When to enroll in Medicare Part D?

- Open Enrollment Period. ...

- Medicare Advantage Open Enrollment Period. ...

- April 1 to June 30 each year: If you don’t have Medicare Part A and you enrolled in Medicare Part B during the General Enrollment Period (January 1 to March ...

When is a person eligible for Medicare Part D?

They should also look at the plan’s drug formulary to make sure that it covers any long-term medications they take. A person becomes eligible for Medicare Part D when they qualify for other parts of Medicare. This usually means reaching 65 years of age.

What are the stages of Medicare Part D?

What are the Four Stages of Medicare Part D?

- The Four Stages. Annual deductible – you have no coverage until you have met your annual deductible, if your plan has one.

- Some Ideas for Saving Money. Within the limits of your prescription drug plan, there are things you can do to save money. ...

- Contact R&R Insurance. If you need prescription drug coverage, contact R&R Insurance Solutions. ...

When do I sign up for Medicare Part D?

You can also get a different type of SEP if you missed your deadline for enrolling in Part B and had to sign up during a general enrollment period, which runs from January 1 to March 31 each year, with coverage not starting until July 1 of the same year; in these circumstances you can sign up for a Part D plan from April 1 to June 30, with coverage beginning July 1, instead of waiting for open enrollment.

When can you enroll in Medicare Part D?

The first opportunity for Medicare Part D enrollment is when you're initially eligible for Medicare – during the seven-month period beginning three months before the month you turn 65. If you enroll prior to the month you turn 65, your prescription drug coverage will begin the first of the month you turn 65.

What makes you eligible for Medicare Part D?

Those 65 or older who are entitled to or already enrolled in Medicare are eligible for Part D drug insurance. Also eligible are people who have received Social Security Disability Insurance (SSDI) benefits for more than 24 months and those who have been diagnosed with end-stage renal disease.

Can Medicare Part D be added at any time?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

Does everyone get Medicare Part D?

Medicare Cost Plan Medicare offers prescription drug coverage for everyone with Medicare. This coverage is called “Part D.” There are 2 ways to get Medicare prescription drug coverage: 1.

Can I get Medicare at age 62?

The typical age requirement for Medicare is 65, unless you qualify because you have a disability. 2. If you retire before 65, you may be eligible for Social Security benefits starting at age 62, but you are not eligible for Medicare.

Who is most likely to be eligible to enroll in a Part D prescription drug plan?

You are eligible for Medicare Part D drug benefits if you meet the qualifications for Medicare eligibility, which are: You are age 65 or older. You have disabilities. You have end-stage renal disease.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.

Is Medicare Part D optional?

Is Medicare Part D Mandatory? It is not mandatory to enroll into a Medicare Part D Prescription Drug Plan.

Do I need Medicare Part D if I don't take any drugs?

No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D.

Do I automatically get Medicare when I turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Can my wife get Medicare at 62?

Traditional Medicare includes Part A (hospital insurance) and Part B (medical insurance). To qualify for Medicare, your spouse must be age 65 or older. If your spouse is age 62 (or any age under 65), he or she could only qualify for Medicare by disability.

What is the maximum out of pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000 (beginning in 2024), while under the GOP drug price legislation and the 2019 Senate Finance bill, the cap would be set at $3,100 (beginning in 2022); under each of these proposals, the out-of-pocket cap excludes the value of the manufacturer price ...

Do I Automatically Get Medicare When I Turn 65?

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift...

What if I’m Not Automatically Enrolled at 65?

If your Medicare enrollment at 65 is not automatic, but you want to enroll, here are some more magic numbers.

Is Medicare Free at Age 65?

While Medicare Part B has a standard monthly premium, 99 out of 100 people don’t have to pay a premium for Medicare Part A. Still, no part of Medic...

How Much Does Medicare Cost at Age 65?

The standard premium for Part B modestly increases year over year. Part A costs also can increase, including the annual deductible and other coinsu...

Can You Get on Medicare at Age 62?

No, but while the standard age of eligibility remains 65, some call for lowering it. In a recent GoHealth survey, among respondents age 55 and olde...

Can a 55-Year-Old Get Medicare?

While 65 has always been Medicare’s magic number, there are a few situations where the Medicare age limit doesn’t apply, and you may be able to get...

How old do you have to be to get Medicare?

Medicare eligibility at age 65. You must typically meet two requirements to receive Medicare benefits: You are at least 65 years old. You are a U.S. citizen or a legal resident for at least five years. In order to receive premium-free Part A of Medicare, you must meet both of the above requirements and qualify for full Social Security ...

How long do you have to be a resident to qualify for Medicare?

Medicare eligibility chart - by age. - Typically eligible for Medicare if you're a U.S. citizen or legal resident for at least 5 years. - If you won't be automatically enrolled when you turn 65, your Initial Enrollment Period begins 3 months before your 65th birthday.

How much is Medicare Part A 2020?

In 2020, the Medicare Part A premium can be as high as $458 per month. Let’s say Gerald’s wife, Jessica, reaches age 62 and has worked for the required number of years to qualify for premium-free Part A once she turns 65. Because Jessica is now 62 years old and has met the working requirement, Gerald may now receive premium-free Part A.

What is the Social Security retirement rate at 65?

Your Social Security retirement benefits will be reduced to 93.3% if you take them at age 65. - Not typically eligible for Medicare, unless you receive SSA or RRB disability benefits or have ALS or ESRD.

Can a 65 year old spouse get Medicare?

When one spouse in a couple turns 62 years old, the other spouse who is at least 65 years old may now qualify for premium-free Medicare Part A if they haven’t yet qualified based on their own work history. For example, Gerald is 65 years old, but he doesn’t qualify for premium-free Part A because he did not work the minimum number ...

Who can help you compare Medicare Advantage plans?

If you have further questions about Medicare eligibility, contact a licensed insurance agent today. A licensed agent can help answer your questions and help you compare Medicare Advantage plans (Medicare Part C) that are available where you live.

Can a 62 year old get Medicaid?

Yes. Medicaid qualification is based on income, not age. While Medicaid eligibility differs from one state to another, it is typically available to people of lower incomes and resources including pregnant women, the disabled, the elderly and children.

What is Medicare Part D?

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs.

How much of Medicare is covered by Part D?

In 2019, about three-quarters of Medicare enrollees obtained drug coverage through Part D. Program expenditures were $102 billion, which accounted for 12% of Medicare spending. Through the Part D program, Medicare finances more than one-third of retail prescription drug spending in the United States.

How many Medicare beneficiaries are enrolled in Part D?

Medicare beneficiaries who delay enrollment into Part D may be required to pay a late-enrollment penalty. In 2019, 47 million beneficiaries were enrolled in Part D, which represents three-quarters of Medicare beneficiaries.

What is Medicare online tool?

Medicare offers an interactive online tool that allows for comparison of coverage and costs for all plans in a geographic area. The tool lets users input their own list of medications and then calculates personalized projections of the enrollee's annual costs under each plan option. Plans are required to submit biweekly data updates that Medicare uses to keep this tool updated throughout the year.

Why did Medicare repeal the Catastrophic Coverage Act?

However, this legislation was repealed just one year later, partially due to concerns regarding premium increases. The 1993 Clinton Health Reform Plan also included an outpatient drug benefit, but that reform effort ultimately failed due to a lack of public support.

How does Part D cover drug costs?

Part D enrollees cover a portion of their own drug expenses by paying cost-sharing. The amount of cost-sharing an enrollee pays depends on the retail cost of the filled drug, the rules of their plan, and whether they are eligible for additional Federal income-based subsidies. Prior to 2010, enrollees were required to pay 100% of their retail drug costs during the coverage gap phase, commonly referred to as the "doughnut hole.” Subsequent legislation, including the Affordable Care Act, “closed” the doughnut hole from the perspective of beneficiaries, largely through the creation of a manufacturer discount program.

When did Medicare start covering prescription drugs?

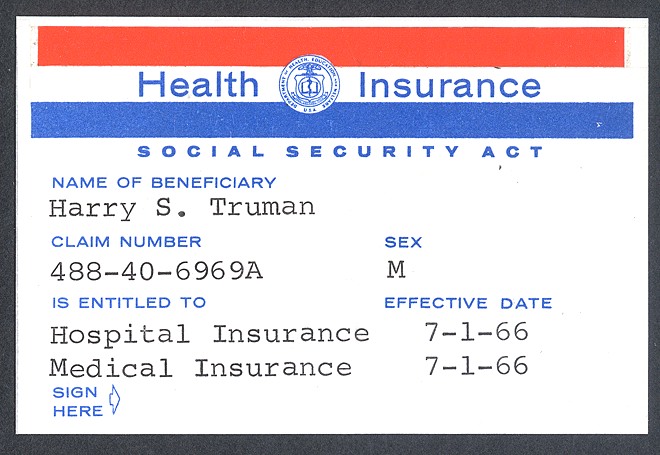

Upon enactment in 1965 , Medicare included coverage for physician-administered drugs, but not self-administered prescription drugs. While some earlier drafts of the Medicare legislation included an outpatient drug benefit, those provisions were dropped due to budgetary concerns. In response to criticism regarding this omission, President Lyndon Johnson ordered the formation of the Task Force on Prescription Drugs. The Task Force conducted a comprehensive review of the American prescription drug market and reported that many elderly Americans struggled to afford their medications.

What is the age limit for Medicare?

Most older adults are familiar with Medicare and its eligibility age of 65. Medicare Part A and Medicare Part B are available based on age or, in some cases, health conditions, including:

How old do you have to be to get medicare?

While some specific circumstances can impact at what age you are eligible for Medicare, most people must wait until 65 as things currently stand.

Why do people not get Medicare at 65?

These days, fewer people are automatically enrolled in Medicare at age 65 because they draw Social Security benefits after 65. If you do not receive Social Security benefits, you will not auto-enroll in Medicare.

How long do you have to be on Social Security to get Medicare?

Individuals under 65 and already receiving Social Security or Railroad Retirement Board benefits for 24 months are eligible for Medicare. Still, most beneficiaries enroll at 65 when they become eligible for Medicare.

When did Medicare become law?

In the summer of ‘65, President Lyndon Johnson signed Medicare into law, establishing the age of eligibility at 65. The eligibility age for Medicare remains the same to this day.

Does Medicare Part B have a premium?

While Medicare Part B has a standard monthly premium, 99 out of 100 people don’t have to pay a premium for Medicare Part A. Still, no part of Medicare can genuinely be called “free” because of associated costs you have to pay, like deductibles, coinsurance and copays.

When will Social Security be 67?

In 2000, the Social Security Amendments of 1983 began pushing back the standard age for full Social Security benefits. The progressive changes are nearing their conclusion: Beginning in 2022, the standard age for full benefits will be 67 for anyone born after 1960.

What happens if you don't enroll in Medicare?

Failing to enroll within this time period, also known as the initial enrollment period, means that you may face a late enrollment penalty if you choose to add Part D coverage at a later date. Although this penalty is added only after adding Part D coverage following the initial enrollment period, it may stick around for the duration of your Medicare enrollment even if you choose to remove Part D coverage in the future .

Why is Medicare important?

Enrolling in Medicare is an important step for many people in protecting their health and their finances as they age. The Medicare program assists millions of seniors and certain individuals with qualifying disabilities, and without Medicare, some Americans would struggle to afford the cost of healthcare and related expenses.

When Am I Eligible for Medicare Part D?

The first time you’re eligible for Part D benefits is during your Medicare Part D Initial Enrollment Period (IEP). Your IEP for Part D is the same time as your IEP for Original Medicare and Medicare Part C, also called Medicare Advantage. Your IEP lasts for seven months and:¹

How long do you have to enroll in Medicare Part D?

From the AEP start date (October 15), you have about eight weeks to enroll in Medicare Part D coverage before the AEP deadline. The coverage you choose during the Medicare Part D Enrollment will be effective the first day of the following year. For example, if you enrolled in a Part D drug plan by December 7, 2020, ...

When Does Medicare Part D Open Enrollment Start?

Medicare Part D Open Enrollment 2022 starts on October 15. This date began Medicare’s Annual Election Period or Annual Enrollment Period (AEP). To access Part D benefits during this time, you can:

What happens if you don't get Medicare Part D?

If you didn’t get Part D during your IEP, you get another chance to do so during the Medicare Part D Open Enrollment. However, you might pay the Part D late enrollment penalty (an extra amount added to your Part D premium) if:². You went more than 63 days past your IEP without having other credible drug coverage.

How long does an IEP last?

Your IEP lasts for seven months and:¹. Begins three months before, and ends three months after, your 25th month of getting Social Security or Railroad Retirement Board (RRB) disability benefits. If you didn’t get Part D during your IEP, you get another chance to do so during the Medicare Part D Open Enrollment.

When is it important to review Medicare Part D?

It’s important to review your Part D options annually during Medicare Open Enrollment. The cost, pharmacy network, and drug formulary for Medicare Part D plans can vary from plan to plan year to year.

Can you opt out of Medicare Part D?

The Medicare Part D Enrollment Period also allows you to opt out of Part D drug benefits. You can:

How long do you have to be in Medicare to get Part D?

You must have either Part A or Part B to get it. When you become eligible for Medicare (usually, when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2. If you don’t elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty ...

How Does Medicare Part D Work?

Part D adds prescription drug coverage to your existing Medicare health coverage. You must have either Medicare Part A or Part B to get it. When you become eligible for Medicare (usually when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2

How Do I Choose a Part D Plan?

Perhaps the most important consideration when choosing a Part D plan is whether that plan covers the specific prescriptions you take. You can input the drugs you take and compare plan options using Medicare’s comparison tool. Otherwise, consider your priorities. Do you want:

How much will Medicare pay for donut hole in 2021?

In 2021, it starts when you and the drug plan have spent $4,130 total on covered prescriptions, and ends once you’ve spent $6,550 out of pocket. In 2022, the Medicare donut hole starts when you and the plan have spent $4,430 total on covered prescriptions, and ends once you’ve spent $7,050 out of pocket (the amounts typically change each year). 7 During this time, you’ll generally pay no more than 25% toward the cost of prescription drugs. 8

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

What is Part D insurance?

For Part D coverage, you’ll pay a premium, a deductible, and copays that differ between types of drugs. Drugs covered by each Part D plan are listed in their “formulary,” and each formulary is generally required to include drugs in six categories or protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretrovirals, and antineoplastics.

What happens if you don't enroll in Medicare?

If you don’t enroll when you’re first eligible for Medicare and decide to enroll later, you may face a lifetime late enrollment penalty.

When do you need to sign up for Medicare?

If the employer has less than 20 employees: You might need to sign up for Medicare when you turn 65 so you don’t have gaps in your job-based health insurance. Check with the employer.

What is a Medicare leave period?

A period of time when you can join or leave a Medicare-approved plan.

Do I need to get Medicare drug coverage (Part D)?

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

What happens if you don't sign up for Part A and Part B?

If you don’t sign up for Part A and Part B, your job-based insurance might not cover the costs for services you get.

Do you have to tell Medicare if you have non-Medicare coverage?

Each year, your plan must tell you if your non-Medicare drug coverage is creditable coverage. Keep this information — you may need it when you’re ready to join a Medicare drug plan.

Does Medicare work if you are still working?

If you (or your spouse) are still working, Medicare works a little differently. Here are some things to know if you’re still working when you turn 65.

Do I need to sign up for Medicare when I turn 65?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work.

How much is the Part D penalty?

The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage.

What is Medicare program?

A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance.

What happens if Medicare's contractor decides the penalty is correct?

If Medicare’s contractor decides that your late enrollment penalty is correct, the Medicare contractor will send you a letter explaining the decision, and you must pay the penalty.

What happens if Medicare decides the penalty is wrong?

What happens if Medicare's contractor decides the penalty is wrong? If Medicare’s contractor decides that all or part of your late enrollment penalty is wrong, the Medicare contractor will send you and your drug plan a letter explaining its decision. Your Medicare drug plan will remove or reduce your late enrollment penalty. ...

What is the late enrollment penalty for Medicare?

Part D late enrollment penalty. The late enrollment penalty is an amount that's permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there's a period of 63 or more days in a row when you don't have Medicare drug coverage or other.

What is creditable prescription drug coverage?

creditable prescription drug coverage. Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage. People who have this kind of coverage when they become eligible for Medicare can generally keep that coverage without paying a penalty, ...

How often does the national base beneficiary premium change?

The national base beneficiary premium may change each year, so your penalty amount may also change each year.

What is an annual notice of change for Medicare?

This is the Annual Notice of Change that Medicare requires plans to send to all of their enrollees. It informs you of any changes the plan will make for next year — including costs (premiums, deductibles, copays); benefits (which drugs are covered); service area; and which pharmacies can dispense drugs under this plan.

Do you have to reenroll for Part D?

You don’t have to reenroll or inform the plan that you’re staying. But be aware that all Part D plans can change their costs and coverage every calendar year. Therefore, the plan that works best for you this year won’t necessarily be your best deal next year.

Overview

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs. Part D was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006. Under the program, drug benefits are provided by private insu…

Program specifics

To enroll in Part D, Medicare beneficiaries must also be enrolled in either Part A or Part B. Beneficiaries can participate in Part D through a stand-alone prescription drug plan or through a Medicare Advantage plan that includes prescription drug benefits. Beneficiaries can enroll directly through the plan's sponsor or through an intermediary. Medicare beneficiaries who delay enrollm…

History

Upon enactment in 1965, Medicare included coverage for physician-administered drugs, but not self-administered prescription drugs. While some earlier drafts of the Medicare legislation included an outpatient drug benefit, those provisions were dropped due to budgetary concerns. In response to criticism regarding this omission, President Lyndon Johnson ordered the forma…

Program costs

In 2019, total drug spending for Medicare Part D beneficiaries was about 180 billion dollars. One-third of this amount, about 120 billion dollars, was paid by prescription drug plans. This plan liability amount was partially offset by about 50 billion dollars in discounts, mostly in the form of manufacturer and pharmacy rebates. This implied a net plan liability (i.e. net of discounts) of roughly 70 billion dollars. To finance this cost, plans received roughly 50 billion in federal reinsur…

Cost utilization

Medicare Part D Cost Utilization Measures refer to limitations placed on medications covered in a specific insurer's formulary for a plan. Cost utilization consists of techniques that attempt to reduce insurer costs. The three main cost utilization measures are quantity limits, prior authorization and step therapy.

Quantity limits refer to the maximum amount of a medication that may be dispensed during a gi…

Implementation issues

• Plan and Health Care Provider goal alignment: PDP's and MA's are rewarded for focusing on low-cost drugs to all beneficiaries, while providers are rewarded for quality of care – sometimes involving expensive technologies.

• Conflicting goals: Plans are required to have a tiered exemptions process for beneficiaries to get a higher-tier drug at a lower cost, but plans must grant medically-necessary exceptions. However, the rule denies beneficiaries the right to reques…

Impact on beneficiaries

A 2008 study found that the percentage of Medicare beneficiaries who reported forgoing medications due to cost dropped with Part D, from 15.2% in 2004 and 14.1% in 2005 to 11.5% in 2006. The percentage who reported skipping other basic necessities to pay for drugs also dropped, from 10.6% in 2004 and 11.1% in 2005 to 7.6% in 2006. The very sickest beneficiaries reported no reduction, but fewer reported forgoing other necessities to pay for medicine.

Criticisms

The federal government is not permitted to negotiate Part D drug prices with drug companies, as federal agencies do in other programs. The Department of Veterans Affairs, which is allowed to negotiate drug prices and establish a formulary, has been estimated to pay between 40% and 58% less for drugs, on average, than Part D. On the other hand, the VA only covers about half the brands that a typical Part D plan covers.