How much will Medicare pay for my health insurance?

May 06, 2021 · Medicare Part B: Original Medicare plus Medicare Supplement: Medicare Advantage: Cardiologist visit: 20% of $180 = $36: $0 (under most standardized Medicare Supplement insurance plans). Medicare Supplement Plan N might charge a copayment up to $20. You’re likely to pay a coinsurance or copayment (the amount may vary among plans).

What is a Medicare pre-payment amount?

You usually pay 20% of the Medicare-approved amount for the doctor or other health care provider's services. For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office.

What is the Medicare-approved amount?

Typically, you will pay 20 percent of the Medicare-approved amount, and Medicare will pay the remaining 80 percent. Your 20 percent amount is called Medicare Part B coinsurance. Let’s say your doctor decides to refer you to a specialist to have your shoulder further examined.

Do you still owe 20 percent of Medicare approved costs?

surgery or procedure will cost and how much you’ll have to pay. Learn how Medicare covers inpatient versus outpatient hospital services. Visit Medicare.gov or call 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048. • Look at your last “Medicare Summary Notice” to see if you met the

Does Medicare always pay 80 percent?

What percent does Medicare pay for and what percent is the patient responsible for?

How does Medicare determine how much to pay?

How Much Does Medicare pay out each year?

What is the Irmaa for 2021?

What are Medicare premiums for 2021?

Why is my Medicare Part B premium so high?

Are Medicare premiums calculated every year?

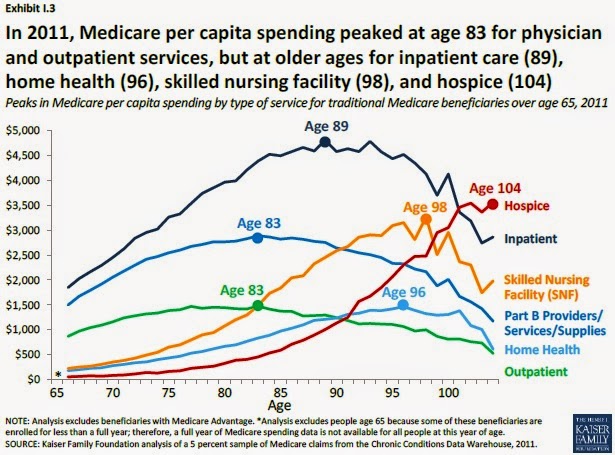

How much does Medicare cost at age 83?

| Average Monthly Cost of Plan F | Age in Years | Average Monthly Cost of Plan G |

|---|---|---|

| $281.39 | 82 | $221.16 |

| $287.31 | 83 | $225.99 |

| $293.24 | 84 | $230.83 |

| $299.29 | 85 | $235.87 |

Do I have to pay for Medicare Part A?

Is Medicare Part A and B free?

What is Medicare Part A deductible for 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Do you have to pay late enrollment penalty for Medicare?

In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare approved amount?

The Medicare-approved amount is the total payment that Medicare has agreed to pay a health care provider for a service or item. Learn more your potential Medicare costs. The Medicare-approved amount is the amount of money that Medicare will pay a health care provider for a medical service or item.

What does it mean when a doctor accepts Medicare assignment?

If a doctor or supplier accepts Medicare assignment, this means that they agree to accept the Medicare-approved amount for a service or item as payment in full. The Medicare-approved amount could potentially be less than the actual amount a doctor or supplier charges, depending on whether or not they accept Medicare assignment.

What is Medicare participating provider?

What is a Medicare participating provider? If a provider agrees to accept Medicare assignment ( they are called a “Medicare participating provider”), they agree to accept the Medicare-approved amount as payment in full for any service they provide (assuming it is covered by Medicare). However, some providers may accept Medicare as insurance, ...

Can a provider accept Medicare?

However, some providers may accept Medicare as insurance, but not accept the Medicare-approve d amount as ...

What is Medicare Part B excess charge?

What are Medicare Part B excess charges? You are responsible for paying any remaining difference between the Medicare-approved amount and the amount that your provider charges. This difference in cost is called a Medicare Part B excess charge. By law, a provider who does not accept Medicare assignment can only charge you up to 15 percent over ...

What percentage of Medicare can you charge a provider who does not accept Medicare?

By law, a provider who does not accept Medicare assignment can only charge you up to 15 percent over the Medicare-approved amount. Let’s consider an example: You’ve been feeling some pain in your shoulder, so you make an appointment with your primary care doctor. This appointment will be covered by Medicare Part B, ...

How much can a provider charge for not accepting Medicare?

By law, a provider who does not accept Medicare assignment can only charge you up to 15 percent over the Medicare-approved amount. Let’s consider an example: You’ve been feeling some pain in your shoulder, so you make an appointment with your primary care doctor.

What is the original objective of Medicare?

The original objective was to establish a uniform payment system to minimize disparities between varying usual, customary, and reasonable costs. Today, Medicare enrollees who use the services of participating health care professionals will be responsible for the portion of a billing claim not paid by Medicare.

What is the intent of Medicare reimbursement?

The intent is to inform health care providers what payments they will receive for their Medicare patients. While the reimbursement rates do take into consideration a number of variable factors, those differences are factored into the reimbursement projections for enrollees living in different geographical locations.

How many specialists are on the Medicare committee?

Medicare establishes the reimbursement rates based on recommendations from a select committee of 52 specialists. The committee is composed of 29 medical professionals and 23 others nominated by professional societies.

How many medical professionals are on the Medicare committee?

The committee is composed of 29 medical professionals and 23 others nominated by professional societies. While Medicare is not obligated to accept all of the recommendations, it has routinely approved more than 90 percent of the recommendations.

Does Medicare accept all recommendations?

While Medicare is not obligated to accept all of the recommendations, it has routinely approved more than 90 percent of the recommendations. The process is composed of a number of variables and has been known for lack of transparency by the medical community that must comply with the rates.

How much can Medicare increase from current budget?

By Federal statute, the Medicare annual budget request cannot increase more than $20 million from the current budget.

Can non-participating professionals receive reimbursement?

While non-participating professionals and companies are able to submit claims and receive reimbursements for their services, their reimbursements will be slightly lower than the rates paid to participants.

Can Medicare take less than the provider's payment?

The Medicare-approved amount may be less than the participating provider would normally charge. However, when the provider accepts assignment, they agree to take this amount as full payment for the services.

What are the services covered by Medicare?

No matter what type of Medicare plan you enroll in, you can use Medicare’s coverage tool to find out if your plan covers a specific service, test, or item. Here are some of the most common Medicare-approved services: 1 mammograms 2 chemotherapy 3 cardiovascular screenings 4 bariatric surgery 5 physical therapy 6 durable medical equipment

What are the different types of Medicare?

Your Medicare-approved services also depend on the type of Medicare coverage you have. For instance: 1 Medicare Part A covers you for hospital services. 2 Medicare Part B covers you for outpatient medical services. 3 Medicare Advantage covers services provided by Medicare parts A and B, as well as:#N#prescription drugs#N#dental#N#vision#N#hearing 4 Medicare Part D covers your prescription drugs.

What is Medicare approved amount?

The Medicare-approved amount is the amount that Medicare pays your provider for your medical services. Since Medicare Part A has its own pricing structure in place, this approved amount generally refers to most Medicare Part B services. In this article, we’ll explore what the Medicare-approved amount means and it factors into what you’ll pay ...

Does Medicare bill for coinsurance?

The provider will bill Medicare for your services and only charge you the deductible and coinsurance amount specified by your plan. The Medicare-approved amount may be less than the participating provider would normally charge. However, when the provider accepts assignment, they agree to take this amount as full payment for the services.

Do you owe Medicare if you bill later?

Even if the provider bills Medicare later for your covered services, you may still owe the full amount upfront. If you use a nonparticipating provider, they can charge you the difference between their normal service charges and the Medicare-approved amount.

How much is Medicare Part A deductible?

If you have original Medicare, you will owe the Medicare Part A deductible of $1,484 per benefit period and the Medicare Part B deductible of $203 per year. If you have Medicare Advantage (Part C), you may have an in-network deductible, out-of-network deductible, and drug plan deductible, depending on your plan.

How much does Medicare cover?

Medicare for most people will only cover 80 percent of the medical costs. Medicare will usually discount a physician or hospital charges and then paid 80 percent of the adjusted cost.

Is Medicare a federal program?

Medicare is a federal insurance program that guarantees health coverage for people 65 and older, those with extreme disabilities and infants who have significant medical problems at birth . However, the entire cost of the health coverage is not covered. Find the best Medicare Advantage plan in your area by entering your zip code above!

Does Medicare have a donut hole?

There is such thing as a “donut hole” in coverage for those with drug prescriptions, so having supplemental coverage is essential for many. Government-issued Medicare will not offer full coverage, so you may want to consider supplemental coverage or private Medicare Advantage insurance (Part C) Persons new to Medicare may ask ...

Does Medicare cover prescriptions?

The short answer is “no”; however, it will cover a significant portion of a person’s medical expenses. Thus, the challenge for the patient is to understand what Medicare, Medigap, prescription plans, and other plans will cover. Medicare is a federal insurance program that guarantees health coverage for people 65 and older, ...

What are the items covered by Medicare?

These items include: Long Term Health Care or Custodial Care, such as a nursing home. Most dental care such as routine examinations, dentures, cavities, etc. Eye Examinations related to prescribing glasses. The cost for eyeglasses or contact lenses will not be covered. Cosmetic surgery.

Can you keep track of Medicare?

It is virtually impossible to keep track of everything Medicare may or may not cover. However, there are certain criteria that must be met. For example, the physician has to agree to accept Medicare payments. Doctors are not required to accept the government programs.

Do doctors accept Medicare?

Doctors are not required to accept the government programs. According to the Kaiser Family Foundation , close to 90 percent of the U.S. Doctors accept Medicare patients. However, approximately 80 percent are accepting new patients and the remainder does not accept new Medicare patients.

What percentage of Medicare deductible is paid?

After your Part B deductible is met, you typically pay 20 percent of the Medicare-approved amount for most doctor services. This 20 percent is known as your Medicare Part B coinsurance (mentioned in the section above).

What is Medicare approved amount?

The Medicare-approved amount is the maximum amount that a doctor or other health care provider can be paid by Medicare. Some screenings and other preventive services covered by Part B do not require any Medicare copays or coinsurance.

How does Medicare copay work?

How Do Medicare Copays and Deductibles Work? A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays (also called copayments) most often come in the form of a flat-fee and typically kick in after a deductible is met. A deductible is the amount you must pay out ...

What is a copay in Medicare?

A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays (also called copayments) most often come in the form of a flat-fee and typically kick in after a deductible is met. A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin ...

How much is Medicare coinsurance for days 91?

For hospital and mental health facility stays, the first 60 days require no Medicare coinsurance. Days 91 and beyond come with a $742 per day coinsurance for a total of 60 “lifetime reserve" days.

How much is Medicare Part A 2021?

The Medicare Part A deductible in 2021 is $1,484 per benefit period. You must meet this deductible before Medicare pays for any Part A services in each benefit period. Medicare Part A benefit periods are based on how long you've been discharged from the hospital.

Does Medicare cover out of pocket costs?

There is one way that many Medicare enrollees get help covering their Medicare out-of-pocket costs. Medigap insurance plans are a form of private health insurance that help supplement your Original Medicare coverage. You pay a premium to a private insurance company for enrollment in a Medigap plan, and the Medigap insurance helps pay ...

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio