Full Answer

What are part B Medicare expenses?

Nov 17, 2021 · Medicare Advantage plans (Medicare Part C) do not cover Part B excess charges. A Medicare Advantage plan, however, does include an annual out-of-pocket spending limit for covered Part A and Part B services. This could help protect you from paying Part B excess charges past a certain amount, if you face them and if they go beyond your plan’s annual out …

Is there a premium for Medicare Part B?

This is called an excess charge. Plan N does not cover this for you like Plan F or G would. This can result in small bills from time to time. However, you can avoid this by simply asking your providers up front if they accept Medicare assignment. If they do, you need not worry about excess charges. Another option is to compare Medicare Plan N v Plan G.

Is there a deductible for Medicare Part?

Jul 24, 2019 · One big difference is that Plan N does not cover excess charges, so the premiums for Plan N are lower. If you live in a state that doesn’t allow excess charges, Plan N might appeal to you. Just remember that when you are out of state, …

Does Medicaid pay the Part B deductible?

These so-called Medicare Part B Excess charges of up to 15% above the Medicare-approved amount are passed on to the patient and billed directly to you after the fact. That is, unless you have a Medigap plans that pays the Part B Excess charges for you. The plans that do this are the two most common plans – Plan F and Plan G.

How do I avoid excess charges on Medicare Part B?

You can avoid having to pay Part B excess charges by seeing only Medicare-approved providers. Medigap Plan F and Medigap Plan G both cover Part B excess charges. But you may still have to pay your medical provider up front and wait for reimbursement.

How common are Plan B excess charges?

Which states allow Medicare Part B excess charges?

What are excess Medicare Part B charges?

Does Medigap cover Part B premium?

Is Part B the same as Medigap?

Does Plan N cover excess charges?

Can a doctor charge more than Medicare allows?

How often are there Medicare excess charges?

What does excess charge mean?

What is the new Medicare Part B deductible for 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What are medical excess charges?

How much does Plan N cost monthly?

Plan N does not have a set premium but ranges from $85 to $200. The premium will depend on several factors such as zip code, gender, age, tobacco u...

What is the deductible for Plan N?

In 2022, the deductible is $233 which is the Part B annual deductible that you are responsible for with Plan N. The Part B deductible is one gap th...

What is the difference between Plan G and Plan N?

Plan N has more out-of-pocket than Plan G, but the premium for Plan N is typically lower. You must pay up to $20 copays for office visits and up to...

Can I switch from Plan N to Plan G?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to ans...

Do people prefer Plan N over Plan G?

Plan N is very appealing as it tends to have lower premiums than Plan G. For those who don’t visit the doctor often, this plan may be a great fit!...

Part B Excess Charges Defined

Doctors and other healthcare providers can choose whether or not to participate with Medicare. Providers who participate with Medicare agree to cha...

How Might Part B Excess Charges Affect You?

Suppose you see a nonparticipating dermatologist for removal of a few suspicious moles. If the Medicare allowable charge for this procedure is $400...

What Can You Do to Protect Yourself Against Part B Excess Charges?

The easiest way to protect yourself from excess charges is to only use physicians who accept Medicare assignment. Then you know you will never be b...

Some States Prohibit Part B Excess Charges

Some states have taken matters into their own hands when it comes to protecting seniors against excess charges. The following states passed laws pr...

What is Medicare Part B excess charge?

What is a Medicare Part B excess charge? An excess charge happens when you receive health care treatment from a provider who does not accept the Medicare-approved amount as full payment. In these cases, a provider can charge you up to 15% more than the Medicare-approved amount. There are some ways you can avoid paying Part B excess charges, ...

Who can make excess charges under Medicare?

Any health care provider who accepts Medicare as a form of insurance (but doesn’t accept assignment) and is offering a service or item covered under Part B reserves the right to make excess charges. This can include: Laboratories. Other medical test providers. Home health care companies.

What is Plan G?

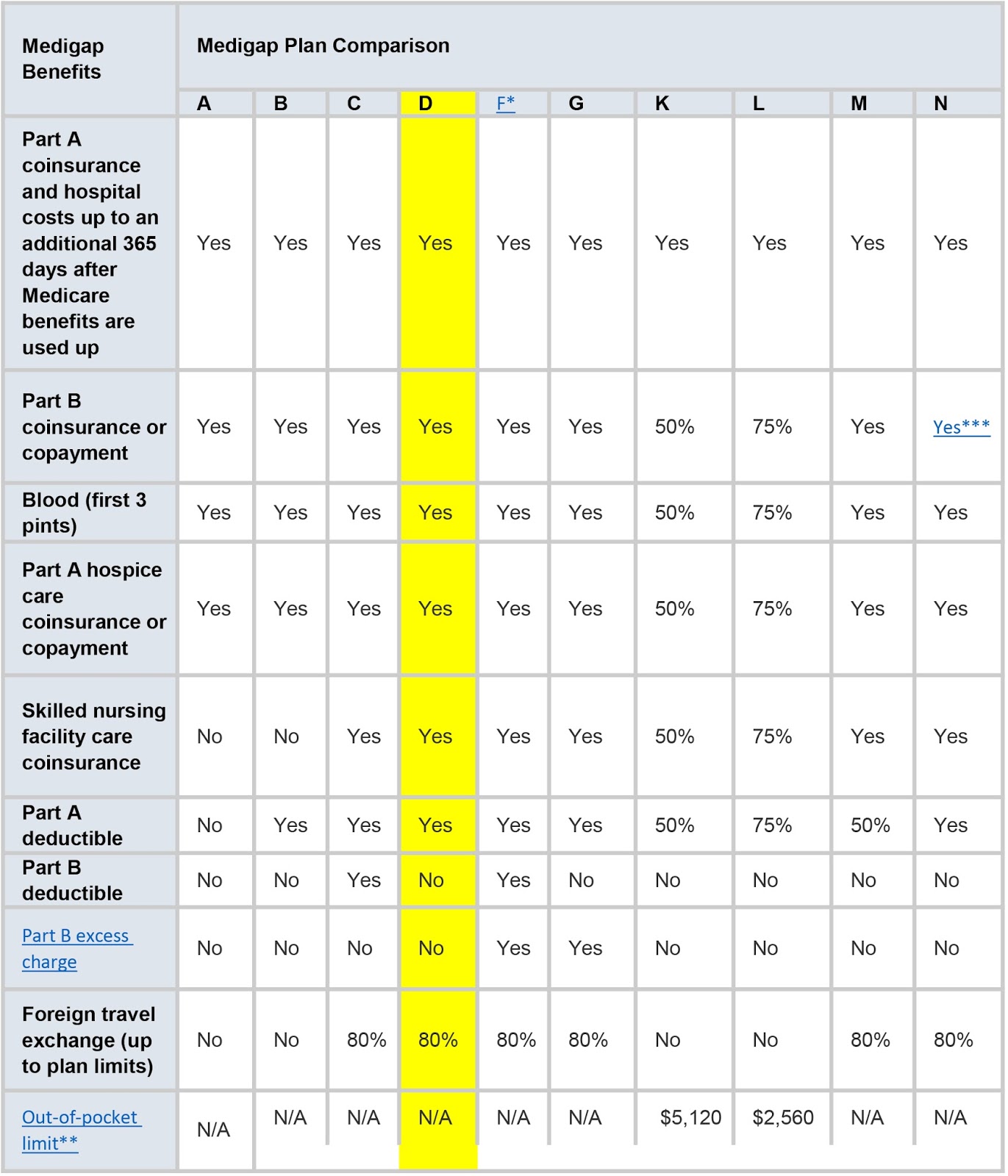

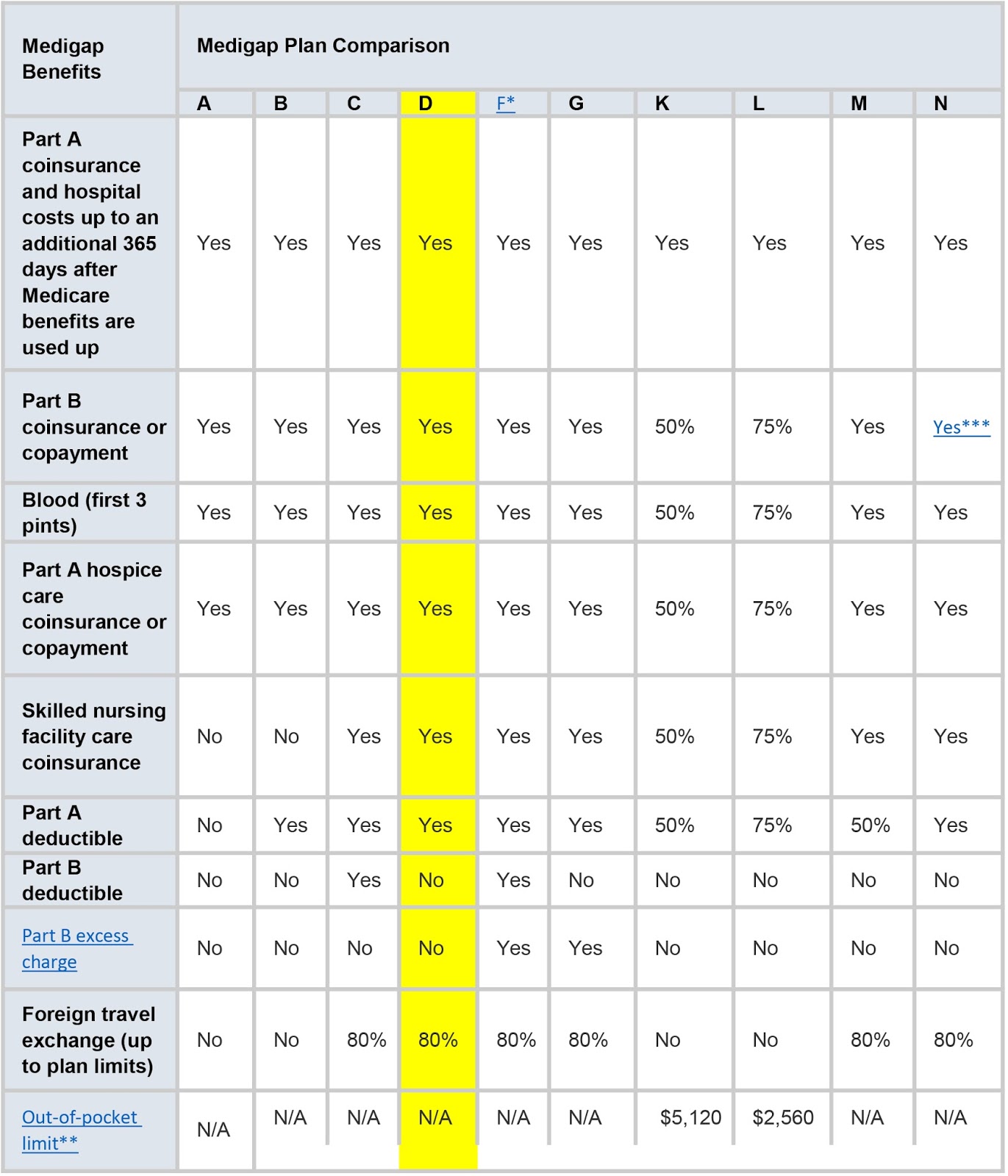

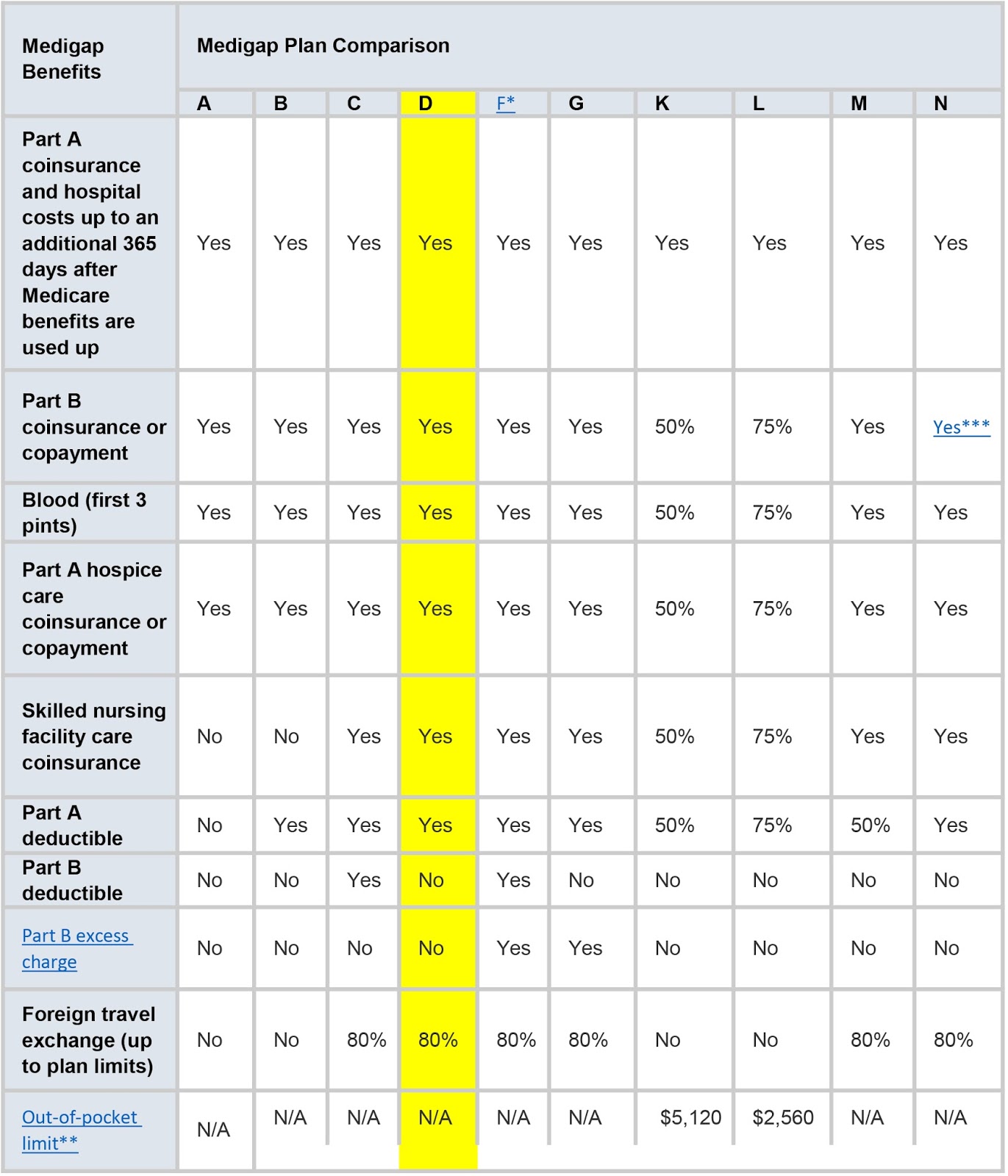

Plan G. Such a benefit allows you to freely visit Medicare providers without worry if they are participating or non-participating providers. Any excess charges they file will be picked up by your Medigap plan. You can use the chart below to compare the types of standardized Medigap plans and the benefits they offer.

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

How much does Medicare charge for non-participating doctor?

You visit a non-participating doctor and receive treatment that carries a Medicare-approved amount of $300. If the doctor is does not accept Medicare assignment, they are allowed to charge up to 15 percent more than that amount. If the provider charges you the full 15 percent Part B excess charge, your total bill for the service will be $345.

What is Part B?

Part B covers doctor’s appointments and other types of outpatient care along with durable medical equipment. Part B excess charges will only occur if you visit a provider or a DME supplier who doesn’t accept Medicare assignment.

What does DME mean in Medicare?

When a doctor, health care provider or a supplier of durable medical equipment (DME) accepts Medicare assignment, it means that the Medicare-approved amount as full payment . The Medicare-approved amount is the amount of money that Medicare has determined it will reimburse a provider for a given service or item.

What is Medicare Plan N?

Medicare Plan N is a supplemental policy that typically has lower premiums while you pay your Part B deductible, excess charges and some copays for doctor and emergency visits. It has been popular since it was first introduced in 2010. Also called Medigap Plan N, this option was created for consumers who like the idea ...

What is the difference between Medicare Plan N and Plan G?

People who enroll in Plan N also often look at Plan G as an alternative because Plan G is only slightly more expensive. The primary difference is that Plan G covers the little copays and excess charges so there are less bills showing up in your mailbox.

What is Medicare Supplement Plan N?

Also called Medigap Plan N, this option was created for consumers who like the idea of paying a lower premium in exchange for taking on a small annual deductible and some copays. All Medicare Supplement Plan N policies are the same, no matter which insurance company you choose.

How much is the Part B deductible for 2021?

First, you agree to pay the small annual Part B deductible ($203 in 2021). You will also pay co-payments up to $20 for doctor appointments. Emergency room visits have a $50 copay. Finally, people with Medigap N also pay excess charges to some medical providers. Providers can charge 15% more than what Medicare allows.

How much does Medicare pay for a medical bill?

Medicare pays 80% and then sends the bill to your Medigap plan. If your doctor does not accept Medicare assignment, you will pay a 15% excess charge. Read more about how this would work in our Medigap Plan N Example below.

What happens if a doctor doesn't accept Medicare?

If your doctor does not accept Medicare assignment, you will pay a 15% excess charge. Read more about how this would work in our Medigap Plan N Example below.

When is the best time to enroll in Medicare Plan N?

You must also live in the plan’s service area. The best time to enroll in Medicare Plan N is during your Medigap Open Enrollment Period. This six-month window starts with your Part B effective date. It’s your one chance to enroll in any Medigap plan without health underwriting.

How much can a Medicare provider bill you if you don't have Medicare?

Providers who don’t participate in Medicare can bill you up to 15% more than the Medicare allowable amount at their discretion. This additional amount is considered a Part B excess charge. You will have to pay it out-of-pocket unless you have a Medigap plan that includes benefits for Part B excess charges.

Which states prohibit Medicare from charging higher than the Medicare allowable rate?

The following states passed laws prohibiting healthcare providers from charging Medicare beneficiaries anything higher than the Medicare allowable rate: Connecticut. Minnesota.

How many primary care providers accept assignment?

Statistics suggest that as many as 95% of primary care providers accept assignment. A slightly smaller number of specialist physicians accept it as well. Not all nonparticipating providers will add Part B excess charges if you don’t have a Medigap plan, so you may only rarely see Part B excess charges. That said, however, there is no limit on the ...

How to protect yourself from excess charges?

The easiest way to protect yourself from excess charges is to only use physicians who accept Medicare assignment. Then you know you will never be billed more than Medicare allows for your healthcare services. It’s always a good idea to ask your doctor if he or she accepts assignment before you make an appointment.

What states have Medigap Plan N?

Minnesota. Ohio. Pennsylvania. Rhode Island. Vermont. Massachusetts. New York. People in these states then, might also consider Medigap Plan N, which has similar benefits to Plan G. One big difference is that Plan N does not cover excess charges, so the premiums for Plan N are lower.

What happens if a doctor doesn't accept Medicare?

Also, if you see a doctor who accepts Medicare assignment, but Medicare doesn’t accept the claim for the service billed, the doctor can charge you more than Medicare’s approved price.

What is accepting Medicare assignment?

In essence, they agree to accept the Medicare amount as payment in full for covered services. This is also called “accepting Medicare assignment.”.

What is Medicare Part B excess charge?

Medicare Part B Excess charges are charges that fall under the doctor charges/outpatient part of Medicare (Part B). These charges are not charged by all medical providers, but in most states, providers do have the option of charging these “excess” charges. So what are Part B Excess charges?

What plan covers Part B excess?

Or, as previously discussed, you can pick a Medigap plan that covers these Part B Excess charges in full. The plans that do so currently are Medigap Plan G and Medigap Plan F.

How much does a doctor charge for Medicare?

A doctor has the option, in most states, of charging up to 15% ABOVE the Medicare-approved payment schedule. These so-called Medicare Part B Excess charges of up to 15% above the Medicare-approved amount are passed on to the patient and billed directly to you after the fact.

How to avoid Part B excess charges?

Beyond that, you can always check with your regular doctors to see if he/she does use “balance billing” (i.e. if they charge Part B Excess charges). If so, you can choose a doctor that does not.

Which states prohibit Part B excess charges?

The current list of those states that prohibit them is: Connecticut, Massachusetts, Minnesota, New York, ...

Is there a limit on how many times a doctor can charge you?

That said, if you do go to the doctor regularly and have a doctor that does charge “excess charges”, it may be beneficial to ensure you are in a plan that covers them. There is no annual limit on the number of times a doctor can charge these charges. Likewise, there is no dollar amount limit to Part B Excess charges – only the 15% “cap” above the Medicare-approved amount. So, it is important to know how common Medicare Part B Excess charges are in you particular area of the country.

What is Medicare Part B excess charge?

Doctors who do not accept Medicare assignment may charge you up to 15 percent more than what Medicare is willing to pay. This amount is known as a Medicare Part B excess charge. You are responsible for Medicare Part B excess charges in addition to the 20 percent of the Medicare-approved amount you already pay for a service.

What is Medicare Part B?

Medicare Part B is the part of Medicare that covers outpatient services, such as doctor visits and preventive care. Medicare Part A and Medicare Part B are the two parts that make up original Medicare. Some of the services Part B covers include: flu vaccine. cancer and diabetes screenings. emergency room services.

What is a Medigap Plan F?

The two Medigap plans that cover Part B excess charges are: Medigap Plan F. Plan F is no longer available to most new Medicare beneficiaries.

What happens if a doctor doesn't accept Medicare?

Your doctor doesn’t accept assignment. If you instead go to a doctor who doesn’t accept Medicare assignment, they might charge you $345 for the same in-office test. The extra $45 is 15 percent over what your regular doctor would charge; this amount is the Part B excess charge. Instead of sending the bill directly to Medicare, ...

What percentage of Medicare does a healthcare professional pay?

These Medicare-approved doctors send the bill for their services to Medicare, rather than handing it to you. Medicare pays 80 percent , then you receive a bill for the remaining 20 percent.

How much does Medicare pay?

Medicare pays 80 percent, then you receive a bill for the remaining 20 percent. Doctors who are not Medicare-approved can ask you for full payment up front. You will be responsible for getting reimbursed by Medicare for 80 percent of the Medicare-approved amount of your bill.

How much does a general practitioner charge for an in-office test?

Your doctor accepts assignment. Your general practitioner who accepts Medicare might charge $300 for an in-office test. Your doctor would send that bill directly to Medicare, rather than asking you to pay the entire amount. Medicare would pay 80 percent of the bill ($240).

How to protect yourself from Medicare Part B excess charges?

First is to make sure that your doctor or healthcare provider is a participant and accepts Medicare assignment. You can check the Medicare website to find doctors and physicians who are participants. See the video below for instructions.

How does Medicare Part B excess charge work?

Part B covers medical and doctor services. Doctors and health providers who take part in Medicare agree to charge you only the assigned rate given by Medicare. This is called accepting Medicare assignment. This means they agree to accept the Medicare amount as payment in full for covered services. The assigned rate for services varies per state.

How many doctors accept Medicare Part B?

Statistically, 95% of primary care providers accept assignments. Only about 5% of non-participating doctors and health providers charge Medicare Part B excess charges. But, take note that there is no limit to the number of times a non-participating doctor can add excess charges to your bill. So if you see a doctor regularly who is a non-participant, expect to possibly pay a lot of excess charges every year.

How much can a doctor charge on top of the rate?

Doctors can charge an extra 15% on top of the assigned rate.

Can you change your Medigap plan if you don't live in California?

Understandably, premiums for Plan F are the highest since it offers complete coverage. That’s why Medigap Plan Gis quickly becoming the new standard, especially for people who don’t live in California or Oregon, where they have “Birthday Rules”. These birthday rules allow you to change plans within 30 days of your birthday without answering questions about your health. That means that if your premiums become too high, you can change plans to a less expensive company, or a lower level plan.

Is there a cap on excess fees?

There is no limit or cap on excess fees other than the 15% on each service. If you are unlucky enough to need multiple services (ie chemotherapy) or expensive services (ie surgery) you could be in for a big bill.

Does Medicare prohibit excess charges?

Some states have passed laws to prohibit Medicare Part B excess charges.

What states do not allow Medicare excess charges?

As of 2020, these states include Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont.

What percentage of Medicare is paid to non-par physicians?

The Medicare-approved amounts for services provided by non-participating (non-PAR) physicians (the 80% paid by Medicare and the 20% patient responsibility) are set at 95% of the Medicare-approved amounts that are paid to PAR physicians. However, non-PAR physicians are allowed to charge more than PAR physicians.

What is a PAR in medical billing?

Participating (PAR) physicians sign an agreement with Medicare in which they agree to accept assigned costs as payment in full for all covered services for that calendar year. This means they accept the 80% from Medicare and the 20% payment from the patient or patient’s insurance as that full payment.

What act gave physicians the right to contract privately outside of the Medicare system?

The Balanced Budget Act of 1997 gave physicians and Medicare patients the right to contract privately outside of the Medicare system for health care services. These private contracting decisions cannot be made on a case by case basis, though.

How many physicians have signed Medicare participation agreements?

Over the past decade, more than 96% of all physicians and clinical professionals have signed participation agreements with Medicare.

What is Plan N?

Plan N is a great plan that we get asked about a lot. Plan N has premiums that are much lower than other more popular plans. Some clients are concerned about not getting the Medicare Excess Charges covered. That is because unlike Plan F or G, Plan N does not cover Excess Charges.

What does it mean if a physician does not accept Medicare?

But if that physician does not accept it, the payment is lower.

What is excess charge in Medicare?

An Excess Charge is defined as the difference between Medicare’s approved billing amount for a service and what your doctor actually charges. Currently, the very popular Medigap Plan G and Medigap Plan F are the only plans that cover excess charges when a doctor bills you above the Medicare allowable.

How much can a non-participating doctor charge?

In fact, in some states, billing for any excess charges is illegal. In the remaining states, the limit is 9.25% (based on a 15% legal limit applied to Medicare’s reduced allowable of 5% to non-participating providers).

How many doctors accept Medicare?

Currently, 96% of doctors accept Medicare assignment. The remaining 4% can charge what they want, up to the legal limits. However, most non-participating doctors will accept the Medicare allowable amount if your Medigap Plan doesn’t cover excess charges.

Can a participating doctor bill you above the Medicare allowable?

This approved amount is known as the Medicare allowable. Participating physicians can not bill you above the Medicare allowable.

Can a non-participating doctor bill you?

Non-participating doctors have different agreements with Medicare. At their discretion, on a case-by-case basis, they can bill you above the Medicare allowable. This amount is called an excess charge. There are rules regarding how much above the allowable non-participating doctors can charge you. In fact, in some states, billing for any excess ...

Blog

Looking for something specific? Search the Blog for topics you are interested in.

How to avoid Medicare Part B Excess Charges

Medicare Supplement Plan N does not cover Medicare Part B excess charges. What is excess charges and how do I prevent a bill for excess charges?

Medicare.gov physician locator tool

If you have internet access Medicare.gov tells you if your provider accepts Medicare assignment