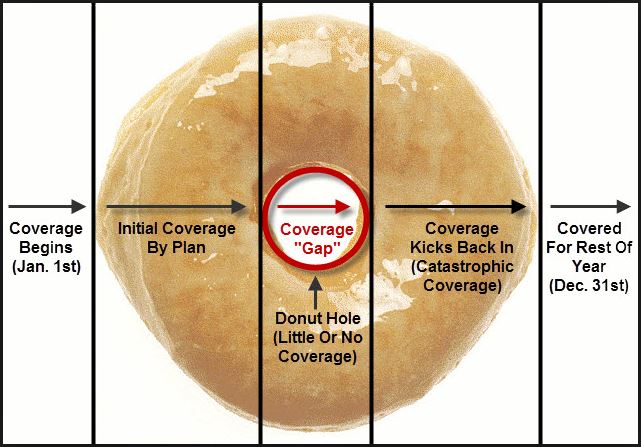

The donut hole is a stage in Part D’s coverage plan that can temporarily limit what medications the plan will and won’t cover. When you reach this stage, you might find yourself paying more for the covered prescriptions than you had to pay earlier. Every year, you’ll enter this donut hole at a different dollar amount.

What you should know about Medicare Part D?

Feb 12, 2020 · Understanding How the Medicare Part D Donut Hole Works Once you fall into the Medicare donut hole, you’ll usually have to pay a certain percentage of your prescription drug cost. For 2019, this cost was 25% for every brand name prescription and 37% for every generic prescription. The costs couldn’t exceed these percentages. While you’re in the donut hole, you’ll …

What are the rules of Medicare Part D?

Dec 12, 2019 · The Medicare Part D Coverage Gap (“Donut Hole”) Made Simple. Last Updated : 12/12/2019 7 min read. Summary: When it comes to Medicare prescription drug coverage, you might have questions surrounding the Medicare Part D coverage gap, also known as the “donut hole.”. The coverage gap is a temporary limit on what most Medicare Part D Prescription Drug …

What is the exact Medicare Part D Donut Hole amount?

The Medicare “donut hole” refers to the coverage gap in Plan D prescription coverage. You will enter it after you have reached an initial coverage limit. In 2022, you will be required to pay 25% out-of-pocket from the time you fall into the donut hole until you meet the out-of-pocket threshold.

How to understand Medicare Part D?

Aug 09, 2010 · In 2010, basic Medicare Part D coverage works like this: You pay out-of-pocket for monthly Part D premiums all year. You pay 100% of your drug costs until you reach the $310 deductible amount. After reaching the deductible, you pay 25% of the cost of your drugs, while the Part D plan pays the rest, until the total you and your plan spend on your drugs reaches $2,800.

How does a Medicare recipient get out of the donut hole?

How does the Medicare donut hole work in 2021?

Is the donut hole gone in 2021?

What happens when you reach the donut hole?

Can I avoid the donut hole?

Does the donut hole end at the end of the year?

Does Medigap cover the donut hole?

Are there any ways to avoid the Medicare Part D donut hole?

- Buy generic prescriptions. Jump to.

- Order your medications by mail and in advance. Jump to.

- Ask for drug manufacturer's discounts. Jump to.

- Consider Extra Help or state assistance programs. Jump to.

- Shop around for a new prescription drug plan. Jump to.

What is the catastrophic coverage amount for 2021?

What is the donut hole amount for 2022?

What is the maximum out-of-pocket for Medicare Part D?

What Is The Coverage Gap (“Donut Hole”), and When Does It Start?

For those who are new to the coverage gap, or “donut hole,” learning about the different Medicare Part D coverage phases is a good place to start....

What Costs Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Once you’ve entered the coverage gap (“donut hole”), it’s important to understand which out-of-pocket costs count towards helping you reach the cat...

What Costs Don’T Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Not all out-of-pocket costs count towards reaching catastrophic coverage. The following costs don’t count towards getting you out of the coverage g...

How Do I Avoid The Medicare Part D Coverage Gap (“Donut Hole”)?

Now that you know about the coverage gap (“donut hole”), here is some good news: 1. Many Medicare beneficiaries won’t have to pay the increased pri...

What If I Have Questions About The Coverage Gap (“Donut Hole”)?

If you have questions about how the coverage gap works and how to avoid it, I can help. A licensed insurance agent such as myself can help you comp...

How does the Medicare Donut Hole Works

There are four stages of Medicare prescription coverage. It begins with your deductible and ends with a catastrophic coverage plan. Regular coverage begins after meeting your deductible and continues until you reach your out-of-pocket maximum of $4,130. It is where things get complicated.

Stages of Coverages

iii) Coverage gap (Donut hole) — begin when you reach the Medicare out-of-pocket maximum ($4,130 in 2021).

How much is My Deductible?

The deductible is the maximum amount of out-of-pocket costs you must pay before your insurance plan covers benefits. This amount varies depending on the program you select.

What is meant by Initial Coverage Period?

You will pay the stated coinsurance or copayment fees for generic or brand-name medications during the first year of coverage. Your specific plan details determine the exact amounts of these costs and vary based on your plan coverage.

What exactly is the Coverage Gap?

As previously stated, the coverage gap is the Medicare term commonly used to describe the donut hole. Each year, Medicare establishes a limit for out-of-pocket expenses that you can incur before reaching the donut hole.

What is the Catastrophic Coverage Stage?

If your out-of-pocket expenses are around $6,550 for the year, you enter the catastrophic coverage phase. After that, you only pay a low coinsurance or copayment for covered prescription drugs for the rest of the year.

What are the Medicare Donut Hole Rules for 2022?

Previously, being in the donut hole indicated you need to pay out-of-pocket costs until you reached the threshold value for more drug coverage. Nevertheless, the donut hole has been closing due to the introduction of the Affordable Care Act.

Does Medicare have a donut hole?

For those that qualify, there is also a program called Medicare Extra Help that helps you pay your premiums and have reduced or no out-of-pocket costs for your drugs. Needless to say, for most people with Medicare Part D, the donut hole presents serious financial challenges.

How does Medicare Part D work in 2010?

In 2010, basic Medicare Part D coverage works like this: You pay out-of-pocket for monthly Part D premiums all year. You pay 100% of your drug costs until you reach the $310 deductible amount. After reaching the deductible, you pay 25% of the cost of your drugs, while the Part D plan pays the rest, until the total you and your plan spend on your ...

Does Medicare Extra Help cover out-of-pocket costs?

These plans also may charge a higher monthly premium.) For those that qualify, there is also a program called Medicare Extra Help that helps you pay your premiums and have reduced or no out-of-pocket costs for your drugs.

Will Part D drugs be covered in 2020?

By 2020, the coverage gap will be closed, meaning there will be no more “donut hole,” and you will only pay 25% of the costs of your drugs until you reach the yearly out-of-pocket spending limit. Throughout this time, you will get ...

Will there be a donut hole in 2020?

By 2020, the coverage gap will be closed, meaning there will be no more “donut hole,” and you will only pay 25% of the costs of your drugs until you reach the yearly out-of-pocket spending limit.

Will Medicare cover Part D in 2020?

By 2020, the coverage gap will be closed, meaning there will be no more “donut hole,” and you will only pay 25% of the costs of your drugs until you reach the yearly out-of-pocket spending limit. Throughout this time, you will get continuous Medicare Part D coverage for your prescription drugs as long as you are on a prescription drug plan.

How much do you pay for a drug deductible?

You pay 100% of your drug costs until you reach the $310 deductible amount. After reaching the deductible, you pay 25% of the cost of your drugs, while the Part D plan pays the rest, until the total you and your plan spend on your drugs reaches $2,800.

What is a donut hole in Medicare?

Specifically, the Donut Hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached the Initial Coverage Limit.

What is a donut hole?

What is the Donut Hole? The Medicare Part D Donut Hole, or Coverage Gap, is one of four stages you may encounter during the year while a member of a Part D prescription drug plan. Specifically, the Donut Hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached ...

Does Tufts Medicare have a Part D deductible?

All other plans do not have a Part D deductible. If you are a member of Tufts Medicare Preferred HMO Value Rx, Basic Rx, or Saver Rx plan: There is no deductible for drugs on Tier 1 and Tier 2. The is a deductible for drugs on Tier 3, Tier 4, and/or Tier 5.

Is there a deductible for Tufts?

If you are a member of Tufts Medicare Preferred HMO Value Rx, Basic Rx, or Saver Rx plan: There is no deductible for drugs on Tier 1 and Tier 2. The is a deductible for drugs on Tier 3, Tier 4, and/or Tier 5. The deductible counts toward any combination of drugs on Tiers 3, 4, and 5. You will not pay a separate deductible for each tier.

What tiers are deductibles?

The deductible counts toward any combination of drugs on Tiers 3, 4, and 5. You will not pay a separate deductible for each tier. After you pay the deductible, you will pay only your copay for Tier 3, 4, and 5 drugs.

How to contact Medicare for copays?

If you qualify, you may receive help paying for your monthly premium and prescription drug copays. For more information, contact Medicare at 1-800-633-4227 (TTY 1-877-486-2048), the Social Security Office at 1-800-772-1213 (TTY 1-800-325-0778), or the Office of Medicaid Commonwealth of Massachusetts at 1-617-573-1770.

How to contact Medicare for Massachusetts?

For more information, contact Medicare at 1-800-633-4227 (TTY 1-877-486-2048) , the Social Security Office at 1-800-772-1213 (TTY 1-800-325-0778), or the Office of Medicaid Commonwealth of Massachusetts at 1-617-573-1770. Pharmaceutical Company Prescription Assistance Programs: You may also qualify for help with the cost ...

Part 1 of your drug coverage

The Initial Deductible Phase The standard Initial Deductible can change each year. In 2022 , the Initial Deductible is $480 ($445 in 2021). If your Medicare Part D plan has an Initial Deductible , you will usually pay 100% for your medications and the amount you pay will count toward the Donut Hole.

Part 2 of your drug coverage

The Initial Coverage Phase After the Initial Deductible (if any), you will continue into your Initial Coverage phase where your Medicare Part D plan covers a portion of your prescription costs and you pay some cost-sharing (co-payment or co-insurance).

Part 3 of your drug coverage

The Coverage Gap or Donut Hole You will leave the Initial Coverage phase and enter the Donut Hole when your total retail drug cost (what you spent plus what your Medicare drug plan spent) exceeds the Initial Coverage Limit ($4,430). As mentioned, the Coverage Gap this is the portion of your Medicare Part D coverage where you traditionally paid a larger percentage of the retail drug cost.

Part 4 of your drug coverage

The Catastrophic Coverage Phase You will stay in the Coverage Gap or Donut Hole phase until your out-of-pocket costs (called TrOOP or total drug spend) reaches a certain level. The TrOOP level in 2022 is $7,050 .

What is the Medicare Coverage Gap?

The Medicare coverage gap is a hole in Part D prescription plans. During this phase of coverage, the cost of medicine can be higher than during other phases of Part D coverage.

How Does the Medicare Part D Donut Hole Work?

After the deductible, you’ll enter the Initial Coverage phase. During the Initial Coverage phase, you pay copays for your prescriptions until the total cost of your medications reaches the threshold that puts you in the donut hole.

Which Part D Plans Will Save Me the Most Money During the Coverage Gap?

Insurance policies change annually and the best policy for your neighbor isn’t always the best policy for you. Also, comparing your options will give you Peace of Mind.