En español | Generally, yes. Even though Medicare doesn’t typically cover care you receive outside of the United States and its territories, you may turn 65 while living abroad. Whether you can — or should — enroll in Medicare while living outside the country depends on your answers to a few questions:

Do I qualify for Medicare Part A If I live abroad?

Receiving or being eligible for Social Security benefits can qualify you for premium-free Medicare Part A. Social Security considers you living abroad once you’ve stayed in a foreign country for at least 30 consecutive days. Once you return to the United States and stay for more than 30 consecutive days, you’re no longer deemed living abroad.

What happens if you sign up for Medicare overseas?

Separately, if you live overseas and don’t qualify for free Part A, and you sign up for Medicare later than age 65, you get a three-month window once you move back to the U.S. to enroll. In that situation, there are no late penalties.

What happens to my Medicare if I move to another country?

What happens to my Medicare if I move to another country? You can still keep your Medicare plan if you move abroad, but you generally won’t be able to access benefits unless you’re in the United States. Do I have to pay for Medicare if I live abroad?

Can I enroll in Medicare if I live outside the US?

Decisions about Medicare enrollment can be complicated if you live outside the United States. Living outside the U.S. means you do not live in the 50 states, the District of Columbia, Puerto Rico, the Virgin Islands, Guam, American Samoa, or the Northern Mariana Islands.

Can US citizens living abroad receive Medicare?

Remember, you can have Medicare while you live abroad, but it will usually not cover the care you receive. Most people qualify for premium-free Part A, meaning you will pay nothing for coverage. If you must pay a premium for Part A, be aware of the high monthly cost for maintaining Part A coverage.

Does Medicare cover you if you live in a foreign country?

Medicare does not usually cover care that you receive outside the United States. However, it may be beneficial to enroll in Parts A and B if you live abroad on a temporary basis, or travel back to the U.S. frequently. Most people qualify for premium-free Part A, meaning you will pay nothing for coverage.

Do I need to notify Medicare if I move to another country?

If you have Original Medicare — Medicare Part A and Part B — you can take your coverage with you if you move within the United States, but you should still notify Medicare before you move. Many Medigap plans will also transfer with you.

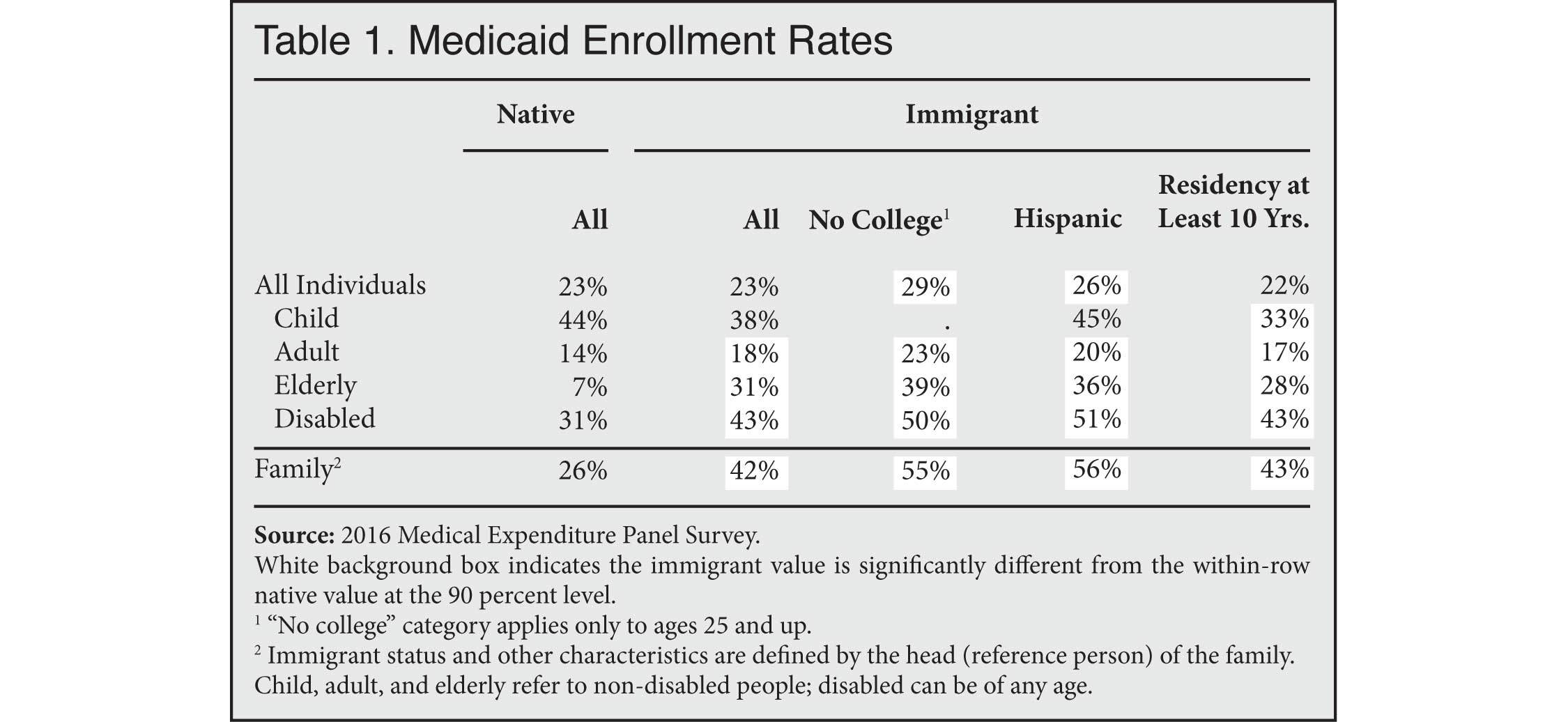

Are US citizens living abroad eligible for Medicaid?

Medicaid provides no option for coverage outside of the United States. If you are covered by Medicaid, you should be aware that coverage can be suspended if you remain outside of the country for more than 30 days. You would have to jump through hoops in order to regain this coverage.

Do I need U.S. health insurance if I live abroad?

Do I Need Health Insurance If I Live Abroad? Yes, all US citizens who live abroad should get international health insurance since domestic insurance plans do not offer protection outside the borders of the US. If you are moving abroad on a long-term basis or permanently, then you should get expatriate health insurance.

Can I lose my Medicare benefits?

Summary: In most cases, you won't lose your Medicare eligibility. But if you move out of the country, or if you qualify for Medicare by disability or health problem, you could lose your Medicare eligibility.

Do expats need a U.S. address?

Even if you are living abroad in a country where mail delivery is dependable, it is important to have an American address. Many companies, not to mention government services, require one, even if it is not your official residence.

Does moving affect Medicare?

If you move to a new city that is outside of your plan's network, you will lose your Medicare Advantage or Part D plan. In this case, if you have a Medicare Advantage plan, you either have to enroll in a new plan or opt to return to Original Medicare and also enroll in a Part D plan.

Can I keep my Medicare supplement if I move?

In general, as long as you're moving states but staying within the country, you should be able to keep your current Medicare Supplement insurance coverage without having to drop your coverage or enroll in a new plan, if that particular plan is available in your new zip code.

How long can a retired U.S. citizen stay out of the country?

As is not the case with Medicare, retirees who decide to move to another country are still entitled to Social Security benefits. Once a retiree has been outside the country for 30 days in a row, he or she is considered outside the United States and the rules for collecting benefits apply.

Can I collect Social Security as an expat?

Expats may be able to receive Social Security payments while living abroad, but it does depend on your citizenship, residency status, and the agreements between the US and the country in which you reside. All US citizens are eligible to receive Social Security benefits if they have paid into Social Security.

Do any countries accept U.S. Medicare?

Here's what you need to know:Medicare doesn't normally cover healthcare costs outside the U.S. (The official definition of the U.S. includes the 50 states and the District of Columbia, Puerto Rico, Guam, the U.S. Virgin Islands, American Samoa, and the Northern Mariana Islands—you can use your Medicare benefits in ...

How long can you go without health insurance if you don't pay for Part B?

If you fail to pay for Part B while abroad, when you move back to the U.S. you may go months without health coverage. This is because you may have to wait until the General Enrollment Period (GEP), which runs January 1 through March 31 each year, with coverage starting July 1.

Does Medicare cover medical expenses when you live abroad?

Although Medicare does not typically cover medical costs you receive when you live abroad, you still need to choose whether to enroll in Medicare when you become eligible or to turn down enrollment. This requires considering: Whether you plan to return to the U.S.

Can you go without Medicare if you are abroad?

If you fail to pay for Part B while abroad, when you move back to the U.S. you may go months without health coverage.

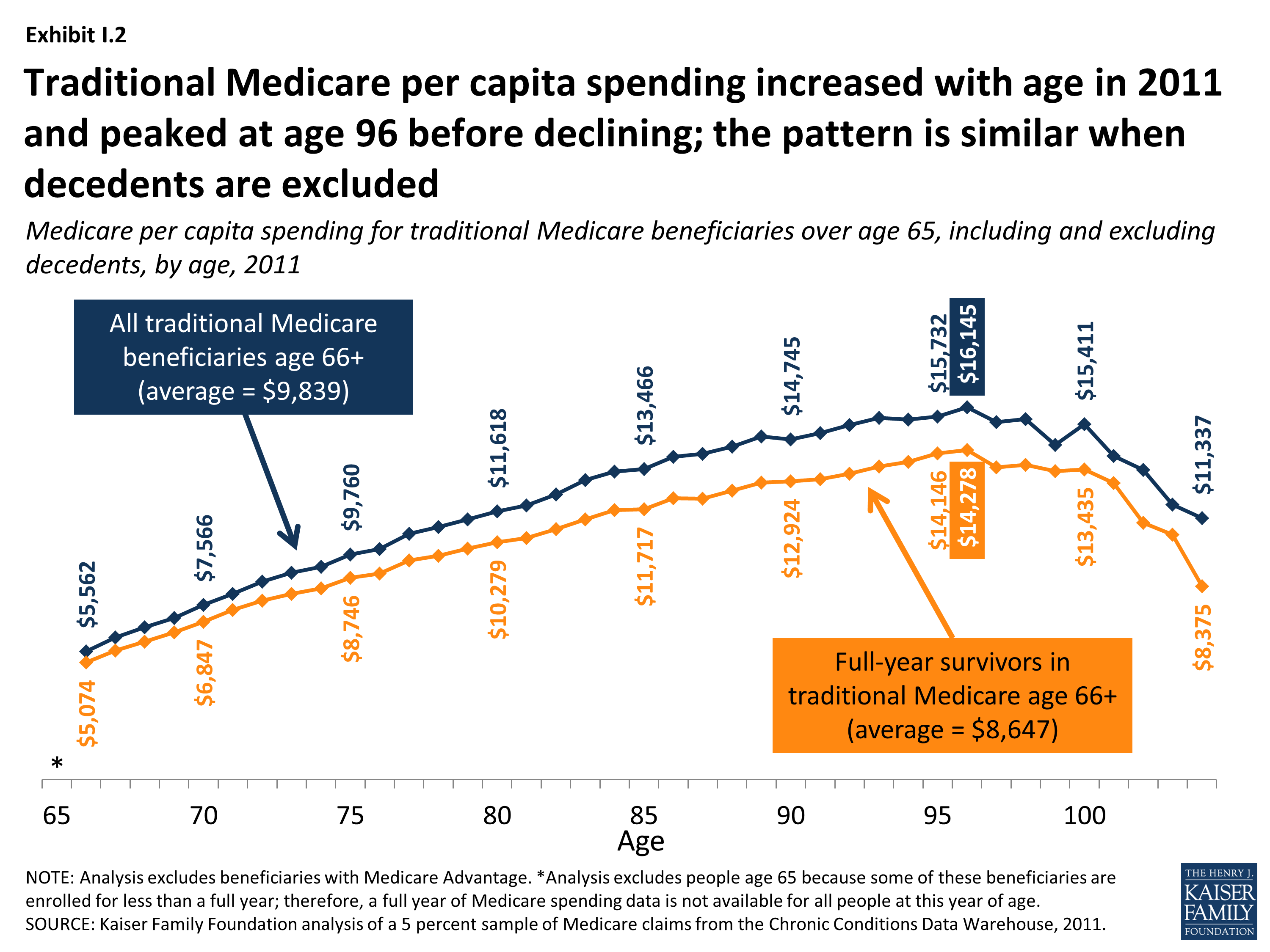

What is Medicare for 65?

Medicare is the federal health insurance program for people age 65 and over. It also extends to certain younger people with disabilities and those with ESRD (permanent kidney failure).

How old do you have to be to qualify for Medicare?

Let’s begin by looking at the qualifications for eligibility. In order to qualify for Medicare, you must be 65 or older and a U.S. citizen or permanent legal resident for at least five consecutive years. There is no residence requirement for Part A or Part B for citizens.

How long do you have to be enrolled in Medicare Supplement?

For Medicare Supplement and Medicare Advantage Plans, the applicant must be enrolled in both Parts A and B at the time of application. This means that if you are unable to enroll in Part B for 15 months, as illustrated above, you are ineligible to enroll in either of these plans until your Part B becomes active.

What happens if you don't enroll in Medicare Part B?

If you do not enroll in Medicare Part B during your Initial Enrollment Period, and you do not qualify for one of the Part B Special Election Periods, you will incur Part B Late Enrollment Penalties if you choose to enroll at a future time.

Why do Medicare Parts A and B become your advocate?

Reason #2: Medicare Parts A and B Become Your Advocate. When you are enrolled, Medicare negotiates with hospitals, clinics, doctors, and other service providers for all qualified medical expenses. When a bill is submitted to Medicare, they determine if it is a Medicare-approved service.

How much does Medicare pay for John?

However, the Medicare Approved Amount is 60% of $20,000, or $12,000. Of this $12,000, Medicare will pay 80%, or $9,600. This leaves John with a bill for $2,400 for all services. However, because John has no Part B coverage, his total responsibility is $20,000. Good luck with the negotiations, John!

How much does Medicare pay for approved services?

Medicare then pays its 80% share of the approved, and the remainder is the responsibility of the beneficiary.

Create an account and access our free 20 minute Medicare 101 video series

We cover all the basics you need to know and give you personalized information on enrollment dates.

Introduction

Why do so many Americans choose to retire overseas? For some, they’re looking for a lower cost of living and better weather. Others want to be closer to family. Some retirees are chasing a dream of living in and experiencing a whole new culture in a foreign country.

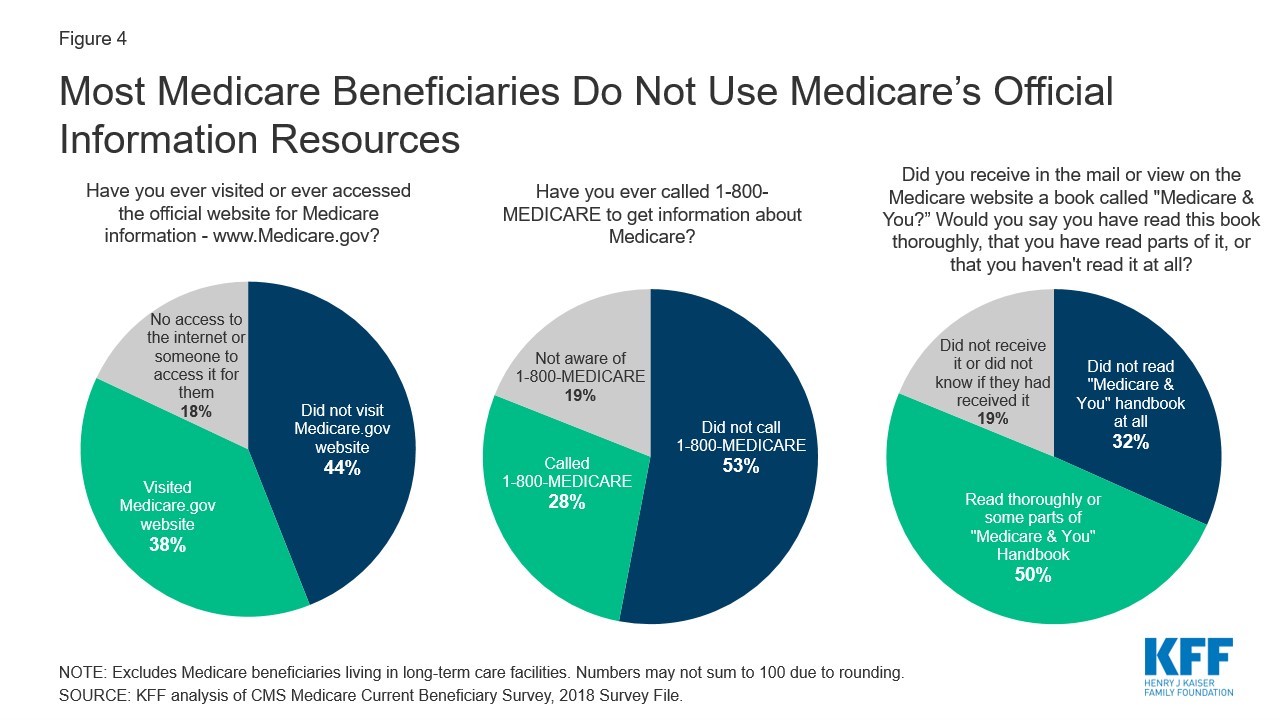

What should you know about having Medicare overseas?

If you become eligible for premium-free Medicare Part A while living abroad, there are two ways to enroll:

What are factors you should consider before moving overseas?

The following questions will help guide your decision regarding whether you should sign up for Medicare while traveling and living overseas:

Final words

Living in a foreign country is an exciting way to spend your retirement. However, you should put thoughtful consideration into what healthcare coverage is right for you. Careful research and planning will help to avoid potentially costly medical situations if you are not correctly insured.

Create an account now to see your options

Review your options online. 100% free. Get unlimited access to a licensed professional.

If you are retired and neither you nor your spouse works while abroad

In this situation, you have a difficult decision to make: Either pay monthly Medicare Part B premiums for coverage you can’t use outside the United States, or delay enrollment until you return to the U.S. and then become liable for permanent late penalties.

If you or your spouse is working while abroad

You can delay Medicare enrollment in Part B (and avoid its premiums) if you have health care coverage from:

AARP In Your State

Visit the AARP state page for information about events, news and resources near you.

How to sign up for Medicare in a foreign country?

To sign up for Medicare abroad, you can contact your closest U.S. Embassy or Consulate. The contact information for offices in different countries is listed on the Social Security website. However, there are three situations in which Medicare may pay for Medicare-covered health care services in a foreign hospital.

How to enroll in Medicare from abroad?

Figure out a plan for your Medicare coverage. If you want to enroll from abroad, find the nearest U.S. embassy or consulate office to your destination. If you want to disenroll, contact your plan provider, Medicare or Social Security. If you want to keep your Medicare plan, find a method to pay for your premiums overseas.

What is the Department of State's checklist for older travelers?

Checklist for Older Travelers: The Department of State has a downloadable checklist for older travelers, which includes tips on dealing with common travel issues that older adults may face, such as scams, medical incidents and accessibility issues.

What is local health insurance?

Local private health insurance: This type of insurance allows you to access private health care within the country. Local insurance may be less expensive than international health insurance and may be ideal for people who plan to stay in one location.

Does Social Security cover overseas?

Social Security has a screening tool for determining your eligibility to receive payments overseas. When deciding on your Medicare plans, consider your budget and how often you’ll be returning to the United States. It may be more convenient to keep your coverage if you plan to move back eventually.

Does travel insurance cover medical expenses?

Travel health insurance typically covers medical emergency costs during your trip. For those who plan to travel for a period of time, this can be a flexible and budget-friendly option. Needless to say, two insurance policies means two premiums, so it will most likely be more economical to commit to one plan.

Can a retiree keep their original Medicare?

For example, a retiree who plans to travel abroad for several years but flies back several times a year to visit family can keep their current Original Medicare plan and get additional travel health insurance to ensure they have coverage regardless of their location.

How long does it take to get Medicare if you live overseas?

Separately, if you live overseas and don’t qualify for free Part A, and you sign up for Medicare later than age 65, you get a three-month window once you move back to the U.S. to enroll. In that situation, there are no late penalties.

How much is the Medicare penalty for traveling abroad?

That penalty amount is based on the “national base premium,” which in 2019 is about $33. For people already on Medicare and heading overseas for a set amount of time, you could consider travel medical insurance for coverage while abroad.

What happens if you miss your Medicare enrollment?

According to Medicare expert Patricia Barry, author of “Medicare for Dummies,” if you miss your initial enrollment period at age 65, these are the circumstances when you would be entitled to what’s called a special enrollment period — which comes with no late-enrollment penalties:

What does it mean to live abroad?

For many people, living abroad means access to cheaper health-care coverage. The Statons, for instance, said they pay $81 monthly for coverage through Ecuador’s national health plan. It comes with no deductible and no restrictions for pre-existing conditions.

When does Medicare enrollment end?

However, if you don’t have a qualifying health plan and sign up late for Medicare, you can only enroll in the general enrollment period, which lasts from Jan. 1 to March 31. Then you have to wait for coverage to be effective July 1. Getty Images.

Does Medicare cover medical expenses?

Basic Medicare does not cover medical services you get outside the U.S. and its territories, except in very specific situations. If you or your spouse work overseas and you have qualifying insurance (as defined by the U.S. government), you generally can avoid late-enrollment penalties if you sign up for Medicare later than age 65.

Is Medicare Part D a private plan?

Meanwhile, Medicare Part D is prescription drug coverage and is sold through private plans — either as a standalone policy or as part of an Advantage Plan. Like basic Medicare, it provides no overseas coverage.