The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($33.37 in 2022) times the number of full, uncovered months you didn't have Part D or creditable coverage.

Full Answer

What is the Part D late enrollment penalty?

2022 Part D national base beneficiary premium— $33.37 This amount is used to estimate the Part D late enrollment penalty and the income-related monthly adjustment amounts listed in …

How does Medicare calculate my premium?

Medicare set forth the following guidelines for 2022 Medicare Part D prescription drug plans, however, available plans may vary from these guidelines. Monthly Premium - $35.00 to $37.00 Paid by the Medicare Beneficiary (See our Medicare Part D Plan Overview by State to review features and premiums of plans available in your state.) More than $7,050.00 annual out-of …

How do you calculate Medicare penalty?

Feb 15, 2022 · How are Medicare Part D premiums calculated? Medicare Part D prescription drug plans are also sold by private insurance companies, so premiums will vary from one plan to the next. As with Medicare Part B premiums, Part D plans also calculate premiums based on your income from two years prior and may charge an IRMAA.

How to calculate Medicare premiums?

2022 Medicare Part D - Out-of-Pocket Cost Calculator Enter Your Current Prescription Drug ANNUAL Retail Costs here: * 2022 Out-of-Pocket costs Beneficiary pays a $480 Deductible Beneficiary pays a 25% of Costs between $481-$4430 Cost of drugs purchased in the Coverage Gap without the Gap Discount (between $4431-$10012.5)

How is Medicare Part D calculated?

Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($33.37 in 2022) times the number of full, uncovered months you didn't have Part D or creditable coverage.

What is the Part D premium for 2021?

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.Nov 6, 2020

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

Is Medicare Part D premium based on income?

Social Security will contact you if you have to pay Part D IRMAA, based on your income. The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB].

How is Medicare Part D Premium 2020 calculated?

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2020 is $32.74, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.Sep 27, 2019

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the cheapest Medicare Part D plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.Dec 1, 2021

What is the cost of Medicare Part D for 2022?

Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.Dec 31, 2021

What is the max out of pocket for Medicare Part D?

A Medicare Part D deductible is the amount you must pay every year before your plan begins to pay. Medicare requires that Medicare Part D deductibles cannot exceed $445 in 2021, but Medicare Part D plans may have deductibles lower than this. Some Medicare Part D plans don't have deductibles.

How much is Medicare Part D 2021?

Monthly Premium - $35.00 to $37.00 Paid by the Medicare Beneficiary (See our Medicare Part D Plan Overview by State to review features and premiums of plans available in your state.)

Can you predict Medicare spending?

In short, you cannot predict your Medicare plan spending with 100 percent accuracy, but you can calculate an estimate of your spending that will help you with budgeting for next year. You can click on the link below to calculate an estimate of your out-of-pocket expenditures with Medicare Part D prescription drug coverage across all phases ...

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

How much will Part D cost in 2021?

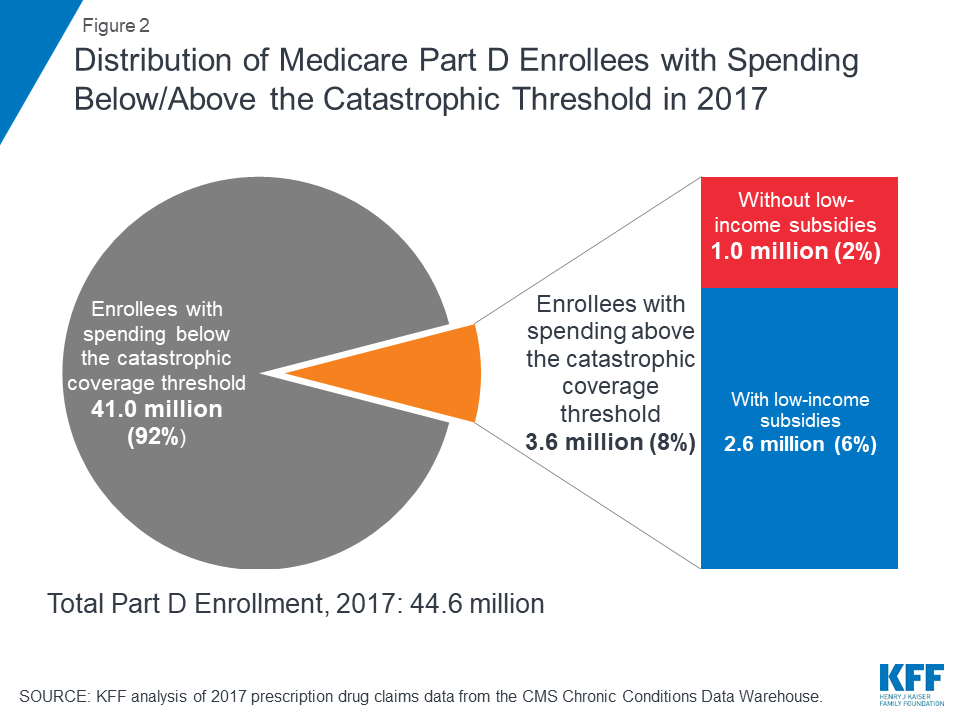

You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021. Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $6,550 for the year in 2021.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

Does Medicare Advantage cover Part A?

Medicare Advantage plans (also called Medicare Part C) provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesn’t cover. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

How is Medicare Part B calculated?

Medicare Part B premiums are calculated based on your income. More specifically, they’re based on the modified adjusted gross income (MAGI) reported on your taxes from two years prior. This means your 2021 Medicare Part B premium may be calculated using the income you reported on your 2019 taxes. If your reported income was higher ...

How much will Medicare pay in 2021?

If you paid Medicare taxes for fewer than 30 quarters, you will pay $471 per month for Part A in 2021.

How does Medicare Advantage work?

A Medicare Advantage plan could potentially help you save money on costs such as dental care, prescription drugs and other costs. A licensed insurance agent can help you compare the Medicare Advantage plans that are available where you live. You can compare benefits, coverage and the costs of each plan and then choose the right fit for your needs.

What is the late enrollment penalty for Medicare?

The Part A late enrollment penalty is 10 percent of the Part A premium, which you must pay for twice the number of years for which you were eligible for Part A but didn’t sign up. Medicare Part B. Medicare Part B is optional coverage, but if you don’t sign up when you’re first eligible, your late enrollment penalty will be calculated based on how ...

What is the penalty for not enrolling in Part A?

The Part A late enrollment penalty is 10 percent ...

Does Medicare Advantage have a monthly premium?

Some Medicare Advantage plans offer $0 monthly premiums and $0 deductibles, and all Medicare Advantage plans must include an annual out-of-pocket cost limit. $0 premium plans may not be available in all locations.

Do high income people pay higher Medicare premiums?

Learn about other Medicare costs and how they are calculated. If you are a high-income earner, you could potentially pay higher premiums for Medicare Part B (medical insurance) and Medicare prescription drug coverage.

What is Medicare Part D?

1 The law created what we now know of as Medicare Part D, an optional part of Medicare that provides prescription drug coverage. Part D plans are run by private insurance companies, not the government.

How much does a generic cost for Part D?

For a generic drug, you will pay $25 and your Part D plan will pay $75. In all Part D plans in 2020, after you've paid $6,550 in out-of-pocket costs for covered medications, you leave the donut hole and reach catastrophic coverage, where you will pay only $3.70 for generic drugs and $9.20 for brand-name medications each month or 5% the cost ...

What is the donut hole in Medicare?

In fact, it has a big hole in it. The so-called donut hole is a coverage gap that occurs after you and Medicare have spent a certain amount of money on your prescription medications.

What is the maximum deductible for 2021?

A deductible is the amount of money you spend out-of-pocket before your prescription drug benefits begin. Your plan may or may not have a deductible. The maximum deductible a plan can charge for 2021 is set at $445, 2 an increase of $10 from 2020.

What is NBBP in Medicare?

The NBBP is a value used to calculate how much you owe in Part D penalties if you sign up late for benefits. Your best bet is to avoid Part D penalties altogether, so be sure to use this handy Medicare calendar to enroll on time.

What is a Part D premium?

Part D Premiums. A premium is the amount of money you spend every month to have access to a health plan. The government sets no formal restrictions on premium rates and prices may change every year. 3 Plans with extended coverage will cost more than basic-coverage plans.

How much will a generic drug cost in 2020?

The remaining costs will be paid by the pharmaceutical manufacturer and your Part D plan. 6 . For example, if a brand-name drug costs $100, you will pay $25, the manufacturer $50, and your drug plan $25. For a generic drug, you will pay $25 and your Part D plan will pay $75. In all Part D plans in 2020, after you've paid $6,550 in out-of-pocket ...

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Does Social Security pay Part D?

Social Security will contact you if you have to pay Part D IRMAA, based on your income . The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB].

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or. Medicare Cost Plan. A type of Medicare health plan available in some areas. In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Do you have to pay extra for Part B?

This doesn’t affect everyone, so most people won’t have to pay an extra amount. If you have Part B and you have a higher income, you may also have to pay an extra amount for your Part B premium, even if you don’t have drug coverage. The chart below lists the extra amount costs by income.

Do you pay extra for Medicare?

If you have questions about your Medicare drug coverage, contact your plan. The extra amount you have to pay isn’t part of your plan premium. You don’t pay the extra amount to your plan. Most people have the extra amount taken from their Social Security check.

How long do you have to be on Medicare to receive Part A?

People under age 65 may receive Part A with no liability for premiums under the following circumstances: Have received Social Security or Railroad Retirement Board disability benefits for two years.

What is the Medicare premium for 2020?

For 2020, the standard monthly rate is $144.60. However, it will be more if you reported above a certain level of modified adjusted gross income on your federal tax return two years ago. Any additional amount charged to you is known as IRMAA, which stands for income-related monthly adjustment amount. Visit Medicare.gov, point to “Your Medicare Costs,” and then click “Part B costs” to see a matrix of premiums corresponding to income ranges across different tax filing statuses.

How many years of work do you need to be eligible for Medicare?

Four is the maximum number of credits a person can earn per year, so it takes at least 10 years or 40 quarters of employment to be eligible for Medicare.

Is Medicare the same for everyone?

Medicare is a federal program that mandates standardization of services nationwide, so many people may assume the premiums would be the same for everyone. In reality, there are variations in the premiums people pay, if they pay any at all.

Can Medicare be charged at 65?

For Part A, most Medicare recipients are not charged any premium at all. Seniors at age 65 are eligible for premium-free Part A if they meet the following criteria: Currently collect retirement benefits from Social Security or the Railroad Retirement Board. Qualify for Social Security or Railroad benefits not yet claimed.