To pick a Medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

- Understand your coverage needs and budget.

- Sign up during the Medigap Open Enrollment Period.

- Explore any potential discounts.

- Know when you may have guaranteed-issue rights.

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

What is the best and cheapest Medicare supplement insurance?

The Medicare Supplement Plan N is best for the following people:

- People looking for complete coverage at a modest monthly rate

- Those who don’t mind paying a minor fee at the time of service

- People who are not subject to Part B excess charges

Are Medicare supplement plans worth it?

Medicare Supplement plans are worth it; doctor freedom, low out of pocket costs, and when Medicare pays the claim, your supplemental Medicare plan will pay the rest. Our team of experts is ready to answer your questions are share the most popular Medigap plans in your area. Call us today to find out if Medicare Supplements are worth it for you!

What is the best Medicare plan?

They are here to talk about their 5 star medicare plans available to switch your current plan or during the election periods throughout the year. As independent agents, Deb and Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers.

How do I know which Medicare plan is right for me?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

Which Medicare Supplement plan has the highest level of coverage?

Plan FPlan F premiums are usually the highest of all Medicare Supplement plans. This makes sense because it offers the highest level of coverage. Medicare Supplement costs vary based on a number of factors, including your age, sex, smoking status, and even your ZIP code.

Can you change Medicare Supplement plans anytime you want?

As a Medicare beneficiary, you can change supplements at any time. As a result, there's no guarantee an application will be accepted if switched outside the designated Open Enrollment Period. An application may be “medically underwritten”.

How are Medicare supplements divided?

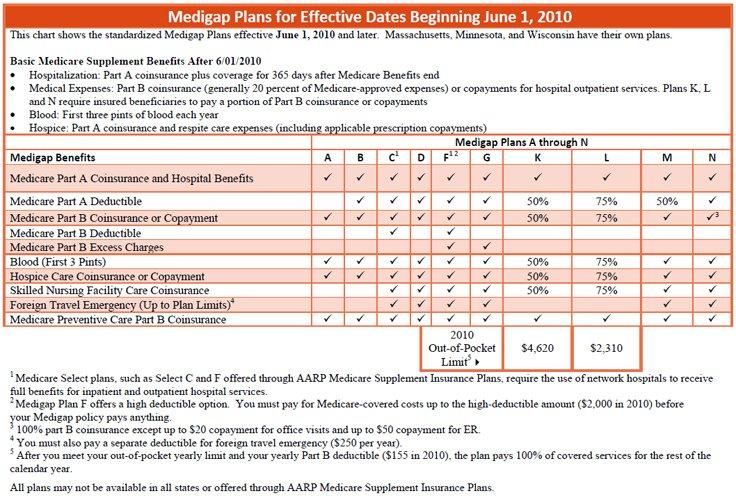

Supplemental insurance plans are divided into categories with an alphabetic label. Medigap plans in tiers A through K provide the highest cost sharing benefits, while plans K through N plans provide less cost coverage.

What is the deductible for plan G in 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses. Medicare Supplement Insurance plans are sold by private insurance companies.

What is the difference between plan G and N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

Why should I keep Plan F?

The reason Medicare Plan F is so well-liked is that it will pay for ALL of the gaps in Original Medicare Part A and Part B, including both your hospital and outpatient deductible. It even pays the 20% that Medicare Part B does not cover. This means zero out-of-pocket for you at the doctor's office.

Do you have to renew Medicare Supplement every year?

Medicare Supplement (Medigap) Plans: You do not have to do anything annually to renew them, and there is no annual open enrollment period for Medicare Supplement plans. They have the benefit of being “guaranteed renewable”. It will continue indefinitely unless you don't pay the premium.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Can you have two Medicare Supplement plans?

A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies. You can buy a Medigap policy from any insurance company that's licensed in your state to sell one.

What is plan G Medicare Supplement?

Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in both Part A and Part B of Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.

What are the 4 phases of Medicare Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

What costs are not covered by original Medicare?

By itself, original Medicare (Parts A and B) generally pays about 80% of the cost for doctors, hospitals, and medical procedures. The patient is responsible for paying the rest, and there is no limit on out-of-pocket expenses.

What does the standard Medigap coverage provide?

In general, Medigap covers your coinsurance bill once you’ve paid the Medicare deductible. Some plans (B, D, G, and N) pay your Part A deductible as well. (Plans C and F also pay the Part A deductible but aren’t available to new enrollees.)

When is the best time to buy a Medigap policy?

In most cases, the best time to buy a Medigap policy is during your open-enrollment period. This period may start either in the month you turn 65 and enroll in Medicare Part B, or when your employer-provided group healthcare coverage ends and you enroll in Part B.

How do I identify which Medigap plan I need?

When picking a Medigap plan, think about both your current and future healthcare needs. It’s important to choose carefully, because there’s no guarantee you’ll be able to switch plans later .

How do I shop for a Medigap policy?

There are a few ways to find out what policies are available in your area.

The bottom line

Medigap plans help cover costs related to Medicare Parts A and B that you'd otherwise pay yourself. The best time to choose a Medigap plan is generally when you first sign up for Medicare, when you won't have to go through medical underwriting.

Health Care Costs and Original Medicare

Original Medicare provides health insurance coverage for hospital stays, doctor's office visits, lab testing, medical supplies and some other services. For Medicare beneficiaries, other out-of-pocket costs can add up quickly.

Choosing the Best Medicare Supplement Plan for You

Medigap plans supplement your Original Medicare coverage with benefits that help fill in some key cost gaps. The basic benefits of each type of Medicare Supplement Insurance plan are standardized by Medicare, though the policies themselves are sold by private companies.

Getting the Most From Medicare Supplement Insurance

If you buy a plan during your Medigap open enrollment period, insurers cannot deny you a policy or charge more for your Medigap plan based on your health or pre-existing conditions. If you don't purchase a Medicare Supplement Insurance plan during your open enrollment period, you could potentially be denied coverage or pay higher monthly premiums.

Medicare Advantage Plans Replace Original Medicare Benefits

Another health plan option is Medicare Advantage plans. It is important to note that Medicare Advantage and Medicare Supplement Insurance are different. Medicare Advantage plans are an alternative to Original Medicare, while Medigap plans work alongside your Original Medicare benefits to help cover out-of-pocket costs.

Get Help Buying the Right Medigap Plan for You

The right Medicare Supplement Insurance plan is the one that best matches your health care cost requirements and your budget. A licensed agent can answer your questions and help you determine which plan is right for you.

Compare Medigap plans in your area

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareSupplement.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.