Medicare Plan F and Medicare Plan N are two kinds of Medigap Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …Medigap

Full Answer

What is Medicare Part F and how does it work?

What is Medicare Part F? Medicare Part F is one of the 10 MedSup policies Americans enrolled in Original Medicare can buy if they want additional health coverage, or if they want help paying for their Medicare Part A and Part B coverage. Beyond that, Part F is the most comprehensive of all the MedSup plans on the market today.

What are the parts of Medicare?

The parts of Medicare (A, B, C, D) 1 Part A provides inpatient /hospital coverage. 2 Part B provides outpatient /medical coverage. 3 Part C offers an alternate way to receive your Medicare benefits (see below for more information). 4 Part D provides prescription drug coverage. More ...

Should I enroll in Medicare Part F?

Plan F — or as it’s sometimes called, Medicare Part F. You may also see or hear it called Medicare Supplement Plan F, MedSup Plan F, Medigap Plan F and Medicare Plan F. Should you enroll in Medicare Part F just because many other Americans enroll in it? Of course not.

What are Medicare Parts A and B and C?

Together, Medicare Parts A and B are called Original Medicare. Part B (medical coverage) covers things like doctor visits, outpatient services, X-rays and lab tests, and preventive screenings. Part C is also known as Medicare Advantage.

What is Part F of Medicare coverage?

Medigap Plan F is a Medicare Supplement Insurance plan that's offered by private companies. It covers "gaps" in Original Medicare coverage, such as copayments, coinsurance and deductibles. Plan F offers the most coverage of any Medigap plan, but unless you were eligible for Medicare by Dec.

What is the difference between plan F and N?

Plan N premiums are typically lower than Plan F premiums, meaning, you spend less out of pocket monthly with Plan N than you will with Plan F. However, Plan F covers more out-of-pocket expenses. If you know that you will have many medical expenses throughout the year, Plan F may be a better choice.

What is part n Medicare?

Medicare Plan N is coverage that helps pay for the out-of-pocket expenses not covered by Medicare Parts A and B. It has near-comprehensive benefits similar to Medigap Plans C and F (which are not available to new enrollees), but Medicare Plan N has lower premiums.

What does Medicare F mean?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

Is Medicare Plan F being discontinued?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.

Why should I keep plan F?

PLAN F PROVIDES COMPREHENSIVE COVERAGE…AT A COST Because Plan F covers the annual Part B deductible, members of the plan are free to visit doctors, hospitals, and other healthcare providers as often as they'd like, with no out-of-pocket costs.

What does an n plan cover?

What does Plan N cover? Plan N covers the Medicare Part A deductible of $1,556, coinsurance for Parts A and B, three pints of blood and 80% of medical costs incurred during foreign travel. Plan N does not provide coverage for the Medicare Part B deductible ($233 in 2022).

What is the difference between plan G and N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

What is Medicare Plan G and F?

Plans F and G are known as Medicare (or Medigap) Supplement plans. They cover the excess charges that Original Medicare does not, such as out-of-pocket costs for hospital and doctor's office care. It's important to note that as of December 31, 2019, Plan F is no longer available for new Medicare enrollees.

What is the difference between Medicare Part F and Part G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

Is plan G better than plan F?

Ultimately, Plan G has the same benefits as the Plan F, except for coverage for the Part B deductible ($233 for 2022). Once you pay the Part B deductible, the coverage is the same for both plans.

Who is eligible for plan F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.

What is Medicare Plan F?

Medicare Plan F, Plan G and Plan N are Medicare Supplement Insurance plans that can be purchased to help supplement your Original Medicare benefits. These popular plan options can help you cover the extra out-of-pocket costs that Original Medicare doesn’t cover.

Is Medicare Plan F still available?

Medicare Plan F is no longer available to new enrollees as of 2020, though it is still an option for people who were eligible for Medicare before 2020. People who already are enrolled in this plan are also able to keep it. It is also the only plan which covers the yearly Part B deductible (which is $198 in 2020).

Is Medicare Plan G the same as Medicare Plan F?

For new enrollees looking for a comprehensive plan that is very similar to Medicare Plan F, Medicare Plan G is a great option. This plan covers everything that Plan F covers EXCEPT the $198 Part B annual deductible that may need to be paid out-of-pocket. Because Plan G offers slightly less coverage than Plan F, it will usually have a less expensive monthly premiums, though these prices will vary depending on the insurance company offering the plan.

What is Medicare Part C?

Medicare Part C. Part C is also known as Medicare Advantage. Private health insurance companies offer these plans. When you join a Medicare Advantage plan, you still have Medicare. The difference is the plan covers and pays for your services instead of Original Medicare.

How often do you have to have a colonoscopy for Medicare?

Colonoscopies. Medicare covers screening colonoscopies. Test frequency depends on your risk for colorectal cancer: Once every 24 months if you have a high risk. Once every 10 years if you aren’t at high risk.

What is hospice care?

Medicare Part A covers hospice care for terminally ill patients who will live six months or less. Patients agree to receive services that focus on providing comfort and that replace the Medicare benefits to treat an illness.

Does Medicare cover chiropractic care?

Medicare has some coverage for chiropractic care if it’s medically necessary. Part B covers a chiropractor’s manual alignment of the spine when one or more bones are out of position. Medicare doesn’t cover other chiropractic tests or services like X-rays, massage therapy or acupuncture.

Does Medicare cover hearing aids?

Hearing aids. Medicare doesn’t cover hearing aids or pay for exams to fit hearing aids. Some Medicare Advantage plans have benefits that help pay for hearing aids and fitting exams.

Does Medicare cover acupuncture?

Assisted living is housing where people get help with daily activities like personal care or housekeeping. Medicare doesn’t cover costs to live in an assisted living facility or a nursing home.

Does Medicare cover assisted living?

Medicare doesn’t cover costs to live in an assisted living facility or a nursing home. Medicare Part A may cover care in a skilled nursing facility if it is medically necessary. This is usually short term for recovery from an illness or injury.

What is Medicare Plan N?

Medicare Plan F and Medicare Plan N are two kinds of Medigap plans. Medigap is also known as Medicare Supplement Insurance. Medigap is supplemental insurance that you may be able to buy from a private insurer. Medigap covers some of the expenses that original Medicare doesn’t, such as deductibles, copays, and coinsurance.

When will Medicare stop allowing Plan F?

Plan F is no longer available to people who are new to Medicare unless you turned age 65 before January 1, 2020. If you already have Plan F, you are able to keep it.

Why is Medigap Plan N so popular?

Medigap Plan N is popular because its monthly premiums are relatively low, compared to some other Medigap plans. However, these monthly premiums vary widely. You can shop for and compare Medigap Plan N plans here. Medigap Plan N covers: Part A coinsurance and deductible.

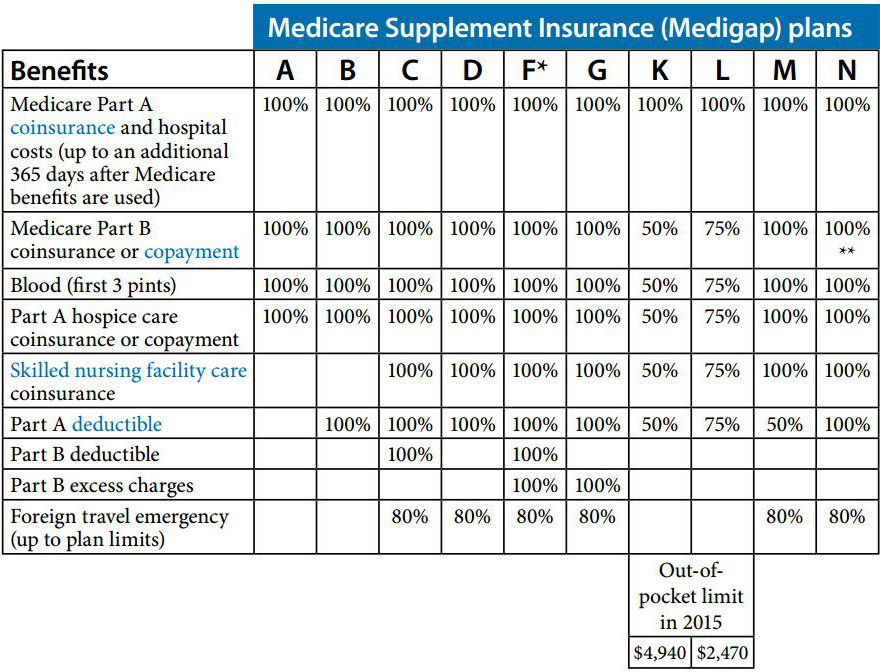

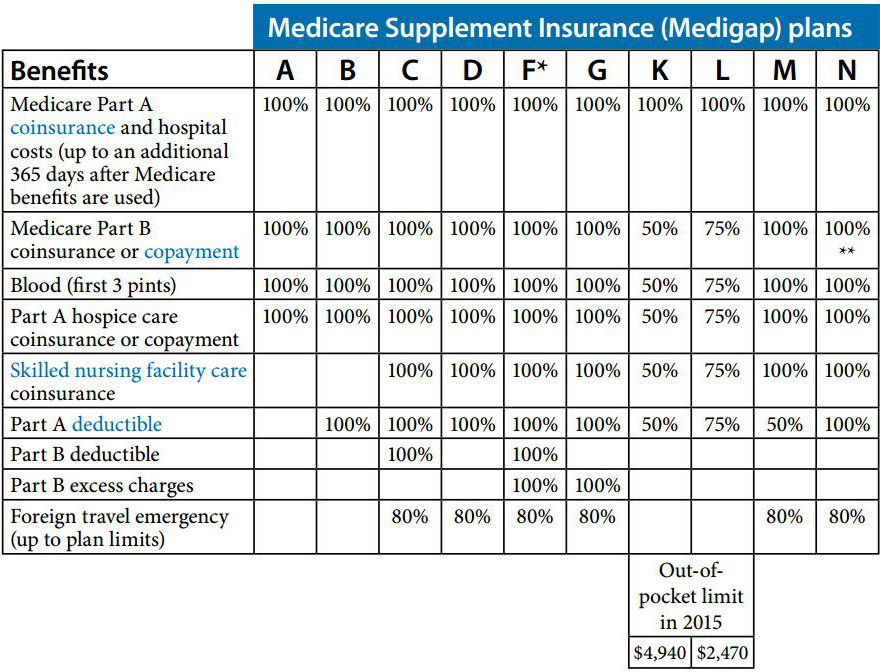

How many Medigap plans are there?

There are 10 Medigap plans to choose from, although not every plan is available in every area. Out-of-pocket gaps can add up.

Does Medigap cover copays?

Medigap plans can cover all or some of the remaining 20 percent . Medigap plans have different premium costs, depending upon which one you choose. They all offer the same basic benefits, although some plans provide more coverage than others. In general, Medigap plans cover all or a percentage of: copays. coinsurance.

Which is better, Plan N or Plan F?

If you know that you will have many medical expenses throughout the year, Plan F may be a better choice. If you expect your medical costs to be on the low side but want to make sure you have peace of mind in case of medical emergencies, Plan N may be a better choice.

Is Plan F available for 2020?

Two popular plans are Plan F and Plan N. Plan F is a full coverage option that is popular, but as of January 1, 2020, it was no longer available to most new beneficiaries. Not everyone is eligible for both plans. The information on this website may assist you in making personal decisions about insurance, but it is not intended to provide advice ...

What is the deductible for Medigap Plan F?

Medigap Plan F also comes with a high-deductible option. High-deductible Plan F features an annual deductible of $2,370 in 2021. You must meet this deductible before the plan's coverage begins. One potential benefit of the high deductible is a lower average premium, which is discussed below.

What is a Medigap Plan F?

Medigap Plan F is the most popular Medicare Supplement Insurance plan. 1. Medigap Plan F helps pay for more out-of-pocket Medicare costs than any other type of Medigap plan, but it may also come with a higher premium. There are 10 standardized Medigap plans available in most states.

How much is the Part B deductible for 2021?

If you were enrolled in Plan N that charged the average premium ($111.28 per month) and paid the Part B deductible in full (which was $203 per year in 2021), you would have paid $1,518.36 on premiums and your deductible. (The Part B deductible is $203 per year in 2021).

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What is the 15% excess charge for Medicare?

This 15% cost is called the Part B excess charge . Medigap Plan N does not provide any coverage for Part B excess charges.

Does Medicare cover Part B excess?

Medigap Plan F also covers Part B excess charges. When you visit a doctor who does not accept Medicare assignment, this means they do not agree to accept Medicare reimbursement as payment in full for the costs of your covered services. If you go to a non-participating doctor, you could have to make a payment of up to 15% ...

Part A: Hospital Services

Medicare Parts A and B are run by a federal agency called the Centers for Medicare and Medicaid Services. Together, these two parts are known as Original Medicare. With Original Medicare, you can see any doctor or hospital anywhere in the country -- as long as they participate in the program and are accepting new Medicare patients.

Part B: Medical Services

Part B is Medicare’s coverage for doctor visits, tests, and other outpatient services. It covers medically necessary services and some preventive ones, like checkups. It also may pay for:

Part C: Medicare Advantage

If you want extra services like those -- and are willing to pay more to get them -- Part C, or a Medicare Advantage plan, may be for you.

Part D: Prescription Drugs

Maybe you don't want to sign up for a Medicare Advantage plan, or the plans in your area don't offer the kind of drug coverage you need. You’ve got one more option to explore: a private insurance company’s Part D plan.

Medicare Supplement Plans (Medigap)

Medigap, or Medicare supplement, plans are extra insurance to pay for all or part of the deductibles, coinsurance, and copayments you have with Original Medicare. You buy them from private insurance companies.

What is Medicare Part F?

Medicare Part F is one of the 10 MedSup policies Americans enrolled in Original Medicare can buy if they want additional health coverage, or if they want help paying for their Medicare Part A and Part B coverage. Beyond that, Part F is the most comprehensive of all the MedSup plans on the market today.

How to lower Medicare Supplement Part F?

One way to lower what you pay for Medicare Supplement Part F is to move to an area where this kind of coverage costs less than it does where you live now. Not many people are going to go to such lengths to save a few dollars a month, though, so here are a handful of other options for cutting your MedSup Plan F costs:

What is the most popular Medicare supplement plan?

Medicare Part F is the most popular Medicare supplement plan around. Here’s why, plus what it covers and costs. The good news for Americans who aren’t entirely happy with the health coverage Original Medicare provides them is that they have options. In particular, they have options when it comes to finding supplemental insurance ...

What does Plan F mean?

It means it helps the people who buy it with all of the payment gaps left open by Medicare Part A and Part B. To put that another way, it often means that those who enroll in Plan F rarely, if ever, have to worry about out-of-pocket costs when they visit a doctor or otherwise seek medical assistance.

How long does Medicare cover coinsurance?

Part A coinsurance and hospital costs up to an additional 365 days after you’ve used up your standard Medicare benefits. Part A hospice care coinsurance or copayment. Part B coinsurance or copayment. Part B excess charge. Skilled nursing facility care coinsurance. First three pints of blood each year.

Which Medicare Supplement Plan is the most expensive?

Medicare Supplement Plan F is great because it provides the most coverage of the 10 currently available MedSup plans. That coverage comes at a cost, however; specifically, Plan F is the most expensive of all the MedSup policies on the market today.

How to figure out how much you have to pay for Plan F?

To figure out how much you may have to pay for Plan F coverage, contact a number of insurance companies that sell the policies in your ZIP code. Compare the prices they quote you and then make your decision based on that.

Which Medicare plan pays 100% of Part B coinsurance?

Plan N will pay 100% of the Part B coinsurance, except for copays of up to $20 for certain office visits and up to $50 for emergency room visits when you’re not admitted to the hospital. Medicare Supplement Plan F is the most comprehensive plan. Plan F covers one more benefit than Plan G, which is the Part B deductible.

Which is better, Plan F or Plan G?

Plan F is the most comprehensive plan. It covers one more benefit than Plan G. Plan G typically has higher premiums than Plan N because it includes more coverage. You could save money with Plan N because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G.

When is the best time to buy Medicare Supplement Plan?

The best time to purchase your Medicare Supplement plan is during the Medigap Open Enrollment Period, the six-month period that begins on the first day of the month in which you are 65 or older and enrolled in Medicare Part B.

Why is Plan G higher than Plan N?

Plan G and Plan N premiums are lower to reflect that. 7. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

Is Medicare Part B deductible?

Plan F, which covers Medicare Part B deductible, is not available to those newly eligible for Medicare on or after January 1, 2020. However, if you already have Plan F or its high-deductible version, you can keep it. Plans F and G offer a high-deductible option, though not every carrier offers them.

Does Medicare cover out of pocket costs?

While Original Medicare covers most things, there are out-of-pocket costs like deductibles, copayments, and coinsurance. Those gaps can be covered by purchasing Medicare Supplement Plans F, G, or N. These policies are standardized across states, meaning they all must provide roughly the same coverage no matter which state you live in.

Does Medicare pay for health care?

Under Original Medicare, the government pays directly for the health care services you receive . You can see any doctor and hospital that takes Medicare (and most do) anywhere in the country. In Original Medicare: You go directly to the doctor or hospital when you need care.

Does Medicare Advantage have network restrictions?

On the other hand, Medicare Advantage Plans typically have network restrictions, meaning that you will likely be more limited in your choice of doctors and hospitals.

Does Medicare Advantage Plan cover Part A?

Each Medicare Advantage Plan must provide all Part A and Part B services covered by Original Medicare, but they can do so with different rules, costs, and restrictions that can affect how and when you receive care. It is important to understand your Medicare coverage choices and to pick your coverage carefully.

Do you have to pay coinsurance for Medicare?

You typically pay a coinsurance for each service you receive. There are limits on the amounts that doctors and hospitals can charge for your care. If you want prescription drug coverage with Original Medicare, in most cases you will need to actively choose and join a stand-alone Medicare private drug plan (PDP).