What is Medicare Part D (Medicare Part D)?

Centers for Medicare and Medicaid Services logo Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs.

When did Medicare Part D drug coverage start?

It required most beneficiaries to choose between maintaining any existing prescription drug coverage or joining a new Medicare Part D program, beginning in January 2006. The Part D drug benefits would be offered through stand-alone drug plans or through comprehensive plans under Part C, renamed the Medicare Advantage program.

Do part D plans pay for all covered drugs?

Part D plans are not required to pay for all covered Part D drugs. They establish their own formularies, or list of covered drugs for which they will make payment, as long as the formulary and benefit structure are not found by CMS to discourage enrollment by certain Medicare beneficiaries.

When did Medicare add outpatient prescription drug benefits?

The next opportunity to add an outpatient prescription drug benefit in the Medicare program came in 1993 as part of the health security act proposed by President Bill Clinton (D).

What President started Medicare Part D?

President George W. Bush signed into law the Medicare Prescription Drug Improvement and Modernization Act of 2003, adding an optional prescription drug benefit known as Part D, which is provided only by private insurers.

Who signed Medicare D?

President BushRather than demand that the plan be budget neutral, President Bush supported up to $400 billion in new spending for the program. In 2003, President Bush signed the Medicare Modernization Act, which authorized the creation of the Medicare Part D program. The program was implemented in 2006.

When did Medicare start covering prescription drugs?

January 1, 2006Medicare did not cover outpatient prescription drugs until January 1, 2006, when it implemented the Medicare Part D prescription drug benefit, authorized by Congress under the “Medicare Prescription Drug, Improvement, and Modernization Act of 2003.”[1] This Act is generally known as the “MMA.”

When did Medicare Part D coverage start?

January 1, 2006The benefit went into effect on January 1, 2006. A decade later nearly forty-two million people are enrolled in Part D, and the program pays for almost two billion prescriptions annually, representing nearly $90 billion in spending. Part D is the largest federal program that pays for prescription drugs.

When did Part D become mandatory?

Medicare Part D Prescription Drug benefit The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.

What issues AARP oppose?

9 Reasons Not to JoinYou Oppose Socialized Medicine. ... You Oppose Regionalism. ... You Oppose Government “Safety Nets” ... You Don't Believe in Climate Change. ... You Oppose Mail-in Voting. ... You Oppose Forced Viral Testing, Masking, or Social Distancing. ... You Do Not Like Contact Tracing. ... You Do Not Like AARP's Barrage of Political Emails.More items...•

What did the Medicare Act of 1965 do?

On July 30, 1965, President Lyndon B. Johnson signed the Medicare and Medicaid Act, also known as the Social Security Amendments of 1965, into law. It established Medicare, a health insurance program for the elderly, and Medicaid, a health insurance program for people with limited income.

Why did Medicare Part D pass?

Medicare Part D dramatically lowered the number of beneficiaries spending more than one-fifth of their income on prescription drugs from 14% in 2003 to 7% in 2010. Part D coverage has made seniors' finances more stable and less prone to bankruptcy due to drug costs.

What did Affordable Care Act do for prescription drugs?

The ACA increased base rebate amounts for both generic and brand drugs: the minimum rebate for brand drugs increased from 15.1 percent to 23.1 percent and the base rebate for generic drugs increased from 11 percent to 13 percent. The federal government captures all additional savings.

Is it mandatory to have Part D Medicare?

Is Medicare Part D Mandatory? It is not mandatory to enroll into a Medicare Part D Prescription Drug Plan.

What is the maximum out of pocket for Medicare Part D?

Medicare Part D, the outpatient prescription drug benefit for Medicare beneficiaries, provides coverage above a catastrophic threshold for high out-of-pocket drug costs, but there is no cap on total out-of-pocket drug costs that beneficiaries pay each year.

What was notable about the Medicare Modernization Act of 2003?

The 2003 Medicare Modernization Act (MMA) is considered one of the biggest overhauls of the Medicare program. It established prescription drug coverage and the modern Medicare Advantage program, among other provisions. It also created premium adjustments for low-income and wealthy beneficiaries.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What is Medicare Part D?

Medicare Part D is a voluntary outpatient prescription drug benefit for people with Medicare, provided through private plans approved by the federal government. Beneficiaries can choose to enroll in either a stand-alone prescription drug plan (PDP) to supplement traditional Medicare or a Medicare Advantage prescription drug plan (MA-PD), mainly HMOs and PPOs, that cover all Medicare benefits including drugs. In 2020, 46 million of the more than 60 million people covered by Medicare are enrolled in Part D plans. This fact sheet provides an overview of the Medicare Part D program, plan availability, enrollment, and spending and financing, based on data from the Centers for Medicare & Medicaid Services (CMS), the Congressional Budget Office (CBO), and other sources.

What is a Part D plan?

Part D plans also receive additional risk-adjusted payments based on the health status of their enrollees, and plans’ potential total losses or gains are limited by risk-sharing arrangements with the federal government (“risk corridors”).

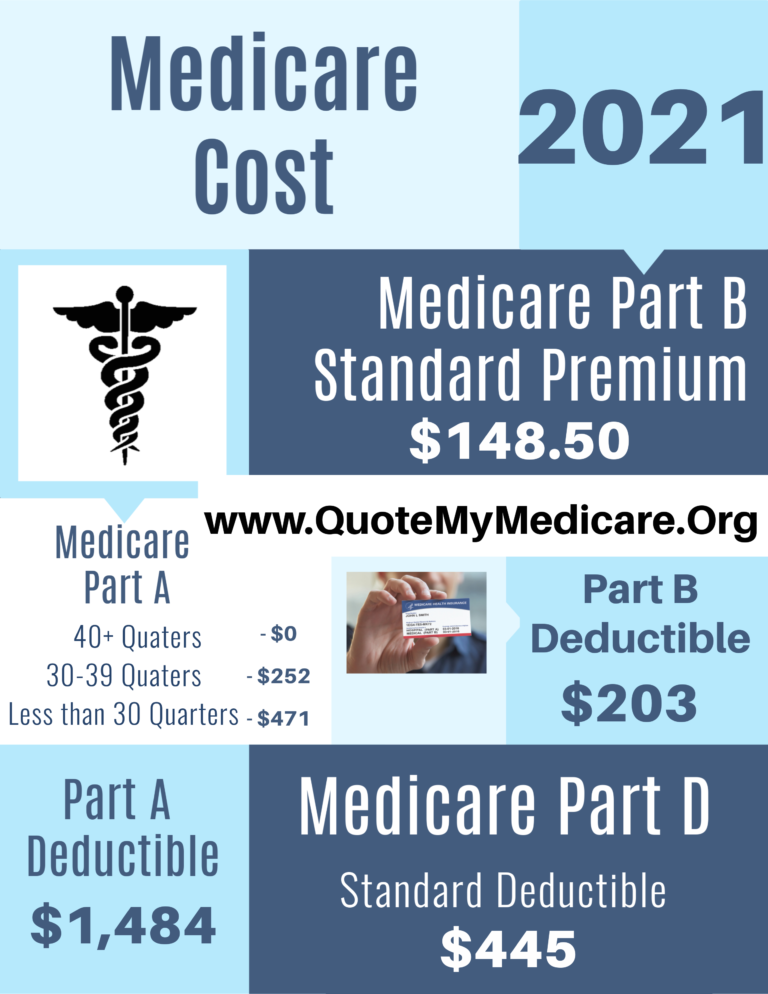

How much is the 2021 PDP premium?

But actual premiums paid by Part D enrollees vary considerably. For 2021, PDP monthly premiums range from a low of $5.70 for a PDP in Hawaii to a high of $205.30 for a PDP in South Carolina (unweighted by plan enrollment). Even within a state, PDP premiums can vary; for example, in Florida, monthly premiums range from $7.30 to $172. In addition to the monthly premium, Part D enrollees with higher incomes ($87,000/individual; $174,000/couple) pay an income-related premium surcharge, ranging from $12.32 to $77.14 per month in 2021 (depending on income).

How much is PDP 2021?

For 2021, PDP monthly premiums range from a low of $5.70 for a PDP in Hawaii to a high of $205.30 for a PDP in South Carolina (unweighted by plan enrollment). Even within a state, PDP premiums can vary; for example, in Florida, monthly premiums range from $7.30 to $172. In addition to the monthly premium, Part D enrollees with higher incomes ...

How many PDPs will be available in 2021?

In 2021, 996 PDPs will be offered across the 34 PDP regions nationwide (excluding the territories). This represents an increase of 48 PDPs from 2020 (a 5% increase) and an increase of 250 plans (a 34% increase) since 2017 (Figure 1).

How many people with Medicare have no drug coverage?

Another 12% of people with Medicare are estimated to lack creditable drug coverage.

How many people will be covered by Medicare in 2020?

In 2020, 46 million of the more than 60 million people covered by Medicare are enrolled in Part D plans. This fact sheet provides an overview of the Medicare Part D program, plan availability, enrollment, and spending and financing, based on data from the Centers for Medicare & Medicaid Services (CMS), the Congressional Budget Office (CBO), ...

What is Medicare Part D based on?

Medicare Part D beneficiaries with higher incomes pay higher Medicare Part D premiums based on their income, similar to higher Part B premiums already paid by this group. The premium adjustment is called the Income-Related Monthly Adjustment Amount (IRMAA). The IRMAA is not based on the specific premium of the beneficiary's plan, but is rather a set amount per income-level that is based on the national base beneficiary premium (the national base beneficiary premium is recalculated annually; for 2016 it is $34.10). In effect, the IRMAA is a second premium paid to Social Security, in addition to the monthly Part D premium already being paid to the plan.

What is the gap in Medicare Part D?

The costs associated with Medicare Part D include a monthly premium, an annual deductible (sometimes waived by the plans), co-payments and co-insurance for specific drugs, a gap in coverage called the "Donut Hole," and catastrophic coverage once a threshold amount has been met.

What is Medicare Savings Program?

Medicare Savings Programs help low income individuals to pay for their Medicare Part A and/or Part B co-pays and deductibles. There are four Medicare Savings programs, all of which are administered by state Medicaid agencies and are funded jointly by states and the federal governments. Participants in these programs are sometimes called "partial dual eligibles." Individuals who qualify for a Medicare Savings program automatically qualify for the Part D Low Income Subsidy (LIS), which is also known as "Extra Help." The LIS helps qualified individuals pay their Part D expenses, including monthly premiums, co-pays and co-insurance. The LIS also covers people during the deductible period and the gap in coverage called the "Donut Hole."

What is LIS in Medicare?

Individuals who qualify for a Medicare Savings program automatically qualify for the Part D Low Income Subsidy (LIS), which is also known as "Extra Help.". The LIS helps qualified individuals pay their Part D expenses, including monthly premiums, co-pays and co-insurance.

What is FDA approved medicine?

A drug that is for a "medically accepted indication" is one that is prescribed to treat a disease or condition (indication) approved by the FDA.

How long does a medical plan have to make an exception?

The member (or his/her representative, or the prescriber) has 60 days from the date of the plan’s Notice of Denial to request an Exception. The plan has 72 hours (three calendar days) to render a "standard" decision, or 24 hours if an expedited ("fast") decision is requested. The plan must render an expedited decision (in 24 hour or less, based on medical necessity) if the plan determines, or the prescriber statement indicates, that a standard decision would seriously jeopardize the patient’s life or health or ability to regain maximum function. The plan is not required to render an expedited decision if the member has already obtained the medication. The timing of the plan’s decision begins when it receives the prescriber’s documentation.

Does Medicare have a DS?

Most plans do not follow the defined Standard Benefit (DS) model. Medicare law allows plans to offer actuarially equivalent or enhanced plans. While structured differently, these alternative plans cannot impose a higher deductible or higher initial coverage limits or out-of-pocket thresholds. The value of benefits in an actuarially equivalent plan must be at least as valuable as the Standard Benefit.

What is the Medicare coinsurance rate?

Medicare is gradually phasing in subsidies in the coverage gap for brand-name drugs and generic drugs, reducing the beneficiary coinsurance rate from 100 percent in 2010 to 25 percent in 2020.

How many PDPs were there in 2015?

In 2015, 1,001 stand-alone prescription drug plans (PDPs) are available nationwide, fewer than in any year since the program began in 2006. Medicare beneficiaries in each region have a choice of 30 stand-alone PDPs, on average, in 2015. Medicare Part D plans are required to offer either the standard benefit that is defined in law ...

How much does Medicare pay for Part D?

The standard Part D benefits would have an estimated initial premium of $35 per month and a $250 annual deductible. Medicare would pay 75 percent of annual expenses between $250 and $2,250 for approved prescription drugs, nothing for expenses between $2,250 and $5,100, and 95 percent of expenses above $5,100.

Who raised the issue of prescription drug coverage in Medicare?

When the proposal was finalized at a meeting of the president, HEW secretary Eliot Richardson, and Assistant Secretary for Planning and Evaluation Lewis Butler, the issue of prescription drug coverage in Medicare was raised at the request of Commissioner of Social Security Robert Ball.

How many Medicare beneficiaries will have private prescription coverage?

At that time, more than 40 million beneficiaries will have the following options: (1) they may keep any private prescription drug coverage they currently have; (2) they may enroll in a new, freestanding prescription drug plan; or (3) they may obtain drug coverage by enrolling in a Medicare managed care plan.

What was the Task Force on Prescription Drugs?

Department of Health, Education and Welfare (HEW; later renamed Health and Human Services) and the White House.

How much did Medicare cut in 1997?

Nonetheless, reducing the budget deficit remained a high political priority, and two years later, the Balanced Budget Act of 1997 (Balanced Budget Act) cut projected Medicare spending by $115 billion over five years and by $385 billion over ten years (Etheredge 1998; Oberlander 2003, 177–83).

How long have seniors waited for Medicare?

Seniors have waited 38 years for this prescription drug benefit to be added to the Medicare program. Today they are just moments away from the drug coverage they desperately need and deserve” (Pear and Hulse 2003). In fact, for many Medicare beneficiaries, the benefits of the new law are not so immediate or valuable.

How much money would the federal government save on medicaid?

The states would be required to pass back to the federal government $88 billion of the estimated $115 billion they would save on Medicaid drug coverage. It prohibited beneficiaries who enrolled in Part D from buying supplemental benefits to insure against prescription drug expenses not covered by the program.

Decisions, Decisions

Terry Coleman, a partner in the Washington, DC, law firm of Ropes and Gray, adds that “if a person has equivalent coverage in some way, there is no penalty for not signing up for Part D coverage. Let's say you're over 65 and you're covered by a spouse's employment plan, so several years go by and you don't sign up.

How Can Doctors Help?

All the key actors involved stress one major point. Doctors, burdened as they are with clinical and administrative duties, can best serve their patients by briefly discussing with them the potential importance of the new coverage and by steering them to good sources of information to help them make informed choices.

An Important Shift in Oncology

The reason that the Part D benefit will matter greatly in oncology is this: The existing Medicare drug benefit, called the Part B benefit, covers only those drugs that are administered in physicians' offices. Part B excludes oral and other medications that patients obtain at their drug store, pharmacy, or mail-in pharmacy for use at home.

Greater Benefits for Those in the Greatest Need

Specifically, CMS states that if a single beneficiary has an annual income less than $14,355 or if a married one living with a spouse has an income less than $19,245, that person may qualify for extra help.

Spreading the Word, a Multipronged Effort

Help for oncologists who want to assist patients in sorting it all out is forthcoming from several reliable quarters. “ASCO will provide members with as much information as we can,” says Bailes. “We are in the process of developing our plans and may put on specific educational programs about the Part D benefit.

Some Imponderables, for Now

As mentioned in the preceding sections, there are kinks to work out. One kink observed by Coleman is this: “Under Part B, there are no restrictions on drugs. If a doctor wants to use a drug, they can use any drug and no prior authorization is required. They use a $20,000 or $30,000 drug and they get paid.

When did Medicare update Part D?

On April 2, 2018 , the Centers for Medicare & Medicaid Services (CMS) issued a final rule that updates Medicare Advantage (MA) and the prescription drug benefit program (Part D) by promoting innovation and empowering MA and Part D sponsors with new tools to improve quality of care and provide more plan choices for MA and Part D enrollees.

What is an OEP in Medicare?

The new OEP allows individuals enrolled in an MA plan, including newly MA-eligible individuals, to make a one-time election to go to another MA plan or Original Medicare. Individuals using the OEP to make a change may make a coordinating change to add or drop Part D coverage.

When is the new version of NCPDP?

CMS is adopting the NCPDP SCRIPT Standard, Version 2017071 beginning on January 1, 2020.

Can a sponsor limit a drug to a POS?

Sponsors will be allowed to limit an at-risk beneficiary’s access to frequently abused drugs to a selected prescriber (s) and/or pharmacy (ies) (“lock-in”), and through the use of beneficiary-specific point-of-sale (POS) claim edits, which are already permitted under the current policy.

How many people are in Medicare Part D?

A total of 48 million people with Medicare are currently enrolled in plans that provide the Medicare Part D drug benefit, representing more than three-quarters (77%) ...

What is Medicare Part D 2021?

Published: Jun 08, 2021. The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...

How much does a PDP payer pay in 2021?

For drugs on the non-preferred tier (which can be all brands or a mix of brands and generics), virtually all PDP enrollees pay coinsurance between 25% and 50% in 2021, while most MA-PD enrollees (83%) pay copayments between $90 and $100. The maximum cost-sharing amount permitted by CMS is $47 or 25% for preferred brands ...

How much is Part D 2021?

For PDPs, the average Part D deductible in 2021 is $350, 3.5 times larger than the average drug deductible in MA-PDs ($102) (Figure 5). The increase in the weighted average Part D deductible for PDPs was particularly steep between 2019 and 2020, when two national PDPs modified their plan design from charging no deductible to charging a partial ...

How many Medicare beneficiaries will receive low income subsidies in 2021?

An increasing share of beneficiaries receiving low-income subsidies are enrolled in Medicare Advantage drug plans, with just over half now enrolled in MA-PDs. In 2021, nearly 13 million Part D enrollees, or just over 1 in 4, receive premium and cost-sharing assistance through the Part D Low-Income Subsidy (LIS) program.

How much is MA PD insurance in 2021?

For MA-PDs, the monthly premium for the Part D portion of covered benefits averages $12 in 2021 (and $21 for Part C and Part D benefits combined). The average premium for drug coverage in MA-PDs is lower than the average premium for PDPs due in part to the ability of MA-PD sponsors to use rebate dollars (which may include bonuses) ...

What is a SNP in Medicare?

SNPs limit enrollment to beneficiaries with certain characteristics, including those with certain chronic conditions (C-SNPs), those who require an institutional level of care (I-SNPs), and those who are dually enrolled in Medicare and Medicaid ( D-SNPs), which account for the majority of SNP enrollees.

Medicare Prescription Drug Plan Availability in 2022

Low-Income Subsidy Plan Availability in 2022

- Beneficiaries with low incomes and modest assets are eligible for assistance with Part D plan premiums and cost sharing. Through the Part D Low-Income Subsidy (LIS) program, additional premium and cost-sharing assistance is available for Part D enrollees with low incomes (less than 150% of poverty, or $19,320 for individuals/$26,130 for married couples in 2021) and modest as…

Part D Plan Premiums and Benefits in 2022

- Premiums

The 2022 Part D base beneficiary premium – which is based on bids submitted by both PDPs and MA-PDs and is not weighted by enrollment – is $33.37, a modest (1%) increase from 2021. But actual premiums paid by Part D enrollees vary considerably. For 2022, PDP monthly premiums r… - Benefits

The Part D defined standard benefit has several phases, including a deductible, an initial coverage phase, a coverage gap phase, and catastrophic coverage, although it does not have a hard cap on out-of-pocket spending. Between 2021 and 2022, the parameters of the standard benefit are risi…

Part D and Low-Income Subsidy Enrollment

- Enrollment in Medicare Part D plans is voluntary, except for beneficiaries who are eligible for both Medicare and Medicaid and certain other low-income beneficiaries who are automatically enrolled in a PDP if they do not choose a plan on their own. Unless beneficiaries have drug coverage from another source that is at least as good as standard Part D coverage (“creditable coverage”), the…

Part D Spending and Financing

- Part D Spending

The Congressional Budget Office (CBO) estimates that spending on Part D benefits will total $111 billion in 2022, representing 15% of net Medicare outlays (net of offsetting receipts from premiums and state transfers). Part D spending depends on several factors, including the total n… - Part D Financing

Financing for Part Dcomes from general revenues (73%), beneficiary premiums (15%), and state contributions (11%). The monthly premium paid by enrollees is set to cover 25.5% of the cost of standard drug coverage. Medicare subsidizes the remaining 74.5%, based on bids submitted by …

Issues For The Future

- The Medicare drug benefit has helped to reduce out-of-pocket drug spending for enrollees, which is especially important to those with modest incomes or very high drug costs. But in the face of rising drug prices, more plans charging coinsurance rather than flat copayments for covered brand-name drugs, and annual increases in the out-of-pocket spending threshold, many Part D e…