It is common to delay Medicare Part B enrollment due to creditable coverage. However, delaying Medicare Part B without creditable coverage has a different result. Once eligible for Medicare, if you do not enroll in Medicare Part B, the Medicare Part B penalty increases incrementally for every year you lack this coverage.

What happens if I don't have Medicare Part B?

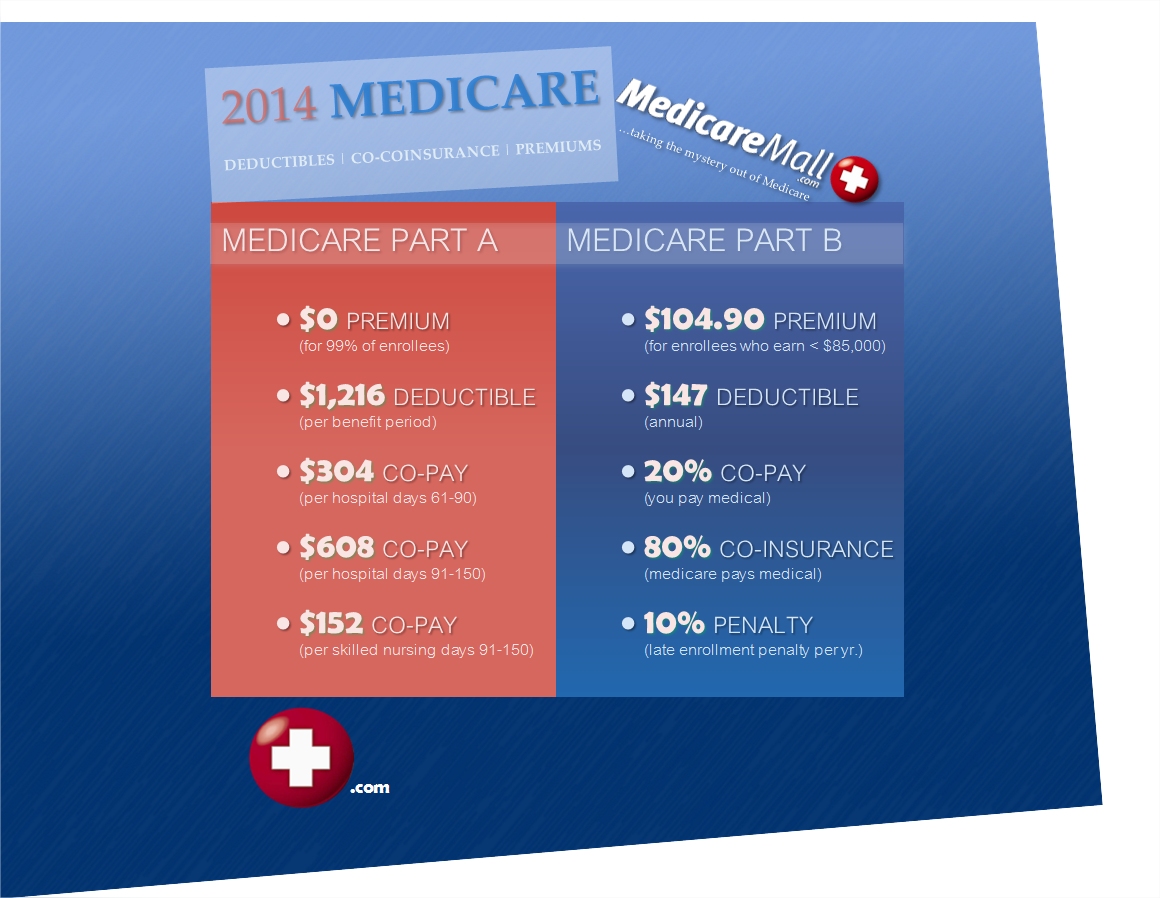

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B. And, the penalty increases the longer you go without Part B coverage.

What is creditable coverage and how does it affect Medicare?

Coverage that’s as good as Medicare is creditable coverage, meaning the plan benefits are up to the same standards as Medicare. When a person has creditable coverage, they may postpone enrollment in Medicare.

What is not considered creditable coverage under Medicare Part D?

An employer with small group insurance is a company with less than 20 employees and may not be creditable coverage under Medicare. Further, a variety of government programs are also considered creditable coverage. Examples of other types of coverage are individual, group, and student health plans. What is Creditable Coverage for Medicare Part D?

Do I pay a late enrollment penalty for Medicare Part B?

Usually, you don't pay a late enrollment penalty if you meet certain conditions that allow you to sign up for Part B during a Special Enrollment Period. Read more about different situations that may affect when you decide to get Part B. If you have limited income and resources, your state may help you pay for Part A, and/or Part B.

Can you lose Medicare Part B coverage?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

Does Medicare cover lapse?

Important for people losing Medicare drug coverage: If there's a period of 63 days or more in a row when the person with Medicare isn't enrolled in Medicare drug coverage and doesn't have other creditable prescription drug coverage, they may have to pay a monthly Part D late enrollment penalty when they join a new plan ...

Do I have to reapply for Medicare Part B?

You can choose a different plan, or you'll be notified to enroll in a new plan if you're no longer in the plan's service area. For Original Medicare (Parts A and B), there are no renewal requirements once enrolled. Medigap plans ― also known as Medicare Supplement plans ― auto renew annually unless you make a change.

What is the maximum Part B late enrollment penalty?

As of now, there is no cap when calculating the Medicare Part B late enrollment penalty. However, legislation has been introduced to cap the Medicare Part B penalty at 15% of the current premium, regardless of how many 12-month periods the beneficiary goes without coverage.

How do I reinstate Part B?

If you're looking to reenroll in Medicare Part B, follow these steps:Go to the Social Security Administration website.Complete the application.Mail all required documents to the Social Security office. Include all required official or certified documents to allow for a seamless process.

How do I avoid Medicare Part B penalty?

If you don't qualify to delay Part B, you'll need to enroll during your Initial Enrollment Period to avoid paying the penalty. You may refuse Part B without penalty if you have creditable coverage, but you have to do it before your coverage start date.

Does Medicare B renew automatically?

If you have Medicare Part A (hospital insurance) and/or Part B (medical insurance) and you are up to date on your Medicare premiums, your Medicare coverage will automatically carry over from one year to the next and there is nothing you need to do to renew your plan.

Do I have to decline Medicare Part B every year?

Once you have signed up to receive Social Security benefits, you can only delay your Part B coverage; you cannot delay your Part A coverage. To delay Part B, you must refuse Part B before your Medicare coverage has started.

Can you add Medicare Part B at any time?

You can sign up for Medicare Part B at any time that you have coverage through current or active employment. Or you can sign up for Medicare during the eight-month Special Enrollment Period that starts when your employer or union group coverage ends or you stop working (whichever happens first).

Why was my Medicare Part B Cancelled?

Depending on the type of Medicare plan you are enrolled in, you could potentially lose your benefits for a number of reasons, such as: You no longer have a qualifying disability. You fail to pay your plan premiums. You move outside your plan's coverage area.

Can Medicare penalties be waived?

You may qualify to have your penalty waived if you were advised by an employee or agent of the federal government – for example by Social Security or 1-800-MEDICARE – to delay Part B. Asking for the correction is known as requesting equitable relief.

How are Medicare Part B late enrollment penalties calculated?

Calculating Lifetime Penalty Fees Calculating your Part B penalty is fairly straightforward. You simply add 10% to the cost of your monthly premium for each year-long period you didn't have Medicare. It's simple to get a snapshot of what you will have to pay each month.

How long does Medicare have to be in effect to be late?

The MMA imposes a late enrollment penalty on individuals who do not maintain creditable coverage for a period of 63 days or longer following their initial enrollment period for the Medicare prescription drug benefit.

What is creditable coverage?

The Medicare Modernization Act (MMA) requires entities (whose policies include prescription drug coverage) to notify Medicare eligible policyholders whether their prescription drug coverage is creditable coverage, which means that the coverage is expected to pay on average as much as the standard Medicare prescription drug ...

How long does it take to complete a CMS 2nd disclosure?

The Disclosure should be completed annually no later than 60 days from the beginning of a plan year (contract year, renewal year), within 30 days after termination ...

When will Part B coverage start?

You waited to sign up for Part B until March 2019 during the General Enrollment Period. Your coverage starts July 1, 2019. Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.)

How much is the penalty for Part B?

Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.) Find out what Part B covers.

How much is the late enrollment fee for Medicare Part B?

For Part B, you’ll be required to pay a late enrollment fee of an extra 10 percent of your monthly premium amount for each 12-month period you didn’t sign up. This penalty lasts for as long as you have Medicare Part B coverage.

What happens if you lose your Medicare?

If you lose your current coverage, this triggers a special enrollment period during which you can sign up for Medicare without penalty. If you don’t have creditable insurance coverage and delay signing up for Medicare, late fees and penalties may apply.

What happens if you enroll in Medicare and keep your insurance?

If you enroll in Medicare, have creditable coverage, and keep your insurance, your current provider would be your primary insurer. Medicare would be your secondary insurer. You may decide to let your current insurance lapse.

How long do you have to enroll in Medicare if you lose your current coverage?

If you lose your current coverage, you should enroll in Medicare within 8 months. This is known as a special enrollment period.

What is Cobra insurance?

COBRA (Continuation of Health Coverage). COBRA is designed to prolong your health insurance coverage if you’re no longer employed. It isn’t creditable coverage for original Medicare but may be creditable coverage for Part D.

What is creditable coverage?

The takeaway. Creditable coverage refers to health insurance that covers at least as much as — or more than — Medicare. If you have creditable coverage, you may choose to keep it instead of or in addition to Medicare.

How long do you have to sign up for Medicare if you lose your credit?

If you lose your creditable coverage, you must sign up for Medicare within 8 months; otherwise, penalties and late fees may apply. If you’re eligible for Medicare but already have health insurance, you may be wondering whether you should keep it or switch.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How long do you have to sign up for Part B?

You may qualify for a Special Enrollment Period when your employer coverage ends if you meet these qualifications. You’ll have eight months to sign up for Part B without penalty.

What happens when the text disappears in the piggy bank?

The text disappears and a gold coin floats above the piggy bank's back. More text appears.

What to talk to a retiree about Medicare?

Speak with your retiree plan administrator about the benefits and costs of your plan as well as other coverage choices you have once you’re on Medicare.

What percentage of Medicare pays for outpatient care?

Medicare Part B pays 80 percent of outpatient health care costs and 100 percent for many preventive services. But it pays to think carefully about when to sign up. Here’s why. Part B comes with a monthly premium. You could save money if you delay enrollment.

When do you get Medicare card?

You will be enrolled in Original Medicare (Parts A & B) automatically when you turn 65. You’ll get your Medicare card in the mail. Coverage usually starts the first day of your 65th birthday month.

How long does a person pay 10% of Part A premium?

Individual pays an additional 10% of Part A premium each month for 4 years.

What happens if you delay Medicare Part B?

It’s important to note that if you delay enrolling in Medicare Part B or Part D prescription drug coverage and didn’t have other creditable coverage, you will most likely be forced to pay late enrollment penalties whenever you eventually do decide to enroll in Medicare.

How long do you have to have non-creditable coverage to get Medicare?

If you have non-creditable coverage for 63 days or more before enrolling in Medicare, you may pay more for your monthly premiums when you do register:

What is a certificate of creditable coverage?

A certificate of creditable coverage is a document that insurance companies can issue to indicate that someone has terminated their coverage. It shows the insured person's name, the period they held insurance, and when they canceled their policy.

What is the penalty for Part D late enrollment?

Part D late enrollment penalty: 1% of the national base beneficiary premium ( $33.06 per month in 2021) multiplied by the number of months you had non-creditable coverage will be added to your monthly Part D premium.

How often do you pay penalties for Medicare?

You'll pay these penalties every month for as long as you receive Medicare.

When do you receive drug coverage notices?

You'll receive these notices each September providing your drug coverage remains creditable. It's wise to file these documents in a safe place as you may need them in the future to prove you maintained creditable drug coverage.

Can you delay Medicare enrollment?

Medicare states that any health plan offering benefits equal to or greater than its own is creditable coverage. So if you have this level of coverage , you won't get penalized for delaying Medicare enrollment.

What is a late enrollment penalty for Medicare?

Under Section §1860D-13(b) of the Social Security Act, and 42 CFR §423.46 423.56(g), Medicare beneficiaries may incur a late enrollment penalty (LEP) if there is a continuous period of 63 days or more at any time after the end of the individual’s Part D initial enrollment period during which the individual was eligible to enroll, but was not enrolled in a Medicare Part D plan and was not covered under any creditable prescription drug coverage. “Creditable prescription drug coverage” is prescription drug coverage that is expected to pay at least as much as Medicare’s standard prescription drug coverage. As outlined at 42 CFR 423.56(c) and (d), with the exception of Prescription Drug Plan (PDP) Sponsors, Medicare Advantage (MA) Organizations, Section 1876 Cost-Based Contractors, and PACE organizations offering prescription drug plans, entities that offer prescription drug coverage must make an annual determination of creditable coverage status and provide a disclosure notice to Medicare eligible individuals. Creditable prescription drug coverage includes, but is not limited to: some employer-based prescription drug coverage, including the Federal Employees Health Benefits Program; qualified State Pharmaceutical Assistance Programs (SPAPs); military-related coverage (e.g., VA, TRICARE); and certain Medicare supplemental (Medigap) policies. (See 42 C.F.R §423.56(b) for a complete list of types of prescription drug coverage that may be determined to be creditable. Additional information related to creditable coverage requirements for employer and union-sponsored plans and all other entities that sponsor prescription drug coverage may be found at

What information is retained for creditable coverage?

Similarly, Part D plan sponsors shall also retain copies of any evidence of creditable coverage, including late attestation forms, and any information regarding reconsideration decisions . (For more information on LEP reconsideration procedures, please see Section 80.7.1 of Chapter 18.)

How is LEP calculated?

The LEP is calculated based on the national base beneficiary premium, not the plan’s premium resulting from the annual bidding process. Therefore, the LEP is billed to applicable members even if the plan’s Part D basic premium is $0.

What section of the IRE will notify beneficiaries and the Part D plan sponsor of the final reconsideration decision?

The Part D plan sponsor shall refer to Chapter 18, Section 80.7.1, of this manual for detailed guidance on LEP reconsideration procedures.

How long does it take to get a LEP from CMS?

The Part D plan sponsor shall notify each plan member of the imposition of, or adjustment to, an LEP in writing within 10 calendar days of receiving notice of the LEP from CMS. The letter to the beneficiary shall include the following elements:

What happens if a Part D plan receives an attestation?

If the Part D plan sponsor receives an attestation form after the stated deadline, it has the discretion to review and report upon it, provided that (1) the sponsor meets the reporting timeframes outlined in Section 20.2.4, “Determination based on Missing Attestation Form,” and (2) the sponsor applies a consistent policy for all late attestation forms.

How long does it take for a Part D plan to report to CMS?

If the beneficiary fails to return the attestation form by the stated deadline, the Part D plan sponsor shall report to CMS, within 7 calendar days after the stated deadline date, the appropriate number of uncovered months based on the available information.