Medicare Part D

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

Full Answer

How to find the best Medicare Part D drug plan?

Part 1 - The Initial $480 Deductible - Some Medicare Part D prescription drug plans (PDP) and Medicare Advantage plans that provide drug coverage (MAPD) have an initial deductible that you must pay out-of-pocket before the start of your plan coverage (or before the start of your plan's cost-sharing). Many Medicare Part D plans (both PDPs and MAPDs) have a $0 deductible and …

What are the Best Part D plans?

What Medicare Part D drug plans cover. Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site. Costs for Medicare drug coverage. Learn about the types of costs you’ll pay in a Medicare drug plan. How Part D works with other insurance. Learn about how ...

What is the Best Part D drug plan?

2019 Medicare Part D Plan Overview by State - Providing detailed information on the Medicare Part D program for every state, including selected Medicare Part D plan features and costs organized by State. Sign-up for our free Medicare Part D Newsletter, Use the Online Calculators, FAQs or contact us through our Helpdesk -- Powered by Q1Group LLC

What is the cheapest Medicare Part D?

Dec 21, 2021 · Most Medicare Part D plans have a monthly premium, although some are available with no premiums. Many also have a deductible, meaning that you pay the full cost for prescriptions until you have reached the set deductible. Then, from that point onward, the plan begins covering part of the cost for your medications.

How do Medicare Part D plans work?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications.

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

What are the 4 phases of Part D coverage?

If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.Oct 1, 2021

Why is Medicare charging me for Part D?

If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit ($87,000 if you file individually or $174,000 if you're married and file jointly), you'll pay an extra amount in addition to your plan premium (sometimes called “Part D-IRMAA”).

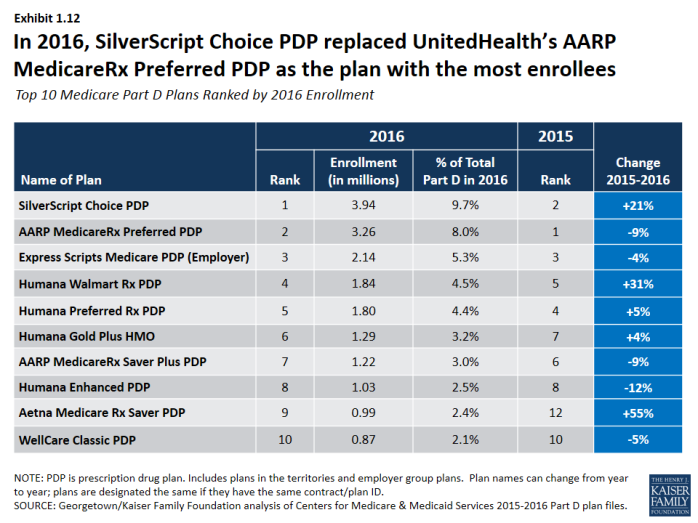

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

How do Part D plans make money?

Part D Financing Financing for Part D comes from general revenues (73%), beneficiary premiums (15%), and state contributions (11%). The monthly premium paid by enrollees is set to cover 25.5% of the cost of standard drug coverage.Oct 13, 2021

What is the max out-of-pocket for Medicare Part D?

A Medicare Part D deductible is the amount you must pay every year before your plan begins to pay. Medicare requires that Medicare Part D deductibles cannot exceed $445 in 2021, but Medicare Part D plans may have deductibles lower than this. Some Medicare Part D plans don't have deductibles.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Does Medicare Part D have an out-of-pocket maximum?

Medicare Part D plans do not have an out-of-pocket maximum in the same way that Medicare Advantage plans do. However, Medicare Part D plans have what's called a “catastrophic coverage” phase, which works similar to an out-of-pocket maximum.Nov 24, 2021

Does Medicare Part D come out of your Social Security check?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.Dec 1, 2021

Is Part D deducted from Social Security?

To be enrolled on Part D, you must enroll through one of the prescription drug companies that offers the Medicare Part D plan or directly through Medicare at www.Medicare.gov. You can pay premiums directly to the company, set up a bank draft, or have the monthly premium deducted from your Social Security check.

How is Medicare Part D premium calculated?

Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($33.37 in 2022) times the number of full, uncovered months you didn't have Part D or creditable coverage.

What is Medicare Part D?

Medicare Part D plans are like any insurance that provides lower-costing coverage for your prescription drugs. And like any other insurance coverage, you usually pay the plan a monthly premium, you may have an initial deductible that you must pay first before your insurance coverage begins to pay a portion of your drug costs, ...

Does Medicare cover all prescription drugs?

And it is important to understand that no Medicare Part D plan covers all prescription drugs. Part D plans are only required to cover a certain number of drugs in specific drug classes. However, Medicare Part D plans can decide to cover a particular generic and exclude the corresponding brand-name drug from coverage.

Does Medicare Part D have a deductible?

Many Medicare Part D plans (both PDPs and MAPDs) have a $0 deduct ible and provide "first dollar coverage" for your formulary prescriptions. You can see our Medicare Part D Plan Finder for examples of Medicare plans with different deductibles (just choose your state to see plans in your area).

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What is Medicare Part D?

Medicare Part D addresses the high costs of prescription drugs by authorizing private insurance companies to create and offer prescription drug plans (PDPs) for Medicare-eligible Americans. Part D first became effective in 2006.

How Much Does Medicare Part D Cost?

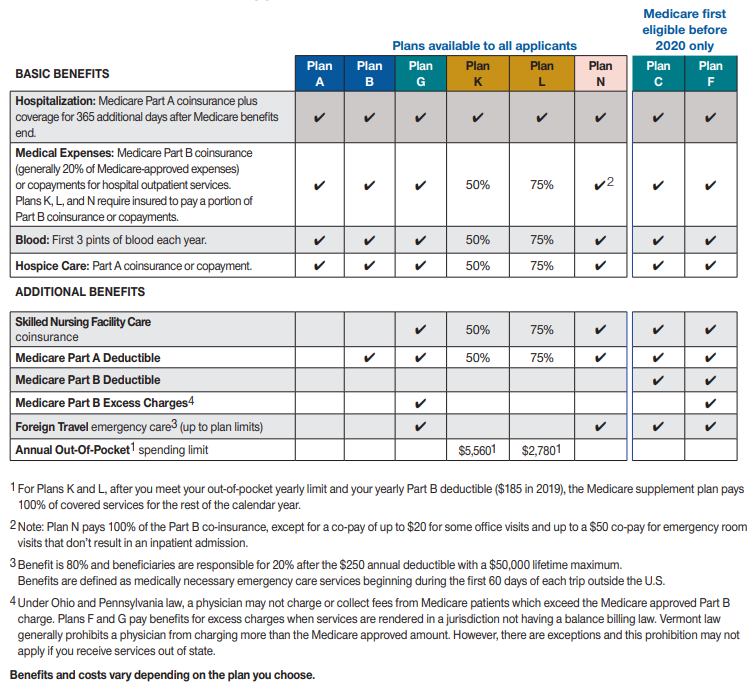

The cost for Medicare Part D varies according to the specific plan you enroll in, as does the coverage that each plan offers. Generally, you can expect to pay the following types of costs for a standalone prescription drug plan:

What Are Medicare Part D Drug Tiers?

Every Part D drug plan must have a formal list of the medications that it covers. This list is known as a formulary. Within the formulary, all the drugs are categorized by tiers, which range from 1 to 4. The higher the number of tier, the more expensive the drug is. The four tiers are organized as follows:

What Are Part D Coverage Stages?

The amount you pay for a covered drug can change during the course of the year. In other words, the price you pay for a Tier 3 medication in December can be different from the price that you pay for the same drug in January.

What is the Part D Donut Hole?

The Medicare donut hole is the nickname used to describe the coverage gap stage. The donut hole got its name from the fact that when an enrollee used to enter the third coverage stage, they would become responsible for a large portion of the cost of medications. As such, there appeared to be a hole in their coverage.

Is Medicare Part D Worth It?

The idea of having to pay for a plan that has something called the “catastrophic coverage stage” can understandably be somewhat scary. As such, you may wonder if having Part D coverage is worthwhile.

When Can You Sign Up for Part D?

Whether you want to enroll in a standalone drug plan or a Medicare Advantage plan with drug coverage, you will have the opportunity to do so when you first enroll in Medicare. For most people, this occurs when you turn 65.

What is the Medicare Part D coverage gap?

If the total cost of your prescriptions reaches a certain amount— set each year by the federal government — you pay more for your prescriptions. This is the Medicare Part D coverage gap, also known as the out-of-pocket threshold or “donut hole.”. In 2020, once you and your plan have spent $4,020 on your prescription ...

How much will Medicare cover in 2020?

In 2020, once you and your plan have spent $4,020 on your prescription drug costs, you will be in the coverage gap. (That’s $200 more than the 2019 amount.) At that point, you will pay no more than 25% of the costs of covered brand-name prescriptions and generic medications until the total cost of your covered medications reaches $6,350 ...

Does Medicare Part D cover outpatient prescriptions?

Medicare Part D helps cover outpatient prescription drugs. Each plan has its own formulary, or list of drugs the plan covers, so not every plan will necessarily cover the same medications. A plan’s formulary may change at any time. You will receive notice from your plan when necessary.

Does Medicare cover insulin?

Medicare Part D also may cover some self-injected medicines, such as insulin for diabetes . But if you go to a doctor’s office or other outpatient facility to receive, for example, chemotherapy, dialysis or other medicines that are injected or given intravenously, Medicare Part B — not Part D —may help pay for those treatments.

Does Medicare have a monthly premium?

Medicare prescription drug plans set their own monthly premium amounts. Premiums may vary depending on where you live, what plan you select, and whether you qualify for help paying your Part D premium.

When can I change my Medicare Part D plan?

During the Annual Enrollment Period from October 15 through December 7 , anyone on Medicare can change their Part D plan. The PACE/PACENET program sends its members a notification regarding their personal plan selection before the start of this period.

What happens if you don't have a Part D plan?

If you do not have a Part D plan when you enroll in PACE or PACENET, we will not assign you to one immediately, but we may provide recommendations to you within a few months.

How much is the deductible for a PACENET card?

When you first use your PACENET card, and in the months that follow, you will have to pay a monthly deductible that is equal to the regional benchmark premium for Part D, which is $37.03 for 2019. After you pay this deductible at the pharmacy, you will pay the PACENET copays for your medications ($8 for generics and $15 for name brand medications).

How to contact Medicare in Pennsylvania?

Information about premiums, participating pharmacies and covered drugs for these companies, and any other Part D plan operating in Pennsylvania, is available by calling 1-800-Medicare (1-800-633-4227 or 1-877-486-2048 (TTY)) or by going on the internet at: www.medicare.gov.

Can I enroll in a Part D plan?

No. We will not enroll the following cardholders into a Part D plan: those who are not Medicare Part D eligible, those in Medicare Advantage Plans, and those in employee retirement plans with creditable drug coverage. The PACE/PACENET program will not enroll anyone who notifies us that they do not want to be enrolled in a Part D plan for 2019.

Can I overpay for Part D?

No, there are many instances in which the program will send payment to your Part D plan on your behalf.By signing up for automatic deductions from Social Security, you may be overpaying for your Part D

Do you have to show your PACE card at the pharmacy?

Yes, show both cards at the pharmacy. This will let your pharmacist know to bill your Part D plan first and bill PACE or PACENET second. It will also let your pharmacist know that you are entitled to all of the drugs that are available under PACE and PACENET.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

What is part B of Medicare?

Another category, Part B, covers doctor appointments, outpatient procedures and tests, some mental health services, as well as wheelchairs, walkers and other equipment.

How many doctors have opted out of Medicare?

According to the federal Centers for Medicare and Medicaid, 2,752 doctors and other providers opted out of Medicare in 2018 — a minute number considering there are more than one million practicing doctors alone. Psychiatrists are the biggest category of doctors who opt out, according to Kaiser.

What is Medicare for 65?

Tuesday was the 54th anniversary of the bill’s signing. Credit... Medicare, the federal health insurance program for people who are 65 or older, has become something of a panacea in the Democratic presidential race.

How much does Medicare pay for a person with a $500,000 income?

Richer Medicare beneficiaries — individuals with annual incomes over $500,000 — pay $460.50 a month. Premiums are typically deducted from people’s Social Security checks. Part B also has a deductible of $185 a year, and co-payments of 20 percent after you reach your deductible.

How much did Medicare spend in 2013?

An analysis by the nonpartisan Kaiser Family Foundation found that Medicare enrollees in fair or poor health spent an average of $6,128 in 2013, or 47 percent of average Social Security income.

Does Medicare cover eye exams?

Medicare does not cover glasses, basic eye exams, hearing aids and most dental care — frustrating omissions for many beneficiaries, who are at an age when they are more likely to need these services. It also won’t pay for care received outside the United States.

What is Medicare Advantage?

Medicare Advantage is an increasingly popular alternative to traditional Medicare. Advantage plans are offered by private insurers that have contracts with Medicare. These plans have all the same benefits as traditional Medicare, and often more, such as dental care or health club memberships.

Choose a Medicare Part D Plan for 2019

The Medicare Annual Election Period is fast approaching. This is the time of year that Medicare benecficiaries can choose a Medicare Prescription Drug Plan for 2019. If you choose not to change your plan, you will stay enrolled in the plan you currently have. Below are instructions on how to choose your plan.

Step 1 of 4 Enter Information

In choosing a Medicare Part D plan in the first step there are two questions that need to be answered. The first is “How do you get your Medicare coverage?”. The second question asks “Do you get help paying for your prescription drugs?” Once these are answered you will click “Continue to Plan Results”.How to choose a Medicare Part D Plan for 2019

Step 2 of 4 Enter your Drugs

The next area is where you will enter each of your prescriptions, dosages, frequency etc. If you have already entered your prescription drugs at an earlier time. You could have saved your Drug List ID and password date.

Step 3 of 4 Select your pharmacies

In this step you will select up to two pharmacies to get a better idea of how much your prescription drugs will cost. If your pharmacy isn’t in a plan’s network, the cost you will see is the full price of the drug with no insurance.

Step 4 of 4 Refine your plan results

Now that you have selected your pharmacy you will see a summary of different types of plans. At this point you select “Drug Plans Only” and click on “Continue to plan results.