How can I reduce my Medicare premiums?

Medicare Part A (Hospital Insurance) Costs Part A monthly premium Most people don’t pay a Part A premium because they paid Medicare taxes while . working. If you don’t get premium-free Part A, you pay up to $499 each month. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

Is Medicare giving back refund?

Nov 15, 2021 · The standard Part B premium is $170.10 for 2022 (largest increase in program history, but Social Security COLA also historically large). The Part B deductible is $233 in 2022 (up from $203 in 2021). Part A premiums, deductible, and coinsurance are also higher for 2022. The income brackets for high-income premium adjustments for Medicare Part B and D start at …

How to get Medicare rebate?

Nov 16, 2021 · Just like with your Part B coverage, you’ll pay an increased cost if you make more than the preset income level. In 2022, if your income …

What is a Medicare Part B premium reduction plan?

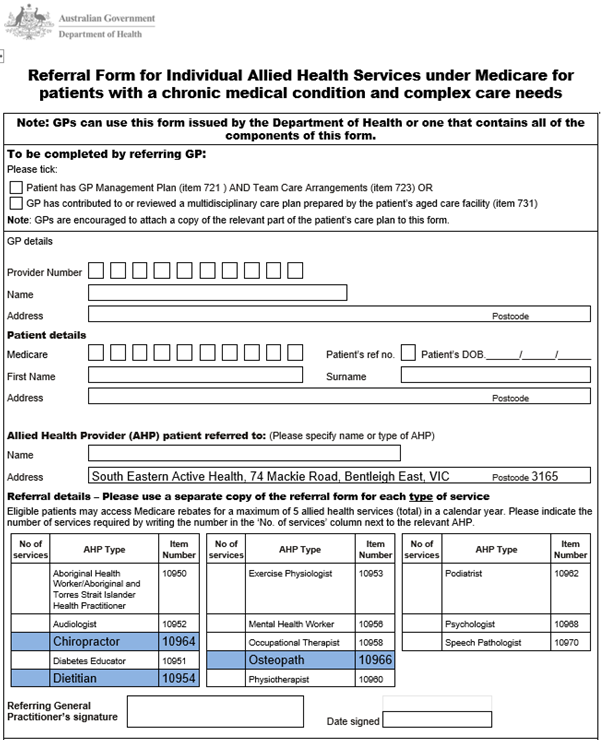

Dec 12, 2021 · Medicare rebates of about $125 per standard consultation are available for up to 10 sessions, if a Medical Practitioner or Psychiatrist refers you through completing a Mental Health Care Plan. Alternatively, Private Health Fund rebates can be claimed if your policy covers you to see a Clinical Psychologist.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

What is the 2021 Medicare rebate?

If you are a new Medicare Part B enrollee in 2021, you will be reimbursed the standard monthly premium of $148.50 and do not need to provide additional documentation.

How much is the Medicare reimbursement?

According to the Centers for Medicare & Medicaid Services (CMS), Medicare's reimbursement rate on average is roughly 80 percent of the total bill. Not all types of health care providers are reimbursed at the same rate.

How much is the Medicare deduction for 2020?

On November 8, 2019, CMS announced that the monthly Medicare Part B premium will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for Medicare Part B beneficiaries increased $13, from $185 in 2019 to $198 in 2020.

What changes are coming to Medicare in 2022?

Also in 2022, Medicare will pay for mental health visits outside of the rules governing the pandemic. This means that mental health telehealth visits provided by rural health clinics and federally qualified health centers will be covered. Dena Bunis covers Medicare, health care, health policy and Congress.Jan 3, 2022

How much does Medicare cost at age 83?

How much does the average Medicare Supplement Plan F cost?Age in yearsAverage monthly premium for Plan F80$221.0581$226.9382$236.5383$220.8118 more rows•Dec 8, 2021

What is a Medicare premium refund?

What Is a Medicare Premium Refund? There are certain cases in which Medicare may issue a refund on your monthly premium. One such case is if you're charged for a Medicare premium but you qualify for a Medicare discount or subsidy that was not applied to your account.Jan 20, 2022

How do I get my Medicare premium refund?

You may be reimbursed the full premium amount, or it may only be a partial amount. In most cases, you must complete a Part B reimbursement program application and include a copy of your Medicare card or Part B premium information.Dec 3, 2021

Who qualifies for Medicare premium refund?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B. 2.

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

Is Medicare Part A free at age 65?

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

How much is the Medicare deductible for 2022?

$233The annual deductible for Medicare Part B will increase by $30 in 2022 to $233, while the standard monthly premium for Medicare Part B will increase by $21.60 to $170.10, CMS announced.Nov 15, 2021

Q: What are the changes to Medicare benefits for 2022?

A: There are several changes for Medicare enrollees in 2022. Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that...

How much will the Part B deductible increase for 2022?

The Part B deductible for 2022 is $233. That’s an increase from $203 in 2021, and a much more significant increase than normal.

Are Part A premiums increasing in 2022?

Roughly 1% of Medicare Part A enrollees pay premiums; the rest get it for free based on their work history or a spouse’s work history. Part A premi...

Is the Medicare Part A deductible increasing for 2022?

Part A has a deductible that applies to each benefit period (rather than a calendar year deductible like Part B or private insurance plans). The de...

How much is the Medicare Part A coinsurance for 2022?

The Part A deductible covers the enrollee’s first 60 inpatient days during a benefit period. If the person needs additional inpatient coverage duri...

Can I still buy Medigap Plans C and F?

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap plans C and F (including the high-deductible Plan F) are n...

Are there inflation adjustments for Medicare beneficiaries in high-income brackets?

Medicare beneficiaries with high incomes pay more for Part B and Part D. But what exactly does “high income” mean? The high-income brackets were in...

How are Medicare Advantage premiums changing for 2021?

According to CMS, the average Medicare Advantage (Medicare Part C) premiums for 2022 is about $19/month (in addition to the cost of Part B), which...

Is the Medicare Advantage out-of-pocket maximum changing for 2022?

Medicare Advantage plans are required to cap enrollees’ out-of-pocket costs for Part A and Part B services (unlike Original Medicare, which does no...

How is Medicare Part D prescription drug coverage changing for 2022?

For stand-alone Part D prescription drug plans, the maximum allowable deductible for standard Part D plans is $480 in 2022, up from $445 in 2021. A...

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Do you pay for Medicare Part A?

Medicare Part A premiums. Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as you’re eligible for Social Security or Railroad Retirement Board benefits. You can also get premium-free Part A coverage even if you’re not ready to receive Social Security retirement benefits yet.

What is the MBS?

The MBS is a list of health professional services that the Australian government subsidises through Medicare.

Why are the changes occurring?

Medical advances mean that over time, some procedures become quicker to carry out, far less complex, and the cost of medical devices and tools can come down too.

Was there any consultation?

Yes. An independent advisory group comprising clinical experts, doctors, academics and consumer representatives, called the MBS taskforce, examined 5,700 MBS items between 2015 and 2020 to see if they needed to be amended, updated or removed. This taskforce identified services that were obsolete, outdated or even potentially unsafe.

What areas are in for the biggest changes?

Orthopaedic surgery, cardiac surgery and general surgery are the areas where the most reforms will occur. It’s important to remember the changes may mean out-of-pocket costs go down. The Consumers Health Forum said on Monday many of the changes will ensure “Medicare payments reflect the latest in cost-effective and evidence-based medicine”.

What is Medicare Part B give back?

Part B Premium Reduction Give Back Plans. The Medicare Part B give back plan, or premium reduction plan is a feature of Medicare Advantage. Yet, only some Medicare Advantage plans offer this benefit, and it isn’t available in all areas. Those with this plan may see a higher amount on their Social Security check, ...

What is a Part B premium reduction plan?

The Part B premium reduction plan is just like it sounds. You enroll in the policy, and the carrier pays either part or the whole premium for your outpatient coverage. In the summary of benefits or evidence of coverage , you’ll see a section that says Part B premium buy-down; this is where you can see how much of a reduction you’ll get.

Does Medicare pay for Part B?

Do Medigap plans offer a Part B premium reduction? No, Medigap plans don’t cover Part B premiums because you need Part B to pay its portion of the claim.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Eligible Patients

All Australian residents and certain categories of visitors to Australia can claim Medicare benefits for services by participating optometrists (optometrists who have signed an agreement to participate in arrangements with the Commonwealth Government).

Referral Arrangements

A General Practitioner (GP) referral is not required for a patient to make an appointment to see an optometrist (with the exception of the arrangement with the Better Start for Children with Disability initiative and Helping Children with Autism program).

The Optometry Medicare Benefits Schedule

Information about the Optometry Medicare Benefits Schedule (OMBS) items includes the service length, type, minimum requirements, fees and explanatory notes. This information is located online at MBS Online under ‘Downloads’.

Optometry Items

Click on the item numbers below to view the current MBS descriptions and explanatory notes.

Claiming a Medicare Rebate

a patient may be bulk-billed for the services. This means the optometrist will be paid for their services through Medicare and the patient will not have out-of-pocket costs;

Limitations on Claiming a Rebate

Medicare only pays benefits for services provided by ‘participating’ optometrists who have signed a Common Form of Undertaking for Participating Optometrists with the Australian Government. From 1 January 2015, participating optometrists are able to claim more than the MBS Schedule fee for services covered under Medicare.

How much does Medicare pay for anesthesia?

You pay 20% of the Medicare-approved amount for the anesthesia services a doctor or certified registered nurse anesthetist provides. The Part B Deductible applies. The anesthesia service must be associated with the underlying medical or surgical service. You may have to pay an additional Copayment to the facility.

What is Medicare Part A?

Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. covers anesthesia services if you’re an inpatient in a hospital. Medicare Part B (Medical Insurance)

What is original Medicare?

Your costs in Original Medicare. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference.

Do you have to pay for anesthesia?

The anesthesia service must be associated with the underlying medical or surgical service. You may have to pay an additional. An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug.