The most common types of Medicare or Medicaid fraud

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

Full Answer

What are the most common types of Medicare or Medicaid frauds?

The most common types of Medicare or Medicaid fraud include: billing for unnecessary procedures or procedures that are never performed; for unnecessary medical tests or tests never performed; or for unnecessary equipment.

Who commits Medicare and Medicaid fraud?

Medicare and Medicaid fraud can be committed by medical professionals or healthcare facilities, patients or program participants, and outside parties who may pretend to be one of these parties. There are many types of Medicare and Medicaid fraud. Common examples include:

How much does healthcare fraud cost the US?

Fraud, abuse, and waste account for up to 10% of overall healthcare expenditures. Medicare invests roughly $700 billion in its services. Medicare lost $2 billion to a single fraud. The US healthcare expenditures are estimated to reach 6.2 trillion by 2028. Medicare could have saved $367 million by investigating inaccurate payments.

What is Medicare fraud and how can you avoid it?

Medicare fraud is when doctors, pharmacists and other health care providers knowingly and purposely claim reimbursement for which they are not entitled, thereby illegitimately collecting money from Medicare.

How common is fraud in healthcare?

(July 2021) In fiscal year 2020, there were 330 health care fraud offenders, who accounted for 7.7% of all theft, property destruction, and fraud offenses. The number of health care fraud offenders decreased by 36.2% since fiscal year 2016.

What is the most common type of Medicare abuse?

The most common type of Medicare abuse is the filing of inaccurate or falsified Medicare claims to increase profits.

What is a major part of Medicare fraud?

Misusing codes on a claim, such as upcoding or unbundling codes. Upcoding is when a provider assigns an inaccurate billing code to a medical procedure or treatment to increase reimbursement. Medicare abuse can also expose providers to criminal and civil liability.

Why is Medicare fraud an issue?

There are health care consequences due to Medicare fraud. A beneficiary may later receive improper medical treatment from legitimate providers because of inaccurate medical records that may contain false diagnoses or incorrect lab results.

How do people defraud Medicare?

Beneficiaries commit fraud when they…Let someone use their Medicare card to get medical care, supplies or equipment.Sell their Medicare number to someone who bills Medicare for services not received.Provide their Medicare number in exchange for money or a free gift.

Which one is an example of Medicare abuse?

The most common types of Medicare abuse include: billing for services that are not medically necessary. overcharging for services or supplies. improperly using billing codes to increase reimbursement.

Does the FBI investigate doctors?

Health care fraud can be committed by medical providers, patients, and others who intentionally deceive the health care system to receive unlawful benefits or payments. The FBI is the primary agency for investigating health care fraud, for both federal and private insurance programs.

How much Medicare fraud is there every year?

approximately $60 billion annuallyMedicare fraud can be a big business for criminals. Medicare loses approximately $60 billion annually due to fraud, errors, and abuse, though the exact figure is impossible to measure.

What is the largest area of fraud identified by the insurance industry?

Application Fraud It is generally the most common form of insurance fraud, being responsible for up to two-thirds of all denied life insurance claims alone, according to the Los Angeles Times.

What factors might be red flags for Medicare fraud?

Some red flags to watch out for include providers that:Offer services “for free” in exchange for your Medicare card number or offer “free” consultations for Medicare patients.Pressure you into buying higher-priced services.Charge Medicare for services or equipment you have not received or aren't entitled to.More items...

What are some examples of Medicare fraud?

Some of the More Common Examples of Medicare or Medicaid Fraud include the following: Paying “kickbacks” in exchange for referring business. “Kickbacks” are customary in healthcare fraud cases. State and federal laws by and large ban payments to individuals who refer patients to a particular hospital or medical provider.

How much money does Medicare pay for healthcare fraud?

Most healthcare fraud today is being committed against Medicare and Medicaid, both funded with U.S tax payer dollars. Medicare pays out over $800 billion a year for claims. Medicaid also has enormous budget, providing $615 billion a year. Their sheer size makes these goliaths a target for those groups committing fraud.

How to avoid inadvertent fraud?

To avoid inadvertent fraud, healthcare providers must maintain accurate billing practices to steer clear of inaccuracies such as overcharges or claims for undocumented or undelivered services. Maintain updated and proper documentation.

What is healthcare fraud?

Healthcare fraud is committed when a dishonest provider intentionally submits, or causes someone else to submit, false or misleading information for use in determining the amount of healthcare benefits payable by an insurer. Many leading, medical groups calculate fraud to amount up to 10% of all healthcare costs.

Why did a doctor fabricated his patient's medical records?

He fabricated his patient’s medical records to indicate office visits and treatments that never took place.

What is the False Claims Act?

As a prime example, the False Claims Act bars medical practitioners from submitting insurance claims for substandard and overpriced goods and services, identifying individuals who do not report their knowledge of such claims as perpetrating fraud.

Is fraud a premeditated crime?

Even mere allegations of fraud can do considerable damage to the professional reputation of a healthcare practice. Such fraud (or perceived fraud) is not always premeditated. However, it can arise as a result of negligence, sloppiness, mistake or oversight.

What is Medicare fraud?

Medicare/Medicaid fraud means a medical provider – doctor, dentist, hospital, hospice care provider or nursing home – makes a fraudulent reimbursement claim. The most common types of fraud include: billing for unnecessary procedures or procedures that are never performed; for unnecessary medical tests or tests never performed; or for unnecessary equipment.

What is a false claim?

Conspiring with others to get a false or fraudulent Medicare or Medicaid claim paid by the federal government; Knowingly using (or causing to be used) a false record or statement to conceal, avoid, or decrease an obligation to pay money or transmit property to the federal government.

What does knowingly mean in Medicare?

Knowingly presenting (or causing to be presented) to the federal government a false or fraudulent Medicare and/or Medicaid claim for payment; Knowingly using (or causing to be used) a false record or statement to get a Medicare of Medicaid claim paid by the federal government;

What are nursing home abuses?

Nursing home abuses. Illegal or improper marketing of drugs. Overcharging at pharmacies. “Off label” marketing of drugs. Paying kickbacks to have doctors, hospitals or other care-givers prescribe certain drugs or otherwise bill the Medicare and/or Medicaid. Kickbacks to obtain business.

Does Medicare fraud violate the False Claims Act?

Medicare or Medicaid Fraud violates the False Claims Act. The False Claims Act is 31 USC § 3729-3733. The qui tam provisions of the False Claims Act allow persons and entities with evidence of Medicare and/or Medicaid Fraud against federal programs or contracts to sue the wrongdoer on behalf of the United States government.

Why is it important to identify Medicare fraud?

Identifying Medicare fraud and abuse helps to maintain the integrity of the program, keep costs down and prosecute criminals. As a Medicare beneficiary, it is your duty to do your part in helping to combat Medicare fraud for the benefit of all. 1 Schulte, Fred.

What is the number to call for Medicare fraud?

1-800-557-6059 | TTY 711, 24/7. The above scenario is just one example of a recent type of Medicare scam. Let’s take a deeper look at Medicare fraud, including the types of scams to be aware of and how you and your loved ones can stay safe.

What are some examples of Medicare abuse?

One example of Medicare abuse is when a doctor makes a mistake on a billing invoice and inadvertently asks for a non-deserved reimbursement. Medicare waste involves the overutilization of services that results in unnecessary costs to Medicare.

What is Medicare scam?

Medicare scams, like the one described above involving Medicare cards, are when individuals pose as health care providers to gather and use a Medicare beneficiary’s personal information to receive health care or money they are not entitled to.

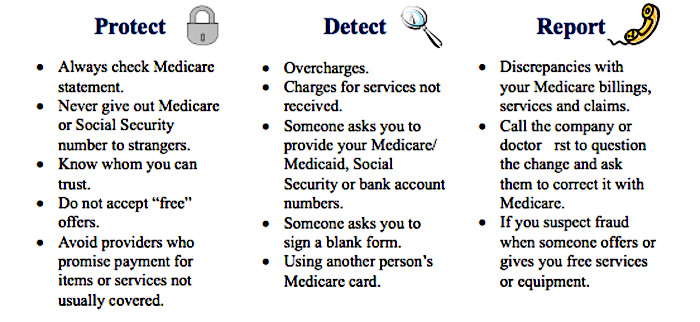

How to protect yourself from Medicare fraud?

There are some additional things you can do and keep in mind to protect yourself from Medicare fraud: When you receive your new Medicare card in the mail, shred your old one. Also, be aware that Medicare will not contact you to verify information or to activate the card.

How long is the man in jail for Medicare fraud?

The man faces up to 10 years in prison for each of the six counts of fraud. A former health care executive in Texas admitted to her role in a $60 million Medicare fraud scheme that included overdosing hospice patients in order to maximize profits. She faces up to 10 years in prison.

What is the False Claims Act?

The False Claims Act protects the government from being sold substandard goods or services or from being overcharged. It holds people accountable who knowingly submit or cause to be submitted a false or fraudulent Medicare claim.

The Societal Impact of Medicare Fraud

Sure, it may not seem like this is a huge problem, especially with only 15 total Strike Force cases in the news through half of 2018, but it’s important to realize that many of these investigations involve millions upon millions of dollars. Furthermore, this is money that has essentially been stolen from the U.S.

Individual Effects of Medicare Fraud

For starters, it’s simply maddening to think that individuals who commit these types of offenses are bringing in much more than the typical, hard-working family earns just to survive. For instance, Money reports that the median real income is $54,635 for households in Michigan and $57,259 for a household in Ohio.

Medicare Fraud: Protecting Yourself Begins by Protecting Your Card

According to Medicare.gov, you should always “treat your Medicare card like it’s a credit card.” In other words, don’t give the number out to just anybody, because there’s a chance it could be used to open up a fraudulent claim.

Even More Ways to Prevent Medicare Fraud

There are other things you can do to avoid being a victim of Medicare fraud.

What to do if You Are a Medicare Fraud Victim

If you believe that you are a victim of Medicare fraud or if you have unequivocal proof, the first thing you want to do is report it to the authorities. Medicare.gov shares that there are three ways to do this:

How many people are on medicaid in 2008?

As of 2008, more than 44 million people were enrolled in Medicare, and close to 40 million people were participating in Medicaid. With the recent move to expand Medicaid, many more people will be given access to the program, but unfortunately that means the number of Medicaid and Medicare scammers will also grow. Due to the nature of these programs, the criminals who attempt to scam and defraud people can come in many forms — sometimes even in the form of those we usually greatly trust and would least suspect. Doctors, nurses, and insurance agents are some of the most common perpetrators, oddly enough being the ones who regularly have to watch out for fraud. They know how to spot it, but for the average Joe, it can be hard to spot Medicaid and Medicare fraud. However, it’s possible if you know exactly what to look for. Here are some of the most common forms of Medicare and Medicaid fraud to be on the lookout for.

Is there a scam with Medicare and Medicaid?

Yes, that’s right — there are people renting out their own Medicare and Medicaid numbers. In this particular scam, both the beneficiary and health care providers can be criminals. For some, it sounds like a nice arrangement to give someone these numbers so multiple individuals can file claims and pay the “landlords” a hefty cash sum in exchange, sometimes up to 50%. Some rent out their policy number to providers, who will bill through that policyholder’s number for services never rendered. In turn, the doctor will write a prescription, er, check to the eager patient. The most common “landlord/tenant” scam though happens when a health care provider rents out their provider number, making claims through several beneficiaries’ numbers and pocketing the reimbursements. Sometimes, other health care providers even “rent” another doctor’s provider number too if they don’t have their own. A new criminal spin on the classic “student fakes being sick to go to the doctor in order to get a doctor’s excuse for skipping school” trick, the Medicare/Medicaid recipient doesn’t even have to go to the length of pretending to be ill, and doctors don’t have to beg for spare change anymore. Instead, the recipient just provides their number and sits back while doctors and other co-conspirators make phony claims that they’ll all split. This can go on for years too. A 71-year-old licensed professional counselor in North Carolina, Linda Radeker, thought she’d hit it big over the course of three years from 2008 to 2011 when making false insurance claims for services she’d never provided. But when you steal $6.1 million from the federal government, someone will notice. I wonder if they require a security deposit or advertise on Craigslist…

What is Medicare fraud?

Medicare fraud includes intentionally covering up the truth with the aim of obtaining illegitimate benefits. Paired with abuse, which involves practices that don’t adhere to authorized fiscal and medical practices to increase expenses, healthcare scams severely harm both the state and the federal medical system.

How much money is wasted on Medicare fraud?

Medicare fraud statistics show that billions of dollars are wasted every year due to scams and corruption. The damage to the entire healthcare system is irreparable, as that money could have been invested in a range of legal medical services. Enormous expenses of fraudulent practices result in Medicare costs escalation.

How much did Medicare spend on hospice?

Medicare spent $160.8 million on medications covered by hospices. (Source: Health Payer Intelligence) The authorities discovered yet another instance of healthcare fraud and abuse with Medicare. Namely, Centers for Medicare and Medicaid Services paid over $160 million on medications for Medicare Advantage.

How much money did the HHS return to Medicare?

Medical fraud statistics reveal that the Office of Inspector General at HHS and the US Department of Justice managed to return nearly $1.4 billion to Medicare Trust funds via fines, forfeits, and recoveries. These departments actively fight healthcare and insurance frauds and prosecute perpetrators.

How many Medicare claims were filed correctly?

Research showed that out of 300 sample claims, only 116 were filed correctly. Such an error cost the insurer almost $367 million.

What is the improper payment rate for medicaid?

Medicaid has an improper payment rate of 14.90%. Inconsistencies in payments may not necessarily mean fraud or abuse, but do indicate a human error. The Medicare fraud rate shows that the program has the highest improper payment rate among its peers, at nearly 15%. In cash, this amounts to $57.36 billion.

How much of the US population has Medicare?

18.1% of US residents have Medicare. Fraud, abuse, and waste account for up to 10% of overall healthcare expenditures. Medicare invests roughly $700 billion in its services. Medicare lost $2 billion to a single fraud. The US healthcare expenditures are estimated to reach 6.2 trillion by 2028.

How does fraud affect health insurance?

It affects everyone—individuals and businesses alike—and causes tens of billions of dollars in losses each year. It can raise health insurance premiums, expose you to unnecessary medical procedures , and increase taxes. Health care fraud can be committed by medical providers, patients, and others who intentionally deceive ...

What is the FBI?

The FBI is the primary agency for investigating health care fraud, for both federal and private insurance programs. The FBI investigates these crimes in partnership with: Insurance groups such as the National Health Care Anti-Fraud Association, the National Insurance Crime Bureau, and insurance investigative units.

Is prescription fraud a crime?

Prescription Medication Abuse. Creating or using forged prescriptions is a crime, and prescription fraud comes at an enormous cost to physicians, hospitals, insurers, and taxpayers. But the greatest cost is a human one—tens of thousands of lives are lost to addiction each year.