When can I sign up or switch Medigap plans?

- You’re enrolled in Medicare Part A and Part B, and

- You’re within your 6-month Medicare Supplement Open Enrollment Period (OEP). This time span starts the month you’re both age 65 or older, and enrolled in Part B, or

- You have guaranteed-issue rights after your OEP, for a different reason (see below).

When can I Change my Medicare Part D plan?

You must decide on a new plan, find out when you can switch, and find out who to contact. When Can You Change Part D Plans? You can change from one Part D plan to another during the Medicare open enrollment period , which runs from October 15 to December 7 each year. During this period, you can change plans as many times as you want.

When should I Make my Medigap policy effective?

Starting your Medigap policy. After buying your policy, it doesn’t mean that it will become effective automatically. You will have to ask the insurance company to make it effective the day you want. In general, the policy usually becomes effective one month after the application has been made and accepted.

When should I switch Medigap policies?

When is the best time to switch Medigap insurance policies? In general, the best time to enroll in or make changes to your Medicare Supplement insurance coverage is during your Medigap Open Enrollment Period, the six-month period that starts when you’re 65 or older and have Medicare Part B.

Can I change my Medigap policy at any time?

You can change your Medigap plan any time, but you may have to go through medical underwriting unless you have a guaranteed issue right, depending on what state you live in. Learn about switching Medigap plans with the help of a licensed insurance agent.

Can I change my Medicare Supplement plan each year?

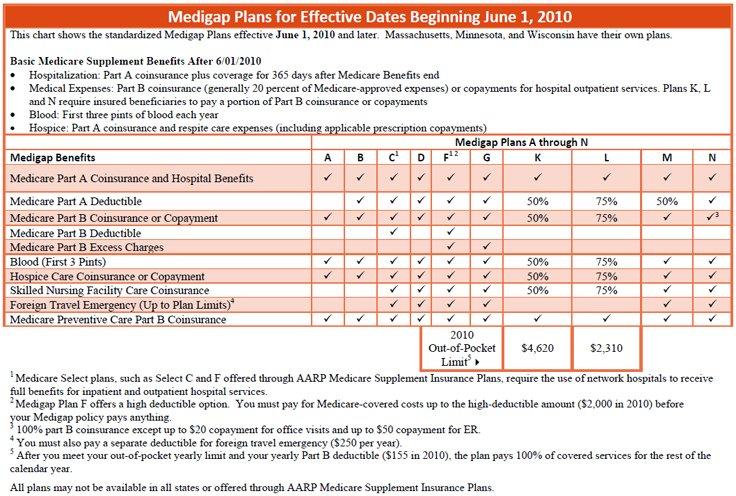

You can either change to a standardized Medicare Supplement insurance plan with the same or fewer basic benefits than your current plan, or buy any Medicare Supplement Plan A, B, C*, F*, K, or L. You've had your current Medicare Supplement insurance plan for less than six months.

What months can you change your Medicare plan?

From January 1 – March 31 each year, if you're enrolled in a Medicare Advantage Plan, you can switch to a different Medicare Advantage Plan or switch to Original Medicare (and join a separate Medicare drug plan) once during this time.

What states allow you to change Medicare Supplement plans without underwriting?

California and Oregon both have “birthday rules” that allow Medigap enrollees a 30-day window following their birthday each year when they can switch, without medical underwriting, to another Medigap plan with the same or lesser benefits.

Can I switch from plan N to plan G?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to answer health questions to switch. Your approval is not guaranteed.

Can you change Part D plans in the middle of the year?

You may qualify for a special enrollment period to change your Part D plan in certain situations at other times during the year: If you receive financial assistance from the Part D Extra Help program, you can change Part D plans as often as once each calendar quarter during the first three quarters of the year.

Can Medigap insurance be denied for pre existing conditions?

Be aware that under federal law, Medigap policy insurers can refuse to cover your prior medical conditions for the first six months. A prior or pre-existing condition is a condition or illness you were diagnosed with or were treated for before new health care coverage began.

Can I switch from a Medigap plan to an Advantage plan?

Can you switch from Medicare Supplement (Medigap) to Medicare Advantage? Yes. There can be good reasons to consider switching your Medigap plan. Maybe you're paying too much for benefits you don't need, or your health needs have changed and now you need more benefits.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Can I switch from plan G to plan F?

Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch. There are a few companies in a few states that are allowing their members to switch from F to G without review, but most still require you to apply to switch.

Do Medigap premiums vary by state?

Medicare Supplement (Medigap) plan premiums vary from state to state. Although the benefits are standardized, Medicare costs by state are not the same. There are many reasons why some states have more expensive Medigap plans than others.

Do Medigap plans vary by state?

Medigap plans are standardized across most states, meaning they offer the same benefits. The exceptions are Wisconsin, Minnesota and Massachusetts. Plans in those states may have options that differ from Medigap plans in other states.

How long do you have to switch Medigap plans?

When you switch from one Medigap plan to another, you may be given 30 days to decide if you wish to keep your new plan. This is called a Medigap free look period.

When is the best time to enroll in Medigap?

One of the best times to enroll in a Medigap plan is during your Medigap Open Enrollment Period, which is a six-month period that starts when you are at least 65 years old and enrolled in Medicare Part B.

What is the AEP number for Medicare?

1-862-286-9564 | TTY 711, 24/7. This is not to be confused with the Medicare Annual Enrollment Period (AEP), which runs from October 15 to December 7 every year. During the Medicare AEP, you can enroll in, change, or drop your Medicare Part D prescription drug plan or your Medicare Advantage (Part C) plan. AEP does not apply specifically ...

What is Medicare Part A and Part B?

You have Medicare Part A and Part B (Original Medicare), and you need to replace an employer health plan that will soon be discontinued. You have Original Medicare and a Medicare SELECT policy, and you move out of the policy's service area.

What to do if you move insurance?

If you move, contact a licensed insurance agent to learn about the plan options available in your new location.

Can you drop a Medigap policy to join Medicare?

You dropped a Medigap policy to join a Medicare Advantage plan for the first time, and within the first year of joining you want to switch back to Medigap. Your Medigap insurance company goes bankrupt or ends your policy through no fault of your own.

Do you have to go through medical underwriting for Medigap?

If you apply for or change Medigap plans outside of your Medigap OEP, you may have to go through medical underwriting unless you qualify for a Medicare guaranteed issue right, depending on what state you live in.

when can you change medigap plans?

If you are not in a Guaranteed Issue situation or still in the Initial Enrollment Period, then you will have to qualify medically. This means the insurance company will ask you some health questions on the application, verify your prescriptions, and possibly conduct a phone interview with you.

Which Medicare plan pays all Medicare eligible charges?

The only Medigap Plan where all Medicare eligible charges are paid is Medigap Plan F.

Can you apply for Medigap Plan N with rheumatoid arthritis?

Mr. Client had a stent put in three years ago and Mrs. Client has rheumatoid arthritis. Both can still apply for a new Medigap Plan N; however, it’s possible they may have to each get a policy with separate insurance companies because of their differing health conditions.

Do you have the same benefits if you have Medigap Plan F?

In reality, if you both have Medigap Plan F then you both have the exact same benefits (just a different ID card).

Is it scary to switch Medigap insurance?

The unknown is scary and the thought of switching Medigap insurance companies overwhelms some people. I’ve spoken with couples who would rather just keep paying more money so they can both stay with the same insurance company.

Is medical underwriting standardized?

Each insurance company has health questions that are unique. Medical underwriting requirements are not standardized, so each insurance company has a different set of parameters. Since your health history may differ from your spouse, so could your ability to qualify with the same insurance company.

Is Plan N a good premium?

The lure for Plan N is the fantastic premium. However, if you’d had Plan N for some time, the premium may not be so fantastic anymore.

When do insurance companies send out notices of changes to Medicare?

Every September, insurance companies must send out a Medicare Annual Notice of Change (ANOC) letter to Medicare beneficiaries. This letter tells you of any changes to your rates. If your rates go up, you may want to consider looking for a new policy.

When Can You Enroll in a Medigap Plan?

If you do consider enrolling in a Medigap plan Medigap plans, you should try to apply for a plan during your 6-month Medigap Open Enrollment Period. Your Medigap Open Enrollment Period is a 6-month period that starts the day you are both 65 years old and enrolled in Medicare Part B.

What Is a Medicare Supplement (Medigap) Plan?

Medigap plans are designed to fill those gaps by supplementing your Original Medicare coverage to pay for certain out-of-pocket costs.

What happens if you don't change your Medicare Supplement?

If you don't change Medicare Supplement insurance plans during your Medigap Open Enrollment Period, your insurer can force you to undergo medical underwriting, and they can now assess your health history during the application process and can turn you down if it chooses.

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

What to do if you are unhappy with your Medicare Supplement?

If you are unhappy with your insurance company for any reason, you can purchase a plan from a different insurance underwriter. Call to speak with a licensed insurance agent who can help you compare Medicare Supplement plans in your area. They can help you change plans once you find the best plan for your needs.

Why do Medicare Supplement plans carry letters?

Medicare Supplement plans carry letters to designate the benefits each type of plan offers. Thus, every plan with the same lettered name has the same basic coverage almost anywhere in the country.

When can I change my Medicare Supplement plan?

You can technically change Medicare Supplement plans anytime you’d like, but unless you have Medigap protections (also called guaranteed issue rights), switching plans may not work out so well .

How long does it take to get a Medigap policy?

Keep in mind that the Medigap protections don't last as long as they did during your Medigap Open Enrollment—you have only 63 days to find a new guaranteed issue policy. If you wait any longer, insurance companies are allowed to use medical underwriting—meaning they can charge you more, exclude health conditions from coverage, or refuse to cover you for a new policy.

How long does a Medigap open enrollment period last?

Your Medigap Open Enrollment Period starts when you enroll in Medicare Part B and lasts for six months. During this time you have guaranteed issue rights, which means you can enroll in any Medigap policy available in your state without medical underwriting. You can also switch to another plan without an insurance company factoring your health into the policy issuance.

What happens if Medicare goes out of business?

The insurance company that provides your Medicare Supplement plan goes out of business and you lose your coverage (or any other situation for which you're not at fault but you lose your coverage).

How long do you have to cancel a new insurance policy?

Once you’re sure the new policy is the best choice for you, then you can cancel your old one. If the new policy doesn’t suit you, you can cancel it before 30 days is up without penalty.

Can you switch Medicare Supplement Plan after 65?

You can switch your Medicare Supplement plan whenever you’d like without experiencing a medicare penalty.

Can you underestimate Medigap?

Sometimes you learn that you underestimated the Medigap benefits you’d need down the line. 2. Your current Medigap plan provides benefits you don’t use. While some people underestimate their coverage needs during enrollment, others overestimate it.

How long do you have to keep Medicare Advantage Plan?

If you don’t drop your Medicare Advantage Plan and return to Original Medicare within 12 months of joining, generally, you must keep your Medicare Advantage Plan for the rest of the year. You can disenroll or change plans during the Open Enrollment Period or if you qualify for a Special Enrollment Period.

How to cancel a Medigap policy?

If you want to cancel your Medigap policy, contact your insurance company. If you leave the Medicare Advantage Plan, you might not be able to get the same, or in some cases, any Medigap policy back unless you have a " trial right. "

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

Does Medigap have prescription drug coverage?

The Medigap policy can no longer have prescription drug coverage even if you had it before, but you may be able to join a. Medicare Drug Plan (Part D) Part D adds prescription drug coverage to: Original Medicare. Some Medicare Cost Plans. Some Medicare Private-Fee-for-Service Plans.

When to buy Medigap policy?

Buy a policy when you're first eligible. The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first ...

How long does it take for a pre-existing condition to be covered by Medicare?

Coverage for the pre-existing condition can be excluded if the condition was treated or diagnosed within 6 months before the coverage starts under the Medigap policy. After this 6-month period, the Medigap policy will cover the condition that was excluded. When you get Medicare-covered services, Original Medicare.

What is a select Medicare policy?

Medicare Select. A type of Medigap policy that may require you to use hospitals and, in some cases, doctors within its network to be eligible for full benefits. . If you buy a Medicare SELECT policy, you have rights to change your mind within 12 months and switch to a standard Medigap policy.

Can you charge more for a Medigap policy?

Charge you more for a Medigap policy. In some cases, an insurance company must sell you a Medigap policy, even if you have health problems. You're guaranteed the right to buy a Medigap policy: When you're in your Medigap open enrollment period. If you have a guaranteed issue right.

Can Medigap refuse to cover out-of-pocket costs?

A health problem you had before the date that new health coverage starts. . In some cases, the Medigap insurance company can refuse to cover your. out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance.

Can you shorten the waiting period for a pre-existing condition?

It's possible to avoid or shorten waiting periods for a. pre-existing condition. A health problem you had before the date that new health coverage starts. if you buy a Medigap policy during your Medigap open enrollment period to replace ".

Can you get Medicare if you are 65?

Some states provide these rights to all people with Medicare under 65. Other states provide these rights only to people eligible for Medicare because of disability or only to people with ESRD. Check with your State Insurance Department about what rights you might have under state law.