is half Levy exemption?

You may be able to claim a full or half Medicare levy exemption if you satisfy both of the following conditions: one of the following Category 1 medical conditions applied during all or part of the income year. you were a blind pensioner. you received sickness allowance from Centrelink.

What cover do you need to avoid Medicare levy?

In order to avoid the surcharge, you must have the appropriate level of cover. For singles, that means a policy with an excess of $500 or less. For couples or families, it means an excess of $1,000 or less.

What is the threshold for the Medicare levy?

Medicare levy reduction eligibility In 2021–22, you do not have to pay the Medicare levy if: you are single, and. your taxable income is equal to or less than $23,365 ($36,925 for seniors and pensioners entitled to the seniors and pensioners tax offset).

How do I know if I am eligible for Medicare levy exemption?

The exemption means you don't pay the Medicare levy for all or part of that year. You need a Medicare Entitlement Statement to ask for an exemption. You need a statement for each year you want to get an exemption. You'll need to tell the ATO you have a statement when you do your income tax return.

How do I know if I have to pay Medicare levy surcharge?

If you have to pay the Medicare levy, you may have to pay the Medicare levy surcharge (MLS) if you, your spouse and your dependent children do not have an appropriate level of private patient hospital cover and you earn above a certain income.

Does everyone pay the 2% Medicare levy?

Not everyone is required to pay the Medicare levy surcharge, but if you're single and earning more than $90,000 or part of a family earning $180,000, you may be charged.

Do I have to pay Medicare levy if I have private insurance?

In addition to the Medicare levy, you may have to pay the Medicare levy surcharge (MLS) if: you, your spouse or dependant children don't have an appropriate level of private patient hospital cover, and. your income is above a certain amount.

Why am I charged Medicare levy?

If your taxable income exceeds $90,000 (singles) or $180,000 (couples or families), you'll be liable to pay the Medicare levy surcharge – unless you hold an appropriate level of private hospital cover with a registered health fund.

What is the Medicare levy threshold 2021?

2021-22 Medicare Levy Income Thresholds Medicare levy low-income thresholds for singles, families and seniors and pensioners are increased (by CPI) for the 2021-22 year. Single seniors and pensioners threshold: increases from $36,705 to $36,925. Singles threshold increases from $23,226 to $23,365.

Is Medicare levy surcharge based on gross income?

The levy is calculated based on your taxable income - the more you earn, the higher percentage you'll pay. As a single, you'll pay 1% if your taxable income is above $90,000, 1.25% if you earn over $105,000, and the maximum rate of 1.5% if you earn over $140,000.

What is the Medicare Levy?

The Medicare Levy is a 2% tax on your income to help fund Medicare, Australia's public health system. It is seperate to the income tax you also pay...

Who pays the Medicare Levy?

Australian taxpayers help to pay for Medicare from their income tax. If you meet certain medical requirements, or if you aren't entitled to Medicar...

Do seniors pay the Medicare Levy?

It depends on your circumstances. Anyone with a taxable income that exceeds the minimum threshold of $36,705 has to pay pay the levy. But the thres...

What is Medicare levy?

Medicare levy. The Medicare levy helps fund some of the costs of Australia's public health system known as Medicare. The Medicare levy is 2% of your taxable income, in addition to the tax you pay on your taxable income. You may get a reduction or exemption from paying the Medicare levy, depending on your and your spouse's circumstances.

How is Medicare levy collected?

The Medicare levy is collected from you in the same way as income tax. Generally, the pay as you go amount your employer withholds from your salary or wages includes an amount to cover the Medicare levy. We calculate your actual Medicare levy when you lodge your income tax return. Find out about:

Do I have to pay MLS for Medicare?

In addition to the Medicare levy, you may have to pay the Medicare levy surcharge (MLS ) if you, your spouse or dependant children don’t have an appropriate level of private patient hospital cover and your income is above a certain amount.

Can I get a reduction on my Medicare levy?

You need to consider your eligibility for a reduction or an exemption separately. You can use the Medicare levy calculator to work out your Medicare levy.

What is the maximum amount of hospital insurance?

From 1 April 2019, the maximum permitted excesses for private hospital insurance is $750 for singles and $1,500 for couples/families (i.e. if multiple hospital claims are made in a single year, the excess paid by you cannot exceed $750/$1,500). The following types of health insurance do not provide an exemption:

What is the taxable income for MLS?

a single person with an annual taxable income for MLS purposes greater than $90,000; or. a family or couple with a combined taxable income for MLS purposes greater than $180,000. The family income threshold increases by $1,500 for each dependent child after the first; and do not have an approved hospital cover with a registered health insurer.

What is Medicare surcharge?

The Medicare Levy Surcharge (MLS) is a levy paid by Australian tax payers who do not have private hospital cover and who earn above a certain income. The surcharge aims to encourage individuals to take out private hospital cover, and where possible, to use the private system to reduce the demand on the public Medicare system.

Can you have hospital cover for part of the year?

Cover for part of the year and suspension of cover. If you have held hospital cover for part of the year, then you will have a partial exemption from the MLS. You will have to pay the surcharge to account for the days that which you did not hold hospital cover.

Do you have to pay hospital surcharge if you have dependents?

If your partner or one of your dependents is not covered, you will pay the surcharge.

What is Medicare tax?

Medicare Levy vs the Medicare Levy Surcharge? The Medicare Levy is a 2% tax that goes towards funding the public health system. You pay a Medicare Levy in addition to the tax you pay on your taxable income. Most of us have to pay it unless we earn less than $22,801 a year. The Medicare Levy Surcharge, on the other hand, ...

How much is Medicare tax?

The Medicare Levy is a 2% tax that goes towards funding the public health system. You pay a Medicare Levy in addition to the tax you pay on your taxable income. Most of us have to pay it unless we earn less than $22,801 a year.

What is the Medicare tax rate for 2019?

The Medicare Levy is a flat 2% income tax for any earning above the threshold. The 2019-20 upper threshold is $28,501 per year. For example, if you earned $75,000 your Medicare Levy would be $1,500. You will only have to pay part of the Medicare Levy if your taxable income is between $22,801 and $28,501 ...

How much does Medicare tax in Australia?

The Medicare Levy is charged at 2% of your annual income and goes towards funding Australia's public health system, Medicare. You usually need to pay the full 2% if you earn over $28,501, though you might be entitled to a reduction if you earn less or are a senior citizen.

Does Medicare cover everything?

Unfortunately, Medicare doesn't cover everything – but private health insurance can help fill in the gaps. It can cover you for things like ambulance transportation, dental and optical, and often gives you access to treatment quicker than the public system.

Who is entitled to free medical treatment in their own right?

You have dependants (i.e. a spouse who is also an ADF member) who are also entitled to free medical treatment in their own right. You have dependants who are all required to pay the Medicare levy on their separate income.

Do you have to pay half levy if you are not a spouse?

If both you and your spouse would have to pay the Medicare levy if it was not for your exemption-category status, you and your spouse will be required to enter into a family agreement and one person only will be entitled to the half-levy exemption.

Do you have to pay half levy for a dependent child?

On the days you have care of your dependant child, you are required to pay the half-levy. On the days that you do not have care of your dependant child, you will be entitled to the full Medicare Exemption.

Do I have to pay Medicare levy if I have no children?

We have no children. Do I need to pay the Medicare levy? No, you may claim a full exemption from the Medicare levy. However, depending on your spouse’s level of income and whether they held private health insurance, you may need to pay the Medicare levy surcharge.

Can a spouse pay Medicare levy?

You have a spouse who is liable to pay the Medicare levy and the spouse contributes to the maintenance of the dependant. If you have been entitled to full free medical treatment for the entire year but do not meet any of the above conditions (B), you are entitled to a half exemption.

Can you claim Medicare levy as an ADF member?

Medicare Levy. As an ADF member, you are entitled to either a full or half exemption from paying the Medicare levy. A full exemption from the levy may be claimed where: You are entitled to full free medical treatment for the whole of the relevant financial year. You meet any of these conditions.

Do ADF members have to pay Medicare?

An ADF member who is entitled to a full Medicare exemption does not need to pay the Medicare Levy Surcharge (MLS). If playback doesn't begin shortly, try restarting your device.

What is Medicare levy surcharge?

365. A Medicare levy surcharge may apply if you, your spouse and all your dependants did not maintain an appropriate level of private patient hospital cover for the full income year. Use the number of days listed at A to help you complete the Medicare levy surcharge question on your tax return. See also:

What is included in a private health insurance statement?

It will include the number of days that your policy provided the appropriate level of private health hospital cover, as shown below. Number of days this policy provides an appropriate level ...

What is the income threshold for MLS?

The base income threshold (under which you are not liable to pay the MLS) is: $90,000 for singles. $180,000 (plus $1,500 for each dependent child after the first one) for families. However, if you had a spouse for the full year, you do not have to pay the MLS if: your family income exceeds the $180,000 ...

How much is a single person liable for MLS?

you may be liable for MLS for the number of days you were single – if your own income for MLS purposes was more than the single surcharge threshold of $90,000. you may be liable for MLS for the number of days you had a spouse or dependent children – if your own income for MLS purposes was more than the family surcharge threshold of $180,000 ...

Can you reduce your income for MLS?

If you meet the following conditions, you can reduce income for ML S purposes by any taxed element of the super lump sum, other than a death benefit, that does not exceed your (or your spouse's) low rate cap: you (or your spouse) received a super lump sum.

Is a super contribution deductible?

if you have a spouse, their share of the net income of a trust on which the trustee must pay tax (under section 98 of the Income Tax Assessment Act 1936) and which has not been included in their taxable income.

Do you have to pay MLS for Medicare?

If you have to pay Medicare levy, you may have to pay the Medicare levy surcharge (MLS) if you, your spouse and your dependent children do not have an appropriate level of private patient hospital cover and you earn above a certain income.

What is a HIC number?

A HIC number (HICN) is a Medicare beneficiary’s identification number. Also, remember when billing, ALWAYS use the name as it appears on the patient's Medicare card. Both CMS and the Railroad Retirement Board (RRB) issue Medicare HIC numbers.

What is the format of a HIC number?

The format of a HIC number issued by CMS is a Social Security number followed by an alpha or alphanumeric Beneficiary Identification Code (BIC). RRB numbers issued before 1964 are six-digit numbers preceded by an alpha character.