You pay your Part D IRMAA directly to Medicare, not to your plan or employer. You’re required to pay the Part D IRMAA, even if your employer or a third party (like a teacher’s union or a retirement system) pays for your Part D plan premiums.

Full Answer

Do you pay higher Medicare premiums for Medicare Part B and D?

While most people pay the standard monthly premium amounts for Medicare Part B and Part D, those with a higher income level will likely face higher premiums. Medicare looks at the modified adjusted gross income (MAGI) reported on your IRS tax return from 2 years ago to determine if you pay higher monthly premiums for Part B and Part D.

What are Medicare surcharges for Part B and Part D?

You’ll pay Medicare surcharges on top of your normal Original Medicare premiums for Part B and Part D coverage if your household makes more than $176,000 combined, or $88,000 if you’re single. These surcharges are also called "Income-Related Monthly Adjustment Amounts" (IRMAA). 1

Do I have to pay Medicare surcharges?

You’ll pay Medicare surcharges as well as premiums for Part B and Part D coverage if your household has more than $176,000 in income combined, or $88,000 if you’re single. Medicare surcharges are also called "Income-Related Monthly Adjustment Amounts" (IRMAA).

How much will I Owe for Medicare Part D?

Most people will pay the standard amount for their Medicare Part B premium. However, you’ll owe an IRMAA if you make more than $88,000 in a given year. For Part D, you’ll pay the premium for the plan you select.

How do I pay Irmaa D?

You'll get a bill each month from Medicare for your Part D IRMAA and can pay it the same way you pay your Part B premiums....How to pay your Part B and Part D IRMAAOnline through your secure Medicare account.From your bank's online bill payment service.Signing up for Medicare Easy Pay.Mailing your payment to Medicare.

Is Part D Irmaa is paid directly to Medicare?

You pay your Part D IRMAA directly to Medicare, not to your plan or employer. You're required to pay the Part D IRMAA, even if your employer or a third party (like a teacher's union or a retirement system) pays for your Part D plan premiums.

How do I pay Part D?

En español | You should check with your plan, but most plans allow you to mail in payments You should check with your plan, but most plans allow you to mail in payments or arrange for direct payment made from your bank account or credit card.

How long do I have to pay Irmaa?

The Social Security Administration (SSA) determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior, meaning two years before the year when you pay the IRMAA. For example, Social Security would use tax returns from 2021 to determine your IRMAA in 2023.

What is the Irmaa amount for 2021?

The IRMAA rises as adjusted gross income increases. The maximum IRMAA in 2021 will be $356.40, bringing the total monthly cost for Part B to $504.90 for those in that bracket. The top IRMAA bracket applies to married couples with adjusted gross incomes of $750,000 or more and singles with $500,000 or more of income.

Is Irmaa tax deductible?

Yes, IRMAA is allowed as a medical deduction on Schedule A, which could come off against your adjusted gross income (AGI).

Can I pay Part D premiums from Social Security?

You can have your Part C or Part D plan premiums deducted from Social Security. You'll need to contact the company that sells your plan to set it up. It might take several months to set up and for automatic payments to begin.

Is Part D premium automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Is Medicare Part D deducted from my Social Security check?

In cases where premiums weren't withheld from your Social Security payment until 1 or 2 months after you enrolled in a Medicare drug plan, you'll get a bill for the months your drug plan's premiums weren't withheld. You'll need to pay your drug plan's monthly premium directly to your plan.

How do I know if I have to pay Irmaa?

SSA determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior, meaning two years before the year that you start paying IRMAA. The income that counts is the adjusted gross income you reported plus other forms of tax-exempt income.

How do I get Irmaa reduced?

Even if you haven't experienced a life-changing event, you can still appeal an IRMAA. Request an appeal in writing by completing a request for reconsideration form. To get an appeal form, you can go into a nearby Social Security office, call 800-772-1213, or check the Social Security website.

Does Irmaa affect Part D?

Part D is affected by IRMAA. As with Part B, a surcharge can be added to your monthly premium, based on your yearly income. This is separate from the surcharge that can be added to Part B premiums.

How many brackets does Social Security have?

The Social Security Administration (SSA) sets four income brackets that determine your (or your and your spouse’s) IRMAA. SSA determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior, meaning two years before the year in which you are paying IRMAA.

What is the SSA premium for 2021?

Your additional premium is a percentage of the national base beneficiary premium $33.06 in 2021. If you are expected to pay IRMAA, SSA will notify you that you have a higher Part D premium. For 2021, your additional premium based on income is as follows: Your annual income.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Does Social Security pay Part D?

Social Security will contact you if you have to pay Part D IRMAA, based on your income . The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB].

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or. Medicare Cost Plan. A type of Medicare health plan available in some areas. In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Do you have to pay extra for Part B?

This doesn’t affect everyone, so most people won’t have to pay an extra amount. If you have Part B and you have a higher income, you may also have to pay an extra amount for your Part B premium, even if you don’t have drug coverage. The chart below lists the extra amount costs by income.

Do you pay extra for Medicare?

If you have questions about your Medicare drug coverage, contact your plan. The extra amount you have to pay isn’t part of your plan premium. You don’t pay the extra amount to your plan. Most people have the extra amount taken from their Social Security check.

What Is The Income Threshold before I am faced with the Medicare High-Income Surcharge?

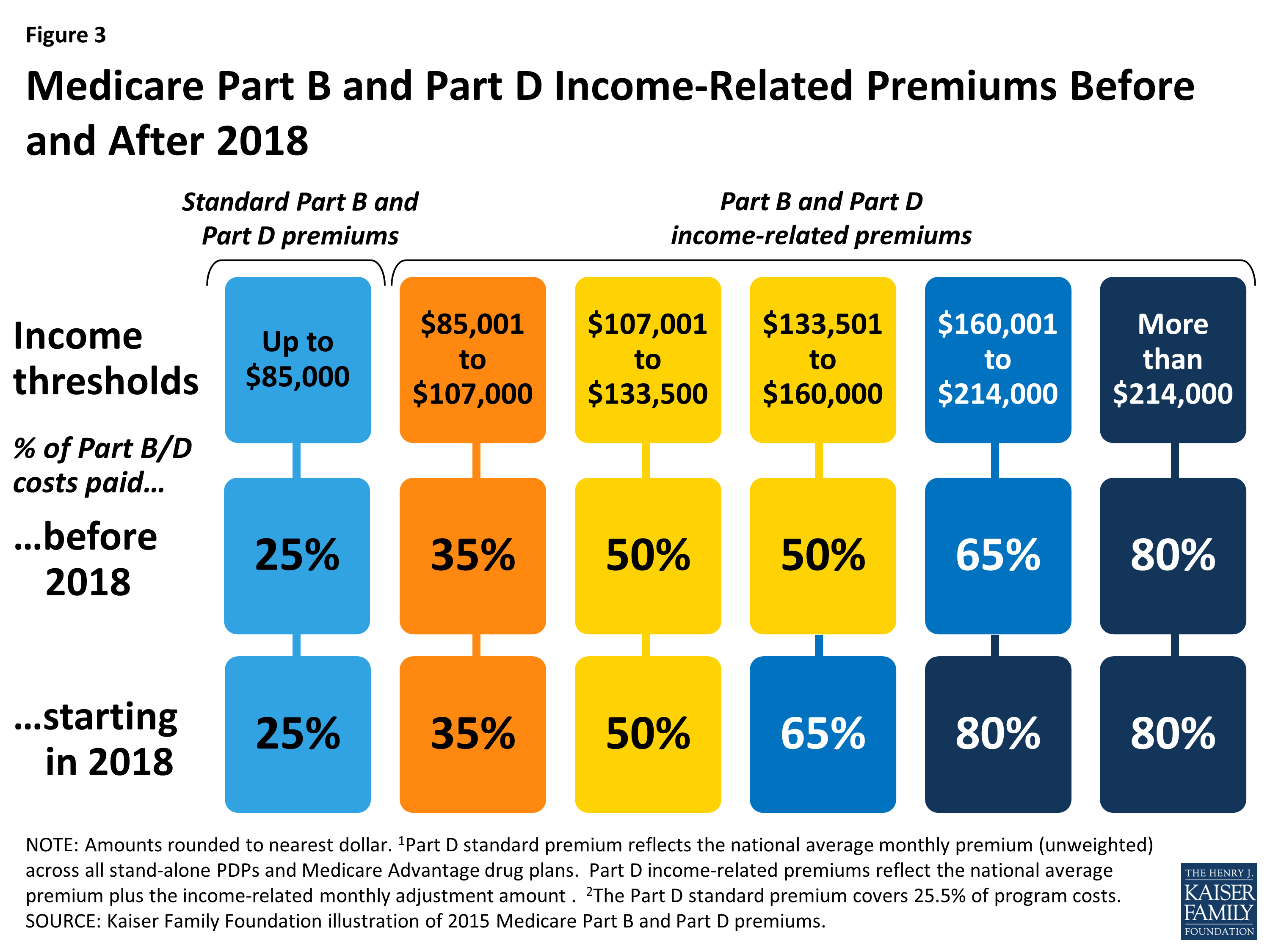

Medicare beneficiaries whose income exceeds certain thresholds must pay more in monthly premiums for Part B doctor coverage and Part D drug coverage. These income adjusted premiums apply to single tax filers and those married filing separately with incomes of more than $85,000 and married couples filing jointly with incomes of more than $170,000.

How does having higher income affect me?

If you have higher income, you will pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. This additional amount is known as the adjustment amount. Here is how it works:

How does Social Security determine if I must pay higher premiums?

To know if you will pay higher premiums, Social Security uses the most recent federal tax return the internal revenue service provides for them. As a beneficiary, if you must pay higher premiums, a sliding scale is used to make the adjustments, based on your modified adjusted gross income (MAGI).

How much extra do you pay for a part B?

Paying extra is something you might be able to avoid, but there’s good news hidden in these extra charges. First, here’s how the charges break down: If you’re married and make $176,000 to $222,000 jointly or $88,000 to $111,000 as an individual, you’ll pay an extra $59.40 monthly for Part B and $12.30 extra for Part D.

How much does Medicare cost for retirees?

That drives monthly healthcare costs higher, but for most people, standard Medicare costs just $148.50 per month. For your Part B premiums, the federal government—thanks in part to your decades of deductions—pays 75% of the cost.

Why did Medicare never reach my pocket?

You watched as somewhere around 15% of your paycheck never reached your pocket, because the federal government took it for Social Security and Medicare payments. 1.

What is MAGI on Social Security?

According to the Social Security Administration, your modified adjusted gross income (MAGI) from two years ago is what counts. This means that benefits for the current period are based on calculations from income earned two years prior. Most poeple's MAGI and adjusted gross income (AGI) will be the same, but if you’re paying student loan interest, ...

Does Medicare cover all of your medical expenses?

Once you reach retirement, you’re a little more accepting of those decades of deductions, because you'll receive full health insurance at next to no cost—especially compared to what you may have paid while you were working. To be fair, Original Medicare alone likely isn’t enough to cover all of your healthcare needs.

What is the difference between Medicare Part B and Part D?

Medicare is made up of several parts. Most have monthly premiums, which is the amount you pay each month for coverage. Part B has a standard premium amount that most people pay each month. That amount changes from year to year , but it's generally consistent for most Medicare enrollees .

What is a Part D plan?

Unlike Medicare Part B, which the federal government provides, Part D prescription drug plans are provided by private health insurance companies that Medicare approves . Part D monthly premiums can vary a great deal from one health insurance company to another. to get the latest monthly premium costs for Part D plans.

How to contact Social Security about IRMAA?

There are 3 things to do to first: Visit SocialSecurity.gov or call Social Security at 800-772-1213 (TTY users can call 800-325-0778) for help. Make sure you contact Social Security within 10 days of receiving an IRMAA notice. You may need to download Social Security Form SSA-44.

Do you get a quarterly bill if you don't take Social Security?

If the amount isn't taken from your payment, you should receive a quarterly bill in the mail. And if you're not taking Social Security retirement benefits, you'll get a bill in the mail for the standard Part B premium amount, plus any IRMAA you owe.

Is MSA tax exempt?

An MSA is like a health savings account (HSA). Contributions made to an MSA are tax-exempt, and withdrawals are tax-free, if the money taken out is spent on qualified health care expenses. Moving money into an MSA could potentially lower your taxable income.

Is it important to get Medicare?

So as part of your retirement income planning, it's important to get the Medicare decisions right. Many older Americans are working longer and continuing to earn income well into their 60s and 70s. This income can help boost their retirement security, but it may also mean they face higher Medicare premiums.

Do people with higher incomes pay higher Medicare premiums?

Key takeaways. While most people pay the standard monthly premium amounts for Medicare Part B and Part D, those with a higher income level will likely face higher premiums.

What is Medicare surcharge?

Not everyone knows this, but there are Medicare surcharges (officially called Income Related Monthly Adjustment Amount , or IRMAA) that correspond to income brackets. These additional costs can really add up. It is the highest-earning 5% of Medicare recipients who pay more for their health coverage.

What is the lowest bracket for Medicare?

Lowest Bracket: People in the lowest income bracket will pay their plan’s premium with no Medicare surcharge. The lowest bracket is for those: Filing jointly with income of 176,000 or less/year. Filing as an individual with income of $88,000 or less/year.

What does IRMAA mean on Medicare?

IRMAA stands for Income Related Monthly Adjustment Amount. Medicare.gov explains that, if your modified adjusted gross income as reported on your IRS tax return from two years ago is above a certain amount, you’ll pay the standard premium amount and IRMAA.

How much does Medicare cost in 2021?

The monthly premiums for Medicare Part A range from $0–$471. Most people don’t pay a monthly premium for Part A. If you buy Part A, you’ll pay $471 each month in 2021 if you paid Medicare taxes for less than 30 quarters and $259 each month if you paid Medicare taxes for 30–39 quarters.

Do you pay monthly premiums for Medicare?

You may pay monthly premiums, IRMAA (see below), coinsurance, as well as co-pays and deductibles. Your total out-of-pocket costs for Medicare will vary tremendously depending on the types of coverage you select, your income, where you live, your health status, and healthcare usage.

Is there a surcharge on Medicare Part D?

Medicare Part D — prescription drug coverage — premiums also vary depending on what plan you choose. However, there is a standardized surcharge over and above your premium for higher income earners. This surcharge is usually added to your Part B premium and paid to Medicare.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.