How does Medicare Part D work?

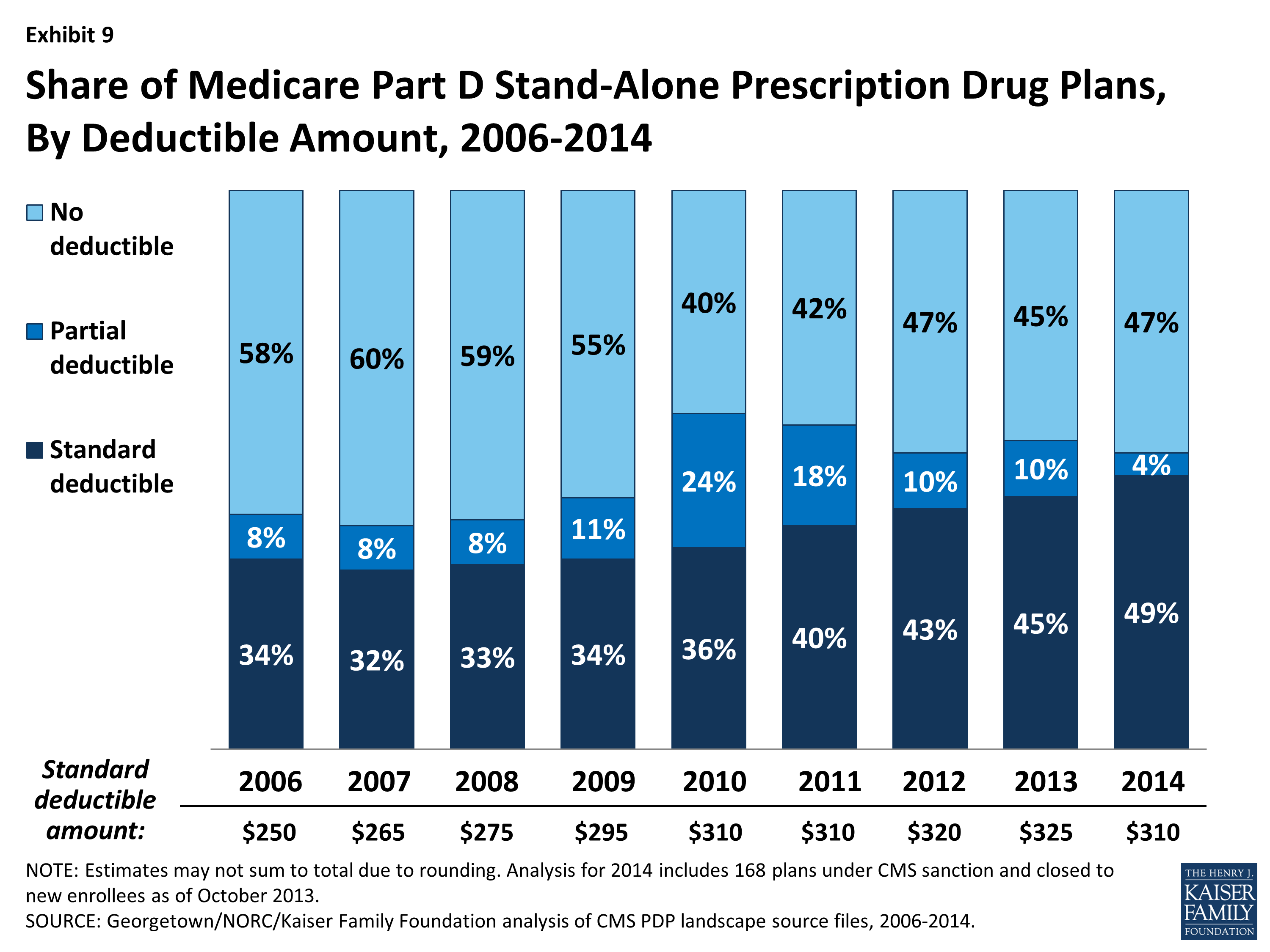

Part D was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006. Under the program, drug benefits are provided by private insurance plans that receive premiums from both enrollees and the government. Part D plans typically pay most of the cost for prescriptions filled by their enrollees.

How much is the initial deductible for Medicare Part D?

Initial deductible. Your deductible during each benefit period is $1,484. After you pay this amount, Medicare starts covering the costs. Days 1 through 60. For the first 60 days that you’re an inpatient, you’ll pay $0 coinsurance during this benefit period.

When did Medicare Part D go into effect?

The final bill was enacted as part of the Medicare Modernization Act of 2003 (which also made changes to the public Part C Medicare health plan program) and went into effect on January 1, 2006. The various proposals were substantially alike in that Part D was optional, it was separated from the other three Parts...

What is the time limit for filing a Medicare claim?

Medicare claims must be filed no later than 12 months (or 1 full calendar year) after the date when the services were provided. If a claim isn't filed within this time limit, Medicare can't pay its share.

Is there a grace period for Medicare Part D?

The Centers for Medicare and Medicaid Services (CMS) have implemented safe-guards to protect Medicare beneficiaries who inadvertently missed a Medicare Part D premium payment and require Medicare plans to contact plan members about the unpaid premiums and provide "a consistent grace period of no less than two (2) ...

How long do I have to submit Medicare claims?

12 monthsMedicare claims must be filed no later than 12 months (or 1 full calendar year) after the date when the services were provided. If a claim isn't filed within this time limit, Medicare can't pay its share.

What is the time frame for a standard Medicare Part D appeal?

60 daysYou have 60 days from the date listed on this notice to begin the formal appeal process by filing an appeal with your plan. This timeline applies regardless of whether your appeal is under standard or expedited review.

How does Medicare Part D reimbursement work?

The monthly premium paid by enrollees is set to cover 25.5% of the cost of standard drug coverage. Medicare subsidizes the remaining 74.5%, based on bids submitted by plans for their expected benefit payments.

What is the timely filing limit for Medicare secondary claims?

12 monthsQuestion: What is the filing limit for Medicare Secondary Payer (MSP) claims? Answer: The timely filing requirement for primary or secondary claims is one calendar year (12 months) from the date of service.

What is timely filing for Golden Rule?

The Timely Filing limit is 1 year and 90 days from the date of service. If your patient also has Medicare coverage, be sure to file with Medicare first and list Golden Rule on the bill as the secondary carrier.

What is the timeframe for appealing coverage or payment decisions for Part D?

within 60 daysYou must file your appeal in writing within 60 days, unless your drug plan accepts requests by telephone.

How can I avoid Medicare Part D Penalty?

3 ways to avoid the Part D late enrollment penaltyEnroll in Medicare drug coverage when you're first eligible. ... Enroll in Medicare drug coverage if you lose other creditable coverage. ... Keep records showing when you had other creditable drug coverage, and tell your plan when they ask about it.

Does Medicare cover 90 day prescriptions?

During the COVID-19 pandemic, Medicare drug plans must relax their “refill-too-soon” policy. Plans must let you get up to a 90-day supply in one fill unless quantities are more limited for safety reasons.

What are the 4 phases of Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

How does pharmacy reimbursement work?

Pharmacy reimbursement under Part D is based on negotiated prices, which is usually based on the AWP minus a percentage discount, plus a dispensing fee (more on dispensing fees later). Private third-party payers currently base their reimbursement formula on AWP.

How is Medicare reimbursement calculated?

The Centers for Medicare and Medicaid Services (CMS) determines the final relative value unit (RVU) for each code, which is then multiplied by the annual conversion factor (a dollar amount) to yield the national average fee. Rates are adjusted according to geographic indices based on provider locality.

How long does it take for Medicare to pay?

Medicare claims must be filed no later than 12 months (or 1 full calendar year) after the date when the services were provided. If a claim isn't filed within this time limit, Medicare can't pay its share. For example, if you see your doctor on March 22, 2019, your doctor must file the Medicare claim for that visit no later than March 22, 2020.

When do you have to file Medicare claim for 2020?

For example, if you see your doctor on March 22, 2019, your doctor must file the Medicare claim for that visit no later than March 22, 2020. Check the "Medicare Summary Notice" (MSN) you get in the mail every 3 months, or log into your secure Medicare account to make sure claims are being filed in a timely way.

How to file a medical claim?

Follow the instructions for the type of claim you're filing (listed above under "How do I file a claim?"). Generally, you’ll need to submit these items: 1 The completed claim form (Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB]) 2 The itemized bill from your doctor, supplier, or other health care provider 3 A letter explaining in detail your reason for submitting the claim, like your provider or supplier isn’t able to file the claim, your provider or supplier refuses to file the claim, and/or your provider or supplier isn’t enrolled in Medicare 4 Any supporting documents related to your claim

What to call if you don't file a Medicare claim?

If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227) . TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got. If it's close to the end of the time limit and your doctor or supplier still hasn't filed the claim, you should file the claim.

What happens after you pay a deductible?

After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). , the law requires doctors and suppliers to file Medicare. claim. A request for payment that you submit to Medicare or other health insurance when you get items and services that you think are covered.

Does Medicare Advantage cover hospice?

Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Most Medicare Advantage Plans offer prescription drug coverage. , these plans don’t have to file claims because Medicare pays these private insurance companies a set amount each month.

Do you have to file a claim with Medicare Advantage?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. , these plans don’t have to file claims because Medicare pays these private insurance companies a set amount each month.

How much of Medicare is covered by Part D?

In 2019, about three-quarters of Medicare enrollees obtained drug coverage through Part D. Program expenditures were $102 billion, which accounted for 12% of Medicare spending. Through the Part D program, Medicare finances more than one-third of retail prescription drug spending in the United States.

What is Medicare Part D?

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs.

What is Medicare Part D cost utilization?

Medicare Part D Cost Utilization Measures refer to limitations placed on medications covered in a specific insurer's formulary for a plan. Cost utilization consists of techniques that attempt to reduce insurer costs. The three main cost utilization measures are quantity limits, prior authorization and step therapy.

How many Medicare beneficiaries are enrolled in Part D?

Medicare beneficiaries who delay enrollment into Part D may be required to pay a late-enrollment penalty. In 2019, 47 million beneficiaries were enrolled in Part D, which represents three-quarters of Medicare beneficiaries.

What is excluded from Part D?

Excluded drugs. While CMS does not have an established formulary, Part D drug coverage excludes drugs not approved by the Food and Drug Administration, those prescribed for off-label use, drugs not available by prescription for purchase in the United States, and drugs for which payments would be available under Part B.

When did Medicare Part D go into effect?

Part D was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006. Under the program, drug benefits are provided by private insurance plans that receive premiums from both enrollees and the government.

What is part D coverage?

Part D coverage excludes drugs or classes of drugs that may be excluded from Medicaid coverage. These may include: Drugs used for anorexia, weight loss, or weight gain. Drugs used to promote fertility. Drugs used for erectile dysfunction. Drugs used for cosmetic purposes (hair growth, etc.)

How long does Medicare benefit last after discharge?

Then, when you haven’t been in the hospital or a skilled nursing facility for at least 60 days after being discharged, the benefit period ends. Keep reading to learn more about Medicare benefit periods and how they affect the amount you’ll pay for inpatient care. Share on Pinterest.

What is Medicare benefit period?

Medicare benefit periods mostly pertain to Part A , which is the part of original Medicare that covers hospital and skilled nursing facility care. Medicare defines benefit periods to help you identify your portion of the costs. This amount is based on the length of your stay.

How much coinsurance do you pay for inpatient care?

Days 1 through 60. For the first 60 days that you’re an inpatient, you’ll pay $0 coinsurance during this benefit period. Days 61 through 90. During this period, you’ll pay a $371 daily coinsurance cost for your care. Day 91 and up. After 90 days, you’ll start to use your lifetime reserve days.

What facilities does Medicare Part A cover?

Some of the facilities that Medicare Part A benefits apply to include: hospital. acute care or inpatient rehabilitation facility. skilled nursing facility. hospice. If you have Medicare Advantage (Part C) instead of original Medicare, your benefit periods may differ from those in Medicare Part A.

Why is it important to check deductibles each year?

It’s important to check each year to see if the deductible and copayments have changed, so you can know what to expect. According to a 2019 retrospective study. Trusted Source. , benefit periods are meant to reduce excessive or unnecessarily long stays in a hospital or healthcare facility.

How much is Medicare deductible for 2021?

Here’s what you’ll pay in 2021: Initial deductible. Your deductible during each benefit period is $1,484. After you pay this amount, Medicare starts covering the costs. Days 1 through 60.

How long does Medicare Advantage last?

Takeaway. Medicare benefit periods usually involve Part A (hospital care). A period begins with an inpatient stay and ends after you’ve been out of the facility for at least 60 days.

What is Medicare Part D?

Medicare Part D or prescription drug coverage is provided through private insurance plans. Each plan has its own set of rules on what drugs are covered. These rules or lists are called a formulary and what you pay is based on a tier system (generic, brand, specialty medications, etc.).

How much does Medicare pay?

Medicare pays for 80 percent of your covered expenses. If you have original Medicare you are responsible for the remaining 20 percent by paying deductibles, copayments, and coinsurance. Some people buy supplementary insurance or Medigap through private insurance to help pay for some of the 20 percent.

What is Medicare reimbursement?

The Centers for Medicare and Medicaid (CMS) sets reimbursement rates for all medical services and equipment covered under Medicare. When a provider accepts assignment, they agree to accept Medicare-established fees. Providers cannot bill you for the difference between their normal rate and Medicare set fees.

Is Medicare Advantage private or public?

Medicare Advantage or Part C works a bit differently since it is private insurance. In addition to Part A and Part B coverage, you can get extra coverage like dental, vision, prescription drugs, and more.

Do providers have to file a claim for Medicare?

They agree to accept CMS set rates for covered services. Providers will bill Medicare directly, and you don’t have to file a claim for reimbursement.

Can you bill Medicare for a difference?

Providers cannot bill you for the difference between their normal rate and Medicare set fees. The majority of Medicare payments are sent to providers of for Part A and Part B services. Keep in mind, you are still responsible for paying any copayments, coinsurance, and deductibles you owe as part of your plan.

How much does Medicare pay for lifetime reserve days?

Medicare lifetime reserve days require a $682 daily co-insurance payment in 2019. All 10 standardized Medicare Supplement insurance plans will pay for this co-insurance cost. They also will cover hospital health care costs up to an additional 365 days after your Medicare benefits are used up.

How long is a lifetime reserve day for Medicare?

Medicare lifetime reserve days are used if you have an inpatient hospital stay that lasts beyond the 90 days per benefit period covered under Medicare Part A. Medicare recipients have 60 Medicare lifetime reserve days available to them, and they come with a $682 daily co-insurance cost.

How much is Medicare deductible for inpatient hospital stays?

The Medicare program will charge you deductibles and co-insurance for Part A inpatient hospital stays and health care costs, including a $682 co-insurance payment per lifetime reserve day in 2019. The table below outlines the 2019 costs associated with inpatient hospital stays.

How to use a lifetime reserve day?

To use a lifetime reserve day, first you must be eligible for inpatient hospital care that is covered by Medicare Part A. To qualify for inpatient hospital care, your hospital doctor must make an official order stating that “you need 2 or more midnights of medically necessary inpatient hospital care to treat your illness or injury and ...

What is Medicare Part A?

Medicare Part A inpatient hospital insurance covers “hospital services, including semi-private rooms, meals, general nursing, drugs as part of your inpatient treatment, and other hospital services and supplies ,” according to Medicare.gov. Medicare lifetime reserve days require a $682 daily co-insurance payment in 2019.

How long do you have to be in a hospital to qualify for Medicare?

You must use Medicare Part A hospital inpatient services for more than 90 days in a benefit period in order for a Medicare lifetime reserve day to be used.

Does Medicare Supplement pay for reserve day?

A Medicare Supplement insurance policy can pay for your Part A daily lifetime reserve day co-insurance. All Medigap plans offer full coverage for the Part A inpatient hospital care co-insurance. If you receive qualifying Part A hospital inpatient care and need to use a lifetime reserve day, your Medigap policy will pay for ...

What is the date of service for a physician certification?

The date of service for the Certification is the date the physician completes and signs the plan of care. The date of the Recertification is the date the physician completes the review.

What do providers need to determine regarding the date of service?

Providers need to determine the Medicare rules and regulations concerning the date of service and submit claims appropriately . Be sure your billing and coding staffs are aware of this information.

What is the date of service for ESRD?

The date of service for a patient beginning dialysis is the date of their first dialysis through the last date of the calendar month. For continuing patients, the date of service is the first through the last date of the calendar month. For transient patients or less than a full month service, these can be billed on a per diem basis. The date of service is the date of responsibility for the patient by the billing physician. This would also include when a patient’s dies during the calendar month. When submitting a date of service span for the monthly capitation procedure codes, the day/units should be coded as “1”.

How long does a cardiovascular monitoring service take?

Some of these monitoring services may take place at a single point in time, others may take place over 24 or 48 hours, or over a 30-day period. The determination of the date of service is based on the description of the procedure code and the time listed. When the service includes a physician review and/or interpretation and report, the date of service is the date the physician completes that activity. If the service is a technical service, the date of service is the date the monitoring concludes based on the description of the service. For example, if the description of the procedure code includes 30 days of monitoring and a physician interpretation and report, then the date of service will be no earlier than the 30th day of monitoring and will be the date the physician completed the professional component of the service.

What is the date of service for clinical laboratory services?

Generally, the date of service for clinical laboratory services is the date the specimen was collected. If the specimen is collected over a period that spans two calendar dates, the date of service is the date the collection ended. There are three exceptions to the general date of service rule for clinical laboratory tests:

When Do I Need to File A Claim?

- You should only need to file a claim in very rare cases

Medicare claims must be filed no later than 12 months (or 1 full calendar year) after the date when the services were provided. If a claim isn't filed within this time limit, Medicare can't pay its share. For example, if you see your doctor on March 22, 2019, your doctor must file the Medicar… - If your claims aren't being filed in a timely way:

1. Contact your doctor or supplier, and ask them to file a claim. 2. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got. If it's close to the end of the time limit and yo…

How Do I File A Claim?

- Fill out the claim form, called the Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB). You can also fill out the CMS-1490S claim form in Spanish.

What Do I Submit with The Claim?

- Follow the instructions for the type of claim you're filing (listed above under "How do I file a claim?"). Generally, you’ll need to submit these items: 1. The completed claim form (Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB]) 2. The itemized bill from your doctor, supplier, or other health care provider 3. A letter explaining in detail your reason for subm…

Where Do I Send The Claim?

- The address for where to send your claim can be found in 2 places: 1. On the second page of the instructions for the type of claim you’re filing (listed above under "How do I file a claim?"). 2. On your "Medicare Summary Notice" (MSN). You can also log into your Medicare accountto sign up to get your MSNs electronically and view or download them anytime. You need to fill out an "Author…