Medicare Part A is free if you: Have at least 40 calendar quarters of work in any job where you paid Social Security taxes in the U.S. Are eligible for Railroad Retirement benefits Or, have a spouse that qualifies for premium -free Part A

Who qualifies for premium-free Medicare Part A?

To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child. To receive premium-free Part A, the worker must have a specified number of quarters of coverage (QCs) and file an application for Social Security or Railroad Retirement Board (RRB) benefits.

Who qualifies for free Medicare?

Dec 15, 2021 · Who qualifies for premium-free Part A? Most people don’t have to pay a monthly premium for their Medicare Part A coverage. If you’ve worked for a total of 40 quarters or more during your lifetime,...

Which Medicare Part is free?

Medicare Part A (Hospital Insurance) coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A. You can get premium-free Part A at 65 if: You already get retirement benefits from Social Security or the Railroad Retirement Board.

Is Medicare Part a premium free?

Medicare Part A is free if you: Have at least 40 calendar quarters of work in any job where you paid Social Security taxes in the U.S. Are eligible for Railroad Retirement benefits Or, have a spouse that qualifies for premium -free Part A

Is Part A of Medicare free?

Medicare Part A (Hospital Insurance) Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.Dec 1, 2021

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Who is Medicare Part A available to?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Does Medicare Part A cost the same for everyone?

A: Most Medicare-eligible people do not have to pay premiums for Medicare Part A. If you are 65 and you or your spouse has paid Medicare taxes for at least 10 years, you don't pay a premium for Part A.

Is Medicare Part A free at age 65?

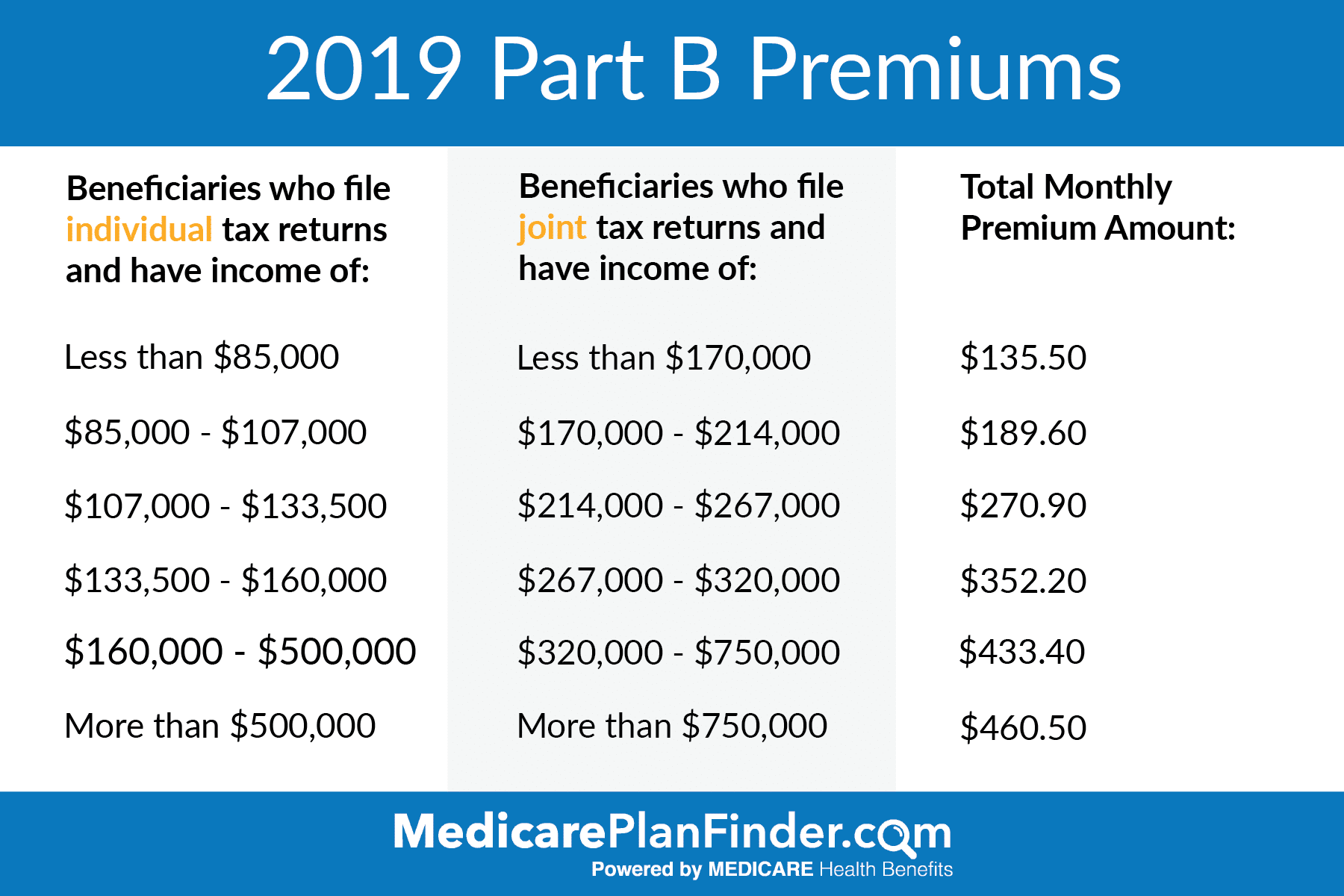

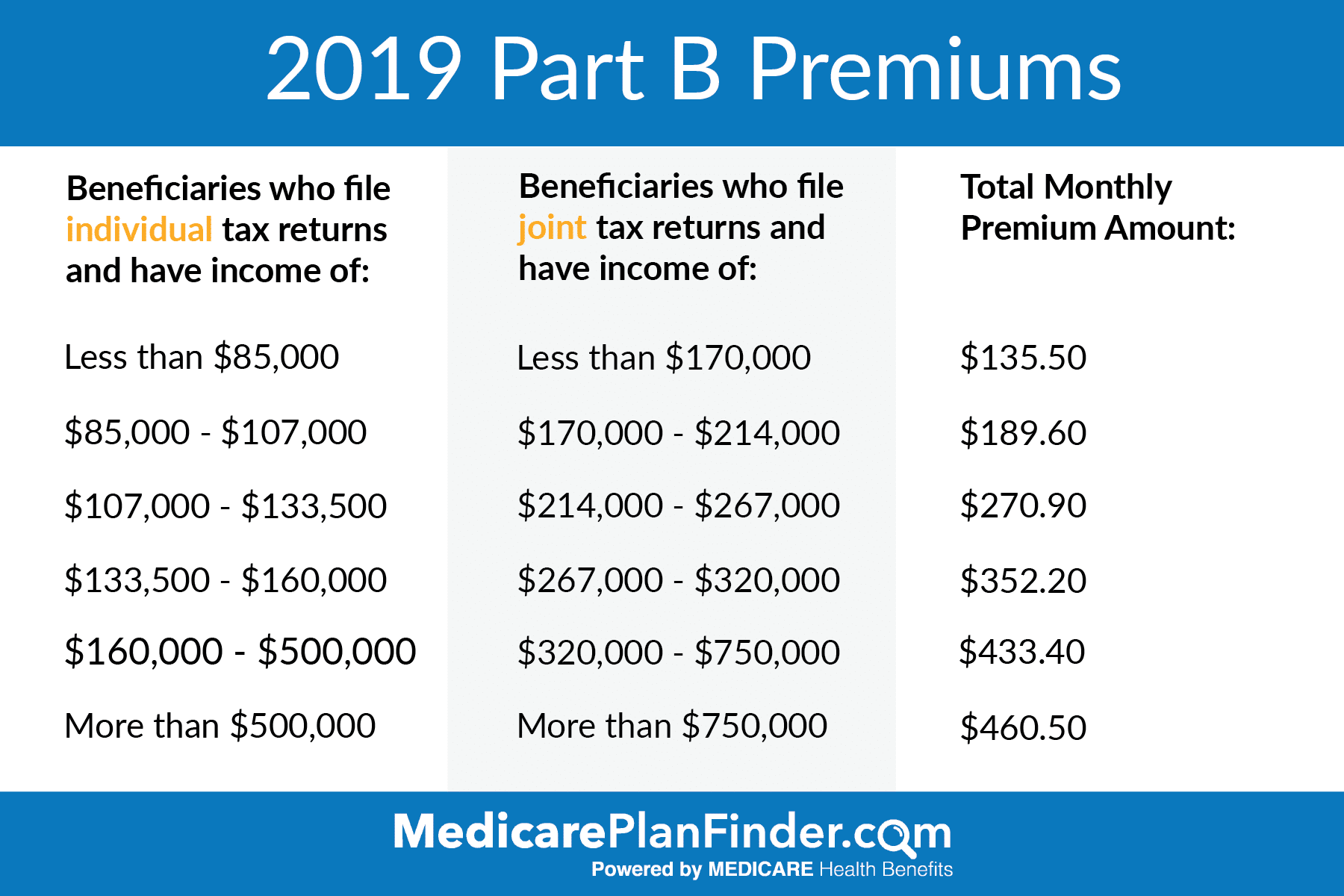

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

What is difference between Part A and Part B Medicare?

Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care.

Does everyone qualify for Medicare?

You are typically eligible for Medicare when you turn 65 if you are a U.S. citizen or permanent legal resident. You can become eligible at a younger age if you have certain rare conditions or disabilities like amyotrophic lateral sclerosis (ALS) or end-stage renal disease.

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Is Medicare based on your income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is Part A Medicare?

Premium-free Part A Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

What is Medicare Part A deductible for 2022?

Medicare Deductibles. The 2022 deductible for Medicare Part A is $1,556 for each benefit period: $0 for days 1-60, $389 coinsurance per day for days 61-90 and $778 per each "lifetime reserve day" after 91 days.

What Is Medicare Part A Coverage?

Medicare Part A is health insurance offered by the federal government to United States citizens and legal immigrants who have permanently resided i...

What Does Medicare Part A Cover?

Medicare Part A (hospital insurance) helps cover a variety of services, including the following: 1. Inpatient hospital care: May include semi-priva...

What Are My Medicare Part A Costs?

Many people get Medicare Part A without a premium if they’ve worked the required amount of time under Medicare-covered employment, generally 10 yea...

When Do I Sign Up For Medicare Part A?

Some people are automatically enrolled in Medicare Part A, while you may need to manually sign up for it in other cases.Automatic enrollment in Med...

How Do I Sign Up For Medicare Part A?

If you need to manually enroll in Medicare Part A, you can do so through Social Security or the Railroad Retirement Board (RRB). You can sign up in...

When do you enroll in Medicare Part A?

You’re automatically enrolled in original Medicare — which is made up of parts A and B — starting on the first day of the month you turn 65 years old.

What is Medicare for people over 65?

Medicare is a government healthcare program that cover s healthcare costs for people ages 65 and over or those with certain disabilities. The Medicare program is split into several sections, or parts. These include:

How long do you have to work to get Medicare?

If you’ve worked for at least 40 quarters — roughly 10 years — and paid Medicare taxes out of your paycheck, you won’t pay a premium for Medicare Part A. If you worked less than that amount of time, you will pay a monthly premium for Part A. Even if you don’t owe a premium, other costs are typically associated with services covered under Part A.

What is Medicare Part A 2021?

Deductibles and hospital coinsurance. With Medicare Part A, you’ll also pay a deductible and coinsurance costs for each benefit period. In 2021, these costs are: Each day beyond day 90 is considered a lifetime reserve day. You have up to 60 of these days to use in your lifetime.

How old do you have to be to get Social Security?

You’re 65 years old and receive retirement benefits from Social Security or the Railroad Retirement Board (RRB). You’re 65 years old and you or your spouse had Medicare-covered health benefits from a government job. You’re under age 65 and have received Social Security or RRB disability benefits for 24 months.

How long do you have to be on Medicare if you are 65?

If you’re under age 65 and receiving Social Security or RRB disability benefits, you’ll automatically be enrolled in Medicare Part A when you’ve been receiving the disability benefits for 24 months. If you’re not automatically enrolled, you can sign up manually through the Social Security Administration.

How much is the Part A premium for 2021?

If you or your spouse worked for 30 to 39 quarters, the standard monthly Part A premium cost is $259 in 2021. If you or your spouse for worked fewer than 30 quarters, the standard monthly Part A premium cost is $471 in 2021.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

How much will Medicare premiums be in 2021?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B. In most cases, if you choose to buy Part A, you must also: Have. Medicare Part B (Medical Insurance)

What does Part B cover?

In most cases, if you choose to buy Part A, you must also: Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. from Social Security or the Railroad Retirement Board.

What is QMB in Medicare?

If you or your spouse worked fewer than 30 quarters (7.5 years) If your income is low, you may be eligible for the Qualified Medicare Beneficiary (QMB) program, which pays for your Medicare Part A and B premiums and other Medicare costs.

Is Medicare Part A free?

Register. Medicare Part A is free if you: Have at least 40 calendar quarters of work in any job where you paid Social Security taxes in the U.S. Are eligible for Railroad Retirement benefits. Or, have a spouse that qualifies for premium -free Part A. [bsa_pro_ad_space id=3]

When do you enroll in Medicare Part A?

If you’re currently receiving retirement benefits from Social Security or the Railroad Retirement Board (RRB), you’re automatically enrolled in both Medicare Part A and Part B starting the first day of the month you turn age 65.

How long does Medicare Part A last?

If you do not automatically qualify for Medicare Part A, you can do so during your Initial Enrollment Period, which starts three months before you turn 65, includes the month you turn 65, and lasts for three additional months after you turn 65.

What is the Medicare Part B?

Together with Medicare Part B, it makes up what is known as Original Medicare , the federally administered health-care program.

How much is Medicare Part A deductible for 2021?

Medicare Part A cost-sharing amounts (for 2021) are listed below. Inpatient hospital care: Medicare Part A deductible: $1,484 for each benefit period. Medicare Part A coinsurance: $0 coinsurance for the first 60 days of each benefit period. $371 a day for the 61st to 90th days of each benefit period. $742 a day for days 91 and beyond per each ...

How long do you have to pay Medicare premiums?

Most people don’t pay a monthly premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a minimum of 10 years (40 quarters) while working. If you haven’t worked long enough but your spouse has, you may be able to qualify for premium-free Part A based on your spouse’s work history.

When do you get Medicare if you are 65?

You will receive your Medicare card in the mail three months before the 25th month of disability.

How old do you have to be to get Medicare?

You are 65 or older and meet the citizenship or residency requirements. You are under age 65, disabled, and your premium-free Medicare Part A coverage ended because you returned to work. You have not paid Medicare taxes through your employment or have not worked the required time to qualify for premium-free Part A.