Medicare Part B (Medical Insurance) is optional coverage, but most Medicare recipients choose to enroll when they qualify for Medicare. Part B helps cover the costs of medically necessary services and supplies and preventive care.

What does Medicare Part B cover?

Part B covers things like: Clinical research. Ambulance services. Durable medical equipment (DME) Mental health Inpatient. Outpatient. Partial hospitalization. Getting a second opinion before surgery.

What is beneficiaries Services Medicare?

Beneficiary Services Medicare is a health insurance program designed to assist the nation's elderly to meet hospital, medical, and other health costs. Medicare is available to most individuals 65 years of age and older.

Do I have to pay Medicare Part A or Part B deductibles?

Medicare beneficiaries enrolled in the QMB program have no legal obligation to pay Medicare Part A or Part B deductibles, coinsurance, or copays for any Medicare-covered items and services.

What does Medicare Part a cover?

What Part A covers. Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

What is Medicare Part B provide?

Medicare Part B helps cover medically-necessary services like doctors' services and tests, outpatient care, home health services, durable medical equipment, and other medical services. Part B also covers some preventive services. Look at your Medicare card to find out if you have Part B.

What does Medicare Part A cover for beneficiaries?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

What types of costs are covered under Medicare Part B?

Medicare Part B covers medical expenses like doctor's visits, diagnostic tests, and other outpatient care. Part B also covers preventative care. In 2022, most people will pay a monthly premium of $170.10 for Medicare part B.

Which of the following services are covered by Medicare Part B quizlet?

Part B helps cover medically-necessary services like doctors' services, outpatient care, durable medical equipment, home health services, and other medical services.

Which of the following is not covered under Part B of a Medicare policy?

But there are still some services that Part B does not pay for. If you're enrolled in the original Medicare program, these gaps in coverage include: Routine services for vision, hearing and dental care — for example, checkups, eyeglasses, hearing aids, dental extractions and dentures.

What does Medicare Parts A and B cover?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers.

What is Medicare Part B also known as quizlet?

Medicare Part B is also called. Supplemental Medical Insurance. Durable Medical Equipment is covered by. Medicare Part B.

What is the difference in Medicare Part A and Part B?

If you're wondering what Medicare Part A covers and what Part B covers: Medicare Part A generally helps pay your costs as a hospital inpatient. Medicare Part B may help pay for doctor visits, preventive services, lab tests, medical equipment and supplies, and more.

What is Medicare Part B?

It consists of several parts, one of which is Part B. Medicare Part B is the part of Medicare that provides medical insurance. You can use it to cover various outpatient services.

What is part B in medical?

occupational therapy. other testing, such as imaging tests and echocardiograms. outpatient hospital and mental health care. physical therapy. transplants. Part B also covers somepreventative services as well.

What happens if you don't enroll in Part B?

When you need to pay the late enrollment penalty, your monthly premium can increase up to 10 percent of the standard premium for each 12-month period that you were eligible for Part B but didn’t enroll.

What is a Part B?

Part B covers a wide variety of medically necessary outpatient services. A service is determined medically necessary if it’s needed to effectively diagnose or treat a health condition. Some examples of servicescovered by Part B are: emergency ambulance transportation. chemotherapy.

What is the monthly premium for Part B insurance in 2021?

Your monthly premium is what you pay each month for Part B coverage. For 2021, the standard Part B monthly premium is $148.50. People with higher yearly incomes may have to pay higher monthly premiums. Your yearly income is determined based off of your tax return from two years ago.

What is a copay?

A copay is a set amount thatyou pay for a service. Copays aren’t typically associated with Part B. However,there are some cases where you may need to pay one. An example is if you usehospital outpatient services.

What is Part B coverage?

Part B coverage will also pay for preventative services that help to either prevent a disease or diagnose illnesses at an early stage so they can be managed before they get worse. The list of services that Part B coverage considers medically necessary includes but is not limited to the following:

What is Medicare Part A?

Medicare Part A is the portion responsible for paying an individual’s fees for services and supplies related to hospital stays. Medicare Part B on the other hand is responsible for paying for general medical services such as doctor visits, checkups, and exams. Let’s take a closer look at the basics of Medicare Part B coverage.

What happens if you opt out of Medicare Part B?

If an individual decides to opt out of Medicare Part B coverage they could face a lifetime penalty for choosing to not carry Part B coverage. Medicare Part B is just a portion of the Medicare program which was designed to provide eligible senior citizens with necessary health insurance during their golden years.

Is Medicare Part B deductible?

Medicare Part B is not without cost to those enrolled in the program. In addition to a monthly premium to pay for the cost of Part B coverage, beneficiaries must meet a certain deductible amount on their own before Medicare’s Part B coverage will kick in and pay for the rest of the services rendered. Even after meeting the deductible and paying the ...

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

What happens when Medicare beneficiaries have other health insurance?

When a Medicare beneficiary has other insurance (like employer group health coverage), rules dictate which payer is responsible for paying first. Please review the Reporting Other Health Insurance page for information on how and when to report other health plan coverage to CMS.

What is Medicare for seniors?

Medicare is a health insurance program designed to assist the nation's elderly to meet hospital, medical, and other health costs. Medicare is available to most individuals 65 years of age and older.

How long does it take for Medicare to pay a claim?

When a Medicare beneficiary is involved in a no-fault, liability, or workers’ compensation case, his/her doctor or other provider may bill Medicare if the insurance company responsible for paying primary does not pay the claim promptly (usually within 120 days).

Does Medicare pay a conditional payment?

In these cases, Medicare may make a conditional payment to pay the bill. These payments are "conditional" because if the beneficiary receives an insurance or workers’ compensation settlement, judgment, award, or other payment, Medicare is entitled to be repaid for the items and services it paid.

What is QMB in Medicare?

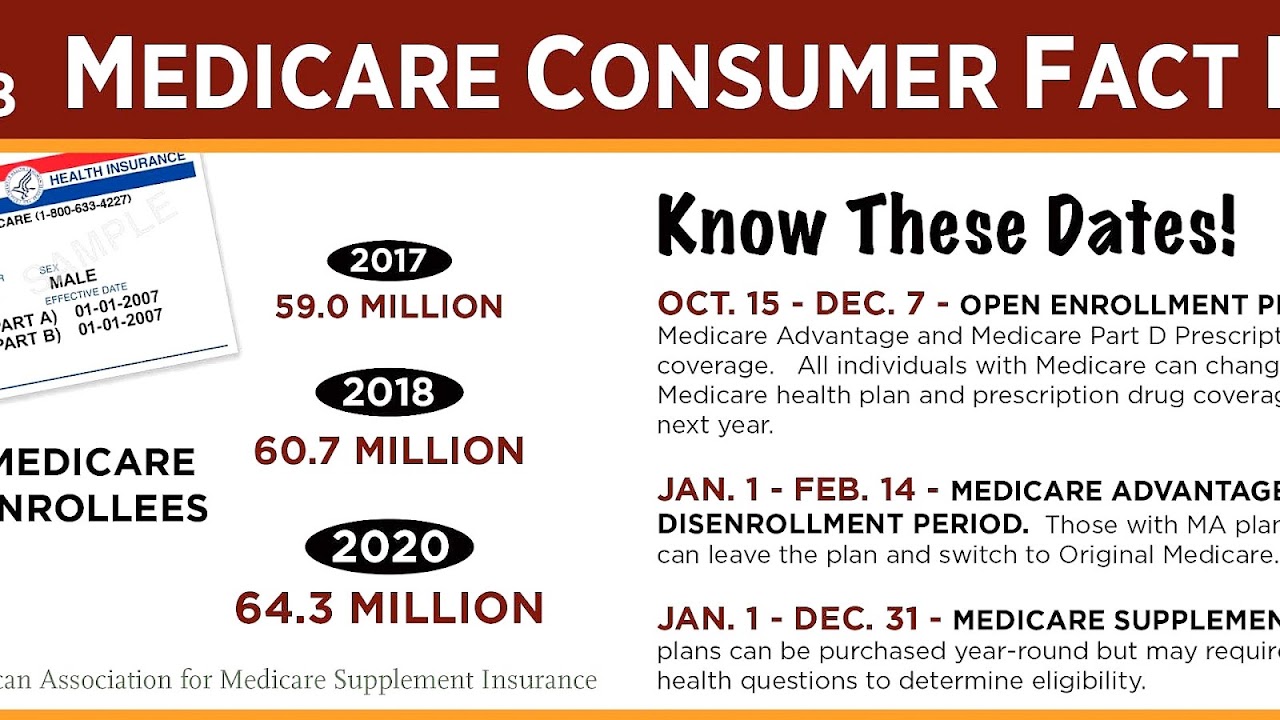

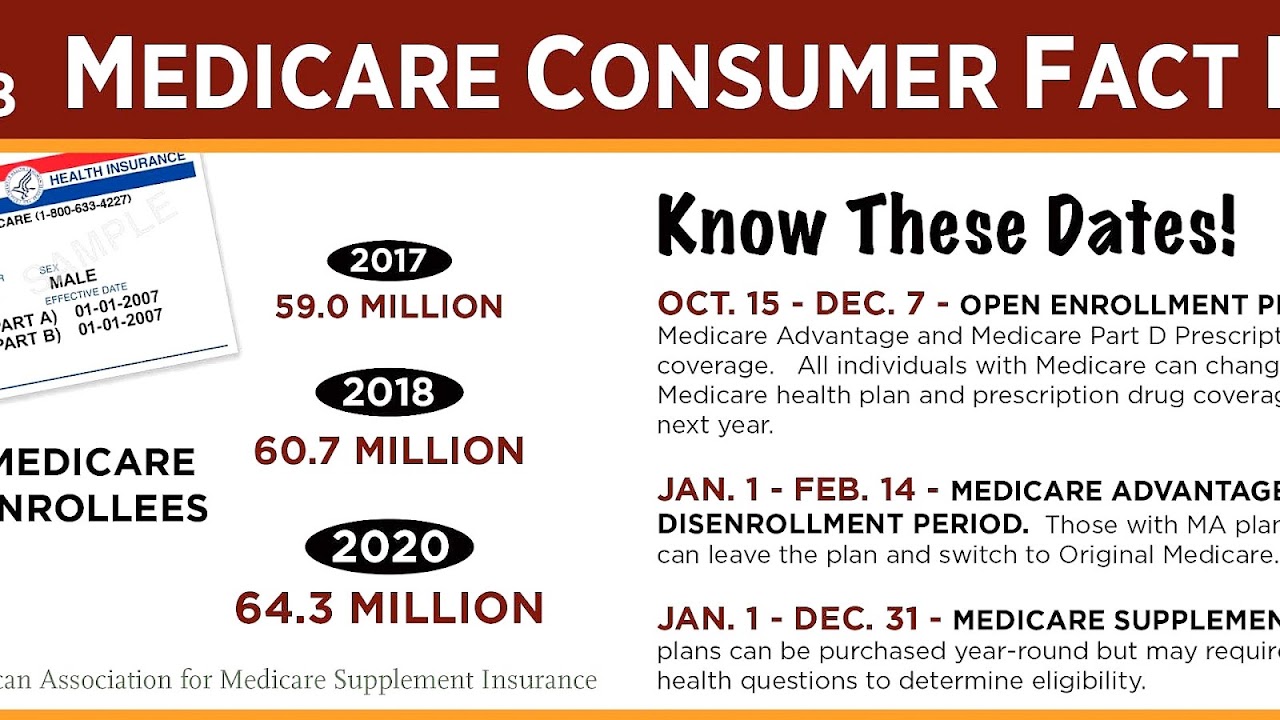

The Qualified Medicare Beneficiary ( QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries. In 2017, 7.7 million people (more than one out of eight people with Medicare) were in the QMB program.

Can a QMB payer pay Medicare?

Billing Protections for QMBs. Federal law forbids Medicare providers and suppliers, including pharmacies, from billing people in the QMB program for Medicare cost sharing. Medicare beneficiaries enrolled in the QMB program have no legal obligation to pay Medicare Part A or Part B deductibles, coinsurance, or copays for any Medicare-covered items ...

What is Medicare Advantage?

Medicare Advantage (Part C) plans are offered by private insurance companies who contract with Medicare to provide your Part A and Part B benefits.

Is Medicare Part B deductible?

Most people are automatically enrolled in premium-free Part A (Hospital Insurance) if they paid taxes for a certain period of time. Many Medicare recipients choose to enroll in Part B (Medical Insurance) when they are first eligible. There is a monthly premium and an annual deductible for Part B coverage. Medicare Part B (Medical Insurance) is ...

How to contact Medicare.org?

Call us at (888) 815-3313 — TTY 711 to speak with a licensed sales agent.

Does QMB cover Medicare?

It means that your state covers these Medicare costs for you, and you have to pay only for anything that Medicare normally does not cover. QMB does not supplement your Medicare coverage but instead ensures that you will not be precluded from coverage because you cannot afford to pay the costs associated with Medicare.